SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The sector that has been most active in recent years is renewable energy. This is due to the policy of the Thai government that has been driving a shift from a reliance of fossil fuels towards renewable energy via incentives and tax benefit schemes.

Another sector that has become intensely active recently is tech start-ups. The total amount of funding in 2017 (excluding initial coin offerings – ICOs) was valued at over $100 million. In addition, we have seen a number of large companies starting to set up their own venture capital funds. This movement shows the growing realization of the potential of tech start-ups in Thailand.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

2016 was considered a surge in M&A practice in Thailand with over $10 billion in deal value, which was driven largely by the Big C Supercenter acquisition. As for 2017, Thailand saw a declining number in the total value of deals. The significant deals, including the acquisition of KFC's operations in Thailand, were still at lower total value than the total value of deals in 2016. This might be a result of the political uncertainty following the passing of His Majesty King Bhumibol Adulyadej in late 2016.

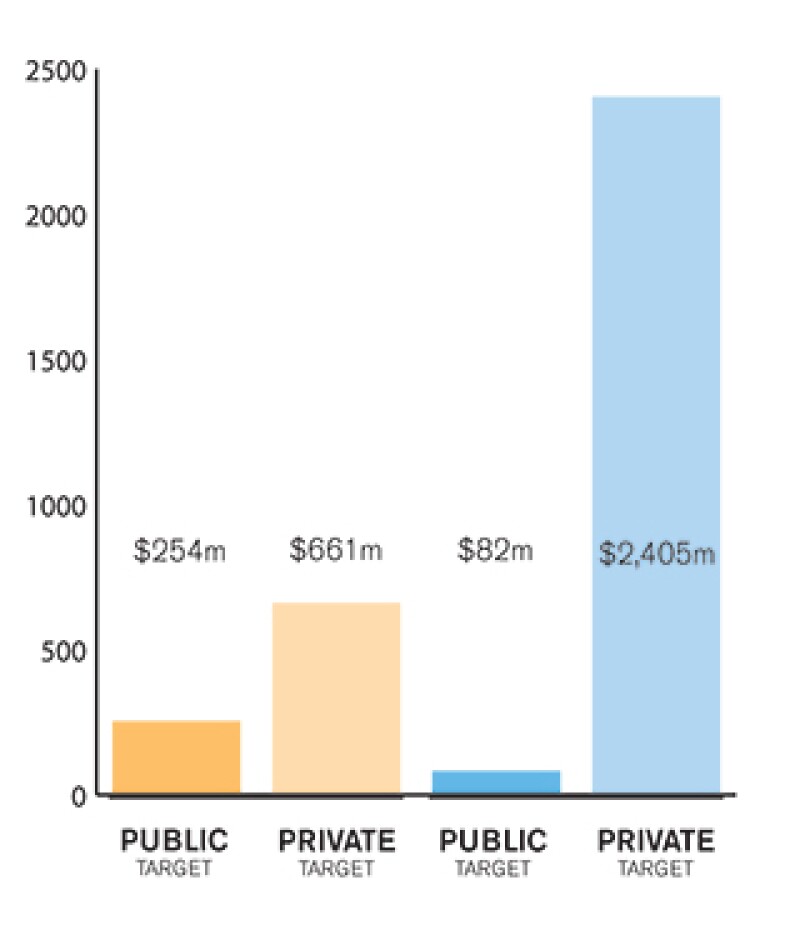

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

The Thai M&A market is driven by private M&A transactions whereby the target companies are mostly private companies but the acquirers are a combination of both public and private companies.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

2017 was the year of start-ups in Thailand. There were many financial investors investing in start-ups, ranging from private equity firms, venture capital firms and high net worth individuals. Some also invested in pre-IPO companies or in IPOs as cornerstone investors. The deals that involved strategic investors are more complicated in terms of structure, tax and other economic conditions.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

In public M&A transactions, where a listed company acquires another business, the deal can be structured in a way that such listed company can complete the transaction and expand its business successfully in compliance with applicable laws but without going through regulatory approvals.

