It is fair to say that virtual currencies (VCs) and initial coin offerings (ICOs) have been all the rage in 2017 and, while many of the more renowned VCs have lost over 50% of their value in the first quarter of 2018, this new digital asset phenomenon has not shown any signs of relenting.

Although Maltese law does not currently have a legal definition of VC, practitioners generally use the Financial Action Task Force (FATF) definition which is essentially 'a digital representation of value that can be digitally traded and functions as a medium of exchange, unit of account or store of value, but does not have legal tender status in any jurisdiction'. These assets are unregulated, decentralised, and not issued or guaranteed by a central body or authority in any country. In fact, a virtual currency only fulfils these functions based on an agreement or understanding between the community of users of the VC in question.

How are virtual currencies classified?

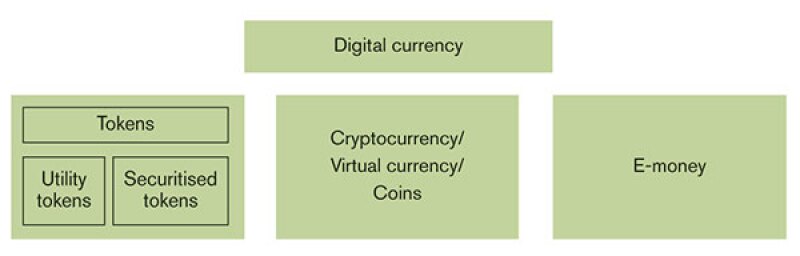

The term virtual currency may effectively refer to and encompass not only VCs, but also tokens and electronic money (fiat currency stored in electronic form). This classification is depicted in the table below:

The FATF regards digital currency as a digital representation of either virtual currency (non-fiat) or e-money (fiat).

Tokens are also a form of digital currency and usually refer to virtual assets offered through an ICO. They are sub-categorised into utility tokens and securitised tokens. Security tokens are understood to refer to those tokens which embed underlying assets and are effectively financial instruments. Utility tokens, on the other hand, are understood to refer to those tokens that provide platform/application utility rights without any underlying assets.

How are virtual currencies currently treated in Malta?

Certain ICOs and VCs fall within the scope of existing legislation and would therefore be governed by existing EU legislation (such as the Markets in Financial Instruments Directives (Mifid and Mifid II), the Prospectus Directive, the Alternative Investment Fund Managers Directive – AIFMD and the Financial Instruments Directive) and Maltese national legislation (such as the Investment Services Act and the Financial Institutions Act).

Those offerings that fall outside the scope of such financial legislation would need to be analysed in some detail to establish the defining features of the offering in question and determine whether or not they would fall into any other legal classification. For example, VCs or tokens can have features of electronic money, payment systems, membership or privilege cards, and/or single- or multiple-use vouchers.

It is of paramount importance that before embarking on any VC or ICO project, the promoters have undertaken a detailed analysis of the features to be embedded in the digital asset in question to ensure the certainty of outcome in the legal analysis undertaken before the asset can be issued and marketed.

At the time of writing (April 2018), the Government of Malta announced its intention to pass the following bills through Parliament. We expect this legislative package, or at least most of it, to be duly submitted to Parliament by Q2 or Q3 2018:

The Malta Digital Innovation Authority Act (MDIA Act), which is expected to provide for the establishment of the Malta Digital Innovation Authority. This Authority will act as a central regulator and 'will promote government policy that favours the development of Malta as a hub for new and innovative technologies'.

The Technology Arrangement Services Act (TAS Act), which is expected to set out the regime for the registration of technology service providers and the certification of technology arrangements. This framework will allow for the registration of auditors and administrators of distributed ledger technology (DLT) platforms and set standards for the certification of such platforms.

The Virtual Currencies Act (VC Act), which will set out a framework for ICOs and the regulatory regime on the provision of services related to VCs.

The Malta Financial Services Authority (MFSA) issued a consultation paper on November 30 2017, with a consultation period that ended on January 11 2018. The MFSA invited practitioners to provide feedback on ICOs, VCs and related service providers. The discussion process focused, among other things, on how securitised tokens can be defined and identified, and also how best to treat those operators and intermediaries involved in the crypto and ICO value chain including: inventors; issuers; miners; processing service providers; wallet providers, exchanges; trading platforms; and other such players.

The feedback submitted by practitioners, operators and other stakeholders will be duly considered by the Authority and the Government in the course of the legislative process.

Consequent to the consultation submissions, on April 13 2018 the MFSA issued a discussion paper focusing exclusively on the Financial Instruments Test. This paper marks another step in the direction of establishing clear lines of delineation between digital assets that are regulated and those that are unregulated. Furthermore, the regulated assets need to be further classified as financial instruments (securities, derivatives etc), e-money or other categories of regulated instruments.

This new discussion paper targets the creation and adoption by the MFSA of a test which will be used to determine whether a DLT asset, based on its specific features, would be: (i) regulated by existing EU legislation and the corresponding national legislation; (ii) regulated by the proposed Virtual Financial Assets Act (VFAA); or (iii) is otherwise exempt. It is envisaged that the test will be applicable both within the context of ICOs as well as during the intermediation of DLT assets by persons undertaking certain activities in relation to such assets in or from Malta. Submissions are open to all interested parties and the submission deadline is May 4 2018.

Can we launch our planned VC or ICO in Malta before this legislation is published and how will the enactment of this legislation affect our issue?

Operators looking to launch a VC or ICO through a Maltese company or to market such instruments in the Maltese market are best advised to seek legal and regulatory guidance focusing on the features of the issue, to ensure that the correct legal and regulatory classification is determined a priori and the relevant rules are complied with. Until this legislative package is issued, there will be many grey areas that need to be tested from a legal and regulatory perspective if the promoters are to stay out of harm's way.

About the author |

||

|

|

Andrew Zammit Managing partner, GVZH Advocates Valletta, Malta T: +356 2122 8888 M: +356 9943 3675 Andrew Zammit is the firm's managing partner and heads the firm's corporate, M&A, banking and finance practice, being actively involved in M&A, corporate finance, licensing of financial services businesses with the Malta Financial Services Authority and asset-financing transactions. He is particularly active in advising businesses within the TMT space, having pioneered the licensing of various fintech operators in Malta, and has led various corporate acquisitions which most notably include the sale of Malta's largest quad telecoms player and a number of significant online gaming operators. Zammit currently holds the position of council member of the Institute for Financial Services Practitioners. Zammit graduated from the University of Malta in 1999 (doctorate of laws) and subsequently pursued a masters of law degree at the London School of Economics and Political Sciences (LSE) in the areas of company law, financial services regulation, the law of international finance and international trade law, which he completed successfully in 2000. Zammit is fluent in English, Italian, French and Maltese. |