Daniel Raun and Philippe Seiler, Bär & Karrer

MARKET OVERVIEW

The current environment in Switzerland continues to be very favourable for both public and private M&A transactions and this was reflected in the high M&A activity in 2018.

The reasons for the ongoing high activity in the M&A market are manifold. The absence (or near absence) of investment restrictions in Switzerland facilitate investments. Various sectors (for example healthcare) are facing a consolidation wave, which increases M&A activity. Many Swiss companies, in particular small- and medium-sized enterprises (SMEs), will need to deal with succession planning in the coming years and are thus attractive investment opportunities. Swiss companies continue to transform and reshape their portfolios through M&A transactions (for example by strengthening digital capabilities or focusing on the core business). Although interest rates began to climb in the US and across the EU, they still remain low and this promotes fundraising and puts pressure on investors to invest. The importance of activist investors is growing, which increases M&A activity, in particular regarding public M&A. Finally, M&A remains an important opportunity for growth.

M&A activity

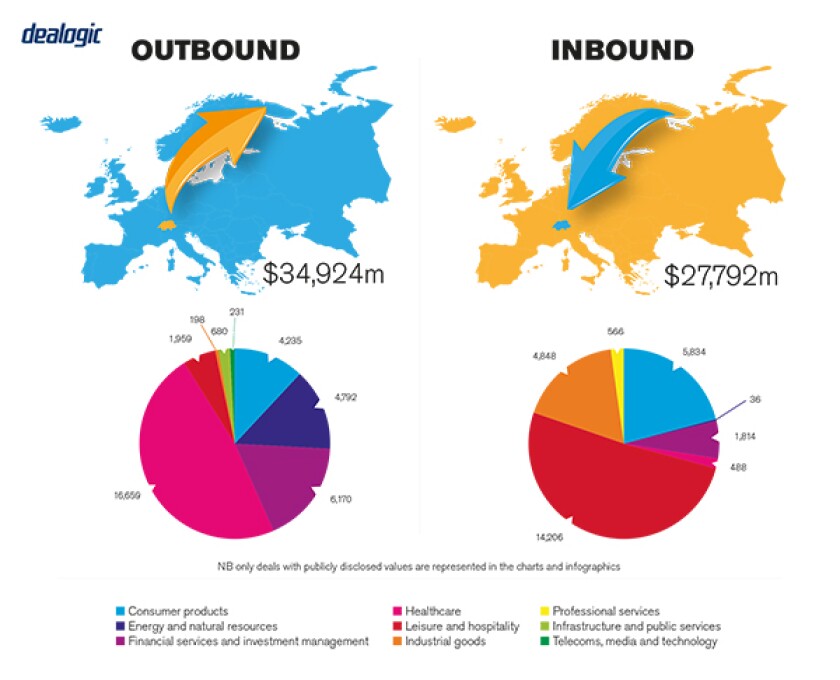

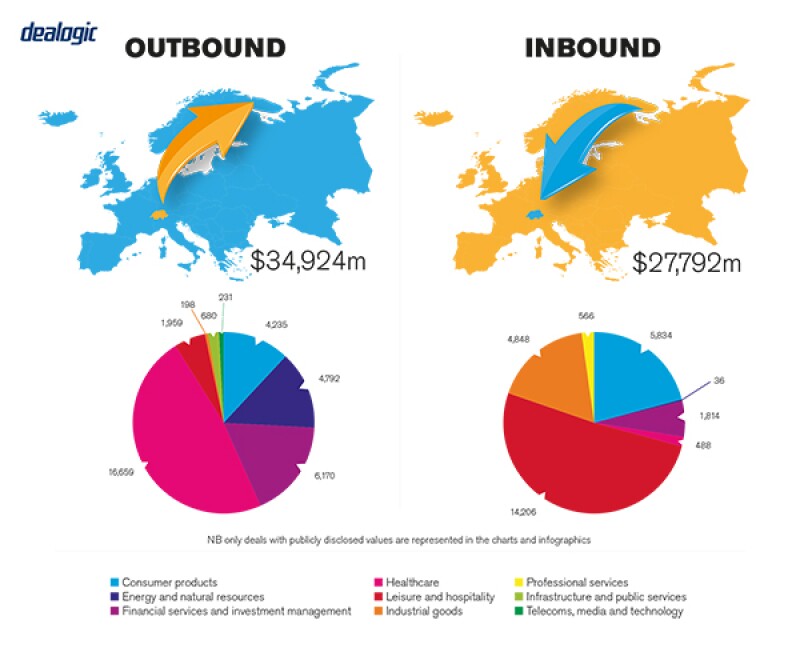

The number of M&A transactions with a Swiss involvement reached a new all-time high in 2018 with 493 recorded transactions, which corresponds to an increase of approximately 20% compared to 2017. The transaction volume increased by approximately 30% compared to 2017 which is, due to the lack of mega-deals, slightly lower than in the record year 2014. The number of outbound deals was about twice as high as the number of inbound deals. The most attractive sectors were the industry sector as well as the pharmaceuticals & life sciences sector.