2.2 What have been the most significant trends or factors impacting deal structures?

Tax and regulatory matters, in particular where a listed company is involved. Most deals were structured to facilitate and ease regulatory concerns.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The primary legislation that governs private M&A transactions is the Civil and Commercial Code of Thailand. The primary body is the Department of Business Development, the Ministry of Commerce.

The key pieces of legislation governing public M&A transactions are: (i) the Public Company Act BE 2535; (ii) the Securities and Exchange Act BE 2535; (iii) the Notification of the Capital Markets Supervisory Board Rules, Conditions and Procedures for the Acquisition of Securities for Business Takeovers; and (iv) the Notification of the board of governors of the stock exchange of Thailand regarding Disclosure of Information and Other Acts of Listed Companies Concerning the Acquisition and Disposition of Assets, 2004. The primary bodies are the Securities and Exchange Commission, the take-over panel appointed by the Capital Market Supervisory Board, and the Stock Exchange of Thailand.

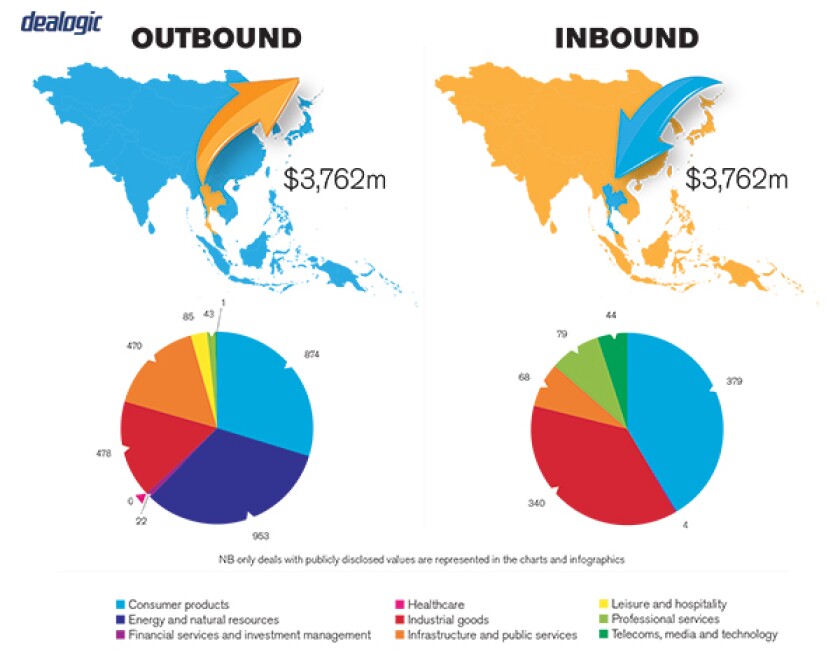

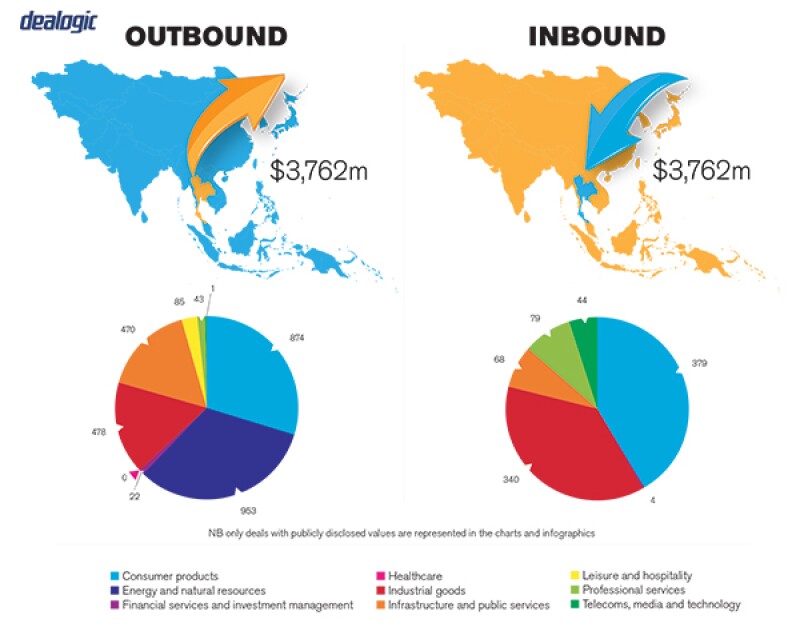

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

The new competition legislation, namely the Trade Competition Act BE 2560 (2017) (the New Trade Competition Act), was recently issued and came into effect on October 5 2017. The New Trade Competition Act repealed and replaced the former legislation (i.e. the Trade Competition Act BE 2542, 1999) in its entirety. One of the key areas that the New Competition Act focuses on is the supervision of business mergers and acquisitions that restrict trade competition or the merger and acquisition of dominant business operators. In this respect, any merger or acquisition that falls within the prescribed criteria would require prior approval from the Trade Competition Committee. Even though the procedure for seeking approval is clearly specified in the Act, the criteria of the mergers and acquisitions that would require approval has not been issued. In addition, the Trade Competition Committee, which is the body responsible for the supervision of compliance with the New Trade Competition Act, as well as the issuance of secondary legislation, has not been formed. Therefore, uncertainties regarding the directions of implementation and enforcement of this law in the future still exist.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

We are not aware of any legislation currently under discussion that may impact M&A transactions in the near future.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

There are no significant mistakes or misconceptions about the M&A market in Thailand. However, the most overlooked area is the foreign ownership limit, which we describe in detail in 4.2 below.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

The most frequently asked questions for inbound M&A are in regard to the foreign ownership restrictions under Thai law. In Thailand, foreign companies are prohibited from engaging in certain restricted businesses. Accordingly, a foreign acquirer may be barred if the target company is engaging in a restricted business and the acquisition of the target company by such a foreign acquirer will render the target company a foreign entity.

