SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

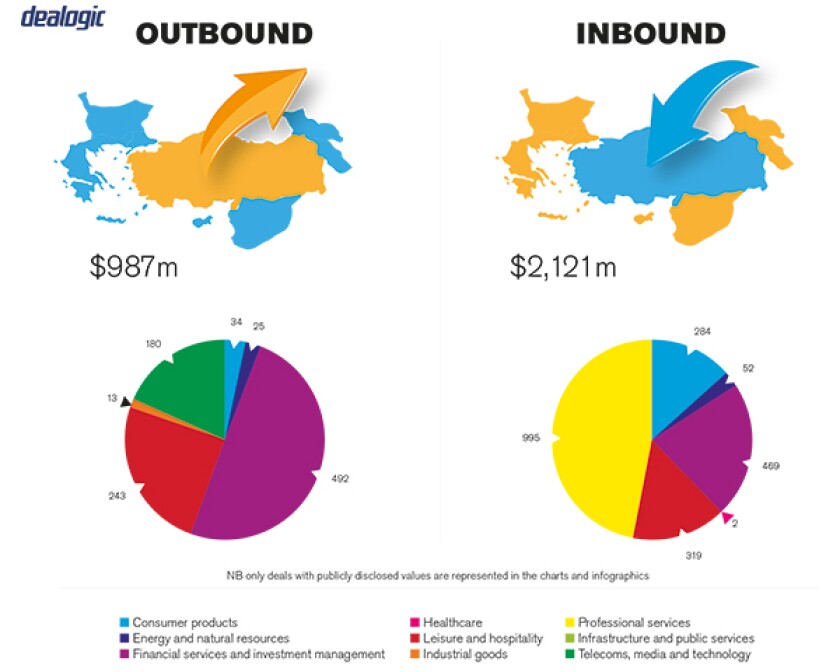

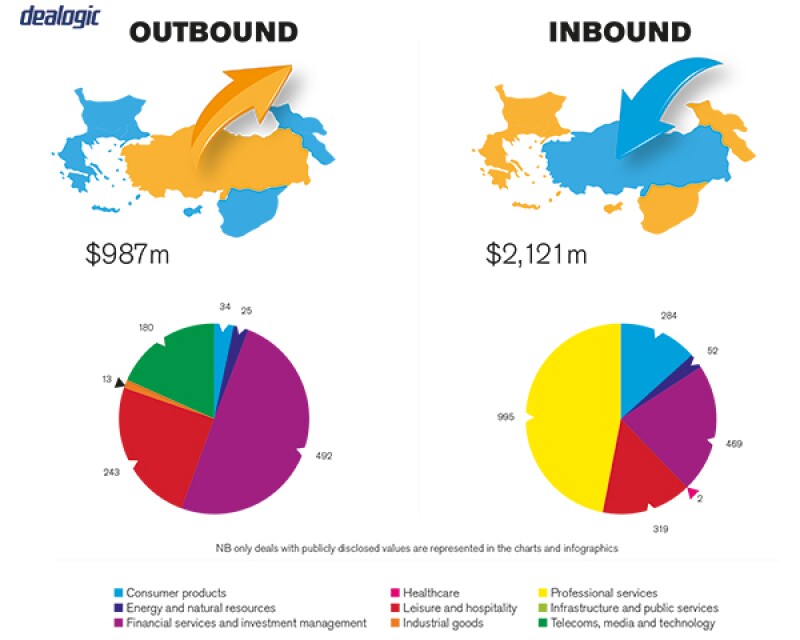

The Annual Turkish M&A Review 2016 by Deloitte reports that around 248 transactions were realised in 2016 with a total value of $7.7 billion. Leading sectors of the M&A market were the internet, technology and energy sectors in 2016. While the internet and technology sectors hosted the greatest activity in terms of deal number, the energy sector was leading in terms of deal value. Furthermore, a remarkable increase in the number of angel investors and start-ups, as well as interest from far eastern investors in Turkey, was observed in 2016.

Additionally, Chinese and Japanese investors' interest in Turkey market was observed in 2016 while the number of European investors decreased. Sectorial interest of the investors canalised to export-oriented producers and interest in retailers reduced.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

M&A value decreased significantly by 53% compared to 2015. Despite this the transaction volume remained almost the same, with average transaction value reduced in 2016. Total transaction value shrunk to its lowest level since 2009.

