SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

For deals of over A$50 million ($39 million), the 2016 Australian M&A market marginally preferred takeover bids in comparison to schemes, although schemes continue as the preferred approach for larger deals, particularly if over A$1 billion ($772 million).

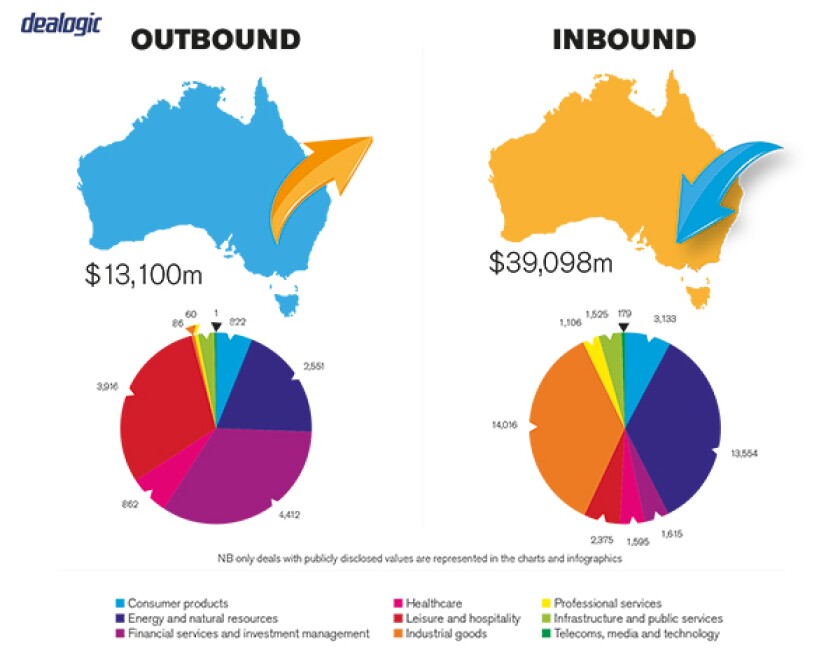

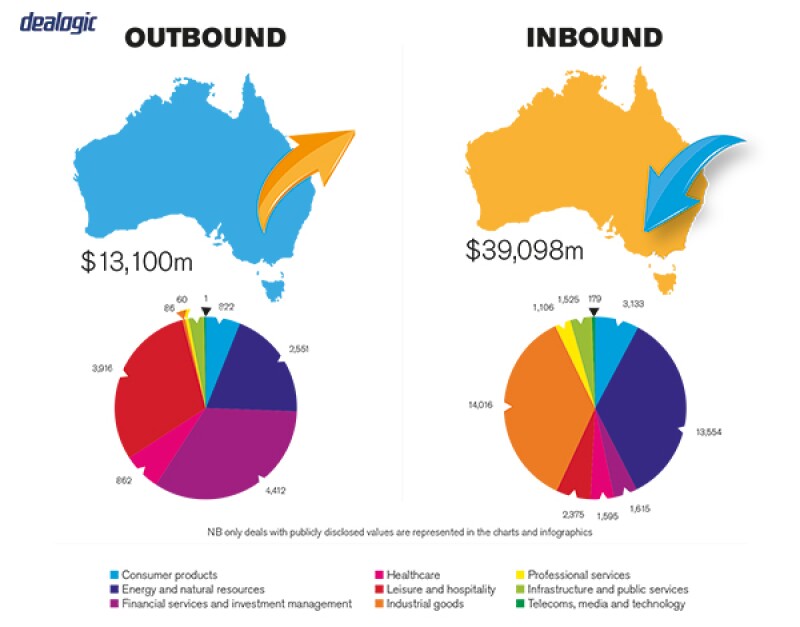

Foreign bidders (especially North American) continue to play a significant role in cross-border Australian M&A activity, with inbound M&A totalling A$39 billion, and making up three quarters of aggregate cross-border deal value (excluding exclusively domestic transactions) in 2016.

