The Japanese M&A market in 2019 continued to be dominated by outbound investment by Japanese corporates. These deals have been driven by corporate restructurings broadly aiming to diversify company holdings via overseas investment while also paring non-core businesses domestically. While investment remains strong across all sectors, Japanese buyers showed an increased willingness to spend big to bolster research and development capabilities via acquisitions of target companies holding innovative technologies.

2019 also saw a maturing of the market for venture capital in Japan with increases in available financing, including from a number of large Japanese corporations that have established their own corporate venture funds (CVC), which typically participate in venture financing along with more seasoned venture capitalists.

Further, in 2019 and early this year, there were an increasing number of hostile transactions (for example, the Itochu tender offer for Descente; the HIS tender offer for Unizo-Holdings and a Murakami related fund's bid for Toshiba Machine). Traditionally, the Japanese M&A market has been dominated by friendly deals, but we may see more hostile activities going forward.

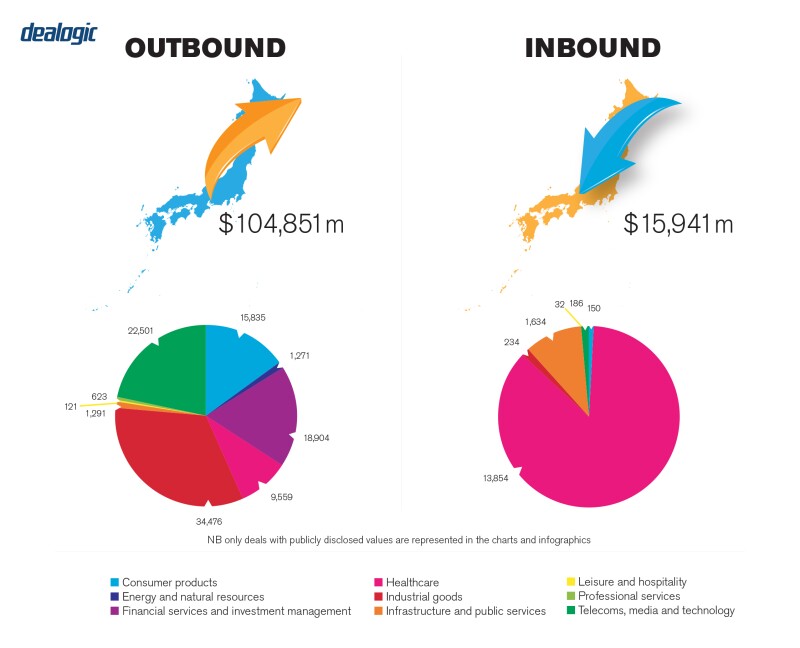

Also in 2019, we saw the closing of the largest-ever acquisition of a foreign company by a Japanese company with Takeda Pharmaceuticals' acquisition of Shire. At roughly $62 billion dollars, this was the largest pharma deal that closed in 2019 worldwide and it elevated Takeda to one of the largest 10 pharmaceutical companies in the world, when measured by sales. This deal follows a trend of deals by large pharmaceutical players to acquire next-generation drugs to replace expiring patents within their portfolios.

