SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

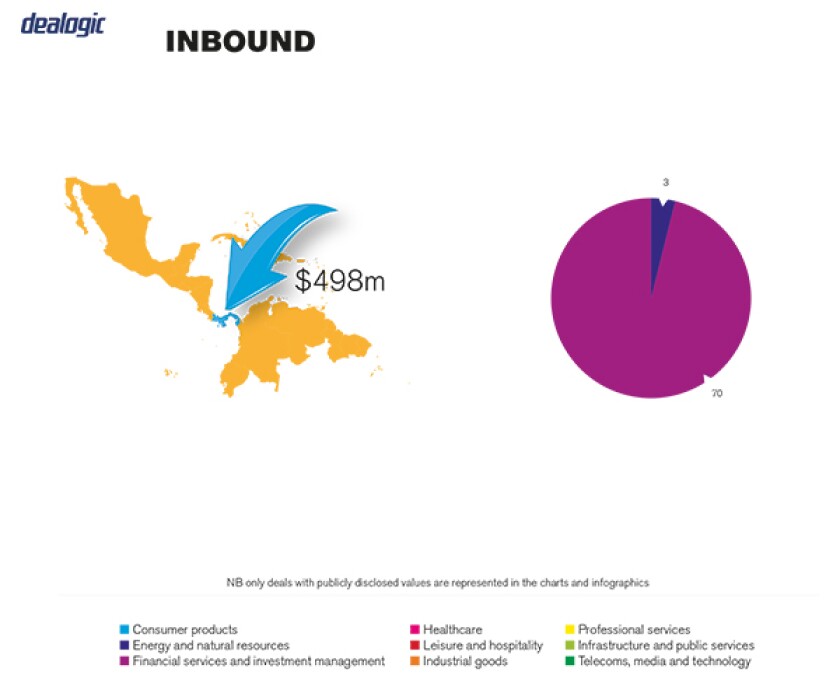

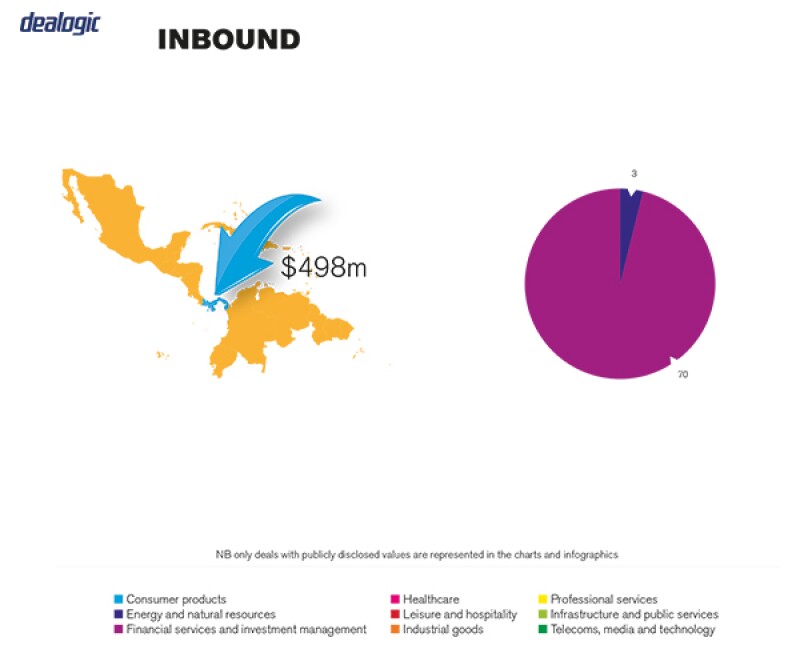

M&A activity in 2016 continued to be as active as it was in past years. In 2017, we expect the level of M&A activity in Panama to remain stable. Although there are no specific driving factors behind the increase in M&A activity in the previous years, it is certainly the case that Panama's economic growth makes local companies more attractive targets. Without question, most of the M&A activity in 2015 happened in the financial industry (banks, investment advisors, and insurance companies), the energy industry (mostly power generation) and local industries (including plastics and dairy, among others).

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

The M&A deal flow during the last few years has remained fairly constant. We do not expect major changes in 2017.