The transportation and utilities sectors featured strongly in 2016, contributing approximately A$21.7 billion to overall inbound deal value, including the A$9 billion takeover of Asciano and the A$9.9 billion takeover of the DUET Group. In contrast, 2016 proved to be a challenging year for the resources sectors, contributing only A$2.8 billion to the total inbound deal value in 2016.

Despite a subdued level of M&A activity, 2016 saw a significant increase in the number of rival bids in public M&A, in contrast to 2015. Seven public M&A targets attracted multiple bidders, and shareholders of those entities ultimately received, on average, a 97% premium to the original bid price.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

While the volume of inbound M&A transactions in 2016 H1 was down only slightly, the overall inbound deal value was down 22.7%. Both inbound deal volume and value improved in 2016 H2. But for 2016 as a whole, whilst inbound deal volume was marginally higher in 2016, aggregate inbound deal value was substantially down, from A$45.92 billion in 2015 to A$39.1 billion in 2016 (-14.9%).

These figures for cross-border transactions were also representative of the Australian M&A market as a whole (including domestic only transactions) in 2016, for which the number of reported transactions was broadly steady but aggregate value was down 17%.

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

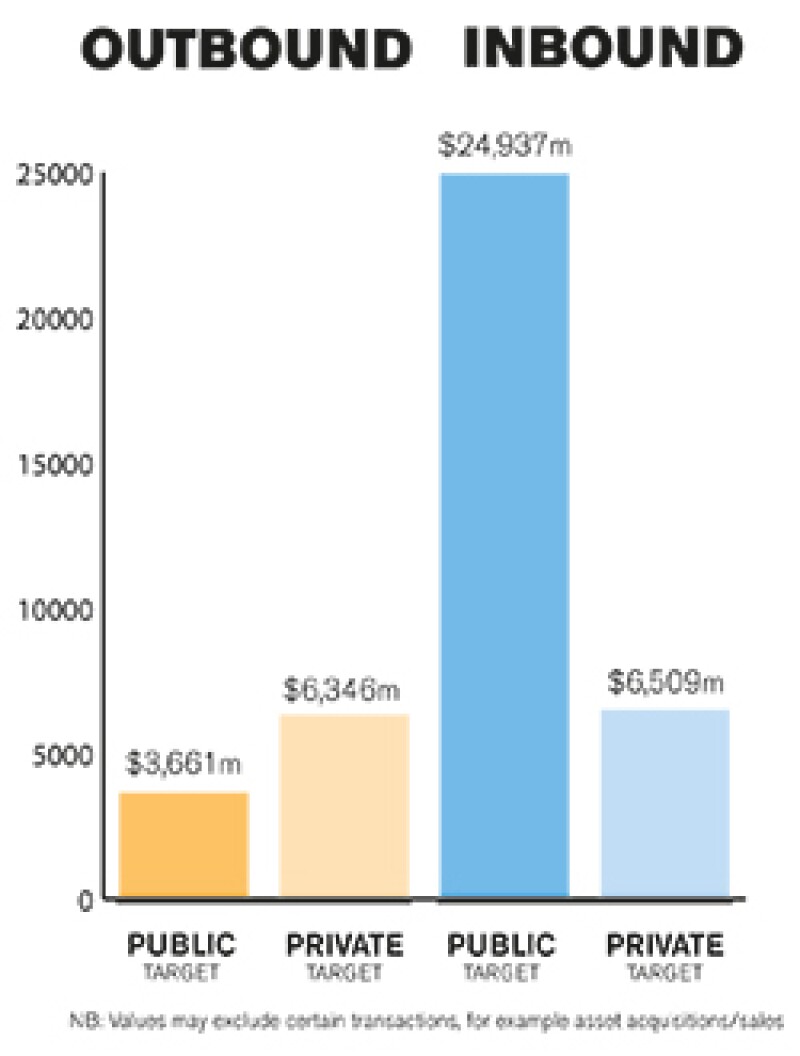

By value, the Australian market is driven by public M&A, with reported inbound public M&A representing A$24.9 billion in 2016, as compared to A$6.5 billion for reported private M&A (down from A$15.8 billion in 2015).

