In June 2016, the Basel Committee on Banking Supervision warned that capital relief transactions "can be complex, artificial and opaque" and reduce capital requirements.1 In this article, we analyse the structure of synthetic 'balance sheet' securitisations, which have, inter alia, the objective of reducing capital requirements, and we critically discuss their impact on systemically important global banks in Switzerland.

'SWISS FINISH'

Following the outbreak of the last financial crisis in 2007, government intervention was also needed in Switzerland to regain and ensure stability for the Swiss financial system and economy. However, these government interventions created potential future costs for the Swiss taxpayer. Therefore, to limit the economic risks posed by systemically important banks (SIBs), Switzerland introduced the too-big-to-fail (TBTF) regulation in 2012. In February 2015, an expert group under the leadership of the Federal Department of Finance (FDF) with representatives of the Swiss Financial Market Supervisory Authority (FINMA) and the Swiss National Bank (SNB) reviewed the effectiveness of those regulations2 and proposed enhancements to solve the TBTF issue, particularly with respect to capital requirements.3 In October 2015, the Federal Council adopted the amendments and decided that they must be met by the end of 2019.4 Thus, under the new regulations, global systemically important banks (G-SIBs) (UBS Group and Credit Suisse Group) must meet, inter alia, a new capital ratio of 28.6% (in contrast to the previous capital ratio of 19%) of risk-weighted assets (including all buffers except the countercyclical buffer).

The special Swiss capital requirements – the so-called 'Swiss Finish' – are the highest in the world. Although higher capital requirements enhance the resilience of the banking system, the Basel Committee on Banking Supervision (BCBS) has raised concerns that they may also induce banks to engage in regulatory capital relief transactions typically defined as synthetic securitisation.5 In this context, the following two questions arise:

What is meant by capital relief?

What are synthetic securitisations?

WHAT IS MEANT BY CAPITAL RELIEF?

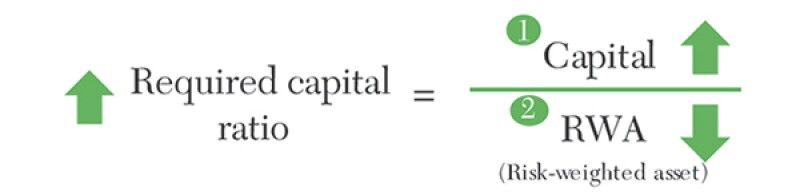

Figure 1: Calculating required capital ratio |

|

The required capital ratio is calculated as the ratio of two simple components, namely, a bank's capital (nominator) and risk-weighted assets (RWA) (denominator) (see Figure 1). To meet the capital requirements, banks can, for example, issue new equity that increases the nominator (1) and/or reduce the RWA (2).6 The deduction of RWA through securitisation is known as a capital relief transaction.

WHAT ARE SYNTHETIC SECURITISATIONS?

In general, two securitisation structures could reduce the RWA, namely, traditional (true sale) securitisation, which is sometimes referred to as the originate-and-distribute model, and synthetic securitisation. Under the former model, the originating institution,7 traditionally a bank, sells a number of homogeneous assets to a securitisation special purpose entity (SSPE), also known as special purpose vehicle (SPV). In other words, true sale transactions are a funding source for the originating institution. The SSPE pools and tranches8 these transactions into super senior tranches, mezzanine tranches and junior tranches (equity tranches) according to their priorities and issues securities to different investors with different risk appetites. In a true sale securitisation, the legal and operational issues change by selling the assets to an SSPE. This structure will be considered (regarding the legal and operational issues) as more expensive than a synthetic securitisation.9

By contrast, synthetic securitisation is more flexible, and the credit risk of a portfolio of exposures is transferred to a third party (the 'reference entity', including mostly non-bank entities such as asset managers, hedge funds and pension funds) through the use of credit derivatives or guarantees. Moreover, the securitised exposures typically remain on the balance sheet of the originator (bank).10 Therefore, these types of transactions are known as synthetic 'balance sheet' securitisations.11 In the literature12 we can distinguish between two main types of synthetic securitisation: unfunded, including derivatives such as credit default swaps (CDS)13 or default options, and funded, including credit linked notes (CLN).

