Turkey's primary piece of merger control legislation is the Protection of Competition Law No. 4054 of December 13 1994. Communiqué 2010/4 on Mergers and Acquisitions Requiring the Approval of the Competition Board (Communiqué 2010/4 of October 7 2010) is the secondary piece of legislation. The Competition Authority (Authority) is the enforcement authority and the Competition Board (Board) is the decision-making body.

One notable aspect of the regime is that Turkish merger control rules do not provide a pre-notification mechanism with a submission of a draft notification form. Otherwise, the Authority closely follows developments in other jurisdictions, especially in the EU. In fact, its guidelines are in line with EU competition law regulations and seek to maintain harmony between EU and Turkish competition law instruments. Apart from looking to the EU regime, the Authority also evaluates developments in the Turkish market and takes any necessary steps to stay aligned to its own aims and policies.

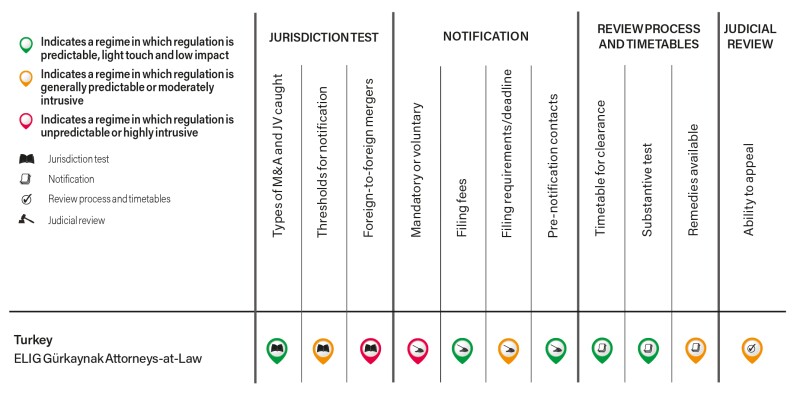

Jurisdiction test

Turkey's competition rules capture any merger between two or more undertakings, as well as any acquisitions of control by any entity or person of another undertaking's assets or a part or all of its shares or instruments that grant management rights. These transactions are all notifiable if they result in a permanent change of control.

Joint-ventures (JVs) are considered acquisition transactions. To qualify as a concentration subject to merger control, a JV must be of a full-function character and satisfy two criteria: the existence of joint control in the JV and the JV being an independent economic entity established on a lasting basis.

Pursuant to the presumption regulated under Article 5(2) of Communiqué No. 2010/4, control may be acquired through rights, contracts or other instruments which, separately or together, allow de facto or de jure exercise of decisive influence over an undertaking. In particular, these instruments consist of ownership or operating rights over all or part of the assets of an undertaking, and those rights or contracts grant decisive influence over the structure or the decisions of an undertaking. Control may be acquired by right holders, or by those persons or undertakings who have been empowered to exercise such rights in accordance with a contract, or who, while lacking such rights and powers, have de facto strength to exercise such rights.

A transaction is subject to the Competition Board's approval if the aggregate Turkish turnover of the parties exceeds TL100 million (approximately $17.6 million) and the Turkish turnover of at least two of the parties each exceeds TL30 million. The Board's approval is also needed in acquisitions where the Turkish turnover of the transferred assets or acquired businesses exceeds TL30 million and the worldwide turnover of at least one of the other parties exceeds TL500 million. In merger transactions, transactions where the Turkish turnover of any of the parties in the merger exceeds TL30 million and the worldwide turnover of at least one of the other parties exceeds TL500 million are subject to the Board's approval.

Article 7 of Law No. 4054 prohibits all concentrations leading to a dominant position and the significant lessening of competition in a product market. While the question on whether the transaction is subject to the Board's approval should be taken into consideration within the scope of secondary legislation (the notification thresholds specified under Communiqué No. 2010/4), the question of whether the same transaction creates competition law sensitivities should be assessed within the scope of the primary legislation (Article 7 of Law No. 4054).

The assessment of whether a transaction creates competition law sensitivities is independent from the question of whether the transaction is subject to the Board's approval within the scope of Article 7 of Communiqué No. 2010/4. As per the hierarchy of norms, the fact that a transaction is not subject to the Board's approval would not influence the assessment of the same transaction in terms of its merits.

Article 7 of Law No. 4054, which regulates the control of mergers and acquisitions, prohibits any merger between one or more undertakings or acquisitions by any undertaking from another undertaking (including transactions among global technology and online companies), which creates a dominant position or strengthens a dominant position, and which may result in a significant lessening of competition in a market for goods or services within the whole or a part of the country.