Cross-border public M&A volume has declined over the past five years from the 172 deals in 2012 to 110 and 111 deals in 2015 and 2016, respectively. The aggregate value of cross-border public M&A deals, however, has shown positive signs, reaching a three-year high of A$28.59 billion in 2016 and representing 69% of the aggregate value of Australian cross-border M&A in 2016.

By volume, however, private M&A continued to make up almost 80% of all cross-border Australian M&A transactions in 2016. Small and medium-sized enterprises were the predominant acquisition targets, reflecting the Australian business landscape.

Overall, by volume, cross-border Australian M&A activity remains based in (predominantly private) deals valued up to A$8 million. Fifty one percent of all cross-border transactions in 2016 were for deals valued at up to A$8 million. Deals valued between A$8 million and A$200 million accounted for another 38% of cross-border transactions. However, the value of cross-border M&A deals within the Australian market is still overwhelmingly obtained from larger value deals, with deals valued above A$200 million accounting for just 11% of all cross-border deals by number but 82% of total value.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Australian regulators had a significant effect on some key transactions in Australia in 2016. A bid from Chinese listed company Dakang to acquire S Kidman & Co, Australia's largest holder of private agricultural land, was blocked by the Australian government for a second time on national interest grounds. A rival consortium proposal emerged between Hancock Prospecting and Shanghai CRED to acquire S Kidman & Co for A$386.5 million. The greater involvement of an Australian partner assuaged national interest concerns and the transaction was ultimately approved.

Foreign investment from China was also blocked by the Australian government in August 2016 when each of the Chinese government-owned State Grid Corp and Hong Kong-listed Cheung Kong Infrastructure were banned from acquiring a 99-year lease over 50.4% of the New South Wales government's electricity distribution network (Ausgrid) despite both already holding substantial power infrastructure assets in Australia.

Both decisions demonstrate increasing risks to deals in certain sectors from rising populist nationalist sentiment in Australia.

The sale and ultimate break-up of the Asciano various port, logistics and railway businesses required intensive negotiation with Australia's competition regulator (and resulting transaction restructuring), before a three-way break-up amongst three consortia was ultimately approved.

2.2 What have been the most significant trends or factors impacting deal structures?

The availability of cheap debt continues to underpin transaction activity and the use of cash consideration for acquisitions.

The recent strength of equity markets, however, allowed a number of bidders to raise equity capital to fund acquisitions, including Vocus Communications (A$652 million), and Mayne Pharma (A$888 million). Both capital raisings were well received in the Australian mrket and we expect more such transactions in 2017.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

For takeovers of publicly listed companies, the key legislation is:

Chapter 6 of the Corporations Act 2001 (Cth) (Corporations Act), which regulates on-market and off-market takeover offers; and

Part 5.1 of the Corporations Act which regulates mergers conducted by way of court-approved schemes of arrangement.

The listing rules of the Australian Securities Exchange (ASX), will also often be applicable.

The principal regulator for mergers and acquisitions is the Australian Securities and Investments Commission (ASIC). The primary arbiter of disputes in relation to takeovers is the Takeovers Panel, a specialist administrative tribunal with wide statutory powers.

In addition, M&A activity must commonly take into account Australian competition/anti-trust legislation, as administered by the Australian Competition and Consumer Commission (ACCC); legislation regulating foreign investment, as administered by the Australian Treasury (which receives advice from the Foreign Investment Review Board (FIRB)); and taxation legislation.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Substantial reforms of Australia's foreign investment approval regime came into effect in December 2015 and March 2016, increasing the scope of the law, increasing application fees and penalties for non-compliance, and introducing new standard conditions required to be attached to foreign investment applications, directed at ensuring full compliance with taxation obligations (including annual reporting obligations).