Private M&A transactions accounted for the majority of the overall Swiss M&A market both in terms of number of deals and deal value in 2018. However, private M&A activity is often fuelled by public M&A and vice versa. For example, a taking private of a company, which typically involves a public tender offer and subsequent squeeze-out, is often followed by subsequent disposals or bolt-on acquisitions to focus, transform or grow the company's business.

For private equity in particular, IPOs have gained in importance in exit strategy considerations either as a standalone solution or as part of a dual-track process (see below). In addition, IPO candidates may seek to secure an anchor shareholder investment upon going public or thereafter, or may become the subject of a takeover offer soon after becoming a public company. This was evidenced by CMA CGM's investment in CEVA Logistics and its recent public tender offer for CEVA Logistics less than a year after the IPO.

TRANSACTION STRUCTURES

We see in particular the following three trends influencing deal structuring (and generally leading to M&A activity): industry consolidation, in particular in the healthcare sector; transformation and portfolio reshaping; and M&A as an opportunity for growth.

Financial investors

Private equity firms were very active in Switzerland in 2018 with 160 recorded deals, marking an increase of approximately 97% compared to 2017. Swiss private equity firms expanded their presence, both in Switzerland and abroad. In order to cope with rising valuations, private equity firms are increasingly pushing to break new ground – straight forward deals have become rather rare. For example, one strategy of private equity firms is to purchase different companies in the same or similar industries and to try to realise synergies. Further, private equity firms tend to do larger deals. The M&A environment in Switzerland has thus become more competitive, more sophisticated and bolder.

After the failed merger of Clariant and Huntsman in 2017, activist investors played an important role in 2018 as well. The Swedish investor Cevian serves as an example. Cevian's pressure on the CEO of ABB, Ulrich Spiesshofer, supposedly led to ABB's decision to sell 80% of its power grids division to Hitachi.

Recent transactions

Noteworthy is the sale of a majority stake in Variosystems (a leader in electronics manufacturing services with facilities in various countries) by its founders to Capvis, a Swiss private equity firm. The transaction shows that there are still attractive targets in Switzerland, in particular in the industry sector, and it serves as an example of the trend of private equity firms doing larger transactions.

Another transaction of significance was CMA CGM's cornerstone investment in CEVA Logistics' IPO on the SIX Swiss Exchange. As the investment required antitrust approval in certain jurisdictions and time was limited, CMA CGM initially subscribed for mandatory convertible securities instead of directly investing into shares at the time of the IPO. The transaction can be considered indicative of a wider trend of companies evaluating potential investments by anchor shareholders. Another example of a recent anchor investment is Saudi Basic Industries Corporation's purchase of a 24.99% stake in Clariant from White Tale following White Tale's successful opposition to the Clariant/Huntsman merger.

LEGISLATION AND POLICY CHANGES

Public tender offers for companies whose equity securities are (fully or partially) listed on a Swiss exchange (in case of non-Swiss domiciled issuers only if the main listing in Switzerland) are subject to the Swiss public takeover regime. The central piece of legislation regulating public tender offers is the Financial Market Infrastructure Act (FMIA) and its implementing ordinances, particularly the Takeover Ordinance (TOO), whose primary purpose is to ensure equal treatment of the target company's shareholders. The key regulatory body is the Swiss Takeover Board (TOB), which is tasked with ensuring compliance with the takeover legislation. The TOB is supervised by the Swiss Financial Market Supervisory Authority FINMA. which also decides in case the TOB's decisions are appealed.

Regulation is generally less strict for private M&A transactions and parties have far-reaching contractual freedom in determining the rules that should apply.

Depending on the involved parties and the nature of the transaction other legislation may need to be observed, such as the Antitrust Act and the Act on the Acquisition of Real Estate by Persons Abroad.

Recent changes in law

Two new acts will enter into force in the near future, most likely with effect from January 1 2020: the Financial Services Act (FinSA) and the Financial Institutions Act. Although primarily addressing the financial services industry, the FinSA in particular could become relevant in the context of M&A transactions, subject also to the provisions of the implementing ordinance, a draft of which has recently been under consultation by the Federal Finance Department and is therefore subject to change.

The FinSA contains rules regarding the duty to publish an issuance prospectus in the case of a public offering of securities. It sets out the required content of prospectuses, bringing the requirements in line with international standards and those already apply by SIX Swiss Exchange for listing prospectuses, and replacing the outdated rules of the Swiss Code of Obligations which only required very limited disclosure.

If in the context of a public tender offer securities are offered as consideration, this will likely constitute a public offering under the FinSA and would in principle require the offeror to publish a FinSA compliant prospectus. While the FinSA does provide for an exemption from the duty to publish an issuance prospectus in takeover situations, this requires that information that is equivalent to that contained in an issuance prospectus be available. SIX Swiss Exchange under its current practice does not consider offer prospectuses equivalent to listing prospectuses and absent the introduction of a specific exemption following the consultation procedure it is doubtful whether the prospectus reviewing body introduced by the FinSA would abandon this practice. Consequently, an offeror offering securities as consideration in a public tender offer would have to issue either an issuance prospectus in addition to the offer prospectus or prepare a document satisfying the requirements of both takeover legislation and the FinSA.

