The volume of M&A transactions decreased significantly last year as a result of several factors, including global economic issues, Costa Rica's enactment of a significant amendment to its tax legislation, the country's fiscal deficit and its stagnant position in the global competitiveness index. The latter primarily reflects lagging infrastructure development.

Despite the above, 2020 offers opportunities for an increase in M&A activity. This is due to a combination of positive factors resulting from measures taken by the government and competitive advantages consolidated over time that have positioned Costa Rica as an attractive destination for foreign investment. These positive factors include: the absorption by the market and its participants of the new tax legislation and its associated rules, which prior to their enactment, had put a brake on M&A activity; and the highly specialised manufacturing and shared services operations channelled through the Costa Rican Free Trade Zone Regime and its robust and skilled work force, coupled by the country's extensive network of free trade and double tax treaties, all of which remains attractive to foreign companies.

These attributes will be key to strengthening the country's position as the main platform for penetrating the Central American and Dominican Republic markets covered by the Dominican Republic-Central America Free Trade Agreement with the US (CAFTA-DR). They will also encourage certain business groups that control key businesses and industries to engage in deals to pursue growth through M&A with stronger international and/or regional players. The retail sector in general, telecoms and real estate and hospitality will be hot sectors for M&A.

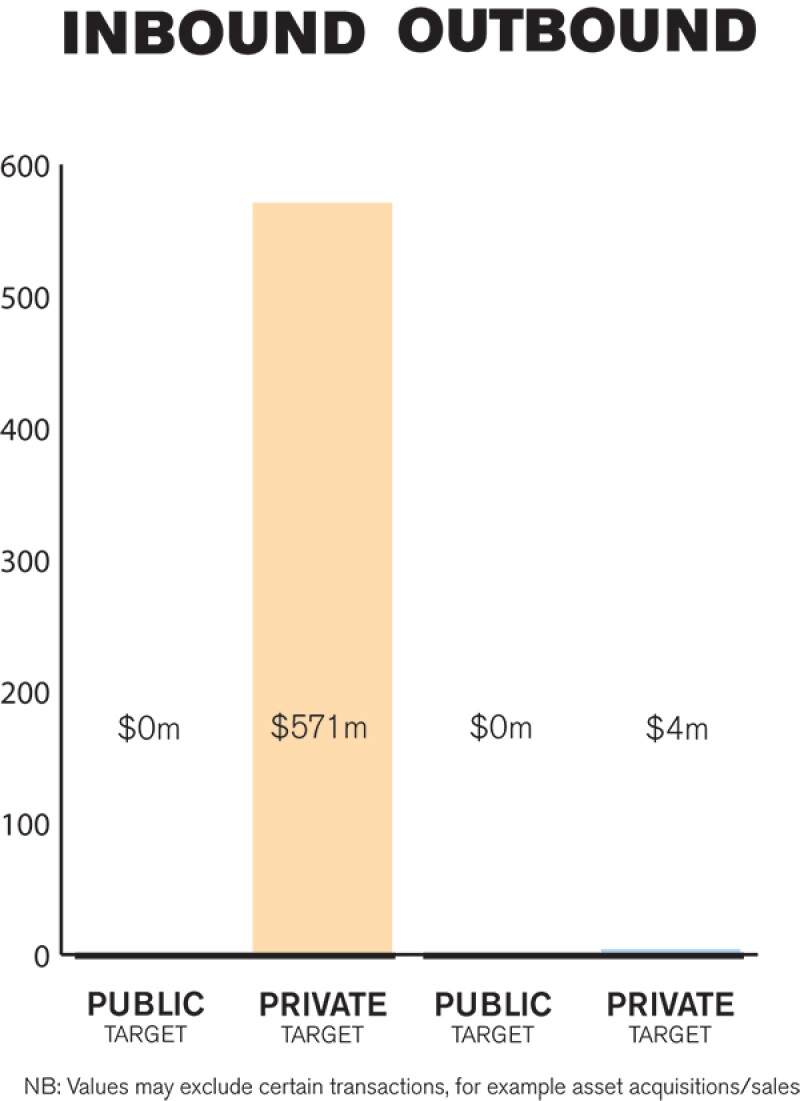

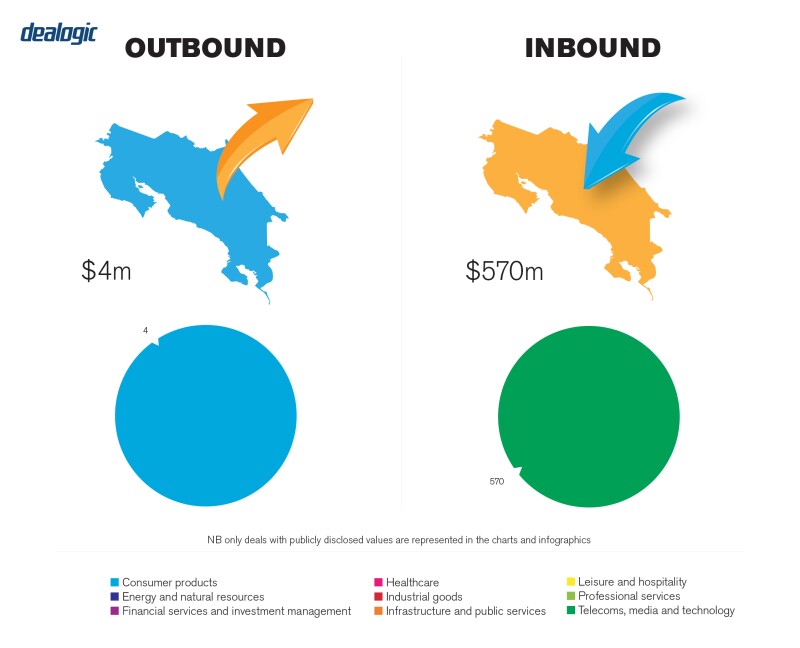

