SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The technology sectors, along with the pharmaceutical and life sciences sectors, continue to lead the Israeli M&A market in terms of both overall industry-wide deal value and volume.

The autonomous cars sector was particularly active in 2017, and saw the acquisition by Intel of Mobileye, a global leader in Advanced Driver Assistance Systems for $15.3 billion; Gett's purchase of Juno Lab, a ride-sharing platform; Lear Corporation's purchase of Exo Technologies, a GPS technology company; and substantial investment rounds in Oryx Vision and Innoviz Technology, both engaged in a LiDAR technology for autonomous vehicles.

Almost half of all 2017 high-tech exits were in IT and enterprise software, reflecting the continued popularity of cyber and cloud technologies.

During the past few years, the Israeli M&A market has experienced an increase in the overall funds expended by foreign investors in domestic targets, especially those from East Asia. However, 2017 saw a drop in the volume of transactions by East Asian investors – $2.7 billion compared to $6.4 billion in 2016, which may be attributable, at least in part, to Chinese regulations on foreign investments. Foreign investors and acquirers from North America remain the strongest players, which may reflect Israeli preferences for the US market.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

The Israeli M&A market is at an all-time high, with Israel's high-tech exit activity reaching $23 billion in 2017. Although there was a 7% decline in the number of high-tech deals from 2016, the value of the transactions increased and the exits were larger, the highpoint being the acquisition of Mobileye by Intel for $15.3 billion, the largest high-tech acquisition and second largest M&A deal in Israel's history.

It seems that there may be a new trend among Israeli entrepreneurs towards growing companies and reaching for higher valuations, rather than quick exits.

In 2017 pharma deals increased. This rise stemmed in part from the sale by Teva of certain of its assets for $2.5 billion and the second highlight of 2017 – the acquisition by Tanabe Mitsubishi Pharma Corporation of NeuroDerm, a clinical stage pharmaceutical company developing drug-device combinations for central nervous system disorders, for $1.1 billion.

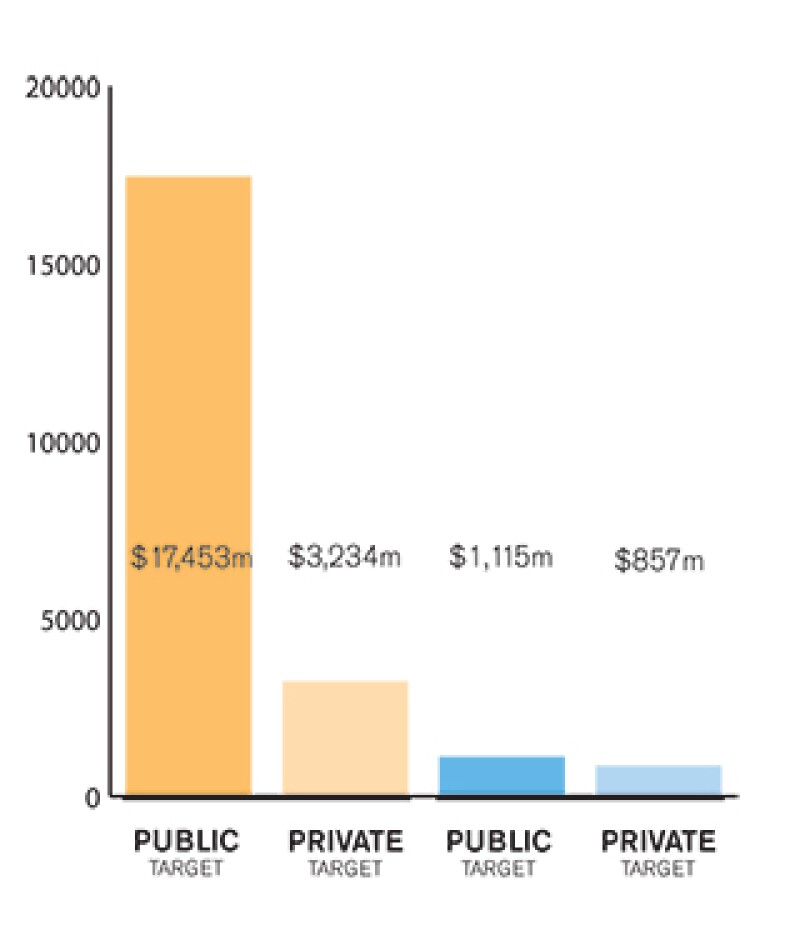

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

The Israeli market is dominated by private M&A transactions.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

