SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

India continues to see reasonably high volumes of M&A activity, both domestic and cross-border, driven by a relatively stable economy, the liberalisation of government policies and a continued interest from both strategic and financial investors. The telecom industry has seen the largest deals, accounting for 37.30% of all deal activity, followed by the technology sector (17.55%), financial services (12.61%) and energy, mining and utilities (9.7%).

The main themes which were drivers for M&A activity in 2017 were: substantial domestic M&A activity; the prominence of strategic acquirers over financial investors; trend towards "control deals" by financial investors; and deals prompted by the distress of the seller or the target.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

2017 saw a higher volume of deals (614 deals worth $77.6 billion), compared to 2016 (421 deals valued at $59.7 billion).

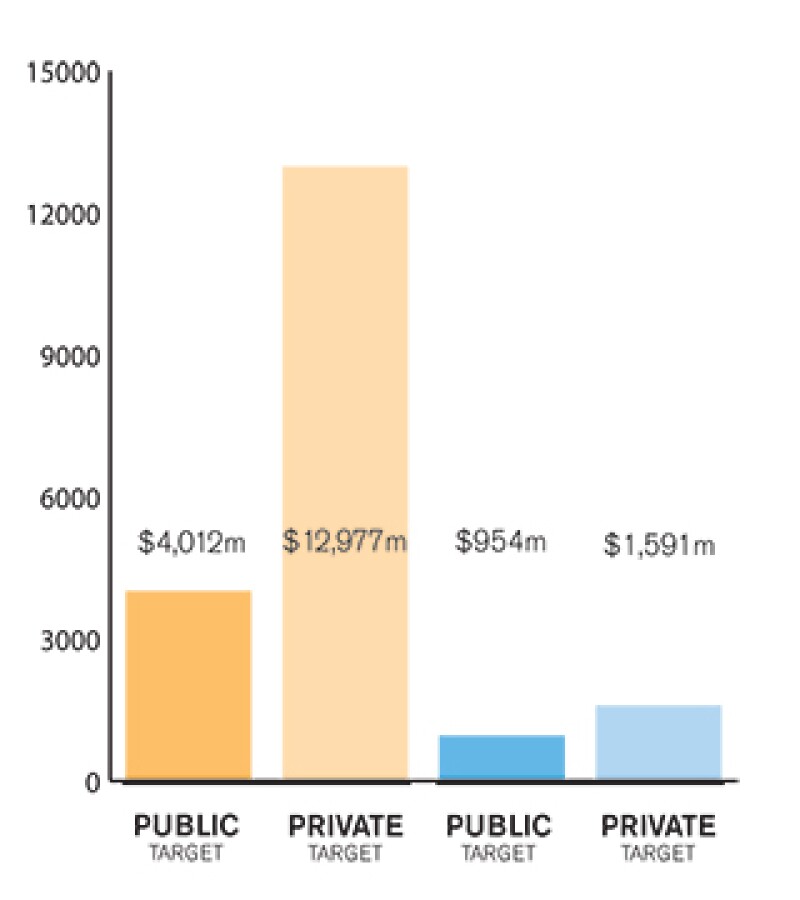

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

Private deals represent the majority of M&A activity in India. Historically, public M&A has seen higher levels as compared to 2017. That said, the public markets did see some large stock deals in 2017, whereas in the past, cash deals predominated. 2018 is likely to see more public M&A than 2017 and the trend of bulge-bracket private equity sponsors to focus on buyouts is likely to gather momentum.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

Recently, strategic acquirers have had the upper hand in acquiring control of large assets, primarily because of their willingness to ascribe higher valuations, justified by synergies and their ability to tolerate longer gestation periods. However, some of these acquirers are themselves backed by private equity, and private equity players have been active sellers in exits over the course of recent years, including 2017. Private equity acquirers predominate in non-control deals, and in certain industries like real-estate or infrastructure.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The merger of Idea Cellular and Vodafone (expected to close mid-2018), valued at $23 billion, is set to create India's largest mobile telecom operator.

