SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

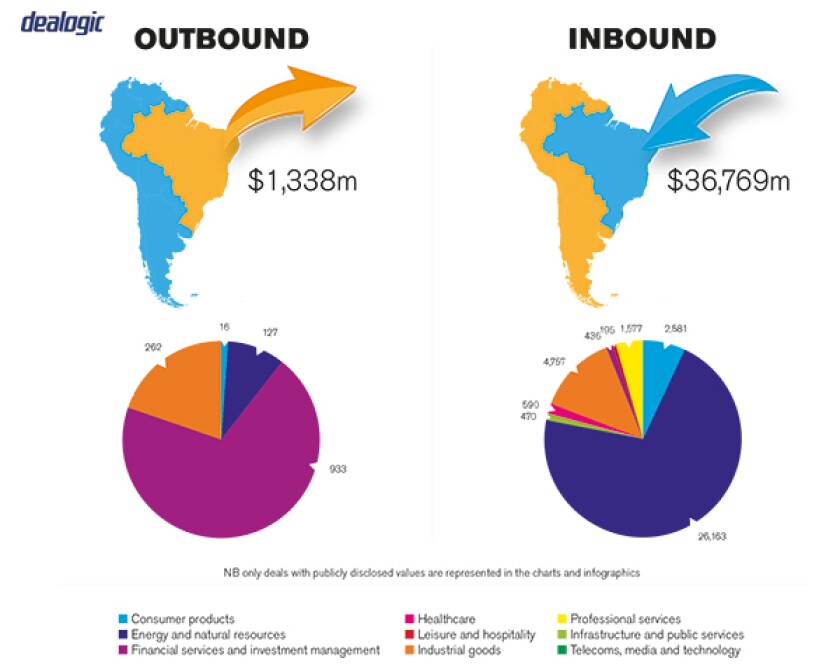

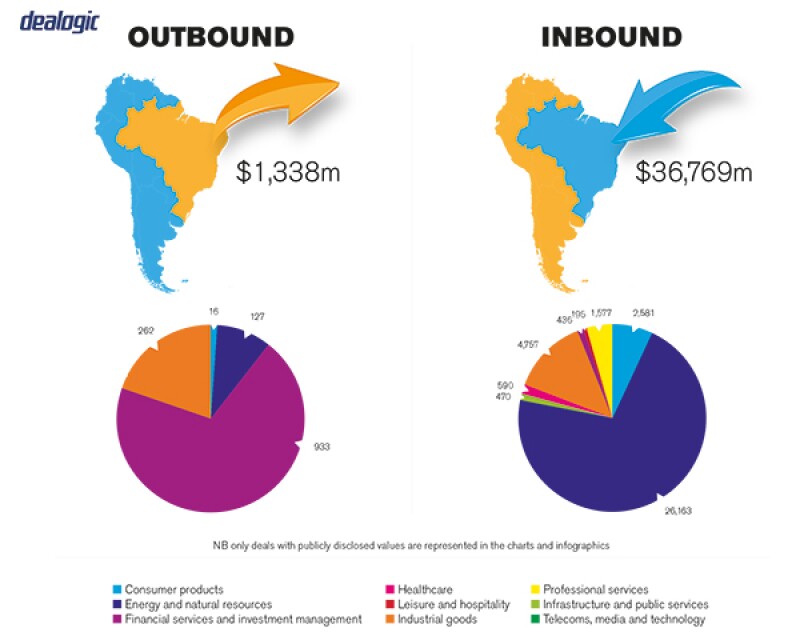

The speculation and uncertainty that loomed over the Brazilian M&A market in 2016 resulted in a year similar to 2015. Joint-ventures remained a strong choice in structuring deals, mainly for the additional assurance that they bring to the table due to having a local partner. Technology was the most active sector, followed by the financial and insurance sectors. Natural resources continued to draw a lot of attention, especially from Asian acquirers.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

According to league tables, the number of deals in the past four years has been relatively consistent, with around 1,100 transactions. The value of the transactions, on the other hand, saw a sharp increase between 2013 (R$189 billion) ($60.9 billion) and 2015 (R$278 billion), and a small decrease in 2016 (R$260 billion).

The fact that the number of deals has remained the same despite the widespread financial crisis can be explained by a general need of companies to divest from non-core assets.

