SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

Targeted government policies, a buoyant domestic M&A market, unparalleled interest in the technology driven start-up sector and large foreign direct investment (FDI) inflows have been the key features of M&A market in India in 2016.

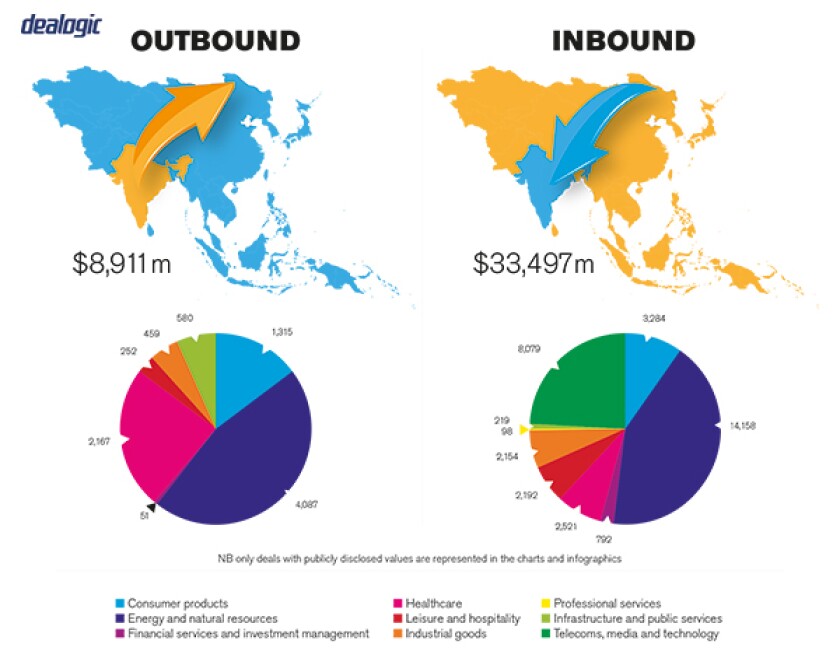

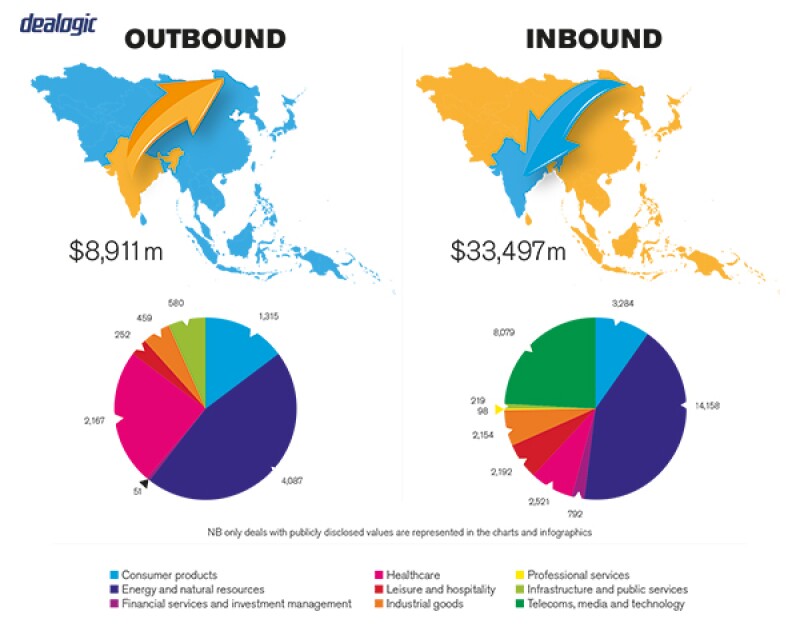

Major outbound M&A activity was witnessed in energy and natural resources, cement, healthcare and financial sectors. Inbound M&A was generally attracted by the high-tech, industrial and healthcare sectors.

Restructuring large debt-ridden companies has provided opportunities for investors to undertake M&A activities at attractive valuations.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

The number of M&A deals fell from 886 in 2015 to 756 in 2016. However, the cumulative announced value sharply increased from $31.3 billion to $52.6 billion due to a few big-ticket transactions. Further, regardless of the low global interest in FDI inflows, FDI in India jumped 18% and a record $46.4 billion. India stood as the tenth most attractive destination in the world for FDI. The US contributed the highest number of FDI inflows at $38.5 billion.