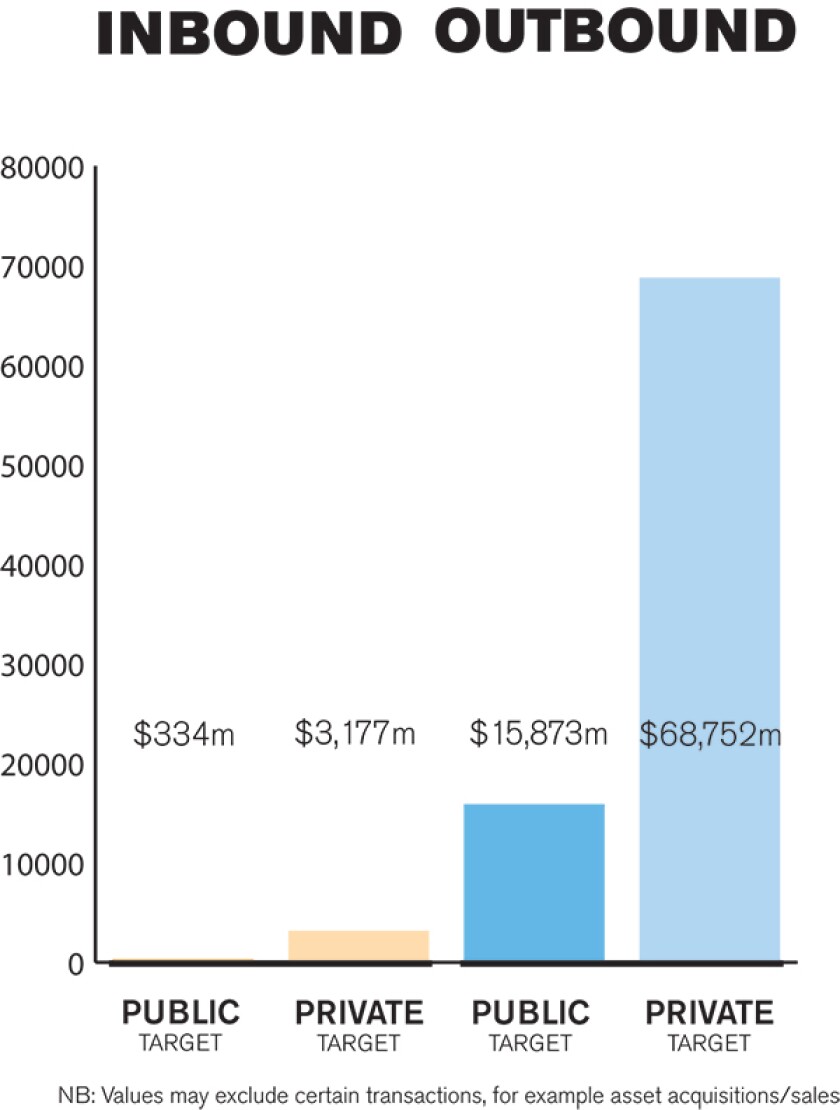

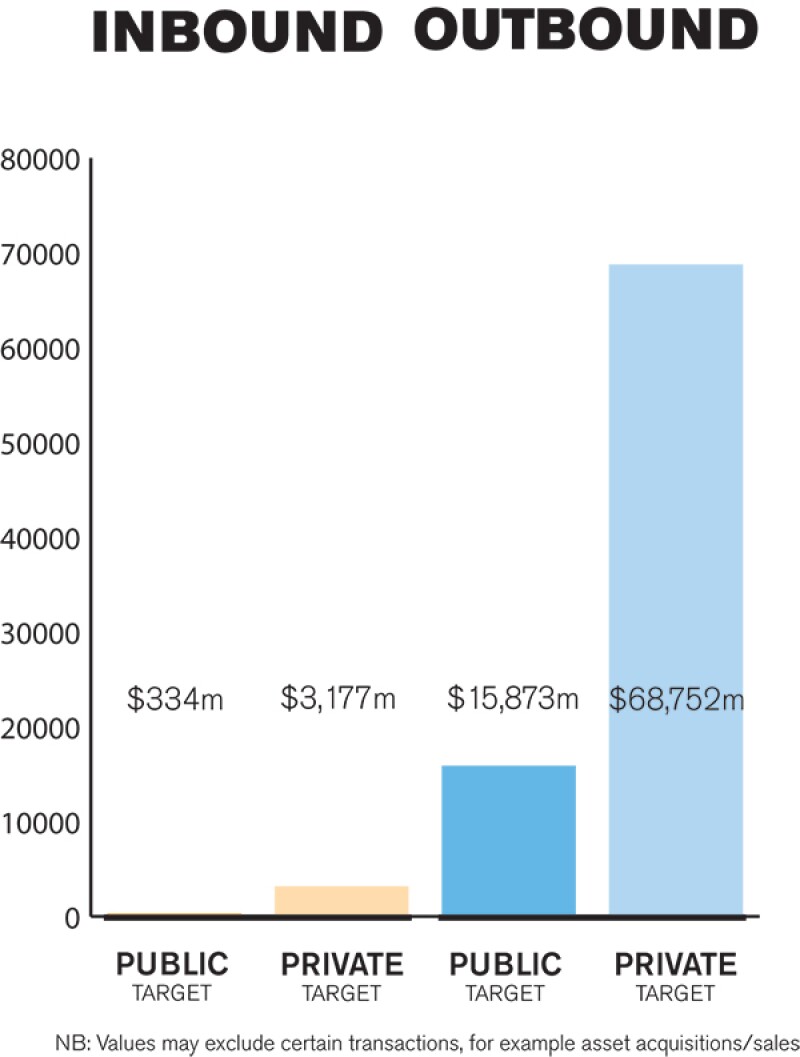

According to data from Dealogic, Japan M&A deal volume in 2019 reached 818 transactions with a total deal value of over $113 billion, which is only surpassed by the US and the UK in terms of total deal value. Unsurprisingly, the sectors producing the largest number of transactions were technology, professional services and industrial/construction.

While outbound M&A activity still vastly outpaces inbound deals, total inbound deal value was up over 400% from 2018.

TRANSACTION STRUCTURES

For public deals, a takeover bid is mandatorily triggered, among others, in the event of an acquisition of (or building the position of) more than one-third of the total voting rights in a public company by way of an off-market trade (including a public company going private). When going private, after completion of the takeover bid, if a bidder acquires 90% or more of the target company, the bidder may request the issuer company to approve the cash squeeze-out of the minority; if less than 90% is acquired, the issuer undertakes a stock consolidation so that the minority will end up with a fractional share, which will be purchased based on an approval issued by the courts. As a result of the recent tax reforms, a cash merger can be used as an alternative to a squeeze-out by way of stock consolidation.