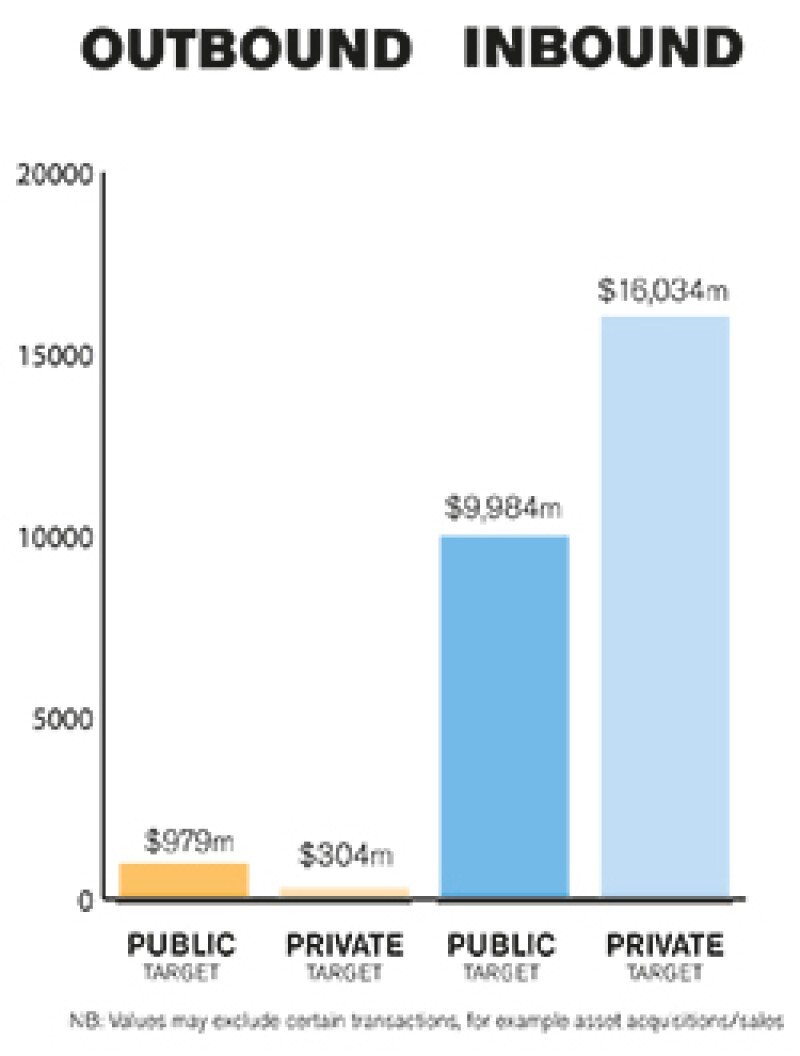

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

The Brazilian market is largely driven by private M&A, with public M&A being the minority of the deals.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

RSA / Sura – £403 million ($490 million)

RSA sold its Latin American unit to Colombia's Grupo Sura for £403 million, as the FTSE 100 insurer prepared for its own possible sale to larger rival Zurich. The transaction involved complex regulatory issues in Brazil with the insurance organ, Susep, and with the competition authorities.

Ball / Ardagh – $3.1 billion

Due to restrictions imposed by the Brazilian Administrative Council for Economic Defense (CADE) for the completion of the global acquisition of Rexam by Ball Corporation, Ball Corporation sold part of the Brazilian subsidiaries' assets, in particular the Alagoinha and Jacareí can plants.

For that purpose, Ball Corporation carried out a long corporate reorganisation of its Brazilian subsidiaries, including the merger of Latapack and Ball Brasil Holdings Participações into Latapack-Ball Embalagens (LBE); creation of a divested company – Latas Indústria de Embalagens de Alumínio do Brasil (Latas); drop-down of LBE's assets into Latas; and the sale of shares of Latas to Ardagh Group.

This deal is important as it allowed the global acquisition by Ball Corporation of Rexam for approximately $6.1 billion in cash and equity, plus the assumption of approximately $2.4 billion of net debt, making Ball the largest manufacturer of beverage cans in the world."

Vinci / Lamsac – R$4.5 billion ($1.43 billion)

Vinci, the world's largest infrastructure company, acquired Peru-based Lamsac and Pex Perú from the Brazil-based infrastructure company Invepar for €1.5 billion ($1.43 billion).