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

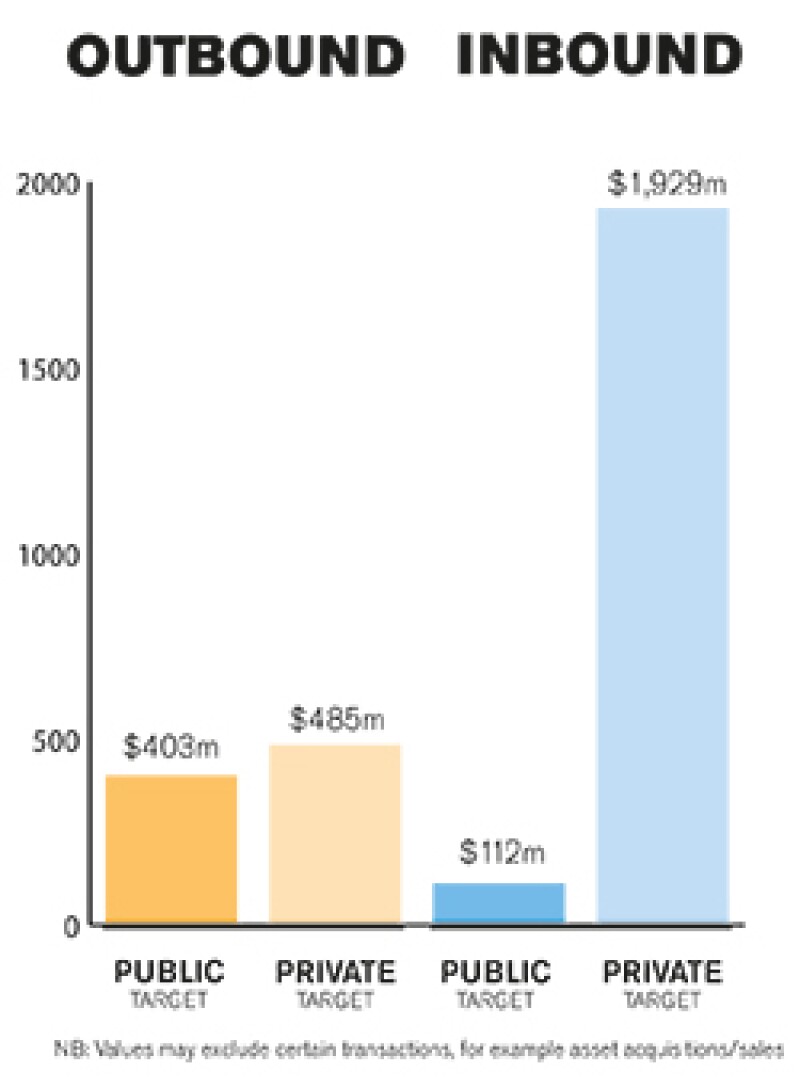

The market has been dominated by private M&A transactions in 2016. Six public transactions with a total value of $1.1 billion were completed in the energy sector, while private transactions had a total value of $6.6 billion. Public transactions corresponded to 14% of total M&A transaction value. 2016 was an unusual year for Turkey as both public and private transactions decreased in value. Public transactions have also been popular historically, unlike in 2016.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Many hydroelectric energy plants were privatised during 2016. Privatisations have been conducted via share transfers instead of public offerings or granting concession rights. Accordingly, the energy sector led the M&A market in terms of deal value in 2016.

2.2 What have been the most significant trends or factors impacting deal structures?

The vendor due diligence concept became more popular in 2016, since the majority of the sellers preferred the service of a vendor due diligence conducted on target companies.

In terms of public transactions, public offering and concession structures which had been realised successfully were substituted with share transfers in 2016.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The key legislation governing M&A activity is the Turkish Commercial Code 6102, published in the Official Gazette dated February 14 2011 and numbered 27846 (Turkish Commercial Code) for privately held companies; and the Capital Markets Law numbered 6362, published in the Official Gazette dated December 30 2012 and numbered 28513 (Capital Markets Law) for the public companies.

The Law on Protection of Competition 4054, published in the Official Gazette dated December 13 1994 and numbered 22140 also governs certain M&A transactions depending on volume of transactions and the dominance of the parties involved. Accordingly, certain transactions regulated under the Communique on Mergers and Acquisitions are subject to the clearance of the Turkish Competition Authority 2010/4.

In this regard, depending on the sector involved in the transactions, approvals of different regulatory bodies would be required.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

The law numbered 6728 on the Amendment of Several Laws concerning Improvement of Investment Environment published in the Official Gazette dated August 9 2016 and numbered 29796 (Law 6728) provided investors with various conveniences in terms of paperwork and tax. These include, among others: an exemption on stamp tax for share transfers of joint stock and limited liability companies; and investors were granted the option of executing of articles of association of companies before notaries (as opposed to trade registries).

The Law on Protection of Personal Data 6698, published in the Official Gazette dated April 7 2016 and numbered 29677, was enacted in line with European Union legislation which may affect M&A transactions.

