SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

2016 was an exciting year for M&A in Vietnam, which has witnessed the emergence of billion-dollar M&A deals that have made a significant influence on numerous industries, primarily in the real estate, retail and consumer goods sectors. In addition to being influenced by strong foreign interest in the M&A market, the main factors driving the development of M&A activities in Vietnam last year were the divestment of various state owned enterprises (SOE) (such as Vissan, Vietnam Airlines and Petrolimex); broad accession and involvement of the major players in the region such as Thailand, Singapore and Japan; the recovery of the real estate market; an expectation that Vietnam will get more deeply involved in the ASEAN Economic Community (AEC); and the new generation of FTAs.

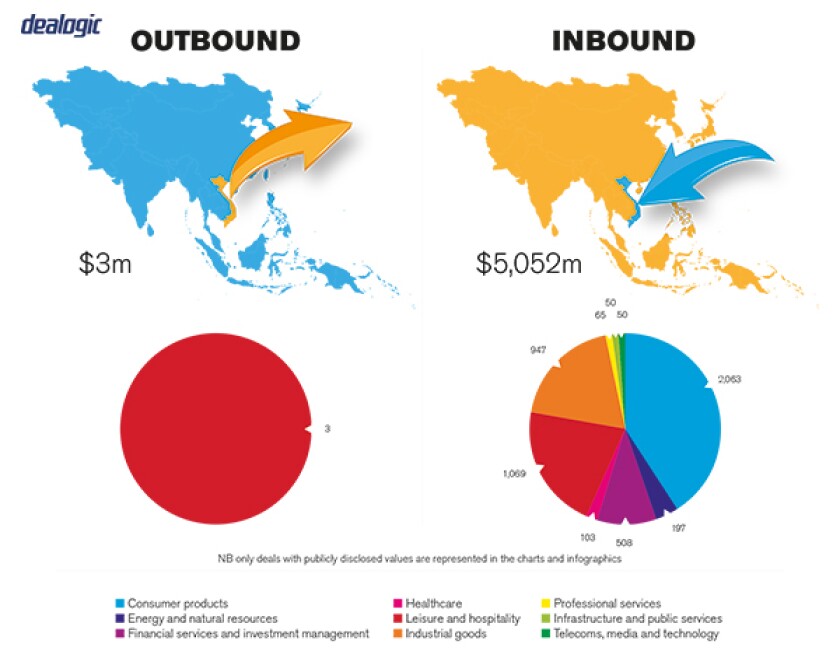

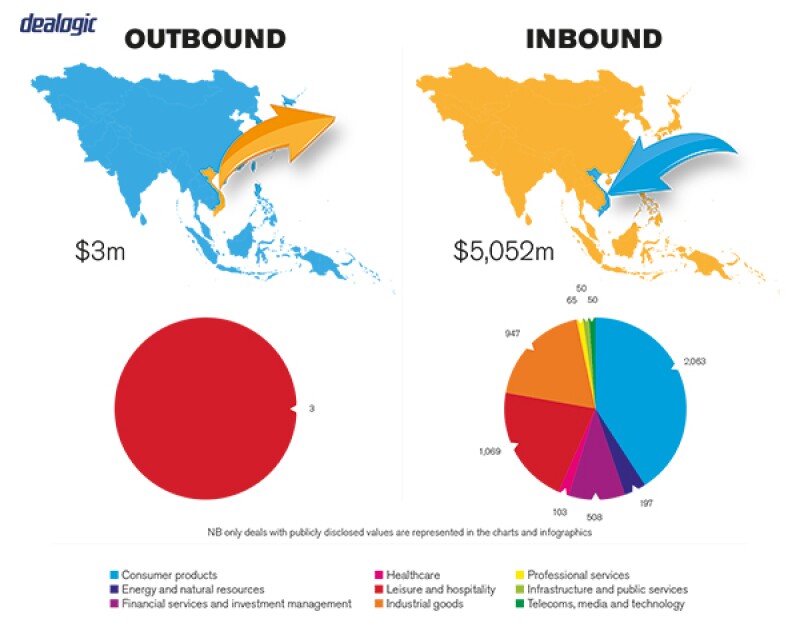

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

M&A activity in Vietnam in 2015 achieved a record $5.2 billion in deal value, as compared to the previous record set in 2012. During the first seven months of 2016, the value of M&A deals surpassed $3 billion, which was an increase of 28% over the corresponding period in 2015. As a result, 2016 has been considered as a boom year for M&A transactions in Vietnam. Not only setting a record in terms of value, 2015 and the first half of 2016 also witnessed the emergence of billion-dollar M&A deals that have had a significant influence on a multitude of industries, markets and the economy in general.