There is an abundance of corporate strategic investors, private equity and venture capital funds investing in and acquiring Israeli companies, as well as operating incubators, accelerators and bridge programs. This has led to a mature and sophisticated eco-system in Israel.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Please see Questions 1.1 and 1.2

2.2 What have been the most significant trends or factors impacting deal structures?

Many Israeli tech companies secure grants from the Israel Innovation Authority (formerly known as the Office of the Chief Scientist) (IIA) which are offered under the Encouragement of Research and Development Law 1984 (the Encouragement Law). This financing is favourable as it is repaid on a royalty basis; however, the Encouragement Law also includes certain restrictions on the transfer of financed technology and production outside Israel. Accordingly, a foreign purchaser may consider buying the target or its assets through an Israeli entity. In general M&A deal structures are guided by tax considerations.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The Companies Law 1999, governs all corporate transactions involving Israeli incorporated companies. The applicable regulatory body is the Companies Registrar.

The Securities Law 1968, applies to Israeli publicly traded companies. The applicable regulatory body is the Israel Securities Authority.

The Restrictive Trade Practices Law 1988, governs all competition-related matters, including mergers, antitrust and restrictive arrangements. The applicable regulatory body is the Israel Antitrust Authority.

The Encouragement Law (as discussed in Question 2.2). The applicable regulatory body is the IIA.

In addition, numerous sector-specific laws and regulations affect M&A transactions, for example government licensing requirements for encryption, dual-use technology, telecommunications, mining, essential infrastructure and power plants. These vary from one deal to another, depending on the nature of the assets that are being sold.