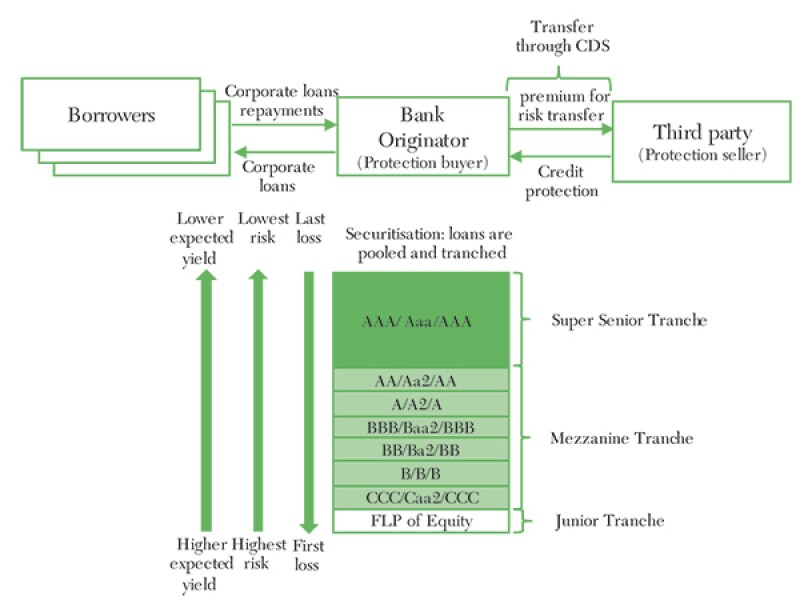

In an unfunded CDS transaction, the originator of the exposure – in our case, the bank (protection buyer) – enters into a bilateral transaction with a third party (protection seller). Figure 2 illustrates the basic structure of an unfunded balance sheet synthetic securitisation. Through a CDS, the bank transfers all or part of the credit risk of an underlying pool of assets (e.g., corporate loans, mortgages, etc.) that it holds on its balance sheet to a third party according to its creditworthiness. Originators often transfer mezzanine tranches and junior tranches (first14 and/or second loss elements) because the higher credit risk of an asset leads to a greater deduction of RWA and/or for risk management purposes.15 Then, the third party sells a credit protection and receives regular premium payments in exchange. If a credit event (default) (e.g., bankruptcy of a borrower) occurs, the protection seller (third party) pays up the insured amount of defaulted assets to the protection buyer (bank) to cover the financial loss arising from the default on the bank's balance sheet.

By contrast, a type of a funded credit derivative is the CLN. In a CLN transaction, the bank bilaterally16 sells to a third party a CLN that protects the bank from a borrower's default.17 In a CLN's credit protection contract, the bank issues a note linked to the corporate loans and pays a premium for the protection. Further, the bank repurchases the CLN at the maturity date at a nominal amount. If no credit event occurs during the contract term, the note will mature at a nominal amount. In the case of a credit event, the capital is at risk; no further coupons will be paid, and the note will be used to cover from the borrowers' financial losses. As for CDS, the CLN reduces the RWA or can be used for risk management purposes.