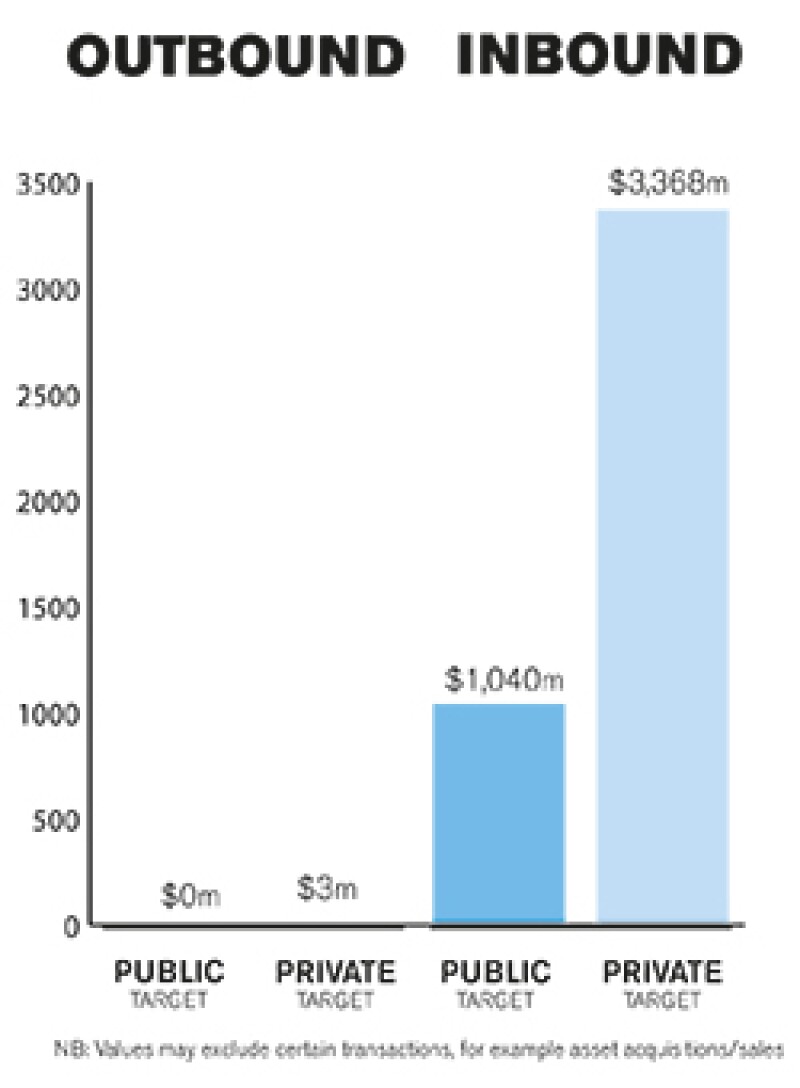

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

In 2016, the market was driven by both private and public M&A transactions, with various high value private transactions (such as the acquisition of Big C Vietnam and Metro Cash & Carry Vietnam) and public strategic sale transactions in Vietnam Airlines and Vissan. In 2016, most of the public M&A transactions were from state ownership divestment transactions which were undertaken in accordance with the divestment plan referred to above, whereas the private M&A transactions were mainly focused on the retail, FMCG, pharmaceuticals and real estate sectors.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Nine out of Vietnam's top ten largest M&A deals in 2015-2016 involved foreign investors, led by Thailand's Central Group's acquisition of Big C Vietnam for $1.14 billion, together with Singha becoming Masan Group's strategic partner at $1.1 billion, the value of which accounted a quarter of all M&A activity in 2015 – 2016. The consumer sector provides a huge potential in Vietnam, and Thai investors have become significant investors in the Vietnam marketplace on the back of Central Group's massive deal.