2.2 What have been the most significant trends or factors impacting deal structures?

The most significant factors have been a revamped insolvency law and new loan restructuring guidelines forcing sales by distressed groups; consolidation in the telecom industry; and a shakeout in the e-commerce and online payments industries.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

Key legislation and regulatory bodies can be classified as follows:

(i) Companies Act, 2013 Administered by the Ministry of Corporate Affairs, the Companies Act is the primary legislation governing both private and public companies in India. All corporate mergers are implemented under the provisions of the Companies Act.

(ii) Securities Regulations The Securities and Exchange Board of India (Sebi) is the securities markets regulator. Sebi (Substantial Acquisition of Shares and Takeovers) Regulations, 2011, govern M&A transactions that involve the acquisition of a substantial stake of a publicly listed company. In parallel, Sebi (Delisting of Equity Shares) Regulations, 2009, govern take-private transactions and Sebi (Listing Obligations and Disclosure Requirements) Regulations, 2015, regulate Pipes (private investment in public equity) and stock-for-stock mergers.

(iii) Foreign Exchange Management Act, 1999 (Fema) Administered by the Reserve Bank of India (RBI), Fema and the regulations issued by the RBI thereunder regulate all capital inflows and outflows.

(iv) FDI Policy India's FDI (foreign direct investment) Policy issued by the Central Government contains the framework for regulating foreign investment into India, including sector-specific restrictions/prohibitions.

(v) Competition Act, 2002 Transactions above prescribed thresholds require approval of the anti-trust regulator, the Competition Commission of India (CCI).

(vi) Income Tax Act, 1961 Administered by the Income Tax Department, the Income Tax Act along with double tax avoidance treaties entered into by the Government of India (if applicable in a given case) govern the tax treatment of M&A transactions.

(vii) Insolvency and Bankruptcy Code, 2016 Administered by the National Company Law Tribunals with respect to auction sales under a scheme of restructuring.