Figure 2: The basic structure of an unfunded balance sheet synthetic securitisation |

|

Source: Author’s own elaboration |

UBS AND CREDIT SUISSE SYNTHETIC SECURITSATION OVERVIEW

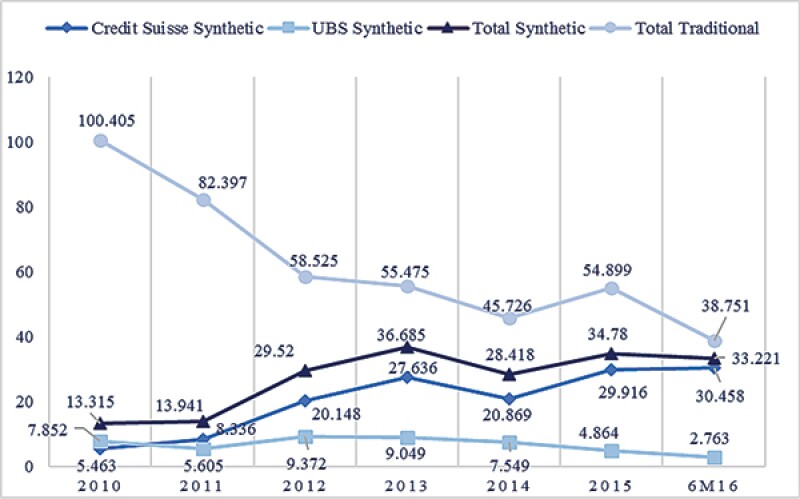

One of the major difficulties in synthetic securitisation transactions in Switzerland is the limitation and unavailability of public data on historical loss and default performance. Nevertheless, since the most recent financial crisis, there have been considerable improvements in disclosure of such information. In this context, the third pillar of Basel III to enhance market discipline requires that G-SIBs disclose information about their capital structure and risk management. According to the third pillar requirement, G-SIBs disclose the outstanding transaction size of synthetic securitisation exposures that are purchased or retained in the banking and trading books. In the first half of 2016, the total par value of synthetic securitisation exposures purchased or retained in the banking books (commercial mortgages, residential mortgages, CDO/CLO and so forth) of UBS and Credit Suisse combined amounted to CHF33,221 million. In other words, the total amount tripled between 2010 and the first half of 2016, whereas the total amount of traditional securitisation significantly decreased from CHF100,405 million to CHF38,751 million, as shown in Figure 3. In other words, the G-SIBs, especially Credit Suisse, changed their trading strategies to synthetic securitisation. Although the par value of synthetic securitisation tripled, Credit Suisse was the main driver of synthetic securitisation transactions; its synthetic securitisation activities increased from CHF5,463 million to CHF30,458 million between 2010 and the first half of 2016. By contrast, the amount of UBS synthetic securitisation exposures decreased from CHF7,852 million to CHF2,763 million.

In light of this data, one may ask why did the total par value of synthetic securitisation exposures purchased or retained increase so significantly, especially for Credit Suisse? It could be that it did so for capital relief purposes. Let us critically examine the nature of capital relief transactions with respect to synthetic securitisation.

Figure 3: Synthetic securitisation exposures purchased or retained in the banking book of UBS and Credit Suisse between the first half of 2016 (CHF million) |

|

Source: Author’s own elaboration based on all Basel III Pillar 3 disclosure reports between 2010 and the first half of 2016 |

CRITICAL APPRAISAL

The literature raises concern about capital relief transactions for the following reasons: (1) Synthetic securitisation can threaten financial stability by increasing inter-connectedness in the non-banking system. In other words, credit risk would transform into a counterparty risk18 due to the risk of default in relation to the originator, resulting in uncovered losses of defaulted assets by the originator.19 (2) Swiss supervisors and regulators have less information about the third parties who sell the credit protection in the non-banking sector.20 (3) Stress tests for G-SIBs do not include shocks on bank capital from the failure of a major third party.21 Thus, synthetic securitisation could harm the financial stability of the Swiss banking system due to the risk of a default by a key third party. (4) Synthetic securitisation creates a two-step asymmetric information problem (a) between the borrower and the G-SIBs and (b) between the G-SIBs and the third party. The fact that banks have difficulties in monitoring the creditworthiness of a third party can create adverse selection.22 Moreover, synthetic securitisation is a source of moral hazard; that is, the risk (hazard) that the third party engages in activities that are undesirable from the bank's point of view;23 and (5) Swiss synthetic securitisations can harm the payment system as a consequence of an operational risk.