As mentioned above, deal flow has decreased overall, especially for inbound transactions; outbound flow is usually modest (only a small handful of local industrial or commercial groups have the firepower to engage in cross-border acquisitions). The tax reform and other internal factors affecting the country, such as the fiscal deficit and the downgrading of the country's credit rating by international credit agencies, have adversely impacted the M&A activity. Hopefully this is a temporary affect as actions taken to solve these problems – some of them only recently implemented – will have a direct and positive impact on M&A, making prospects more sanguine.

Almost all M&A transactions in the market are between privately held companies. The reality of the Costa Rican market markets is that stock exchanges are incipient and very few companies are listed. Public issues often come up when a public company listed abroad gets into an M&A transaction that touches upon a local subsidiary or branch. This structure means that the transaction is to a certain extent impacted by regulated market rules and hence the local component of the transaction is also subject to the rules.

TRANSACTION STRUCTURES

The most common trend in M&A in Costa Rica is industry consolidation with a view to M&A-driven growth, coupled with financing considerations. This has been notably the case in the telecoms sector and with strategic purchases for certain supply chains and facilities for the production and/or processing of raw materials.

Private equity fund activity has increased and this trend is supported by a more open environment among local businessmen and entrepreneurs to sell their businesses to strive to be more competitive through M&A-driven growth. The other types of entities that have become active in the M&A market in the region are family offices or private equity funds created by family groups that want to compete for the acquisition of attractive businesses. These family groups have previously sold their own businesses or disinvested out of operations that they acquired in the past as part of diversification strategies. As a result of those sales, they have fresh funds that they are willing to invest in the acquisition of businesses outside their traditional core areas.