3.3 Are there any rules, legislation or policy framework under discussion that may impact M&A in your jurisdiction in the near future?

Different incentive packages are expected to be introduced in 2017. Also, a capital market regulation concerning crowd funding is expected to be legislated in 2017.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

The discrepancies between common law and civil law give rise to various misconceptions in the Turkish M&A market. The use of some boiler plate provisions of Turkish law (such as good faith and fair dealing, frustration or force majeure) in an English law governed agreement creates problems of interpretation.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Usually, dispute resolution is overlooked during the negotiation of deals. Consequently, in the event of a dispute between the parties, the delay in the decision-making process of the courts causes parties to face additional financial losses.

Competition requirements and administrative requirements, such as workplace opening and operating licence and additional benefits granted to employees of target companies, are usually overlooked.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

The abovementioned idiosyncrasies may be handled through obtaining well-experienced legal consultancy services.

Choice of arbitration as a means of dispute resolution between parties may be suggested to resolve disputes diligently and eliminate the risk of financial loss arising from disputes.

Turkish legislation allows for international arbitration in the event that the dispute involves a foreign element (such as having the business places or habitual residences in different states, or one of the parties having a foreign shareholder bringing foreign investment or the disputed contractual relationship creates a flow of investment from one country to another). Turkey is party to the New York Convention and foreign arbitral awards are enforceable in Turkey in accordance with the Convention. As regards the enforcement procedure, Turkey is an arbitration-friendly country.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

The main legislative text governing public companies is the Capital Markets Law. According to the Capital Markets Law, public companies which either have more than 500 shareholders or are publicly traded are joint stock companies.

Pursuant to Article 12 of the Communiqué on Takeover Bids II-26.1, published in the Official Gazette no 28891 dated January 23 2014 (Communiqué on Takeover Bids) issued by the Capital Markets Board, control is defined as holding either or both of: over 50% of the voting rights of a corporation directly or indirectly; and/or privileged shares enabling their holder to appoint the simple majority of the members of the board of directors or to nominate such majority of directors in the general assembly meeting.

5.2 What conditions are usually attached to a public takeover offer?

Pursuant to Article 11(4) of the Communiqué on Takeover Bids, a mandatory takeover bid cannot be subject to any conditions. However, under Article 20 of the Communiqué on Takeover Bid, a voluntary takeover bid may be submitted for all or some of shares of a publicly held corporation. If a voluntary takeover bid is submitted for some of the shares and the number of shares covered by the demands for participation in the takeover bid is greater than the number of shares covered by the takeover bid, then the voluntary takeover bid process is conducted in accordance to a pro rata distribution method; in order to eliminate any inequality between the demanding shareholders. Since the form to be submitted to the Capital Markets Board requires the bidder to submit information on the conditions of a bid, it is implied that certain restrictions may be imposed on voluntary takeover bids upon the approval of the Capital Markets Board.

Furthermore, under the Communiqué on Material Events Disclosure II-15.1 published in the Official Gazette dated January 23 2014 and numbered 28891, tender offers and public takeovers are subject to certain disclosure requirements.

It is also noteworthy that following the enactment of Law 6728, a ten percent threshold has been determined for purposes of defining a related party with regards to transfer pricing requirements. In the meantime, the threshold for the rate of shareholding that can be subject to buyback by a company with regards to its own shares is ten percent, under the Turkish Commercial Code.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

There is no specific regulation as per break fees under the capital markets legislation. Therefore, the Turkish Code of Obligations, numbered 6098 published in the Official Gazette dated February 4 2011 and numbered 27836 (TCO), will be applicable. There is no restriction with regards to a break fees under the TCO between merchants.

Especially in private deals, where the target is sold by means of a tender, break fees are frequently used for violation of exclusivity or lack of closing, for instance unsuccessful tenders. However, break fees are not very commonly seen for public M&A deals.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

As per the Turkish private M&A markets, purchase price adjustments have been the most popular mechanism for pricing and payment.

Recently, the locked box mechanism was offered by a greater number of sellers, where a corresponding increase in the number of buyers accepted such alternative consideration mechanism.

On the other hand, the earn-out method was not as commonly resorted to as the aforementioned, and used generally for partial share acquisitions where one of the parties maintains its presence in the target.

Finally, an escrow mechanism has been seldom come across in the Turkish M&A market, since Turkish banks are not very enthusiastic about the application of such a mechanism and its facilitation.

5.5 What conditions are usually attached to a private takeover offer?

The most used conditions precedents for a private takeover offer are regulatory authority clearances and approvals. Among these clearances and approvals, the most ubiquitous condition precedent is merger clearance from the Turkish Competition Authority. There might also be other regulatory authority clearance required from authorities such as the Energy Market Regulatory Authority and Information and Communication Technologies Authority designated as conditions precedent, depending of the activities of the target.