However, these points should be discussed critically. In relation to the first point, synthetic securitisation can threaten the financial stability but the CHF33,221 million in exposures is a relatively small amount compared to CHF821,164 million total assets of Credit Suisse.24 Therefore, the impact of synthetic securitisation with respect to the financial stability is questionable again. Nevertheless, it would be desirable to conduct a study to measure the market size because in the United States the Office of Financial Research calculated for 18 banks a size of $38 billion in notional value for regulatory capital relief transactions.25 In reference to the second and third points, there is not enough information available about counterparties to analyse their impact on regulatory capital in Switzerland. Therefore, the impact of capital relief in the Swiss banking sector is questionable. Consequently, a systematic impact analysis about the market for synthetic securitisation in Switzerland is desirable. With respect to the fourth point, in order to mitigate moral hazard, verification institutions (such as audit companies) can provide clear life cycle support for originators and systematic due diligence for third parties that would mitigate the risk of moral hazard. Moreover, synthetic securitisation makes economic sense. Firstly, shifting credit risk away from the originating institution to a third party that is more able to bear this risk makes sense because some market participants (e.g., insurance companies) have long-term investment horizons and therefore do not consider the credit risk of corporate loans financing to be a risk at all.26 Secondly, even if a bank cannot distinguish a priori between short-term and long-term third parties, synthetic securitisation of long-term investments can still make sense.27 Thirdly, according to Credit Suisse, the "synthetic structures predominantly represent structures where the Group has mitigated its risk by selling the mezzanine tranche of a reference portfolio".28 Fourthly, although synthetic securitisation played a role in the last financial crisis, there is a difference between arbitrage-driven (re)securitisations and synthetic balance sheet transactions because the latter could stimulate bank lending.29

REGULATORY OUTLOOK

In Switzerland, securitisation has developed without specific legislative support. However, several authorities are relevant for Swiss securitisation transactions on national (e.g., FINMA and the SIX Exchange Regulation of the SIX Swiss Exchange)30 and international levels (i.e., BCBS). According to the securitisation framework, G-SIBs follow the standards of the BCBS, and the BCBS revised the securitisation framework in July 2016. In unison with the international standards, the revision of the securitisation framework (amended to include the alternative capital treatment for "simple, transparent and comparable" securitisations) will become effective in Switzerland as of January 1 2018.31 The elements of the revised securitisation framework are as follows: revision of the hierarchy to reduce the reliance on external ratings and to simplify and limit approaches; and incorporation of the STC criteria (simplicity, transparency and comparability). According to the latter case, STC criteria should assist counterparties in undertaking their due diligence on securitisation that reduces the asymmetric information problem and RWA and/or expected loss exposure through credit risk transfer.32 Although the BCBS did not explicitly exclude synthetic securitisation from the scope of the STC framework,33 "the Committee is of the view that synthetic securitisation should not be the scope of the STC framework for regulatory capital purposes".34 Nevertheless, with the new securitisation framework, Swiss G-SIBs should meet the revised hierarchy of approaches for traditional and synthetic securitisation. Thus, synthetic securitisation will be subject to the revised securitisation framework of the BCBS.

IN NEED OF A SYSTEMATIC IMPACT ANALYSIS

Although the total par value of synthetic securitisation exposures purchased or retained for G-SIBs increased, especially for Credit Suisse, the impact of capital relief remains questionable. Therefore, it would be desirable to conduct a systematic impact analysis before the scope of regulation is extended. Moreover, with new regulatory requirements taking effect in 2018, Swiss G-SIBs should meet the revised standards of the BCBS. Therefore, clear life cycle support for originators and systematic due diligence for third parties will help to mitigate the credit risks of such transactions, meet these standards and optimise the bank's balance sheet.