We expect these changes to have a minor impact upon aggregate inbound M&A, but will likely make certain larger transactions that require approval more difficult to navigate. The changes have resulted in an increased interaction between the regulators including the Treasury and its foreign investment adviser FIRB, the Australian Taxation Office and the ACCC. Transaction parties must therefore adopt strategies to proactively engage with regulators.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

Long-running proposed reforms to Australia's media ownership laws remain on the legislative agenda, but are uncertain. If they ultimately occur, significant consolidation in the media industry may result, from the abolition of the prohibitions on commercial television broadcasting to more than 75% of the population of Australia; and controlling more than two out of three of regulated television, radio and newspaper assets in any one relevant licence area.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Australia has an open economy, with wide-ranging free trade agreements in place with the US (2005), ASEAN countries and New Zealand (2010), South Korea (2014), China (2015) and Japan (2015). Whilst famed for its resources and agriculture sectors, the Australian services sector actually represents around 70% of GDP and 75% of employment.

Since 1983, employer funded (but essentially diverted employee income) pension savings schemes (called superannuation) have been compulsory, with the minimum rate of contributions now being 9.5% of income. A$2 trillion is now held by superannuation funds or their managers, which have in consequence become strong forces in Australian capital markets and can sometimes become critical to the outcome of public M&A proposals.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

The potential need for foreign investment approval is sometimes initially overlooked by foreign investors and can sometimes add to the transaction timetable if not given early attention. This is particularly the case in relation to transactions involving private equity sponsors, which the law may treat as foreign government investors because of the characterisation of their limited partners (for example state teachers, public/civil servant pension funds).

Although market sounding conversations by prospective acquirers and their advisers are not prohibited, where the target is a company regulated by Chapter 6 of the Corporations Act (mainly listed entities) those discussions must avoid reaching done deals with shareholders/controllers holding the 20% acquisition threshold which triggers the need for a full public bid. Advice on the scope and content of such discussions should be obtained at an early stage.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

While mergers and acquisitions are not necessarily difficult to accomplish in Australia, care and specialist advice is required to ensure that the process is timely and successful.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

The recommendation of the target's board of directors (or the target's independent directors) will strongly promote the success of the bid. Culturally, the boards of listed Australian companies tend to be receptive to takeover offers and maintain good lines of communication with major shareholders.

A supportive board also permits a transaction to be completed by way of shareholder and court approved scheme of arrangement, which, if approved by a majority of the shareholders (holding 75% of the shares) entitled to vote and who vote, provides 100% ownership of the target company and can also afford greater flexibility regarding transaction structuring than is the case under contractual takeover bids (the latter requiring the bidder to ultimately have at least 90% of the target shares, and have acquired at least 75% of the target shares bid for, in order to exercise rights to compulsorily acquire minority holder shares).

That said, Australia maintains a legal regime that is relatively favourable for making hostile takeover offers, compared to other western jurisdictions.

5.2 What conditions are usually attached to a public takeover offer?

Off-market takeover bids may be subject to a wide range of conditions. These typically include:

negative control conditions;

material adverse change conditions;

conditions regarding regulatory approvals;

conditions requiring a minimum level of acceptances.

There is no requirement to have a minimum acceptance condition (assuming foreign investment, competition law and other key requirements are satisfied). Wholly unconditional takeover offers are permissible.

Certain types of conditions are prohibited, however, such as maximum acceptance thresholds and conditions which turn on the opinion or belief of the bidder or an event which is within the bidder's control.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees are routinely used in Australian public M&A deals and are relatively standardised, Takeovers Panel guidance requiring that fees not ordinarily exceed one percent of the equity value of the target company. There have been developments in recent years that suggest some shift toward more target-friendly deal protection provisions and a focus on not fettering target directors' fiduciary duties during a control transaction.