The major sources of debate in M&A deals going forward will be the impact that the above-mentioned tax reform will have on deal structuring, along with the recently enacted reform to the antitrust legislation, which strengthens antitrust controls and regulations; the new antitrust rules enable full ex-ante control of M&A transactions by the Anti-Trust Authority (Coprocom). These reforms will have a substantial effect on deal structures and deal implementation. The low approval thresholds for transactions set forth in the law will require that most deals are reviewed and approved by Coprocom, which raises questions as to the new timeframes to obtain the necessary clearances and to the interpretation and application of the new legislation.

LEGISLATION AND POLICY CHANGES

The main regulatory body for M&A transactions is Coprocom (Comisión para Promover la Competencia), which is regulated by the antitrust legislation contained in the Ley de la Promocion de la Competencia y su Reglamento (Law No. 7472) and its amendments in Law No. 9736 (collectively, the Anti-Trust Act and its By-laws).

The other key legislation is the Costa Rican Commerce Code and its amendments and interpretations as to certain legal concepts or figures by rulings of the Civil Courts and/or resolutions issued by the Costa Rican Tax Administration.

It is worth highlighting that there have been recent significant legal developments in the market. The substantial and material amendments to the Anti-Trust Act and its By-laws contained the new antitrust regulations that entered into effect in November 2019. The main impacts are the required ex-ante approvals, the new reporting thresholds based on the value on the transaction and/or the sales volumes in the aggregate of the parties (or related parties) involved in the transaction, stronger powers for the regulator and steeper penalties for breach of the regulations.

Discussions will likely arise once Coprocom further interprets and applies the new antitrust regulation.

MARKET NORMS

As regards market practice, there is a varying degree of understanding about the reach of the antitrust regulations, the application of the new tax regulations on deal structures and the payment of a fiscal tax based on the value of a transaction.

Given the impact of the new tax legislation, parties to a transaction must prepare for tax planning structures that could require corporate reorganisations. Companies should also plan structures to secure successful entry and exit strategies and to include provisions to secure a successful post-closing and transition period. Issues those related to post-closing obligations that will facilitate full compliance with applicable regulations in general – and labour law specifically (which is also governed by recently enacted legislation) – are especially important.

In terms of the incorporation of technology into legal practice, we are seeing the use of certain tools, in the form of artificial intelligence (AI) and bot automation primarily, especially for due diligence procedures. These have changed the normal format and scope of a traditional due diligence processes, with an emphasis on security, speed, accuracy and the presentation of information and findings in dashboards.

PUBLIC M&A

The Costa Rican Stock Market Regulatory Law (Law No. 7732) establishes in article 36 that anyone who intends to acquire, directly or indirectly, in a single act or successive acts, a volume of shares or other securities of a public company, and thus achieve a significant participation in the share capital, must formulate a takeover bid (TOB) directed to all the shareholders of the target company.

Article 102 of the Regulation on the Public Offering of Securities defines "significant participation" as "a percentage equal to or greater than 25% of the outstanding and voting capital of the company". When the bidder intends to reach a participation equal to or greater than 25%, but less than or equal to 50%, the offer must be made on a quantity of shares representing at least 10% of the share capital of the company. If the bidder's intention is to reach a participation greater than 50%, the offer must be made for a number of shares that will allow the bidder to reach at least 75% of the share capital of the company.

The TOB must comply with several requirements listed in article 107 of the Regulation on the Public Offering of Securities and must be submitted to previous authorization before the General Superintendence of Securities (SUGEVAL) before going public.

When submitting for TOB authorisation, the bidder must prove to SUGEVAL that it has issued guarantees covering 100% of the offer.

On the other hand, the recently enacted amendments to the Anti-Trust Act included a new article 27, paragraph a), which mandates that SUGEVAL must notify Coprocom of any business combination in its knowledge that has "monopolistic tendencies" and that involves entities supervised by Financial Super-Intendency. Coprocom must send a copy of the notification to the National Supervisory Board of the Financial System (Conassif) and request information on the business combination. Conassif will determine if it can issue a final resolution to authorise the business combination or not. If Conassif considers that it should not issue the final resolution on the business combination, Coprocom will issue the resolution.