For private companies, share deals remain the preferred structure, although asset deals are not uncommon.

Financial investors are playing a more significant role than ever in shaping the Japanese M&A market. In recent years, Japan has seen an increase in shareholder activism driven by reforms in corporate governance, introduction of the stewardship code, greater awareness among shareholders of their power to shape company policy (including in the areas of environmental, and social responsibility), and a decline in the power that Japan's banks exert over corporations.

In October 2019, Japan also saw its first ever spin-off deal involving a listed entity when Koshidaka Holdings announced its plan to spin off its subsidiary, Curves Holdings, which will be listed on the Tokyo Stock Exchange in March 2020.

LEGISLATION AND POLICY CHANGES

In recent years, Japan has introduced a number of corporate governance reforms, including the introduction of the Corporate Governance Code. These changes have increased the number of independent directors and empowered activist shareholders.

A recent revision of the Companies Act, promulgated on December 11 2019, has eased regulation of 'share delivery' (kabushiki koufu seido), whereby Japanese joint stock companies use their own shares as consideration paid to a target company's shareholders in certain domestic M&A transactions and when creating a new subsidiary. Under existing law, when companies use share delivery to acquire less than 100% of their target, they are faced with daunting legal hurdles. The law as amended should compare favourably with currently existing law, as it avoids some burdensome compliance aspects, such as requirements and procedures required for in-kind contribution and potential liabilities of directors. Share delivery allows for consideration to be paid in equity rather than cash in acquisitions of less than 100% of the target. These revisions will come into force by June 2021, and further regulations and guidance from the government will be forthcoming. One major factor in whether these revisions will gain wider acceptance will be whether these types of transactions are able to make use of tax deferrals similar to those used in a reorganisation.

In November 2019, the legislature passed an amendment to the Foreign Exchange and Foreign Trade Act that will significantly expand prior-notice (which operates functionally as prior approval) requirements for certain types of foreign investments in Japanese companies, including the acquisition of shares of Japanese publicly traded companies. The amendment would lower the threshold shareholding ratio required for advance notification (approval) from 10% to 1% of foreign ownership with respect to two categories of reviewable transactions: (i) acquisition of shares or voting rights of a publicly traded company, and (ii) consenting to a material change to the purpose of a public company. Exemptions for the advance notice requirement will be provided by regulation at a later date. The amendment expands the government's power to intervene in a completed transaction or activity in which the parties involved failed to submit an advance notification. The amendment may be expanded to include divestiture orders, among other things. The amendment may require financial institutions who trade in public companies' shares, and mutual funds and other funds whose investment portfolios include shares of such companies, to revisit and reconsider their trading or investment practices to determine whether those institutions can fit their trading or investment practice into an exemption.

Whether these changes will have a negative impact on the recent progress seen in corporate governance and increased activism is yet to be determined, but they are sure to be followed closely by stakeholders in Japan.

MARKET NORMS

As mentioned above, the Companies Act has historically placed onerous requirements on the issuance of shares to particular third parties (namely sellers or shareholders of the target company in the M&A context). Due to these requirements, Japanese companies have long favoured cash consideration in M&A transactions, while foreign investors may prefer the use of stock consideration or the combination of cash and stock. Legal practitioners have long stressed that this has been a significant detriment to Japanese companies, in particular in the global M&A market, and have hoped for the creation of a level-playing-field in relation to cross-border transactions.

In November 2019, Japanese data analytics company Data Section announced its stock consideration deal to acquire a Chilean company by obtaining approval under the Act on Strengthening Industrial Competitiveness, which provides for certain exemptions from the foregoing requirements under the Companies Act. This is the first such approval given to a Japanese public company under that act. Other Japanese companies will no doubt keep a close eye on whether such approvals will continue to be granted.

PUBLIC M&A

The primary law governing M&A, including those of public companies, is the Companies Act. The most common method for obtaining control of a public company in Japan is by means of a cash tender offer. The detailed rules in relation to when a mandatory tender offer must be made are set out in the Financial Instruments and Exchange Law.

When making a tender offer, the bidder is required to make the offer on the same terms and conditions to all shareholders. Conditions customarily attached to tender offers include that the bidder will not purchase any shares if: (i) the number of shares tendered is less than the number of shares originally specified by the bidder in the offer, or (ii) a part or any part of the shares tendered exceeds the number (which must be less than two-thirds, above which level the bidder must offer and purchase all shares tendered) of shares originally specified by the bidder in the offer (in the case of (ii), the bidder must purchase on a pro rata basis). A tender offer may be withdrawn only on the basis of certain statutorily prescribed conditions. A financing-out is generally not allowed.