The main legislation governing the business of foreign entities is the Foreign Business Act (FBA), which limits foreign participation in certain financial business activities, including wholesale and retail, brokerages or agents and any type of service activities (including lending, leasing, and consultancy). The FBA limits foreign ownership to 49.99% of shares in the target company conducting a restricted business. Approval from the Ministry of Commerce is required prior to conducting any such business. The target company may also apply for an investment promotion certificate from the Board of Investment for certain promoted businesses to benefit from a relaxation of this foreign ownership restriction.

Apart from the FBA, certain industries have specific regulations which may have separate requirements on foreign shareholding. For example, the laws governing commercial banking businesses or insurance businesses stipulate a foreign shareholding limitation of 25%, with certain exceptions.

In addition, the Land Code of Thailand prohibits foreign entities from owning land unless, among other things, an investment promotion certificate is granted by the Board of Investment.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

We believe Thailand's market is still affected by the change of regulatory measures, as a result of the current military government's policies. Therefore, investors should monitor the dynamics in changing of legislation on a regular basis. Consultation with a legal advisor on the current legal situation is also highly recommended.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

When obtaining control of a listed company, the most important factor is in relation to the tender offer rules under the Securities and Exchange Act (SEC Act) and the Notification of the Capital Market Supervisory Board Rules, Conditions and Procedures for the Acquisition of Securities for Business Takeovers (CMSB Notification). According to the tender offer rules, if an acquirer obtains shares of any listed company which constitute up to or more than 25%, 50% or 75% of the total voting rights of such listed company, the acquirer will be required to make a mandatory offer for all the securities of the listed company. In the tender offer, an offered price must not be less than the highest price paid for shares of such class by the acquirer during the period of 90 days prior to the date on which the tender offer document was submitted to the SEC.

Another factor is foreign ownership restriction, as detailed under the Foreign Business Act (FBA). Under the FBA, a foreigner is prohibited from participating in certain businesses that fall within any of the restricted categories under the FBA, including the catch-all category "other services". For this purpose, a "foreigner" includes a company incorporated in Thailand that is majority-owned by foreign individuals/companies. In order to comply with such foreign ownership restrictions, a foreign acquirer may make a partial tender offer (PTO) for less than 50% of the voting shares of the listed company. However, this PTO structure may only work in a friendly acquisition, as it requires approval from a shareholders' meeting of the target company supported by not less than 50% of the total votes of the shareholders present at the meeting and having the right to vote. The approval of the Office of the SEC is also required, and certain conditions provided under the CMSB Notification need to be satisfied.