Another industry that continues to be consistently attractive to many foreign M&A investors, especially South Korean and Singaporean investors, is real estate. Singaporeans were clearly among the most active buyers in the first half of 2016 with Keppel Land acquiring a 40% stake in the $1.2 billion Empire City project and Mapletree purchasing the Grade A Kumho Asiana Plaza Saigon for $215 million. Japanese investors also remain active in the M&A market, with JX Nippon Oil & Energy acquiring an eight percent stake worth $183 million in Petrolimex, ANA Holdings purchasing 8.77% ($108 million) in Vietnam Airlines and Taisho acquiring 24% in Hau Giang Pharmaceuticals.

Many industry leaders, such as Vinamilk and Saigon Beer Alcohol Beverage Corporation (Sabeco), following the state ownership divestment plan approved by the government, are likely targets for foreign investors in the coming years. Indeed, Fraser & Neave Group of Singapore acquired a further 5.4% stake in Vinamilk in December 2016 for $500 million.

2.2 What have been the most significant trends or factors impacting deal structures?

Choice of structure depends on a number of factors such as: the regulatory framework in Vietnam; the type of acquisition; the type of business activity being undertaken by the target; the relationship between the target and buyers; the risk appetite of buyers; and the nationality of buyers (foreign vs local).

In the case of foreign investors, the existing foreign ownership restrictions and conditions applicable to foreign investors have been the most significant factors impacting upon deal structures in Vietnam.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

In addition to any legislation which might focus on the specific business sector, public M&A transactions are mainly governed by the Law on Enterprises, Law on Investment, Law on Securities, Law on Competition and relevant decrees, circulars and other implementing legislation.

Any establishment or change to the existence, capital structures or shareholders of relevant enterprises shall be governed by and, if required, reported to the State Securities Commission, Vietnam Competition Authority and the Ministry of Planning and Investment (and the relevant municipal or provincial Department of Planning and Investment), as well as specific authorities which manage certain specialised sectors.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Decree 60, which came into effect in September 2015 and which loosened the foreign ownership limits in public companies, has been a major positive regulatory development enabling foreign investors to theoretically take a more significant stake in Vietnamese companies. The new Civil Code 2015, which came into effect as of January 1 2017 also affects certain terms and conditions of M&A transactions, for example late payment rate, statute of limitations and bona fide third party rights.

The change of cabinet and government members as a result of the Communist Party's five yearly elections last February, together with the new state ownership divestment plan, may considerably impact upon M&A transactions in the coming years with the divestment of state ownership in various large SOEs.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

Amendments to the Law on Competition are currently in the preparatory stage and are proposed to be passed by the National Assembly within 2017, with the purpose of covering recent changes of, inter alia, the concept of economic concentrations (which includes M&A transactions), may materially impact upon M&A transactions in Vietnam in the near future.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

The most common mistakes in Vietnam market are:

Local vendors not being sufficiently prepared for the extensive time and effort an M&A deal may require;

Foreign investors with overly-optimistic timelines;

Not having a complete online data room;

Inflexible or overly complex deal structures – is Vietnam at a suitable stage of development for the proposed deal structure?

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

During the formulation of the deal structure, parties often overlook the closing and post-closing steps, which contain significant risks from both a legal and financial perspective.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Having a roadmap for the transaction at an early stage will prepare a potential purchaser for what to expect during a transaction. Ensure the proposed structure works from a Vietnam perspective at an early stage. If the proposed structure does not work, then be flexible in considering alternatives. Encourage the vendor to start collating documents for due diligence purposes at least four weeks in advance of when they will be required; otherwise, expect the deal timeline to slip accordingly.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

The voting threshold for a general meeting of shareholders, the highest decision maker in a public company, to pass ordinary resolutions and special resolutions is 51% and 65% of the voting shares of attending shareholders, respectively, unless the charter of such company provides for a higher threshold.

5.2 What conditions are usually attached to a public takeover offer?

A public takeover offer shall be undertaken in strict compliance with Vietnam's securities law. In addition, if the offer is at least 25% of the entire shares of a target company or in other certain cases, such offer will be subject to the mandatory public offer (MPO) requirements and would need to be undertaken in the strict procedures required under Vietnam law (unless an exemption or waiver of such procedures is possible in accordance with the law;

Approval of the State Securities Commission of Vietnam is required for transactions having a purchase price not falling within the allowable trading band applicable to each specific stock exchange.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees are still not common in the Vietnam marketplace.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

We have been involved in all of these types of mechanisms in M&A transactions in Vietnam, especially if the purchaser is a foreign party. However, we note that price adjustment clauses and indemnity holdbacks are usually used in the context of private M&A in Vietnam as opposed to locked box, completion accounts or earn-outs mechanisms. It also needs to be appreciated that most local vendors still prefer simple structures as compared to the more sophisticated deal structures which are commonplace in more developed jurisdictions within the region.