Break fees that are reasonable are thought to be generally enforceable in Japan; however, they are not common in public M&A transactions

PRIVATE M&A

In Japan, the most common way to acquire a private company is via a share purchase, due to its relative simplicity. Parties that do opt for an asset purchase will usually accomplish it via business transfer (jigyou jouto).

The consideration mechanism utilised in most private transactions is the use of closing accounts, with use of locked-box mechanics being relatively rare. One-time lump-sum payments without a completion true-up are also relatively common, in particular for deals involving small and medium-sized enterprises.

The use of earn-outs and escrow arrangements in Japan remains relatively rare.

The general awareness of representations and warranties insurance continues to increase in Japan, though its use still has not gained wide acceptance. One hurdle to the acceptance of representations and warranty insurance in domestic transactions may be the requirement that the documentation be drafted in English, which is uncommon for domestic M&A deals.

Deals of a certain size will typically condition closing upon satisfactory due diligence, accuracy of representations and warranties, no breach of obligations and undertakings, completion of all transactional documentation and internal approvals, third-party approval of a change of control, resignation (or retention) of directors, the absence of any material adverse change, and regulatory consents, including merger control and inward direct investment approval, for deals over a certain threshold or in regulated industries.

Deals involving Japanese assets or shares are most commonly governed by Japanese law and subject to the jurisdiction of Japanese courts. However, where one of the parties is based outside of Japan, the parties may negotiate for the use of commonly accepted laws (England and Wales or New York) or the parties may agree upon the use of foreign-seated arbitration.

In recent years, both trade sales and initial public offerings continue to be viable options for exits in Japan.

LOOKING AHEAD

The Japanese government has submitted its 2020 tax reform proposal, which includes the introduction of a two-year (until March 31 2021) special tax treatment for promotion of open innovation, with reports that up to 25% of the invested amount will be deductible from taxable income on investments of JPY100 million ($910,000) or more to a private venture company who has a company history of less than 10 years. This is expected to stimulate venture capital financing and promote open innovation, which is a key policy priority of Prime Minister Shinzo Abe's Abenomics.

Further, with the rapid aging of Japanese society, there is an increased focus on 'business succession' (jigyo shokei) from older generation to younger generation and/or strategic or financial buyers.

Given the expected continuation of the Bank of Japan's relaxed credit policy, the large internal cash reserves held by Japanese companies, and the upcoming Tokyo Olympics/Paralympics in 2020 (as well as the low birth-rate and long life expectancy in Japan, which could have an impact on the domestic market both positively and negatively), we would expect that current M&A trends will continue for the foreseeable future.

About the author |

||

|

|

J Ryan Dwyer, III Managing Partner, K&L Gates Tokyo, Japan T: +81 3 6205 3601 W: www.klgates.com/tokyo-japan/ J Ryan Dwyer, III concentrates his practice on cross-border M&A for Japanese clients investing outside of Japan, foreign direct investment into Japan by US and other non-Japanese companies and international joint-ventures involving Japanese parties. He is the managing partner of the firm's Tokyo office and a member of the firm's global advisory council. He has extensive experience advising non-Japanese companies on the corporate, regulatory, employment and commercial aspects of transactions and investing in Japan and setting up and operating businesses in Japan. He has worked across a number of industries on Japanese and complex cross-border deals, with particular focus in the technology sector, advising companies in relation to licensing and distribution agreements, and regulatory issues. |

About the author |

||

|

|

Kyle Jackson Associate, K&L Gates Tokyo, Japan T: +81 3 6205 3639 W: www.klgates.com/tokyo-japan/ Kyle Jackson is an associate at the firm's Tokyo office where he is a member of the corporate practice group. He has advised clients on a wide range of cross-border transactions, in particular M&A, joint-ventures and strategic alliances, licensing, and supply and distribution arrangements, often involving multijurisdictional issues. Prior to joining the firm, Kyle served as legal counsel for a leading Japanese chemical company in Tokyo where he was responsible for the execution of international acquisitions, joint-ventures and joint development projects. |

About the author |

||

|

|

Tsuguhito Omagari Partner, K&L Gates Tokyo, Japan T: +81 3 6205 3623 E: tsuguhito.omagari@klgates.com W: www.klgates.com/tokyo-japan/ Tsuguhito Omagari is experienced in domestic and cross-border mergers and acquisitions, private equity, domestic and international joint-ventures, investments into Japan and by Japanese companies overseas, private investment in public entities (PIPEs), real estate investment transactions, aviation finance, investment management, banking and securities regulations, class share issuance, general corporate, litigation and dispute resolution. He has acted for domestic and international banks, private equity firms, manufacturing companies in various industries, securities firms and real estate asset managers. |