In 2016, India witnessed 917 private equity (PE) and venture capital (VC) investments as against 1,045 in 2015. PE investments declined for the first time in four years, with nearly 1,000 transactions contributing to just below $14 billion. Startups contributed to 70% of the transactions, both in terms of deal values and deal volumes.

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

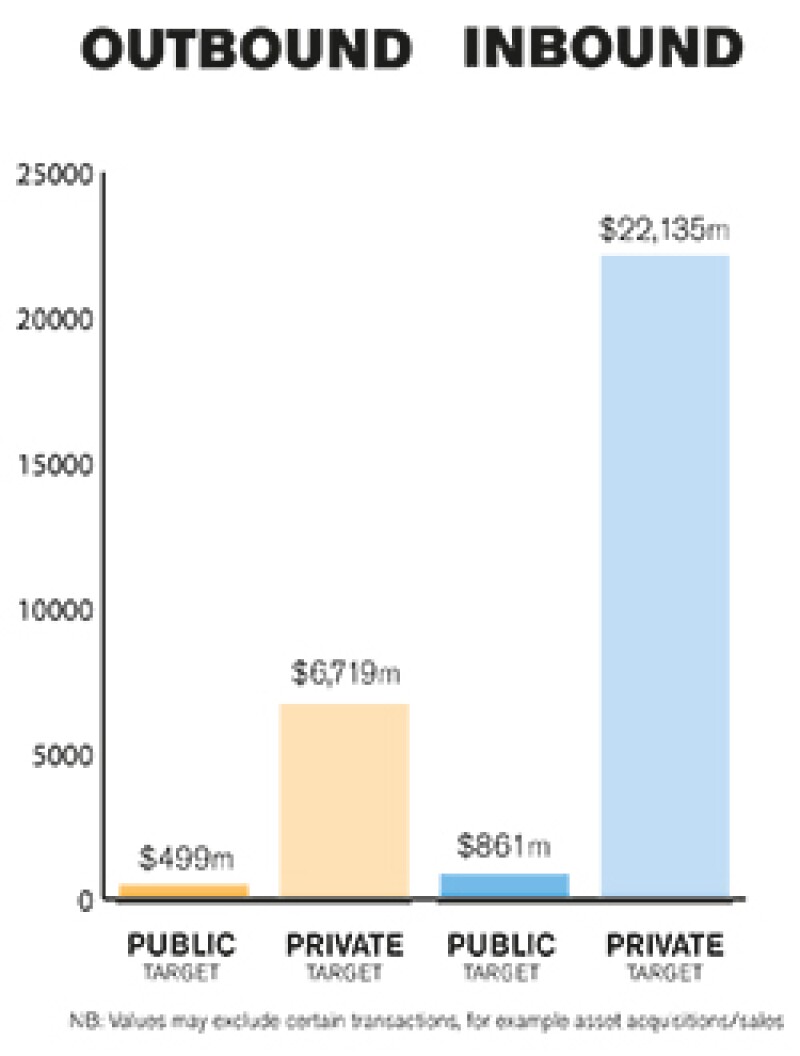

The market is driven by both public and private M&A.

As expected, a public M&A carries with it certain additional compliances under the securities laws and therefore transactions can take longer to close. However, unlike a private transaction, substantial information about a public listed target can be accessed easily in the public domain, thereby paving way for better and faster due diligence. Given that India has several unlisted but high value enterprises, deal sizes of both public and private transactions are comparable. Shares of a listed company can also be bought and sold on the stock exchange, which offers a significant tax benefit compared to transactions in the unlisted space. However, listed transactions where a public takeover offer needs to be made cannot be carried out on the stock exchange.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The acquisition of Essar Oil by Rosneft, Trafigura and United Capital Partners was a multi-jurisdictional transaction and faced significant regulatory and political hurdles. The fallout of the Vodafone case was the reason that the investors sought an assurance from the government that the transaction would not face withholding tax. This deal also witnessed Sebi (India's securities regulator), after it received complaints from public shareholders, stepping in to ask the parties to raise the delisting price for Essar Oil shareholders in line with the valuation offered to the promoters by Rosneft.

The acquisition of Jindal Steel and Power by JSW Energy, a large domestic M&A transaction, saw a structure combining asset sale and share acquisition. Hybrid structures involving a share purchase and slump sale are being used to provide the necessary balance between the regulatory constraints and commercial objectives.