PRIVATE M&A

The trend in the Costa Rican market, leveraging off the expertise of more sophisticated investment bankers, has been to use mechanisms for setting the final purchase price, along with its allocation, disbursements, premiums, etc. Locked-box mechanisms, and earn-outs, have been used more frequently for certain transactions. Escrow agreements to guarantee contingencies and/or liabilities usually identified in a due diligence process have become the norm in the drafting of the closing documents for an M&A transaction. W&I Insurance is not common at a regional level, but it is used by certain transnational companies or sophisticated private funds.

The conditions for a private takeover usually involve obtaining shareholder and/or board of director approval pursuant to the articles of incorporation of the company. For certain transactions, parties must comply with the minority shareholder safeguards enacted by an amendment to the national Commerce Code of 2016. These safeguards require approval for a sale of the assets of the target.

It is a general standard practice to submit to buyer corporate resolutions issued in a Shareholders Assembly Meeting to approve an offer, as the Shareholders Assembly is the supreme organ of local companies. Such resolutions are also required to complete a takeover transaction. The general terms and conditions of the offer are generally standard and are contained in a letter of intent negotiated by the parties, subject to due diligence, price negotiations, warranty mechanisms, etc. Moreover, the above-mentioned anti-trust regulations are now creating a need to pre-emptive analysis of the impact of the regulations on a potential transaction.

Choice of law and choice of forum provisions are common. It has become common practice to provide for foreign laws and/or jurisdictions in the agreements in the applicable law and dispute resolution clauses. Given that US companies are the most frequent participants in local M&A transactions, New York law has been widely selected as the applicable governing law, expect for those matters that require the application of Costa Rican law (for instance disputes related to property, etc.).

W&I Insurance is not common in Costa Rica. This type of insurance is, sometimes, part of the general insurance policies of certain transnational corporations that have acquired going concerns in Costa Rica or the Central American region.

The exit environment is certainly more limited than in other jurisdictions with developed capital markets. Local businessmen aim to sell their operations to targeted companies, and in some cases – depending on the type of operation – to private equity funds.

LOOKING AHEAD

We predict an increase in regional M&A for 2020. The legal practice continues to become more sophisticated, more attuned to international standards and more focused on key areas of M&A practice, including cross-border and local tax issues. We feel that clients will continue looking for comprehensive multidisciplinary approaches to their transactions and projects. Furthermore, clients seek more digital resources from its legal/tax advisors.

About the author |

||

|

|

Fernando Vargas Winiker Partner, EY Law Central America Santa Ana, Costa Rica T: +506 22089 800 E: Fernando.Vargas.Winiker@cr.ey.com Fernando Vargas has acted as a general corporate strategic counsel for transnational, regional and local companies doing business in Costa Rica and the rest of Central America, focusing on corporate matters that have spanned cross-border business transactions covering M&A, joint-ventures, corporate reorganisations, foreign investment and market entry issues, compliance and corporate governance. He also participates in structuring projects for energy generation, telecommunications and infrastructure, and in the set-up of manufacturing and shared services operations for global companies in Costa Rica under the Free Trade Zone Regime, including several ranked in the Fortune 500 listing, among others. Several international publications have praised him in general for his knowledge, commitment and responsiveness. |

About the author |

||

|

|

Ana Sáenz Gammans Senior manager, EY Law Central America Santa Ana, Costa Rica T: +506 22089 800 E: Ana.Saenz.Gammans@cr.ey.com Ana Sáenz is a senior manager of the corporate and M&A division of EY Law, where she has participated in cases concerning mergers, acquisitions, joint-ventures, foreign and domestic investment, distribution and agency, collaborating mainly in due diligence processes, complex research, review of agreements, and drafting and preparation of reports and opinions. Ana has a sound knowledge of foreign investment, as well as corporate and transactional issues. |