SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

Overall, the China M&A market slowed down somewhat in the past 12 months. We attribute this mainly to market issues and regulatory changes, especially relating to outbound investment policies. That said, M&A in certain industries grew robustly, such as in artificial intelligence (AI), big data, healthcare and advanced manufacturing.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

According to PwC's M&A 2017 Review and 2018 Outlook, "2017 China M&A value fell 11% to $ 671 billion off the record highs of 2016". The total deal volume in 2017 was 9,839 transactions compared to 11,407 in 2016. Despite of the slowdown, 2017 still ranks as second highest in the past five years in terms of deal volume and value.

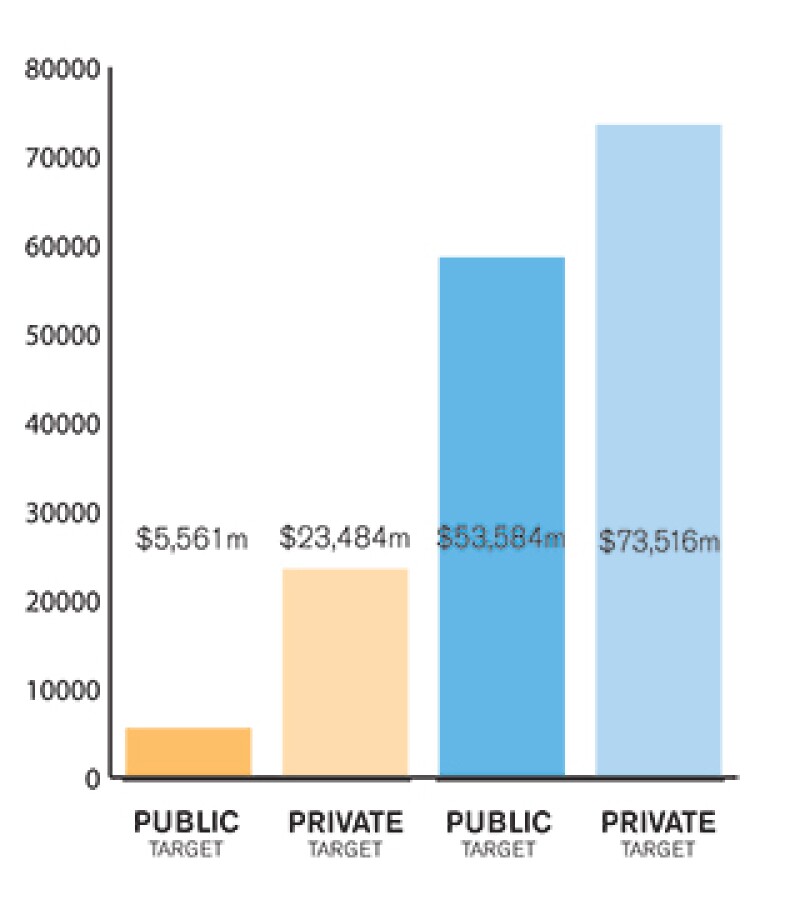

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

The Chinese market is driven by both private and public M&A transactions. Indeed, it is not uncommon to see private and public M&A transactions occurring in parallel. For example, some listing companies may involve M&A investment funds to acquire target companies first, and then initiate an (major) asset restructuring to acquire the targets by issuing shares to the M&A investment funds.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

Both strategic and financial investors significantly influence the M&A environment. For example, the internet giants in the China market, Baidu, Alibaba and Tencent (collectively BAT) are dominant strategic investors in the China internet and technology industries. They also have significant influence over start-up companies and certain private equity (PE) and venture capital (VC) investors. Likewise, some PE and VC investors go to great lengths to build market influence in selecting investment targets and leading investment trends in specific industries.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

In August 2017, ELE, a leading food delivery company in which Alibaba is a major shareholder, announced its acquisition of Baidu Waimai. Upon closing, Baidu Waimai will become a wholly-owned subsidiary of ELE and will continue to operate as an independent brand for high-end food delivery services. ELE will issue new shares to Baidu as partial payment of the total consideration. In the M&A market, BAT companies usually insist as a standard provision that any companies in which they invested are prohibited from selling to another BAT company (among other significant competitors). This deal, however, shows that such restrictions are not absolute and under certain circumstances, Alibaba and Baidu may work together (at least indirectly).