About the author |

||

|

|

Antonios Koumbarakis Manager, Legal FS Regulatory and Compliance Services, PricewaterhouseCoopers Zurich, Switzerland T: +41 58 792 45 23 M: +41 76 406 1207 E: antonios.koumbarakis@ch.pwc.com W: www.pwc.com Antonios Koumbarakis is a manager within PwC Zurich and a team member of its Legal FS Regulatory & Compliance Services practice. Koumbarakis specialises in regulatory project execution and project management. He is a subject matter expert in the following areas: Basel III, Basel IV, TBTF regulation such as securitisation framework, capital requirements, liquidity requirements and recovery and resolution standards. Koumbarakis holds a master of arts in economics (lic.rer.pol) from University of Fribourg (Switzerland) and he has written his PhD thesis in the area of macroeconomics and monetary economics. He was a Visiting Research Fellow at the Max Planck Institute for Research on collective goods in Bonn with a research focus in monetary policy, financial stability and bank regulation. Moreover, he has participated in the London School of Economics’ Executive Education Program. |

About the author |

||

|

|

Guenther Dobrauz-Saldapenna Partner, Leader PwC Legal Services Switzerland & Leader PwC Legal FS Regulatory and Compliance Services, PricewaterhouseCoopers Zurich, Switzerland T: +41 58 792 14 97 M: +41 79 894 58 73 E: guenther.dobrauz@ch.pwc.com W: www.pwc.com Guenther Dobrauz-Saldapenna is a partner within PwC Zurich and Leader PwC Legal Services Switzerland as well as Leader PwC Legal FS Regulatory and Compliance Services practice. Dobrauz-Saldapenna specialises in supporting the structuring, authorisation and ongoing lifecycle management of financial intermediaries and their products. In addition, he is focused on leading and supporting the implementation of large scale regulatory change and compliance alignment projects at Swiss and international financial institutions with particular focus on EU regulations and Swiss regulations. He received his masters and PhD degrees in law from Johannes Kepler University (Linz, Austria). Dobrauz-Saldapenna also holds an MBA from the University of Strathclyde Graduate School of Business (Glasgow, UK) and has participated in Harvard Business School’s Executive Education Program. |

Basel Commission on Banking Supervision (BCBS) (2016a: Internet) Statement on capital arbitrage transactions, accessed 13 March 2017 at http://www.bis.org/publ/bcbs_nl18.htm.

See Federal Council (2015:3) Report of the Federal Council "Too big to fail" (TBTF), Evaluation regarding Article 52 of the Banking Act, Bern: Federal Council.

Moreover, recovery plans for the SIBs must be executable by 2019.

Federal Council (2016: Internet) Federal Council adopts amendment of too-big-to-fail provisions, Media releases, Bern: Federal Council.

BCBS (2013:1) Recognising the cost of credit protection purchased, Consultative Document, Basel: Bank for International Settlements.

In other words, after the transaction, the Common Equity Tier 1 ratio increases because of a decreasing denominator.

An originator creates or purchases financial assets (e.g., corporate loans) and securitises them within a traditional or synthetic transaction.

Tranching means transferring a given portfolio of assets into different tranches of risk.

European Banking Authority (EBA) (2015: 8) The EBA report on synthetic securitisation, London: European Banking Authority.

EBA (2015: 7) The EBA report on synthetic securitisation, London: European Banking Authority and BCBS (2016b: 8) Basel III Document Revision to the securitisation framework – Amended to include the alternative capital treatment for «simple, transparent and comparable» securitisations, Basel: Bank for International Settlements.

The literature distinguishes between balance sheet synthetic securitisation and arbitrage synthetic securitisation. The following article focuses on balance sheet synthetic securitisation; therefore, no further considerations on arbitrage synthetic securitisation are made herein.

See BCBS (2016b: 8) Basel III Document Revision to the securitisation framework – Amended to include the alternative capital treatment for «simple, transparent and comparable» securitisations, Basel: Bank for International Settlements.