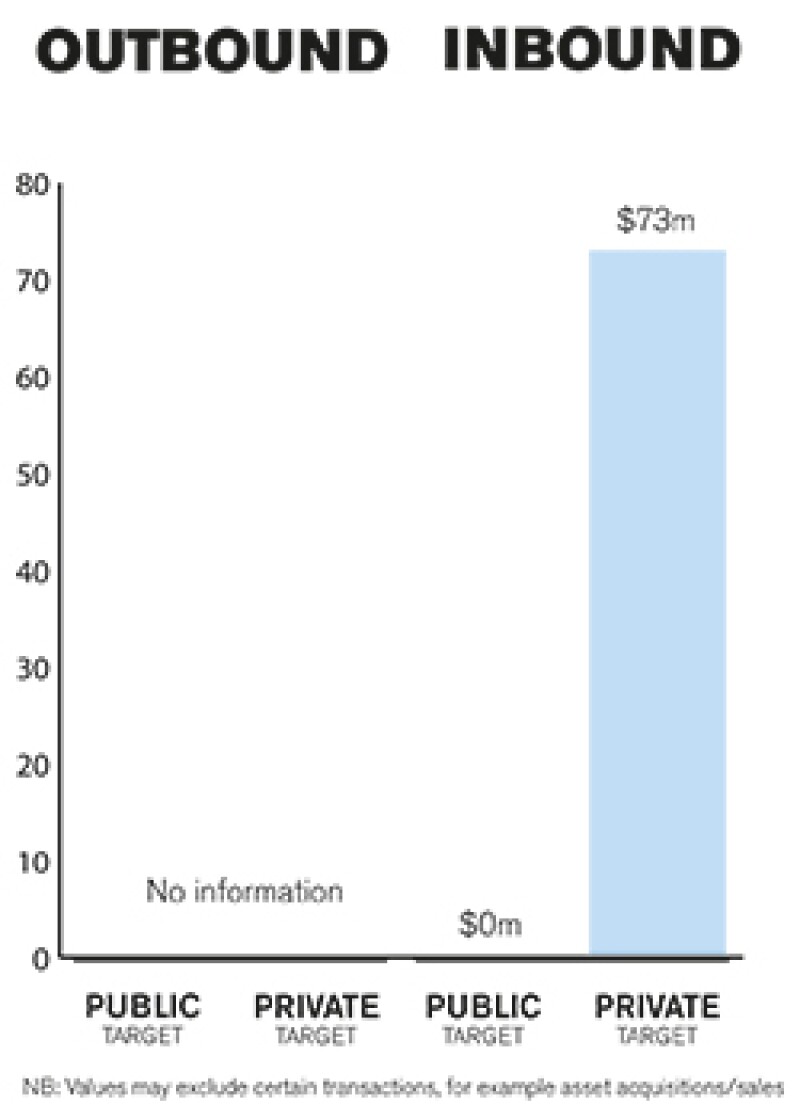

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

There is no clear driver between private or public M&A, and the balance can change from one year to the next depending on specific deal flow for any given year.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Among the most notable M&A transactions in Panama in 2016 was the transfer of several companies owned by a person designated as SDNs (Specially Designated Nationals) by the Office of Foreign Assets Control (Ofac) of the US Department of the Treasury, which required the transfer of the shares of these companies to a trust structure for the benefit of the group's creditors and structured through the National Bank of Panama to facilitate the sale of the businesses, which was ongoing in Q1 2017. The implementation of the trusts, and the sale process, presented various complex situations above and beyond a typical M&A transaction by having to tackle various issues with creditors and local and foreign governments.

2.2 What have been the most significant trends or factors impacting deal structures?

Recently we have seen a number of financed transactions in which the closing of the transaction is conditional upon obtaining the required financing. This has not been very typical in Panama as we are used to seeing cash offers.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

M&A transactions in Panama are impacted by provisions of the Commercial Code, the Civil Code, and depending on the nature of the target company, by the Corporations Law, Limited Liability Company Law and industry-specific regulations (banking, securities, mining and energy). The primary regulator for M&A activity in Panama will depend on the nature of the business undertaken by the target company. So, for example, in the case of banks, the primary regulator would be the Superintendence of Banks of Panama, and in the case of broker dealers or investment advisory firms, the primary regulator would be the Superintendence of the Securities Market (formerly known as the National Securities Commission). In all cases that may result in an economic concentration, the antitrust authority (Acodeco) could play an important role.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

There have been no recent changes to regulations or regulators during 2016 that would specifically impact M&A transactions or activity in 2017 and beyond, and none are expected to be adopted.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

To our knowledge, there are no rules, legislation or policy frameworks under discussion that may impact M&A in Panama in the near future, and none in relation with most regulated industries (telecom, energy, banking, securities, mining, among others).

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

The most common mistake or misconception is that there are no economic concentration regulations in place in Panama that need to be considered in an M&A transaction. In reality, M&A transactions in Panama can be directly affected by Law 45 of October 31 2007 (Consumer Protection and Competition Defence Law), Executive Decree 8-A of January 22 2009, which regulates Title I (Monopoly) and other dispositions of Law 45 of October 31 2007 and Resolution A-31-09 of July 16 2009, through which the Consumer Protection and Competition Defence Authority (Acodeco) approves the Guide for the Control of Economic Concentrations, even though these regulations do not establish a specific threshold for review of particular transactions.