2.2 What have been the most significant trends or factors impacting deal structures?

Notable factors include industry practice, market share of the target or the acquirer (in the cases of strategic investors), founder background, regulatory environment, etc. Capital increase or share transfer or a combination of both are common deal structures.

A recent policy-driven trend in 2017 is that many PRC investors have switched to pure offshore structures when conducting outbound investment to avoid the Chinese regulatory approvals.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The key laws and regulations include the PRC Company Law, Sino-Foreign Joint Venture Law, the Sino-Foreign Cooperation Joint Venture Law and Foreign Enterprise Law, and the implementation rules of such laws; outbound investment regulations; foreign exchange laws and regulations; company registration laws and implementation rules; PRC Corporate Tax Law and its implementation rules.

Key regulatory bodies include:

In general, the State Administration of Industry and Commerce (SAIC) and the State Administration of Tax (SAT).

With respect to outbound investment, the National Development and Reform Commission (NDRC), the Ministry of Commerce (MOFCOM), the State Administration of Foreign Exchange (SAFE).

With respect to public M&A, the China Securities Regulatory Commission (CSRC).

The Anti-Trust Bureau of MOFCOM, which governs anti-trust issues of M&A transactions.

For certain specific industries, such as the education, healthcare and media industries, the Ministry of Education, the China Food and Drug Administration and the State Administration of Press, Publication, Radio, Film and Television may also be the governing regulatory bodies for any M&A deals in the industry.

The local branches of the above regulatory bodies.