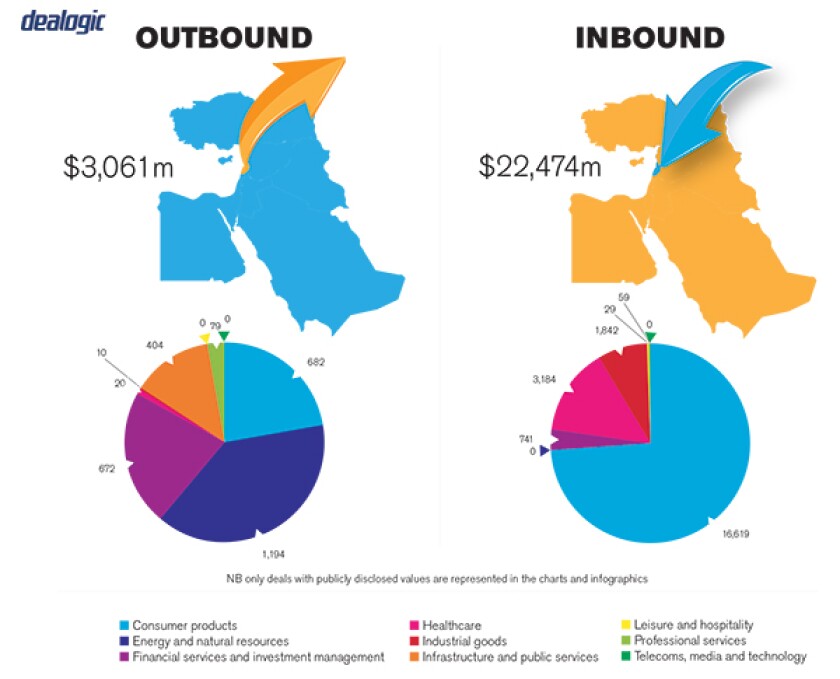

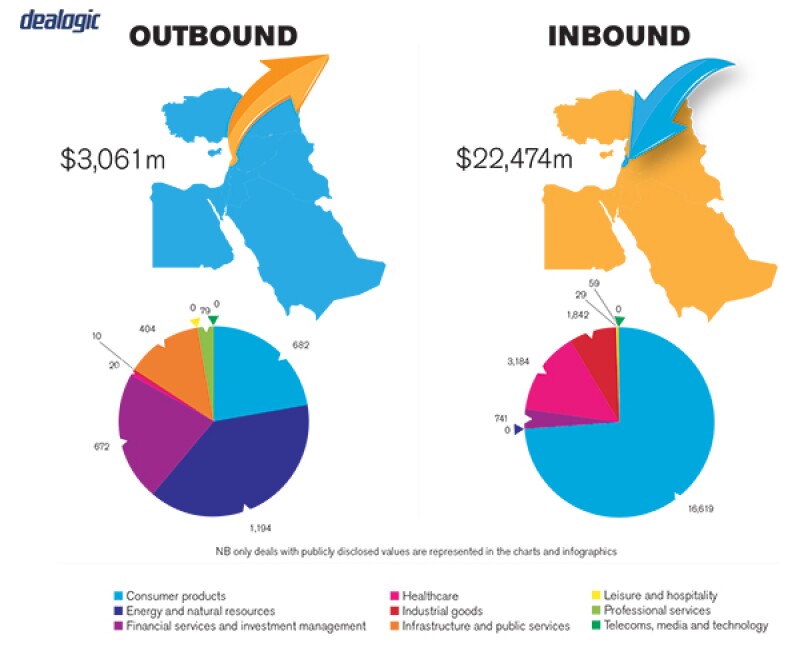

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

The Law for the Promotion of Competition and Reduction of Centralisation (2013) (the Centralisation Law) requires that control groups holding both substantial real assets (e.g., retail chains and construction companies) and substantial financial assets (e.g., banks and insurers) divest and dispose of one of these two classes of substantial asset by 2019, and seeks to break down certain pyramid structures of concentrated entities. Accordingly, the market is expecting non-technology based large-cap M&A transactions during 2018 as well as interesting opportunities for buyers, as corporations will be seeking to sell their assets ahead of the December 2019 compliance date.

In a similar vein in January 2017, the Knesset legislated that Israel's two largest banks, Bank Leumi and Bank Hapoalim, had to sell their credit card businesses within three years, and precluded the sales to large Israeli financial and non-financial institutions and corporations. Accordingly, we expect to see foreign private equity funds and money pursuing these opportunities in 2018.

The Israel Securities Authority has yet to finally settle the applicability of domestic securities laws to Initial Coin Offerings (ICOs), however the expectation is that ICOs will not be exempt from the current securities laws. Accordingly, certain Israeli entrepreneurs have taken and will continue to take their ventures off shore to pursue this financing route, at the expense of the local traditional M&A market.

A recent amendment to the Israeli Income Tax Ordinance from August 2017 seeks to relax tax requirements on corporate reorganizations and make it easier to raise funds and make acquisitions in the tech industry. We imagine this change will lead to increased M&A activity and corporate restructuring, including mergers, spin offs and asset transfers.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

The Capital Markets, Insurance, and Savings Authority seems to be hesitant in approving the purchase of Israeli insurance companies and financial institutions by Chinese buyers. Two proposed M&A deals did not obtain the requisite regulatory approvals last year, the first being a sale of Delek's 52% stake in Phoenix to Yango Investments, China (which Delek also previously failed to sell to Fuson (China)) for NIS2.15 billion ($624 million) and the sale of Meitav Dash Investments to the XIO Group.

There is a bill currently under consideration in the Knesset to amend Israel's antitrust laws. One of the proposed provisions is to raise the threshold required for approval by the Israel Antitrust Authority for a merger, from total sales of the merging parties from NIS150 million to NIS360 million. If this law passes it would create more flexibility in the M&A sector.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

While Israel is a dynamic, exciting tech hub, engaged in the current popular trends of fintech, GPS, IoT, robotics, augmented reality, cyber security, life sciences, medtech (medical technology), autonomous cars and much more, it would be a mistake to think technology is all that Israel has to offer. In light of the Centralisation Law, the next year should see exciting M&A deals in the more traditional markets.

In addition, while Israel is viewed as a hotbed of opportunity for foreign investment, there is also outbound activity, with Israelis engaging in M&A abroad. For example, in 2017 Delek Group acquired the Canadian company Ithaca Energy for $590 million and Keter Group acquired the Italian company ABM Italia for €400 million ($493 million).

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Foreign strategic buyers of Israeli tech companies, which intend to ultimately transfer the intellectual property of the target company outside of Israel, should be careful not to overlook the subsequent tax implications. They should seek advice to avoid the double tax exposure famously incurred by Microsoft in 2017 in connection with its acquisition of the Israeli start-up Gteko in 2006.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

When negotiating an M&A transaction it is key to give attention to Israel-specific issues for example, rigorous and very pro-employee Israeli employment law and the recent wave of employee unionisation, the terms of grants and benefits under the Encouragement of Capital Investments Law 1959 and the Encouragement Law, and restrictions on the export of encryption technology. Understanding these idiosyncrasies will allow investors to structure their investment more wisely and efficiently.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

Israeli takeover rules mandate the need for a tender offer when the first shareholder passes the 25% or 45% holding threshold in a public company. Acquiring full control of a public company is usually achieved by way of a reverse triangular merger, which requires the approval of a simple majority, however it is subject to an assessment remedy whereby the minority shareholders can challenge the consideration to be paid.