5.5 What conditions are usually attached to a private takeover offer?

The number of directors in the target company appointed by the purchasers and the veto right enjoyed by the purchaser;

All necessary licences having been obtained and requirements being satisfied to undertake the business activities of the target company;

No material adverse change in the target company's activity, financial situation or future prospects;

Completion of a satisfactory due diligence investigation, which does not disclose any matters of significance that adversely influence the value of the company.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Due to the provision under the Civil Code 2005 providing that a "contract which is entered into in Vietnam and performed entirely in Vietnam must comply with the laws of Vietnam", it has been not common in practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements in Vietnam. However, as from January 1 2017 when the new Civil Code 2015 came into effect, the parties under a contract are entitled to choose foreign law as the governing law for such contract if such choice of foreign law is not contrary to the fundamental principles of the laws of Vietnam, except in certain cases (for example, the subject matter of the contract is immoveable property or is a consumption contract).

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance on private M&A transactions is still relatively uncommon in a Vietnam context, although we are beginning to see it on some transactions.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

In January 2017, the Vietnamese government released a portfolio of state-run enterprises where it will retain the entire ownership of those companies and those entities in which it will reduce stakes in the 2016-2020 period in a move designed to boost participation of investors in the privatisation process. Compared to the former plan, which was issued back in 2014, under the new decision issued by the Prime Minister of Vietnam, the government has specified a list of 137 SOEs that will be equitised in the 2016-2020 period. Among them, the state will hold a stake of over 65% in four SOEs, 50-65% in 27 SOEs, and below 50% in 106 SOEs, including a large number of major firms such as Saigon Trading Corp (Satra), Benthanh Group, PV Oil, PV Power, Binh Son Refining and Petrochemical Company (BSR) – the operator of the Dung Quat oil refinery, Saigon Jewelry Company and cement maker Vicem.

It is expected to provide a considerable boost to the equitisation process in particular and to the M&A market in general in the next few years. In addition, it is expected that the legislation implementing state ownership divestment and equitisation will be amended in order to be consistent with recent market developments.

About the author |

||

|

|

Mark Fraser Managing partner, Frasers Law Company Ho Chi Minh City/Hanoi, Vietnam T: 84 8 3824 2733 F: 84 8 3824 2736 Mark Fraser is the managing partner of Frasers Law Company, which advises on Vietnam law matters and focuses on mergers and acquisitions transactions as one of its core practice areas. Fraser has been primarily based in Vietnam since 1995, and during that period he has advised numerous clients on successful M&A transactions in Vietnam across a wide spectrum of industry sectors, including banking and finance, education, FMCG, healthcare and pharmaceuticals, hospitality, infrastructure, insurance, logistics, mining, oil and gas, real estate, retail and TMT. Fraser holds degrees in law and commerce (accountancy) and is recognised as one of the leading lawyers in Vietnam by numerous authoritative guides to law firms in Vietnam. Prior to establishing Frasers Law Company in Vietnam, Fraser spent more than ten years with a UK magic circle firm, for which he worked in London, Singapore, Hong Kong and Bangkok and was responsible for establishing their presence in Ho Chi Minh City in 1995. |

About the author |

||

|

|

Ho Thuy Ngoc Tram Senior associate, Frasers Law Company Ho Chi Minh City/Hanoi, Vietnam T: 84 8 3824 2733 F: 84 8 3824 2736 Ho Thuy Ngoc Tram is a senior associate at Frasers Law Company and joined Frasers in September 2010 immediately after graduating from Ho Chi Minh City Law University as the top student in her final year. During the course of 2012-2013, Tram completed her master in commercial law at the University of Melbourne in Australia under an Endeavour Postgraduate Award, granted by the Australian Department of Education, Employment and Workplace Relations. Tram's key areas of practice include real estate, M&A, inward investment, corporate governance, banking and finance, commercial transactions, dispute resolution and employment law. She has assisted clients on numerous matters and has been involved in complex M&A deals in the private and public sectors, as well as financial markets, in large scale transactions. Tram is a member of the Ho Chi Minh City Bar Association. |