Another often used type of condition precedent is the approval or consent of third parties, where a change of control clause requires such approval or consent, with regard to the contracts, where the buyer will become a party. In relation to such consent / approval, if the target company holds certain licences or permits, such as an electricity distribution licence, approval must be obtained for certain changes in the shareholding structure of the licence-holder target company.

Among other examples of condition precedents are the resignation of the board structure of the target and its replacement with new members appointed by the buyer; undertakings with regards to the post-signing and pre-closing interim period; disclosure of transactions out of ordinary course of business during such interim period; transfer of loan agreements and the security agreements in connection with such loans; exclusivity and break fees with regard to such exclusivity; and non-occurrence of material adverse events.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Under Turkish law, parties to an agreement with a foreign element can choose the governing law for the agreement. Choice of Turkish law as governing law for Turkish target companies is general market practice. However, during recent years, it has been more frequently seen that a foreign, non-Turkish, jurisdiction was designated as the governing law in order to eliminate the difficulties of recognition and enforceability of court decisions.

In addition, arbitration has become preferable as the means of dispute resolution, including both international commercial arbitration, such as ICC and UNCITRAL arbitration, and arbitration by the recently established Istanbul Arbitration Centre.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Professional liability insurance and director's and officer's liability insurance is available under the Turkish Commercial Code. However, warranty and indemnity insurance is not available under Turkish law.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

The market is expected to be slow in terms of M&A transactions in the first half of 2017 due to the economic developments foreseen for the first six months.

During the second half of the year, more privatisations are expected to take place, especially in the energy sector. In addition to privatisations, the energy sector will hopefully be more active in terms of other types of M&A deals, following the global trends. For instance, sub-sectors, such as the renewable energy sector, especially in solar energy, are subject to wishful future projections of increasing activity.

Furthermore, the insurance, technology and real estate sectors are expected to grow in the second half of 2017 along with the media sector. Finally, the biggest trend of start-up investments will keep up in 2017. We believe that both angel investors and private equity funds will remain active.

About the author |

||

|

|

Ercüment Erdem Founder and senior partner, Erdem & Erdem Law Office Istanbul, Turkey T: 90 212 291 73 83 F: 90 212 291 73 82 Ercüment Erdem is the founder and senior partner of Erdem & Erdem Law Office. He has more than 30 years of experience in mergers and acquisitions, international commercial law, privatisations, corporate finance and arbitration. He serves international and national clients in a variety of industries including energy, construction, finance, retail, real estate, aerospace, healthcare and insurance. Erdem is a member of Istanbul Bar Association, co-chair of ICC Commercial Law and Practice Commission, and a member of the ICC Court of Arbitration, ICC Institute Council, ICC Incoterms Expert Group and ICC Turkish National Committee Arbitration Council, as well as a member of several ICC task forces. He is a member of the Association Suisse de l'Arbitrage (ASA), International Bar Association (IBA), Association Henri Capitant des amis de la culture juridique française, and the Research Institute of Banking and Commercial Law. He has a highly strong academic background. He is an emeritus professor and continues to lecture in leading universities such as Galatasaray University in Turkey and Fribourg University in Switzerland. He has authored books on mergers and acquisitions, international trade law, competition law, commercial law, CIF sales etc. In addition, he has authored numerous articles in national or international publications related to commercial law, competition and antitrust law, contracts law, arbitration, complex business litigation issues, dispute resolution etc. |

About the author |

||

|

|

Özgür Kocabaşoğlu Partner, Erdem & Erdem Law Office Istanbul, Turkey T: 90 212 291 73 83 F: 90 212 291 73 82 E: ozgurkocabasoglu@erdem-erdem.av.tr Özgür Kocabaşoğlu is a partner and the head of corporate of Erdem & Erdem Law Office. Kocabaşoğlu has nearly 20 years of experience in national and multijurisdictional complex mergers and acquisitions, structuring, banking, capital markets transactions, corporate and project finance. He has extensive experience of international transactions involving a number of overseas jurisdictions in a variety of business sectors including energy, mining, transportation, ports, airports, construction, finance, retail and real estate. He focuses on privatisations, public private partnership models and complex cross-border transactions involving commercial banks, corporate entities, public and private companies. In recent years, he has led mergers and acquisitions in a wide geography including Europe, Latin America, Russia, CIS countries, Africa and Asia. Moreover, he regularly acts as a consultant to multinational corporations on every aspect of commercial law, contract law, capital markets and mergers and acquisitions. He is a member of Istanbul Bar Association and International Bar Association (IBA). |