Therefore, Law No. 4054 deems mergers or acquisitions that significantly diminish competition illegal, regardless of whether the relevant turnover thresholds are exceeded or not. The jurisdictional threshold provided under Communique No. 2010/4 acts as a filter by excluding some transactions from the notification obligation, as such transactions do not attain a certain economic size.

Foreign-to-foreign mergers

Turkey's merger control regime does not exempt foreign-to-foreign transactions. If one of the turnover thresholds is triggered, a foreign-to-foreign deal will be notifiable. Law No. 4054 defines an "effects criteria", with the key criterion being whether the undertakings concerned impact Turkey's goods and services market. Even if the relevant undertakings do not have Turkish subsidiaries, branches, sales outlets or other local structures, the transaction could still be subject to merger control if the relevant undertakings have sales in Turkey and the merger therefore impacts the Turkish market.

Furthermore, the Competition Authority is empowered to exchange information with certain regulatory authorities around the world, including the EU Commission Competition Directorate-General (DG Comp). Article 43 of Decision No. 1/95 of the EC-Turkey Association Council (Decision No. 1/95) authorises the Authority to notify and request the DG Comp to apply relevant measures if the Competition Board believes that a transaction realised within EU territory may adversely affect competition in Turkey. This provision grants reciprocal rights and obligations to the parties (EU-Turkey). Although, there have been cases where the Authority has exchanged information with the EU Commission and other competition authorities, the EU Commission has been reluctant to share evidence or arguments with the Authority in the few cases where the Authority has explicitly asked for them.

The Authority's research department also makes periodic consultations with relevant domestic and foreign institutions and organisations.

Notification

Filing is mandatory once the parties' turnovers exceed the thresholds. The existence of an affected market is not sought in assessing whether a transaction triggers a notification requirement.

If the parties violate the suspension requirement or do not notify the transaction, the Board imposes a turnover-based monetary fine. The minimum fine in 2019 is TL26,027.

If there is a risk that the transaction might be viewed as problematic under the dominance test and the transaction is closed before clearance, the Authority may launch an investigation. It may order structural or behavioural remedies to restore the situation to that of pre-closing and impose a fine up to 10% of the parties' annual turnover. Executive members who have a significant role in the infringement may also receive monetary fines of up to 5% of the fine imposed on the undertakings.

A notifiable concentration is invalid with all its legal consequences, unless and until it is approved by the Board.

Even though there is no specific deadline for filing, it is advisable to file the notifiable concentration to the Authority at least 45 calendar days before closing (a transaction is deemed closed on the date the change of control occurs (Article 10, Communiqué)).

The filing can be made by either one of the parties to the transaction or jointly, and there is no filing fee. There is also no specific deadline for filing but it is advisable to file the transaction at least 45 calendar days before closing (a transaction is deemed closed on the date when the change of control occurs (Article 10, Communiqué)). However, there is an explicit suspension requirement (namely that the transaction cannot be closed before obtaining the approval of the Board), which is set out under Article 11(1)(a) of Law No. 4054 and Article 10(5) of Communiqué No. 2010/4.

The notification form is similar to the European Commission's Form CO. Certain additional documents are also required (such as the transaction documents and their sworn Turkish translations and annual reports.)

Review process

After a preliminary notification review, the Board decides either to approve or to further investigate the transaction (Phase II). There is an implied approval mechanism where a tacit approval is deemed if the Board does not react within 30 calendar days of a complete filing. If the information requested in the notification form is incorrect or incomplete, the notification is deemed filed only on the date when this information is completed after the Board's request for data. A Phase II review takes about six months and may be extended for only one additional period of up to six months.

During either phase, the Authority can send written requests to the parties, to any other party relating to the transaction or to any third parties, such as competitors, customers or suppliers.

If the Authority asks for another public authority's opinion in reviewing a transaction, the applicable time periods for the approval mechanism automatically reset to the date on which the relevant public authority submits its opinion to the Authority.

The substantive test for clearance is the dominance test. Efficiencies may play a more important role in cases where the combined market shares of the parties exceed 20% for horizontal overlaps and the market share of either of the parties exceeds 25% for vertical overlaps. The Board may consider efficiencies to the extent they operate as a beneficial factor.

Parties to a proposed transaction can provide commitments to remedy substantive competition law issues relating to a concentration under Article 7 of the Competition Law (Article 14, Communiqué) and the Authority stipulates that structural and behavioural remedies can be imposed to restore the situation as before the closing (restitutio in integrum). Parties have the discretion to offer and submit behavioural or structural remedies (Guidelines on the Remedies that Are Acceptable by the Competition Authority in Mergers and Acquisitions (Guidelines)) and although structural remedies take precedence over behavioural remedies, in some cases the Board has accepted behavioural remedies.