'Credit default swaps are financial insurance contracts that provide payments to holders of bonds if they default' (Mishkin 2013: 678). Mishkin (2013) The Economics of Money, Banking and Financial Markets, 10th Edition, Essex: Pearson Education Limited.

First loss means that, if a default or credit event occurs, the investor who bought the equity (tranche) will be affected first.

See EBA (2015: 8) The EBA report on synthetic securitisation, London: European Banking Authority.

CLN transactions can be also issued by an SPPE.

See EBA (2015: 23) The EBA report on synthetic securitisation, London: European Banking Authority.

That is the counterparty credit risk exposure of the protection seller towards the protection buyer (EBA 2015: 23).

See EBA (2015: 8-9) The EBA report on synthetic securitisation, London: European Banking Authority.

In the United States, the OFR (2015: 1) analyses a nominal amount of $38 billion for 18 banks' capital relief transactions. The authors find that the median bank engaging in these transactions could have improved its risk-based capital ratio by eight to 38 basis points, and one by as much as 388 points (OFR 2015: 1). However, we are sceptical that banks have significant incentives to reduce their required regulatory capital because, as the OFR (2015: 1) concludes, 'this analysis is incomplete, relying on just one vehicle for measurement, and more data are needed'. Therefore, further research in this area would be desirable.

See Cetina et al. (2016: 7) More Transparency Needed For Bank Capital Relief Trades, Office of Financial Research Brief Series 15-04.

Adverse selection occurs when a third party most actively seeks junior and mezzanine tranches with a high credit risk in order to obtain a high premium. In other words, low-quality synthetic transactions displace high-quality services (see Tirole 1988). Tirole, J. (1988) The Theory of Industrial Organization, Cambridge, Massachusetts and London: MIT Press.

See Mishkin (2013: 82) The Economics of Money, Banking and Financial Markets, 10th Edition, Essex: Pearson Education Limited.

See Credit Suisse (2016a: 9) Financial Report 2Q16, Zurich: Credit Suisse.

See Cetina et al. (2015: 1) More Transparency Needed For Bank Capital Relief Trades, Office of Financial Research Brief Series 15-04.

See Hellwig (2008: 11) Systemic Risk in the Financial Sector: An Analysis of the Subprime-Mortgage Financial Crisis, Preprints of the Max Planck Institute for Research on Collective Goods, Bonn.

See Hellwig (2008) Systemic Risk in the Financial Sector: An Analysis of the Subprime-Mortgage Financial Crisis, Preprints of the Max Planck Institute for Research on Collective Goods, Bonn.

Credit Suisse (2016b: 31) Basel III Pillar 3 – disclosures, Zurich: Credit Suisse.

Van Leeuwen and McNicol (2016: 2) Capital relief: the future of securitisation?, Financial Market Research, Rabobank.

Wyss, Bürgi and Winzap (2016: 2) 'Switzerland', in Dolan, P.D. and Dechert LLP (eds) Structured Finance & Securitisation 2016, Law Business Research, London.

See FINMA (2016: 2) Adjustments to the Capital Adequacy Ordinance (CAO) and FINMA Circular 17/xx "Credit risks – banks", Key points, Bern: Swiss Financial Market Supervisory Authority.

See BCBS (2016b: 5) Basel III Document Revision to the securitisation framework – Amended to include the alternative capital treatment for «simple, transparent and comparable» securitisations, Basel: Bank for International Settlements.

In Europe, the European Commission did not include synthetic securitisation in their corresponding criteria (i.e., Simple, transparent, and standardised (STS) framework (EBA 2015: 5)), but may include them at a later stage (European Parliament 2016: 1). See European Parliament (2016) Synthetic securitisation: A closer look, Briefing, Brussels: European Parliament.

BCBS (2015: 3) Capital treatment for "simple, transparent and comparable securitisations", Consultative Document: Basel: Bank for International Settlements.