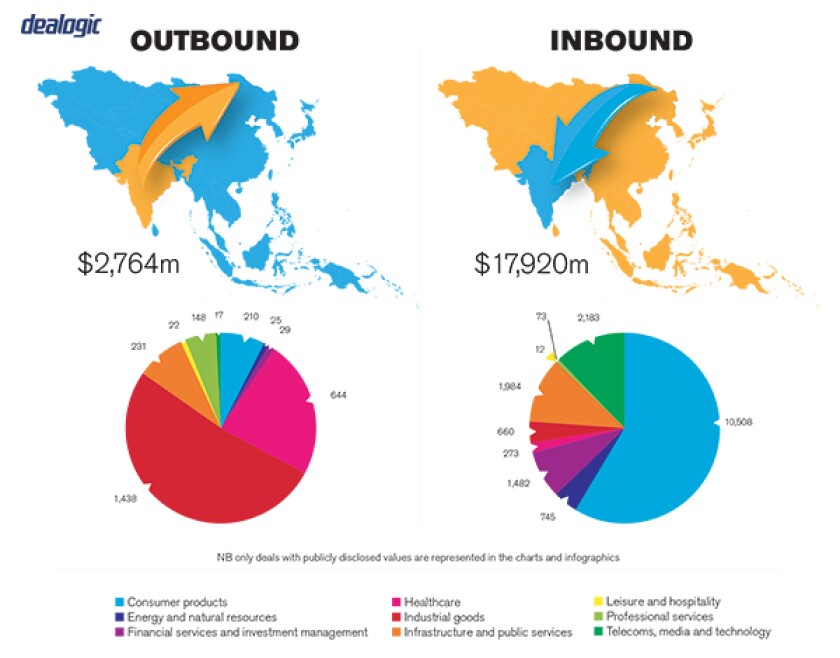

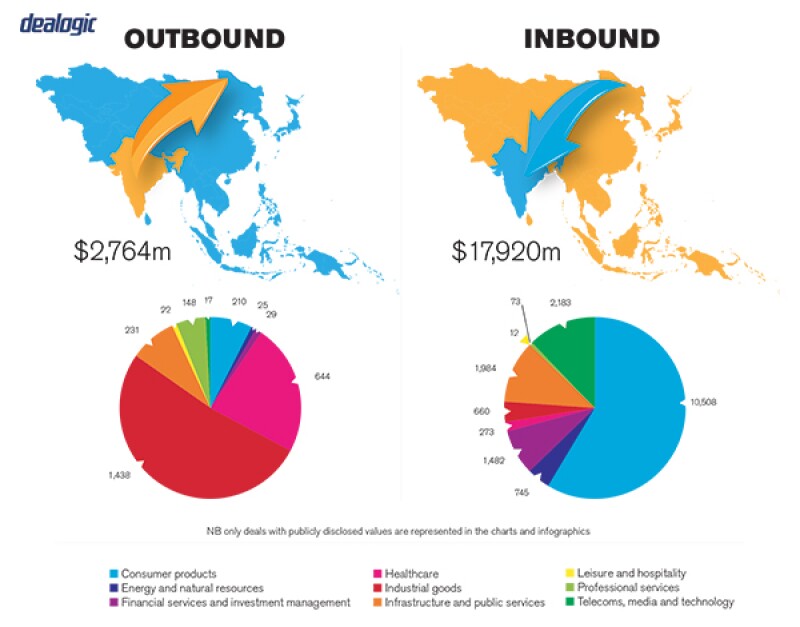

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Recent legislative changes include the following:

(i) Companies (Amendment) Act, 2017 The Companies Act, 2013 was a significant piece of legislation as it overhauled the erstwhile Companies Act, 1956. The 2013 Act has since undergone amendments in 2015 and 2017. The 2017 amendment has introduced several changes to the framework of the Act – the amendments are being brought into force in a phased manner.

(ii) Fema The principal regulations governing foreign investment are the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017, which have replaced an earlier set of regulations. There have been a number of amendments to these regulations in 2017, which have simplified and liberalised the regime for foreign investment in India.

(iii) Insolvency and Bankruptcy Code, 2016 (IBC) and Restructuring Guidelines of the Reserve Bank of India Implementation of the recently enacted bankruptcy code has become a significant driver for M&A in India, primarily through auction sale of businesses in bankruptcy, but also, by forcing owners of distressed businesses to aggressively pursue a sale. Simultaneously, loan restructuring guidelines of the RBI have been overhauled to encourage lenders of distressed companies to force a change of control.

(iv) Competition Act, 2002 The Central Government has exempted acquisitions involving targets with assets of less than $53 million or revenues of less than $153 million from merger control requirements, effectively raising the de minimis threshold. This has made smaller acquisitions, as well as acquisitions of growth-stage technology companies, easier and quicker to complete.

(v) Sebi (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (Takeover Code) A number of amendments to the Takeover Code were made in 2015, 2016 and 2017, with the aim of making it easier and quicker to implement transactions involving the acquisition of a substantial stake in a publicly listed company, especially in cases of distress.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

(i) Imposition of long term capital gains tax: Recent amendments to tax laws have imposed income tax on long-term capital gains on the sale of listed equity shares (previously most transfers of listed shares were exempted from capital gains tax). However, notional gains earned on such shares till January 31 2018 are exempt irrespective of when they are realized.

(ii) The Union Budget for 2017-18 also proposes to tax all M&A transactions in which a company with higher accumulated profits merges with a company with lower profits to avoid paying dividend distribution tax. In such cases, dividend calculation would now include the accumulated profits of the amalgamating company on the date of amalgamation.

(iii) Amendments to the stamp duty regime Varying rates of stamp duty across Indian states have historically made certain states unattractive for M&A activity, particularly asset sales and mergers. The Ministry of Finance is proposing to bring uniformity in stamp duty in all Indian states, which could boost M&A activity.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

There is a common belief that sale of an overseas holding company is the better way to effect sale of an Indian company. This may not hold good in cases where the Indian company represents the primary asset that is sought to be sold, and particularly if there are there are third party investors at the India level. There is also a strong rationale, pursuant to recent changes to the Mauritius and Singapore tax treaties, for private equity investors to exit their investments in portfolio companies directly at the India level.

Similarly, there is a belief that the use of Indian law governed transaction documents increases the risk of exposure to delays in the Indian legal system. The Indian government has made improvements to the Indian court system and is actively encouraging arbitration (including through recent amendments to Indian arbitration law) to address this concern. This belief does not hold true in cross border transactions, which provide for international arbitration seated in litigation friendly jurisdiction such as London or Singapore.