This is by far the largest toll road M&A of 2016 in Brazil. It involved cross-border regulations in infrastructure, financing and competition. French group Vinci is the world's largest concessions and construction company by revenues. Lamsac owns the concession of the toll road Linea Amarilla in Lima, Peru. Pex Perú is a provider of electronic payment solutions for vehicles. The two companies were the first and sole foreign investments of the Brazilian infrastructure company Invepar.

Ashland / Valvoline

Ashland sold its lubricant oil business operated by Valvoline to Valvoline Holdings, concluding with its IPO.

The Valvoline business, which focused on engine and automotive lubricant oil, was segregated worldwide as part of a global restructuring of Ashland group. After the conclusion of the restructuring, Valvoline and Ashland are now two independent publicly traded firms.

In Brazil, the restructuring is being implemented through the sale of the totality of the shares of the Brazilian subsidiary of Valvoline to new partners pertaining to the Valvoline business. After closing, Valvoline launched its IPO on September 23 2016, in which it raised $660 million, giving a market valuation of $4.6 billion. This deal ended several years of speculation over whether Ashland would split off the global motor-lubricants brand. The complex structure of the deal consisted of a separation and resulted in investors holding shares in both companies.

The split is the latest step in Ashland's evolution from oil refiner to supplier of value-added chemical products for customers in industries such as construction and pharmaceuticals. The initial phase of the transaction involved restructuring Ashland under a new public holding company and the execution of several financing transactions, and culminated in the IPO of approximately 17% of the common stock of Valvoline Inc. Subject to final board approval, the final phase of the separation is expected to be completed in spring 2017 with the distribution to Ashland's shareholders of the remaining shares of Valvoline.

2.2 What have been the most significant trends or factors impacting deal structures?

Compliance remains on the top of the list of any acquirer and impacts due diligence of target companies. Also, a (still) devaluated Brazilian real (R$) continues to attract investors looking for distressed assets or other types of acquisitions that would have been valued too high until recently. The lack of liquidity is causing some large Brazilian groups to divest non-core assets including participation in infrastructure assets, which makes for a good opportunity for investors looking to acquire infrastructure assets without the hurdles of public bids.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

Private M&A transactions are regulated by the Brazilian Corporations Law in the case of closely-held corporations, and the Civil Code in the case of limitadas.

Public M&A activity is governed by the Brazilian Corporations Law and regulations issued by the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários) (CVM), especially:

Regulation 361 of 2002 (public takeovers, covering mandatory or voluntary tender offers for publicly-held companies' shares);

Regulation 319 of 1999 (mergers, spinoffs and consolidations involving publicly-held companies);

Regulation 400 of 2003 (public offerings of securities); and

Regulation 480 of 2009 (registration of a publicly-held company before the CVM).

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

To make infrastructure investments more attractive to investors that have financing in foreign currency, the federal government announced that winning bidders will be allowed to use a portion of the funds that should be paid to the government (for the concession) to support the costs of foreign exchange hedge. By bearing with part of the foreign exchange risk, the number of bidders is expected to increase.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

Since 2010, foreigners have been restricted from freely acquiring rural lands. After much debate, it appears Congress is coming close to voting on new legislation that will loosen the restriction, allowing foreigners to acquire as much as 100,000 he of rural land, in addition to leasing another 100,000 he. The changes in the restrictions are expected to attract some R$50 billion in investments.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Foreign acquirers often think of an asset purchase as a structure that can insulate them from liabilities from the buyer. However, in Brazil even if you are a bona fide buyer and acquire the assets of a Brazilian company in an arm's length transaction, there is a chance of succession of liabilities. The chance of succession increases in cases where the acquisition involves all or a substantial amount of the assets of the seller. Also, because obtaining new licences to operate acquired assets may be time consuming, an equity deal may often be more beneficial than an asset deal.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Due to the risk of succession liability, tax, labour and environmental issues are areas of concern in any acquisition in Brazil. A buyer should never make assumptions in these areas and take the time to conduct extensive due diligence.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

It is said that personal relationships in Brazil are more important than in other jurisdictions when it comes to help closing a deal. This feature of the Brazilian business environment often causes deals to take longer due to the need to strengthen the relationship and trust prior to an agreement. Also, foreign buyers should be prepared to navigate the complex Brazilian tax system (good local advisors are a must).

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

The most important factor is the trigger for a public bid, which the acquirer may wish to avoid, since they are generally subject to registration with the CVM.