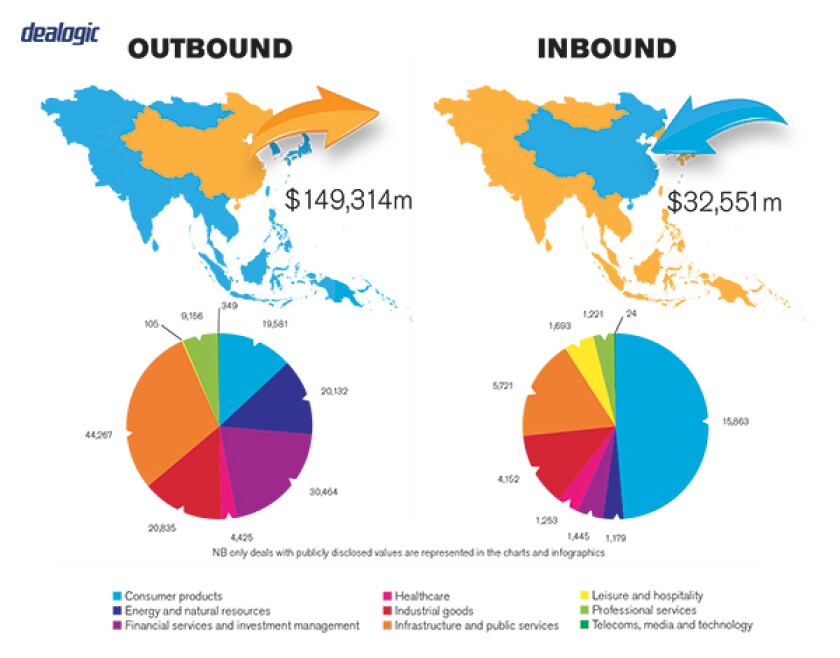

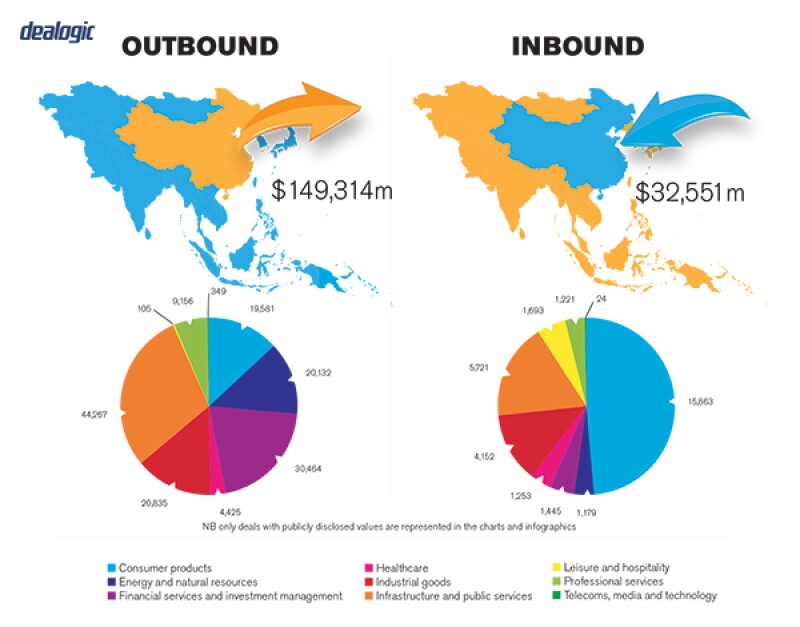

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

On November 3 2017, the NDRC promulgated the Administrative Measures on Enterprise Outbound Investment which has enter into force on March 1 2018 (Administrative Measures). The Administrative Measures and accompanying rules such as the Catalogue of Sensitive Industries for Outbound Investment and the template documents for the Administrative Measures are expected to allow closer monitoring and heightened transparency for the NDRC with respect to outbound investments.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

As the laws governing foreign investment were promulgated in the 1980s immediately after the opening reforms by the PRC government, some articles are obsolete or even contradict other existing laws, such as the Company Law. In this connection, there have been efforts to replace the current foreign investment laws and promulgate new ones. In particular, MOFCOM led the preparation of a new Foreign Investment Law, a draft of which was published for public comments in 2015. However, the draft law was met with an intensive public discussion, especially in the international business community and no subsequent drafts of this law have appeared to date.

Nevertheless, given existing issues in the current foreign investment-related laws, it is widely expected that the PRC government and the National People's Congress (NPC) will eventually adopt new laws to regulate foreign investment. However, as foreign investment plays a significant role in China's economic growth, any significant changes of laws may have far reaching consequences.

Nevertheless, trial regulations have been underway in select areas, such as the Free Trade Zones. The PRC government and NPC are also rolling out new foreign investment laws and regulations to ease administrative burden on foreign investors to invest in China.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Inexperienced buyers tend to neglect the importance of government approvals/filings in PRC M&A transactions in certain industries and consider the processes to be mere formalities. In practice, some government authorities even may substantially review transaction documents and raise concerns or requests which may affect the overall deal structure. Potential investors are therefore advised to communicate with relevant government authorities early and often to ensure the smooth closing of M&A deals.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

In M&A deals in which exiting shareholders receive all or a portion of the sale proceeds, parties tend to agree in principle of the tax obligations without consulting PRC tax authorities in advance. As a result, issues often arise when actual tax filings are made. Sometimes the selling shareholders may even request the buyers to raise the purchase price in order to cover "unexpected" tax obligations. It is generally advisable to consult tax advisors early on the tax implications of the transactions and ensure that selling shareholders are aware of such implications as early as possible.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

In the PRC, parties should pay special attention to the following:

specific industry regulations, which may include shareholder qualifications, foreign investment restrictions and/or capital thresholds;

arrange for project financing as soon as possible once deal structure is determined. In particular, for a cross-border transaction, the parties may discuss financing solutions simultaneously with M&A project itself. Due to the outbound restrictions set by the PRC government in late 2016, we have seen many outbound investments terminated/put on-hold due to funding issues;

do not underestimate employment risks, as PRC employment law is highly complex and local and could cause last minute issues;

consult anti-monopoly specialists early in the transaction, who can assess whether filing will be needed in the PRC or any other jurisdictions, as such filings could be time consuming and could result in substantial delays.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

The key factors in obtaining control of a public company in China include:

the shareholding percentage of the listed company that the buyer needs to acquire;

the buyer's own track record in terms of legal compliance, securities actions, debt;

the source of funds for the purchase of the intended shares;

compliance with relevant rules, e.g., the Administrative Rules on Acquisition of Listed Company and relevant rules on disclosure (see below); and

the buyer's commitment to hold the purchased shares for the periods as specified by listing rules.