The Board will neither impose nor ex-parte change any submitted remedies. In the event the Board considers the submitted remedies insufficient, it may allow the parties to make further changes to its remedies. If the remedy is still insufficient to resolve the competition concerns, the Board may block the transaction.

Parties can submit proposals for possible remedies either during the preliminary review (Phase I) or the investigation period (Phase II). While parties can submit the commitments during Phase I, notification is deemed filed only on the date of the submission of the commitments. In any case, a signed version of the commitments that contains detailed information on their context and a separate summary should be submitted to the Authority. The Authority's Remedy Guidelines also provide a form that lists the necessary information and documents to be submitted in relation to the commitments.

The Board's final decisions can be submitted to judicial review before the administrative courts by filing a lawsuit within 60 days of the receipt by the parties of the Board's reasoned decision. Rights of judicial review are available only to the parties to the decision. Third parties can challenge the Board's decision before the competent judicial tribunal, provided that they prove their legitimate interest. The judicial review period before the administrative court usually takes about 24 to 30 months.

Looking ahead

In 2019, important merger control decisions concerning high-value transactions were taken by the Authority. One highlight was the Board's Nidec/Embraco decision regarding the transaction concerning the acquisition of sole control of Embraco, Whirlpool Corporation's compressor manufacturing business, by Nidec Corporation (April 18 2019). After a Phase I review the Board took the transaction to a Phase II review, due to competition law concerns arising from the deal. Notwithstanding this, the transaction was approved pursuant to a commitment package submitted to the EU Commission which involved Nidec divesting its own light commercial compressor and household compressor businesses. The Board concluded that those commitments would eliminate the horizontal and vertical overlaps in Turkey regarding the sales of household reciprocating hermetic cooling compressors, reciprocating hermetic light commercial cooling compressors and the sales of condenser units.

The Board also conditionally approved Harris Corporation's acquisition of sole control over L3 Technologies (June 20 2019) in a Phase I review. The Board held that commitments had completely eliminated the overlap between the parties and that therefore, the transaction did not result in the creation or strengthening of a dominant position, nor did it significantly impede competition. In line with the commitments submitted to the Commission, Harris committed to divest its businesses for night vision devices and image intensifier tube Technologies used in these devices to eliminate the vertical overlap.

With respect to the legislative reforms, the Draft Competition Law, which was issued by the Authority in 2013 and officially submitted to the Presidency of the Turkish Parliament on January 23 2014, is now null and void following the start of a new legislative year of the Turkish parliament. To re-initiate the parliamentary process, the draft law must again be proposed and submitted to the presidency of the Turkish Parliament. At this stage, it remains unknown whether the Turkish Parliament or the government will renew the draft law.

Gönenç Gürkaynak |

||

|

|

Partner, ELIG Gürkaynak Attorneys-at-Law Istanbul, Turkey Tel: +90 0212 3271724 Gönenç Gürkaynak is a founding partner of ELIG Gürkaynak Attorneys-at-Law, a leading law firm of 90 lawyers based in Istanbul, Turkey. Gönenç graduated from Ankara University Faculty of Law in 1997 and was called to the Istanbul Bar in 1998. He received his LLM from Harvard Law School and is qualified to practice in Istanbul, New York, Brussels and England and Wales (currently a non-practising solicitor). Before founding ELIG Gürkaynak Attorneys-at-Law in 2005, Gönenç worked as an attorney at the Istanbul, New York and Brussels offices of a global law firm for more than eight years. Gönenç heads the competition law and regulatory department of ELIG Gürkaynak Attorneys-at-Law, which currently consists of 45 lawyers. He has unparalleled experience in Turkish competition law, with over 20 years of experience. Gönenç represents multinational companies and large domestic clients in over 35 Turkish Competition Authority investigations each year, as well as about 15 antitrust appeal cases and over 85 merger clearances. |

Öznur İnanılır |

||

|

|

Partner, ELIG Gürkaynak Attorneys-at-Law Istanbul, Turkey Tel: +90 0212 3271724 Öznur İnanılır joined ELIG Gürkaynak Attorneys-at-Law in 2008. She graduated from Başkent University Faculty of Law in 2005 and after training at a reputable law firm in Ankara, she obtained her LLM in European Law from London Metropolitan University in 2008. She is a member of the Istanbul Bar. Öznur became a partner in the regulatory and compliance department in 2016 and has extensive experience in all areas of competition law, in particular compliance to competition law rules, defence in investigations alleging restrictive agreements, abuse of dominance cases and complex merger control matters. She has represented various multinational and national companies before the Turkish Competition Authority. Öznur has authored and co-authored articles published internationally and locally in English and Turkish pertaining to her practice areas. |