The types of transactions caught are all transactions that fit into the economic concentration concept, as established by Law No. 45 of 2007, which includes any merger, acquisition of control or any other act by virtue of which corporations, partnerships, associations, shares, social parties, trusts, establishments, or assets in general are grouped together, that takes place between suppliers or potential suppliers, customers or potential customers and other competitors or potential competitors.

Certain sectors, such as energy, have specific thresholds.

Internal restructurings or reorganisations are not included in the concept of economic concentrations.

Prior notification of a potential economic concentration is voluntary. If parties decide to voluntarily notify in advance, they must do so before the merger has taken effect; that is, before there has been a change in control. Parties typically file prior notifications of an economic concentration when there are circumstances surrounding the transaction (ie market share) that increase the risk of an investigation by Acodeco.

Given that it is a voluntary prior notification, there is no prohibition of closing before clearance, but the transaction may be challenged by Acodeco or third parties within three years if it is not cleared before it takes place. If the prior notification is filed, Acodeco must review within 60 days or additional information requested by Acodeco is provided. If the Acodeco does not issue a response within that 60-day timeframe, the concentration is deemed to be approved. If Acodeco reviews the transaction directly, it has up to three years to complete its review of the transaction. Acodeco will have the authority to investigate and challenge economic concentrations which have not submitted to prior verification, within a three-year period from the date on which change of control occurred. Acodeco would only have jurisdiction to review and impose penalties in case there is an economic concentration in Panama.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Typical questions have to do with the filing of a prior no-objection request from Acodeco, and in the case of M&A transactions in regulated industries like financial services (banking and securities), questions dealing with the requirements and timing for applicable prior authorisations.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

The most critical measure is making sure that enough time is given for purposes of sufficiently documenting any regulatory request for prior approval either from the Acodeco, or the specific industry regulatory body, and allowing sufficient time for the approvals to be obtained prior to closing on the M&A transaction.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

A takeover offer of a public company must be made to all of the shareholders, with equal terms and conditions and the purchase price must be paid to all shareholders who accept the offer. If a bidder offers to purchase more than 25% of the shares of a public company, or offers to purchase any number of shares which, as a result of said purchase, would result in the bidder owning more than 50% of the issued and outstanding shares of the public company, the offer must be subject to the public tender offer rules under the securities laws. If the tender offer will result in the bidder owning more than 75% of the issued and outstanding shares of the public company, the offer must be made for all shares of the target which are not owned by the bidder.

5.2 What conditions are usually attached to a public takeover offer?

In Panama, buyers can make conditional offers. However, in the context of public tender offers, the securities law requires committed funding and the posting of a guarantee (for example cash or bond) to cover the tender offer.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

There is no market standard. The parties in an M&A transaction are free to agree to any preferred break fees, if any.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

In Panama, the use of escrows is perhaps the only current trend with regard to consideration mechanisms. Locked box mechanisms and completion accounts are not commonly used.

5.5 What conditions are usually attached to a private takeover offer?

There are no specific conditions, above and beyond the standard, that are attached to a private takeover offer in Panama.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

While valid and binding under Panama law, it is not common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements, except from certain larger transaction involving a foreign purchaser.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance on private M&A transaction is not common in Panama.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Our prediction is for the M&A market to remain stable. Panama's economy is expected to continue to lead the region in growth, and that should ultimately translate into continued M&A activity.

About the author |

||

|

|

Eloy Alfaro B Partner, Alemán Cordero Galindo & Lee (Alcogal) Republic of Panama, Panama City T: 507 269 2620 F: 507 264 3692 Eloy Alfaro joined Alemán Cordero Galindo & Lee as an associate in 2004 and became a partner in 2011. His professional practice concentrates on banking, finance and capital markets, corporate and M&A, public bids and concession contracts and real estate law. Alfaro has been active in mergers and acquisitions, assisting clients such as Citibank, the Bank of Nova Scotia and BBVA in banking acquisitions, mergers and dispositions in Panama, in addition to assisting several other international banks and companies in cross-border financing transactions. Alfaro has also advised Panamanian and international clients in important public bid projects. Alfaro has a juris doctor from the University of Pennsylvania Law School, and a bachelor of arts in political science from Columbia University. He is a member of the National Bar Association of Panama. He is fluent in Spanish and English. |

About the author |

||

|

|

Rita de la Guardia Associate, Alemán Cordero Galindo & Lee (Alcogal) Republic of Panama, Panama City T: 507 269 2620 F: 507 264 3692 Rita de la Guardia joined Alemán Cordero Galindo & Lee in 2014. Her professional practice concentrates on banking, finance and capital markets, corporate and M&A. De la Guardia has been active in mergers and acquisitions, assisting clients such as Citibank and Celsia SA ESP. De la Guardia has a JD from Cornell Law School and a bachelor of science in foreign service from Georgetown University. She is a member of the National Bar Association of Panama. She is fluent in Spanish and English. |