Public offerings for acquisition of securities or takeover bids are generally required:

for de-listing a publicly held company. This must be performed by the company or its controlling shareholder (de-listing offering);

following a disposal of the controlling interest of a publicly held company (tag-along offering);

if the increase of the controlling shareholder's equity participation (direct or indirect) affects the company's remaining shares' liquidity, as per the thresholds provided for in the applicable regulation (ownership increase offering); or

following an increase of an investor's equity participation (direct or indirect), as per the thresholds provided for in the target's by-laws (dispersed ownership protection offering). Note that this offering is commonly referred to in Brazil as a poison pill-related offering, although the structure differs from the actual poison pill other countries adopt.

5.2 What conditions are usually attached to a public takeover offer?

The most important condition is the minimum price to be offered in a public bid. There are minimum prices to be observed, according to the offering. As a general rule:

De-listing offering: fair price based on an appraisal report, considering net assets, net assets appraised at market value, discounted cashflow, comparison by multiples, stock prices on the securities market, or based on any other criteria accepted by the CVM.

Tag-along offering: except as otherwise provided in the company's by-laws, minimum price must be equivalent to at least 80% of the price paid for each controlling voting share (tag-along right). Nevertheless, for companies listed in the Level 2 listing segment of BM&FBovespa, the price shall be 100% of the price paid for each controlling voting share, either for preferred or common shares, and 100% of the price paid for each controlling voting share, for companies listed in the Novo Mercado listing segment.

Ownership increase offering: fair price based on an appraisal report, which may consider net assets, net assets appraised at market value, discounted cashflow, comparison by multiples, stock prices on the securities market, or based on any other criteria accepted by the CVM.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees were rare in public M&A in Brazil until recently, and a review of the break fees present in transactions in recent years shows an average of less than ten percent of the total value of the transaction.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Locked box mechanisms are not very common in Brazil. Buyers still favour a closing accounts mechanism, likely due to the lack in accounting methods of a large number of companies and the risks associated therewith. For the same reason, guarantees in the form of earn-outs, holdbacks and escrows are very typical.

5.5 What conditions are usually attached to a private takeover offer?

Private takeover offers are not regulated, so conditions vary. Typical conditions imposed by the buyer include the termination of non-key employees, 'love letters' to key employees, remediation of environmental damages and discharge of relevant tax liabilities. The seller may require that the buyer approves the financial statements right after the takeover (in order to free the management from any future claims) and also not to lay off employees (except for cause) for a determined period of time to avoid triggering past labour liabilities before the statute of limitations expires.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

No. Local courts will not enforce contracts that elect foreign governing laws, and it may be important for the parties to be able to obtain injunctions and other court orders locally. Doing so with a foreign ruling would require having the foreign ruling being certified by the Brazilian Superior Court of Appeals, in a lengthy process. However, parties often use foreign arbitration chambers, even if Brazilian law is elected as the governing law.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

It is still not very common in Brazil, and few policies are available in the Brazilian market. Knowledge about this type of insurance is increasing, which may make it more common in the future.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Brazil is undergoing a transition, with an increase in the predictability of the political scene, a less interventionist public agenda and a real desire for a balance in public accounts. The economy has started to signal a slow recovery, the federal administration has announced its desire to carry out public bids for infrastructure assets and investor confidence seems to be returning (even though a large number of companies remain in distress, also making for good targets). These factors should create a good environment for strategic buyers and a promising year in M&A.

About the author |

||

|

|

Paulo Coelho da Rocha Partner, Demarest Advogados São Paulo, Brazil T: 55 11 3356 1698 F: 55 11 3356 1700 Paulo Coelho da Rocha graduated from Universidade de São Paulo Law School in 1993 and earned an LLM in corporation law from New York University School of Law in 1997. He then worked for two years as a foreign associate at Cravath Swaine & Moore, in New York. He is an officer of the International Bar Association, chair emeritus of Lex Mundi and a member of the Brazilian-American Chamber of Commerce and of the advisory board of "Working Group on Legal Opinions" of the American Bar Association. An expert in M&A, corporate law and corporate governance, Coelho da Rocha has authored many articles on the subjects and co-authored the book Business Laws of Brazil (WestThompson, 2015, 4th edition), and has been nominated for many years a leading lawyer in his field by directories such as IFLR1000, Chambers, Legal 500, Who's Who Legal and the Brazilian Análise Advocacia. |