4.3 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

India has exchange control laws, which regulate how shares of an Indian company may be transferred – this represents the biggest area of Indian law which gives rise to such questions. Indian antitrust, tax and securities laws also provide for long-arm jurisdiction with respect to certain overseas deals, which involve indirect sale of an Indian business.

Specifically with respect to publicly listed companies, the Takeover Code provides for a mandatory public tender in connection with any direct or indirect acquisition of a substantial stake (25%) or control of a publicly listed company. Delisting regulations pose additional challenges in taking a company private.

4.2 What measures should be taken to best prepare for your market's idiosyncrasies?

Legal and tax advice should be sought early on in the process, before any heads of terms are agreed.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

Under the Takeover Code, a person who enters into an agreement to acquire substantial stake (25%) or control of a publicly listed company is required to make a public tender offer to acquire at least an additional 26% of the target company's shares (from public / institutional shareholders). At the same time, the acquirer must maintain a public float of at least 25%, unless the company is delisted as part of the transaction. Delisting a public company is particularly challenging in India as the acquirer must do so through a delisting offer, which involves a minimum acceptance level of 90% and a reverse book-building process to determine the offer price, which often results in a significant premium.

5.2 What conditions are usually attached to a public takeover offer?

Mandatory regulatory approval, such as merger control approval from the Competition Commission.

Except for such regulatory approvals, there is limited scope to impose additional conditions in a public tender offer. If the underlying transaction is terminated because an essential condition, over which the acquirer has no control, is not satisfied, the acquirer is permitted to withdraw the tender offer.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees are not common, nor are go-shop provisions.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Completion accounts are more common than locked box arrangements. However, locked box mechanisms are gaining popularity.

Earn-outs are quite common (in the range of 10% to 30%), though it is worth keeping in mind that there are some regulatory limitations, which apply to earnouts in cross border transaction.

Over the last few years, escrows have become quite standard, in transactions involving both – business owners and private equity sellers. However, the escrow amount tends to be modest (5% to 10%).

5.5 What conditions are usually attached to a private takeover offer?

There is no practice of private takeover offers in India, except in transactions involving the exercise of tag-along or drag-along rights with respect to sale by a majority shareholder; or the sale of pledged shares by lenders. The main reason for this is that the board of directors of a private company must approve a sale of shares.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

It is not common for M&A transactions to be governed by foreign law. However, agreements for cross-border transactions often provide for international arbitration seated in Singapore or London.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance is not common in India, although it is a growing trend, especially in private equity transactions.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

2017 was a record-year for IPOs, driven by a buoyant market and rich valuations compared to trade sales. To an extent, this reduced the volume of trade sales by financial sponsors in 2017 (although it was a relatively healthy year from that perspective as well). 2017 saw further development of the trend for larger financial sponsors to focus on buy-outs as against acquiring minority positions.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

M&A volumes are likely to grow in the next 12 months, especially transactions involving public companies, infrastructure assets and the sale of distressed or insolvent companies as part of a restructuring.

About the author |

||

|

|

Harsh Pais Partner, Trilegal Mumbai and New Delhi, India T + 91 22 4079 1062, + 91 11 4259 9290 Harsh Pais is a partner in Trilegal with a focus on M&A. In the course of his practice, Pais advises corporations and institutions extensively on cross-border acquisitions (involving public and private targets) and joint-ventures. He also advises on transactions in regulated sectors such as telecom and financial services. In addition, Pais provides strategic counsel to clients on matters involving change of control transactions, corporate governance, securities laws, troubled joint ventures and crisis management. Pais has been ranked as a leading lawyer for M&A and private equity in India by Chambers and Partners, IFLR1000 and RSG. He has past experience at a major international law firm in New York and is additionally qualified in the UK and New York. |

About the author |

||

|

|

Clarence Anthony Counsel, Trilegal New Delhi, India T: + 91 11 4163 9393 E: Clarence.Anthony@trilegal.com Clarence Anthony is counsel, Trilegal with a focus on private equity, mergers and acquisitions and funds. He has extensive experience on transactions in regulated sectors, such as insurance, financial services and real estate. His clients include some of the largest private equity funds and multinational corporations in India. Anthony is an alumnus of Government Law College, Mumbai and is a solicitor registered with the Bombay Incorporated Law Society. Anthony is also qualified to practice in England and Wales. |