Another deal announced in 2016 was the merger of Reliance Communications (RCom) with unlisted telecom company Aircel. The deal will be brought through RCom taking the wireless business into a special purpose vehicle (SPV) through a slump sale and ultimately getting merged with the mobile business of Aircel. In the process, RCom and Aircel will transfer substantial portions of their debts into the merged entity. Upon completion, the merged entity also plans to sell 25% of its equity, such that economies of scale could be achieved. The merged entity would create the fourth largest mobile telecom service provider. This structured deal could be seen as an illustration of an M&A transaction driven by the need for consolidation in the Indian telecom sector, which is getting increasingly competitive by the day.

2.2 What have been the most significant trends or factors impacting deal structures?

In most cases, M&A in India has been driven either by the objective of the seller to reduce its debt or the goal of sectoral consolidation.

Cross-border deals have been successful where correct valuation has been met by the Indian promoters' willingness to factor in major due diligence concerns, including regulatory and compliance issues.

Hybrid financing sources have been the preferred mode for M&A deals, while stock only transactions have been the least preferred.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

All companies in India are regulated by the Ministry of Corporate Affairs (MCA) through the Companies Act 2013 (CA 2013). The MCA has recently notified the new set of provisions in CA 2013 that will govern M&A activity.

The Securities and Exchange Board of India (Sebi) through the Sebi (Prohibition of Insider Trading) Regulations 2015 and Sebi (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (Takeover Regulations) regulates public M&A activities in India.

Cross-border M&A regulated by the Reserve Bank of India (RBI) through the Foreign Exchange Management Act 1999 (Fema), associated rules and regulations and the Foreign Direct Investment Policy promulgated by Department of Industrial Policy and Promotion (DIPP), Government of India.

The anti-trust regulator, Competition Commission of India (CCI) regulates M&A transactions based on the nature, size and effect of such transaction in India.

The Income Tax Department regulates M&A transactions through the Income Tax Act 1961 (ITA) and the Double Tax Avoidance Agreement (DTAA) with foreign countries.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

India has recently notified the provisions under CA 2013 relating to compromise, arrangements and reconstruction which now allow fast-track mergers (between small companies and between holding and its wholly-owned subsidiary) and paves way for deals with lesser compliances. A provision in CA 2013 enabling a merger of a foreign company with an Indian company is also expected to be notified shortly.

The newly promulgated Insolvency and Bankruptcy Code 2016 (IBC) has created a framework for acquisition of stressed assets.

The RBI also radically liberalised the FDI regime by easing norms for defence, civil aviation and pharmaceuticals and opened them for greater foreign ownership.

Further, Foreign Portfolio Investors (FPIs) have now been allowed to invest in unlisted non-convertible debentures and other debt securities issued by private and public companies and end-use restriction on investment in real estate, capital market and purchase of land. Also, the rules for foreign investment in rupee denominated bonds have been eased for FPIs.

The CCI, in early 2016, eased the rules and procedures for M&A pre-clearance by increasing the thresholds for applicable asset and revenue values for reportable transactions thereby paving way for completion of an increased number of M&A transactions without requiring the pre-approval of the CCI.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

The general anti-avoidance rules (GAAR) will be effective from April 1 2017 and which permits the authorities to declare any transaction as "impermissible avoidance arrangement", if it has been entered with the intention of obtaining undue tax benefit. Tax treaty benefits could also be denied if investors fail to show commercial substance benefit through the country they invest.

In 2016, India and Mauritius announced an amendment in their treaty, which will no longer allow Mauritius tax residents to be exempted from Indian capital gains tax on sale of shares of Indian companies that are acquired on or after April 1 2017. Also, investments from April 1 2017 that are sold prior to April 1 2019 will be taxed at 50% of the prevailing rate, subject to motive and bonafide business test. Similar changes were made to India-Singapore tax treaty as well. These changes would increase the tax costs of investors investing in India and alternative investment structures will have to be considered.

The government of India has announced the abolition of the Foreign Investment Promotion Board, which is the authority for granting approval for foreign investments in certain sectors. This is expected to further ease the flow of foreign capital into India.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Unlike in many jurisdictions where an independent board drives an M&A transaction, in India, the M&A transactions are mostly driven by families with significant shareholding and their nominees on the boards of the target or the acquirer.