5.2 What conditions are usually attached to a public takeover offer?

A mandatory tender offer must be unconditional. However, pursuant to the CMSB Notification, the acquirer is permitted to cancel the tender offer upon the occurrence of one or more of the following events: (i) the occurrence of an event, after submission of the tender offer document to the SEC but within the tender offer period, which causes, or may cause, severe damage to the status or to the assets of the target company, which does not result from the acts of the acquirer or any act for which the acquirer must be responsible; and (ii) any action conducted by the target company after submission of the tender offer document to the SEC but within the offer period, which causes, or may cause, a significant decrease in its shares' value, provided that these events are stated clearly in the tender offer document.

In a voluntary tender offer, in addition to the aforementioned conditions provided under the CMSB Notification, it is common that the acquirer includes a condition that the tender offer can be cancelled if the number of shares tendered is less than the number of shares specified by the acquirer.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

A break-fee provision can be regarded as one of the main options for deal protection. However, the most common mechanism is an exclusivity arrangement. We note that break-fees are regarded as liquidated damages in Thailand and may be reduced by the Thai court if they are considered disproportionately high.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Both locked box and completion accounts are the most common consideration mechanisms for private M&A in Thailand. Neither of them can be regarded as a dominant approach. In recent years, however, we have noticed a slight increase in the use of locked box or even fixed price consideration mechanisms, especially for individual sellers who need to speed up negotiations and conclude their deals.

5.5 What conditions are usually attached to a private takeover offer?

Unlike with public M&A, there is no concept of taking over a private company under Thai law. Therefore the private M&A must be carried out through a share sale agreement containing terms and conditions as mutually agreed by the parties. The share sale agreement shall contain general conditions, including: (i) warranties given by the parties being true and accurate; (ii) no occurrence of any event resulting in any material adverse change; and (iii) necessary corporate approvals being obtained.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Yes. It is common to use the laws of a neutral jurisdiction as the governing law in a private M&A share purchase agreement.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

We rarely see this practice in Thailand.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

The most common exit strategy for the owner of a private business is to seek a larger company to buy its business through an M&A transaction. This is a win-win situation for the parties, where the seller can easily cash out and, for the buyer, it a more efficient way to grow its business than creating new products from scratch.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect the legal practice to respond?

We believe Thailand's prospects for 2018 will remain strong due to its positive economic fundamentals. This results from a number of positive factors, including the government's Thailand 4.0 economic plan and the continual integration of the ASEAN Economic Community. The Thai economy should grow about 4% in 2018 according to the current estimation of financial advisors and it is expected that the stock market would still reach a new high, as it did during 2017. This should promote both outbound and inbound investments. We therefore expect to see active M&A transactions throughout 2018.

About the author |

||

|

|

Kudun Sukhumananda Partner, Kudun and Partners Bangkok, Thailand T: +66 88 088 4288 F: +66 02 838 1795 Kudun Sukhumananda's principal areas of practice are capital markets and securities, mergers and acquisitions, corporate, and banking and financial services. He has extensive experience in advising domestic and international clients on international and domestic offerings of shares and debentures, corporate mergers and acquisitions, investments, corporate and debt restructuring, joint-ventures, and commercial transactions, as well as real estate investment trusts and infrastructure funds. |

About the author |

||

|

|

Kom Vachiravarakarn Partner, Kudun and Partners Bangkok, Thailand T: +66 61 914 6653 F: +66 02 838 1795 Kom Vachiravarakarn's principal areas of practice are capital markets, securities regulatory advice and mergers and acquisitions. He has extensive experience in advising domestic and international clients on international and domestic offerings of shares, corporate mergers and acquisitions, investments, corporate restructuring, joint-ventures, and commercial transactions, as well as real estate investment trusts and infrastructure funds. |