In general, the local public market is characterised by closely held companies controlled by majority shareholders, so hostile takeovers are uncommon, with a notable exception being the struggle at ADO Group in 2017.

5.2 What conditions are usually attached to a public takeover offer?

Most public takeover offers are executed by way of reverse triangular mergers, involving an acquisition of all the outstanding shares of the target company in exchange for a cash payment. The main advantage of this route is that merger transactions only require approval by a simple majority at a shareholders' meeting (other than in special circumstances). This is compared to the full tender offer route, which requires obtaining consent of 95% of shareholders. However, mergers may be subject to assessment claims by dissenting shareholders.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break-up fees in public M&A are rare.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

In Israeli M&A, part of the consideration is typically held in escrow to guarantee the seller's representations, warranties and obligations under the transaction documents. In Israeli high-tech deals where entrepreneurs are being bought out, part of the consideration is also customarily held back and payable as an earn-out, subject to achievement of certain financial or technical milestones. This is particularly true in early Israeli high-tech exits, where the underlying technology is not always ripe or proven.

Israeli acquisitions often include purchase price adjustment mechanisms in the event that the financial assumptions on which the purchase price was determined prove incorrect.

5.5 What conditions are usually attached to a private takeover offer?

In a private acquisition, the buyer typically demands that the sellers undertake not to compete with the target or solicit its suppliers, customers or employees, and that the sellers waive all claims against the target and are bound by confidentiality undertakings. The buyer also asks that key employees enter into new employment agreements as a condition to closing, in an effort to retain key talent. On the other side, the sellers often ask that the target or buyer maintains a directors and officers tail insurance policy.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

If the purchaser is a foreign entity, it will often insist on a foreign governing law and/or jurisdiction clause in a private share purchase agreement.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance is very rare in Israeli M&A transactions.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

In addition to the negative trends affecting the global initial public offering markets, the Tel Aviv Stock Exchange (Tase) remains unattractive to local high-tech companies seeking to raise equity capital at attractive valuations (of the 13 Israeli high-tech IPOs in 2017, only three were on Tase). Consequently, M&A deals remain the preferred exit route for Israeli tech companies.

However, in general we saw an increase in companies listing on Tase, from three in 2016 to 20 in 2017 raising approximately $860 million.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Blockchain technology and the autonomous car space will continue to be fertile ground for investments and M&A deals in 2018.

We expect to see large-cap M&A transactions and attractive opportunities for foreign private equity funds and money, deriving rom the Centralisation Law and legislation seeking to break up the banks and credit card companies.

The public markets seem to be recovering from the shock of 2016 and proving to be a real alternative to the M&A route, and we expect to see an increase in IPOs on Tase this year.

About the author |

||

|

|

Ariella Dreyfuss Partner, Barnea Tel Aviv, Israel T: + 972 36400600 F: +972 36400650 W: www.barlaw.co.il/attorneys/ariella-dreyfuss/ Ariella Dreyfuss, originally from England, advises international and Israeli clients, including PE funds, VCs, corporate ventures, entrepreneurs and start-ups in the high-tech fields of IOT, communications, life sciences, medtech, internet, fintech, cyber-security, adtech, arts etc., as well as in low-tech industries. From incorporation through to exit, Dreyfuss skilfully guides companies in drafting and negotiating multi-layered corporate and commercial agreements, establishing strategic partnerships, raising capital, consummating complex mergers and acquisitions, all the time considering each companies' unique commercial concerns. Dreyfuss has been endorsed by the prestigious ranking guide Chambers & Partners as one of Israel's leading lawyers in the field of Corporate/M&A High-tech (Chambers Global 2016 and 2017). |

About the author |

||

|

|

Michael Barnea Managing Partner, Barnea Tel Aviv, Israel W: www.barlaw.co.il/attorneys/michael-barnea/ Micky Barnea is the Managing Partner of Barnea. His diverse practice encompasses corporate, securities, technology, and cross-border matters. Micky has earned an excellent reputation working with private and public companies on securities offerings, fundraising, M&A transactions, transfers of control, and reorganizations. Micky is also greatly respected as a legal advisor to public companies trading on both Israeli and foreign stock exchanges, as well as to foreign investors with stakes in Israeli publicly-traded companies. In the technology sphere, Micky counsels a variety of early- and later-stage companies, as well as leading venture capital, corporate venture, and private equity investors. He also manages prominent cross-border technology-related transactions. These transactions, usually focused on intellectual property issues, span a variety of industries, including fintech, artificial intelligence, life sciences, internet, financial services, and advertising. |