In a cross-border transaction, the parties are free to choose foreign law as the governing law which was often done in order to avoid complex and delay ridden Indian court system. The situation has now significantly improved and fast track arbitration with quicker enforcement of judgment is now entirely feasible within India.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

In cross-border transactions, acquirers often enquire about ownership restrictions, availability of acquisition finance, post -acquisition funding through the debt route as well as tax impact upon exit.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Early engagement with qualified legal and accounting advisors will ensure that no unexpected roadblocks delay a transaction.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

In an M&A with a listed public company in India, control can be secured through a mandatory public offer and such transactions often need pre-clearance of the CCI. Acquirers need to be careful that even after a public takeover offer, a listed company continues to maintain a minimum public shareholding of 25%. Although it is now possible to make a combined delisting and takeover offer, the mechanism is not yet widely adopted by acquirers in the listed space.

5.2 What conditions are usually attached to a public takeover offer?

Although a public takeover offer can be made subject to conditions of minimum acceptance, the acquirer is prevented from acquiring any shares in the target company if the minimum level of acceptance is not reached. Further, a public takeover offer can be made subject to the condition of receiving regulatory approvals required for the acquirer to complete the transaction. An acquirer is generally prohibited from making its offer conditional upon any factor which is within its control (like availability of funding).

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees are not a widely prevalent concept in India and are not recognised under Indian law unless it can be established that the break fees would amount to the actual damages suffered by the party seeking the break fees. Payment of break fees to a person resident outside India will require prior approval from the RBI.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Parties, especially in cross-border deals, often like to structure their transactions though completion account mechanism. Foreign exchange regulations however favour a locked box mechanism as, at the time of completion of a cross-border acquisition, the parties are required to file a form declaring the purchase price. This form cannot be amended subsequently. Parties often address this regulatory challenge by dividing the acquisition over several tranches (with one major tranche in the beginning) and adjusting the effect of completion account in subsequent tranches.

The RBI in 2016 permitted a foreign acquirer to defer payment of 25% of the purchase consideration to be paid to an Indian seller for a period not longer than 18 months. The transaction may be structured either through an escrow mechanism or by way of indemnity from the Indian seller to the foreign acquirer.

5.5 What conditions are usually attached to a private takeover offer?

There is no concept of private takeover offers in India. However, it is possible to squeeze out minority shareholders after completion of acquisition of an unlisted company, provided such acquisition is structured through a court scheme or a contract in accordance with the provisions of CA 2013.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Clauses pertaining to foreign governing law or a jurisdiction to foreign courts are usually provided in cross-border deals where one party to the agreement is a resident of a foreign country. However, given the reforms in Indian arbitration laws, increasingly parties are making share purchase agreements subject to Indian law.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurances are not common in the Indian deal space.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

2017 may be impacted by the recent global and domestic developments of Brexit, increasing protectionist US policies, rising geo-political tensions and demonetisation. However, M&A activity in India is expected to increase with the push of stable rupee, continuing regulatory reforms, decreasing interest rate cut and demographic enthusiasm.

Sectors such as infrastructure, pharmaceuticals and healthcare, financial services, technology and e-commerce are expected to gain the widest attention.

Due to the regulatory changes in 2016 and implementation of such legislation in 2017, the legal industry will have to ensure timeliness in deal advice and execution, taking into consideration different deal structures and strategies available in light of the new legislations.

About the author |

||

|

|

Dipankar Bandyopadhyay Partner, Verus Mumbai, India T: 91 22 2860101 F: 91 22 22834102 E: dipankar.bandyopadhyay@verus.net.in Dipankar Bandyopadhyay is an experienced M&A lawyer and head of the corporate practice at Verus. Bandyopadhyay advises on public and private M&A, private equity, venture capital and financing matters. Bandyopadhyay has represented both acquirers and sellers on several complex, cross-border public M&A transactions, a number of which have been recognised as leading transactions in the jurisdiction. Bandyopadhyay regularly advises on structuring of M&A deals from the perspective of the complex regulatory environment in India. He has advised Idea Cellular, India Power Corporation, HSBC, AXA, India Carbon and Suzlon on M&A matters in India. |

About the author |

||

|

|

Priyanka Devgan Associate, Verus Mumbai, India T: 91 22 2860113 F: 91 22 22834102 E: priyanka.devgan@verus.net.in Priyanka Devgan is an associate with Verus. Her principal areas of practice are M&A and corporate finance. She often advises clients on the regulatory aspects of M&A transactions, including tender offers, insider trading and competition law aspects. |