Reverse break-fees have lately become more common, particularly in leveraged deals or where a private equity buyer is involved. There is flexibility in pricing reverse break fees, but in practice these also tend to be at around one percent.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

The market for sellers remains positive, with many private sales being run as a competitive process, leading to reduced buyer protections such as earn-outs and escrow arrangements. Where a competitive sale process is taking place, some sellers are now able to obtain deposits ahead of transactions closing, and will typically require buyers to seek warranty and indemnity insurance in lieu of vendor covenants/warranties.

5.5 What conditions are usually attached to a private takeover offer?

Conditions are naturally highly tailored to the transaction but deals usually include regulatory (for example foreign investment approval, and competition law) and financing conditions.

Volatility in the markets in recent years has also led to material adverse change (MAC) conditions receiving more attention than they perhaps did in the past, which has led to the vast majority of MAC conditions being measured against very specific financial metrics (as opposed to generalised MAC clauses which often result in later dispute).

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

No. This would be extremely rare unless some particular cross-border element of the transaction required the application of foreign law, and even in such event this would usually be only to the minimum extent required.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Take up of warranty and indemnity insurance has grown in Australian private M&A over the last five years, with some estimates suggesting it is used in 40% of reported private M&A deals, especially where the transaction arose from a competitive sale processes or transactions involving private equity sponsors.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Some cooling on inbound M&A may be expected with the Australian dollar having largely found a new level and practical restrictions on investment from China to Australia increasing, as well as growing protectionist sentiment generally. That said, we think certain sectors will attract increasing amounts of capital and M&A activity, in particular the resources sector, assuming global economic growth improves and minerals and energy prices continue to hold up or even advance.

About the author |

||

|

|

Jon Skene Partner, Atanaskovic Hartnell Sydney, Australia / London, UK T: 61 2 9777 7000 / 44 20 7629 8700 F: 61 2 9777 8777 Jon Skene practises in public and private mergers and acquisitions in both the Australia and UK, business sale and purchase, joint-ventures, capital markets and securities (including advice on the listing rules of the ASX, LSE and AIM), private equity, corporate governance, general corporate advisory matters, and competition and antitrust law generally (including relating to the foregoing). He has acted on numerous M&A transactions including: acting for WIN Corporation on its sale of Channel 9 Adelaide to the Nine Network, the granting of a call option over and subsequent sale of Channel 9 in Perth, and the renegotiation of WIN's programme supply arrangements with the Nine Network; acting in the UK for Asia Resource Minerals in relation to the $210 million takeover bid by Asia Coal Energy Ventures; acting for Glencore International on its takeover bid for Minara Resources, valuing Minara at in excess of A$1 billion; advising Glencore on its merger by way of scheme of arrangement with Xstrata, valued at $90 billion (including the UK takeover code, corporate and contract law issues and Australian competition law aspects). |

About the author |

||

|

|

John Atanaskovic Managing partner, Atanaskovic Hartnell Sydney, Australia / London, UK T: 61 2 9777 7000 / 44 20 7629 8700 F: 61 2 9777 8777 John Atanaskovic practises both English law in London and Australian law in Sydney, focusing on mergers and acquisitions, corporate governance, capital markets, competition law, and litigation. He has been rated by Chambers Global as Australia's leading business lawyer and by UK Legal Business as one of the top ten corporate lawyers in the world. His previous transactions and cases include acting in the UK for Glencore in its acquisition of Xstrata and Asia Resource Minerals on its takeover bid defence; and in Australia for Glencore on its acquisition of Minara Resources; for The Coca-Cola Company in successfully resisting the Lion Nathan/Kirin bid for Coca-Cola Amatil (CCA) and CCA's formation; for Westfield on its reorganisations and acquisition of the AMP Retail Trust; for Xstrata on its acquisition of MIM; for Ten Network on its IPO and introduction of see through shares; for News Corporation on its acquisitions of HWT and Queensland Press and introduction of non-voting shares; on numerous IPOs and new issues for News Corporation, Westpac Banking and various governments; for James Hardie on its A$3.5 billion asbestos compensation funding agreement; and in numerous court cases for Glencore, News Corporation (including the Super League litigation), James Hardie and Seven West Media. |