5.2 What conditions are usually attached to a public takeover offer?

Common conditions attached to a public takeover offer include:

the buyer's track record in terms of legal compliance, securities actions and debt status meeting the applicable legal requirements;

full compliance with the disclosure rules of the stock exchange, such as public disclosure of further share purchases after a buyer holds 5% or more of the shares in a listed company;

the submission of a takeover offer proposal to the stock exchange and the CSRC for approval;

no objection is raised by the CSRC or the relevant stock exchange; and

the sources of funds meeting applicable requirements.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Given the generally high purchase price involved in public M&A deals, we have seen more and more companies adopt break fee mechanisms to mitigate the risk of the deal falling apart. However, for cross-border M&A deals, more detailed mechanisms are often included in the transaction documents which specifically take in to account applicable foreign exchange rules.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Locked box mechanisms, completion accounts, earn-outs and escrow are all common consideration payment mechanisms in the PRC. In some deals, a combination of these may be adopted for various reasons. Strategic investors often focus on the overall growth of the target company and therefore tend to favour earn-out mechanisms to motivate founder shareholders/management.

Escrow-like arrangements are sometimes used in the PRC, but due to local restrictions, these are more common in real estate deals and need to be handled with a local notary (not a bank). As such, where an escrow arrangement is needed, parties tend to arrange for the purchase price to be paid at the offshore level.

5.5 What conditions are usually attached to a private takeover offer?

The conditions attached to a private takeover offer usually include:

consideration amount, form (cash or equity/share), payment schedule;

key closing conditions, such as obtaining necessary government approvals (if applicable), completion of company registration alteration;

overall closing timeline;

tax obligation allocation;

break fees.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Subject to the Law of the Application of Law for Foreign-related Civil Relations, yes. However, in some cases PRC laws may mandate the use of PRC laws in certain key transaction documents. For instance, where a purely domestic company is being purchased or invested in by a foreign buyer, the parties must choose PRC law as governing law. Therefore, parties should consult their advisors prior to determining the governing law for the transaction's share purchase agreement.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Currently, it is not common for parties to purchase warranty and indemnity insurance on private M&A transactions in the PRC M&A market.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

The IPO review process is comparatively lengthy in China which also involves uncertainties. It is common for a company to wait one to two years before it is able to officially submit its IPO application. Recently the market has also seen a large number of IPO applications rejected. The official review itself may also take one year or even longer, subject to legal, financial or other issues raised by the IPO review board.

As a result, trade sales and sales to financial sponsors are more common. Those sales are usually dependent on the company's status, e.g., market share, financial performance, overall growth prospects, etc., and if selling to a financial investor, the buyers will in turn weigh their exit possibilities.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

We believe that the M&A will continue to grow in 2018. As PRC outbound investment policies become clearer, we foresee outbound M&A picking up speed. Domestic PE/VC investment activities will remain strong, as the government continues to encourage innovation and entrepreneurship. Certain new technology industries, such as AI, cloud computing, life sciences, advanced manufacturing, etc., will continue to experience rapid growth. Publicly listed companies will also continue to play a significant role in M&A deals.

About the author |

||

|

|

Cloud Li Counsel, DaHui Lawyers Shanghai, China T: +86 21 5203 0688 F: +86 21 5203 0699 Cloud Li is a senior member of DaHui Lawyers' M&A and private fund practices. He graduated from Fudan University law school and Transnational Law and Business University, Republic of Korea. He has extensive experience representing European and North American multi-nationals, large state-owned and private Chinese companies and PE funds in fund formation, mergers and acquisitions, investments, dispute resolution and compliance matters. He assists clients in a variety of different industries, including internet, entertainment, media, health care, energy, transportation, infrastructure and real estate. His recent representations include a few PRC listed company acquisitions of target companies in and out of China in the media and transportation sectors using onshore and offshore structures. He has also advised a number of leading PE funds investing in energy, infrastructure and financial sectors. |

About the author |

||

|

|

Leo Wang Counsel, DaHui Lawyers Shanghai, China T: +86 21 5203 0688 F: +86 21 5203 0699 Leo Wang is a member of DaHui Lawyers' M&A and corporate teams. He graduated from Peking University law school and Georgetown University law centre. He has worked for many years with extensive experience in foreign direct investment, M&A, general corporate compliance and outbound investment. He assists clients in a variety of different industries, including IT, entertainment, media telecoms, education, e-commerce and real estate. His recent representations include a PRC listed company's acquisition of a controlling interest in a Korean-listed company. To date, this deal is one of the largest investments by a Chinese enterprise in a Korean television producer. He has advised on a public M&A project on behalf of a PRC listed company to purchase two target companies in the video game and entertainment industries in China. He represented two leading exhibition and event organisation companies in purchasing several internationally recognised show events in China. |