Regulatory changes under discussion

Even though some politicians favour investment restrictions for critical infrastructure in Switzerland (for example in power supply, oil supply, natural gas supply and district and process heat etc.), no such restrictions are currently in force nor being planned by the Swiss government.

MARKET NORMS

A common misconception about the Swiss M&A market is that Switzerland only offers targets in the financial industry. In 2018, (only) 12% of transactions concerned the financial services sector. More important are the industrial markets, pharmaceutical & life sciences and TMT sectors.

It is also noteworthy that other than transactions involving regulated financial institutions and transactions subject to antitrust approval, most M&A transactions require no approval or consent in Switzerland by regulatory or governmental authorities.

A common mistake is to not pay sufficient attention to Swiss particularities in transactions involving a Swiss target – not only concerning the legal system but also the usual approach of Swiss people doing M&A. The chances of sourcing a potential investment as well as closing a transaction are higher if advisors are involved that are aware of such particularities.

Frequently overlooked areas

In almost every case, the chain in the ownership of Swiss target companies cannot be fully traced back to incorporation. Sellers planning a transaction should therefore initiate the title clean-up (including obtaining confirmations, assignments, endorsements or board resolutions) well before starting the sales process in order not to jeopardise the timeline.

PUBLIC M&A

If following a public tender offer an offeror holds more than 98% of the voting rights in the target company, it may file for cancellation of the remaining shares in a statutory squeeze-out court procedure pursuant to the FMIA against payment of the offer price to the holders of the cancelled shares. If the offeror falls short of the 98% threshold but holds at least 90% of the voting rights, full ownership can be achieved through a squeeze-out merger pursuant to the Swiss Merger Act.

Therefore, while holding more than 50% of the voting rights will give an offeror effective control over a company, and 662/3% of the voting rights together with the majority of the capital allows the taking of certain important resolutions that by law are subject to this higher quorum, an offeror will typically want to reach at least the 90% threshold in order to be able to obtain full control. In mandatory takeover offers minimum acceptance threshold conditions are not permissible (more on this below). A voluntary offer, however, may be conditional on a minimum acceptance threshold, though only if the threshold is not unrealistically high. Whether or not the TOB considers a threshold as unrealistically high depends on the circumstances of the specific case. Absent significant holdings by the offeror in the target company prior to the offer the TOB will typically not permit a condition requiring that the offeror reaches the 90% threshold. In contrast, a 662/3% minimum acceptance is generally accepted even if the offeror does not yet hold any shares in the target company. However, in practice the vast majority of successful public tender offers have also cleared the 90% hurdle.

Swiss law allows hostile and friendly takeover bids, but an offer that is supported by the target company's board is more likely to be successful. In a friendly takeover, the offeror and the target company will typically enter into a transaction agreement pursuant to which the target's board of directors agrees to recommend the offer to its shareholders subject to a "fiduciary out" in case of a superior offer. It is also customary for the target to agree in the transaction agreement not to solicit offers from third parties.

Conditions for a public takeover

Which conditions may be attached to a public takeover offer depends on whether the offer is voluntary or mandatory. The duty to make a mandatory offer is triggered if the offeror acquires shares in a company exceeding the threshold of 331/3% of the voting rights or a higher threshold of up to 49% that applies pursuant to a so-called "opting-up" clause in the target's articles of association (Swiss law also allows companies to opt out from the mandatory bid regime).

With respect to mandatory offers there is only a very limited number of offer conditions that the TOB deems permissible. These include that no injunction or court order prohibiting the transaction will be issued and that necessary regulatory approvals can be obtained as well as conditions ensuring the ability of the offeror to exercise the voting rights (ie entry in the share register and abolishment of any transfer and/or voting restrictions). In voluntary offers the TOB accepts a much wider range of conditions, including, among others, minimum acceptance thresholds (see above), "no MAC" conditions and conditions protecting the offeror against disposals and distributions by the target.

Break fees

Break fees are generally considered permissible if the amount is set so as to compensate the offeror for the approximate costs of a breakup. Break fees that have a punitive character and significantly restrict shareholders in their freedom of whether to accept an offer or not and/or deter potential competing offerors may be invalid, although the question has not been answered conclusively in Swiss legal doctrine and case law.

PRIVATE M&A

Unlike in the US and Asia, locked-box pricing mechanisms are widely used in Switzerland. In particular in the current sellers' market, sellers seeking to limit balance sheet risks and reduce the risk of post-closing purchase price adjustment disputes push towards using locked-box pricing mechanisms.

As a consequence of the current sellers' market, locked-box pricing mechanisms are often combined with an interest payment for the period between the locked-box date and actual payment of the purchase price (ie closing), allowing sellers to participate in the generated cash flow, and buyers tend to accept longer periods between the locked box accounts and closing.

Conditions for a private takeover

In the current sellers' market, sellers usually push towards reducing conditions to an absolute minimum in order to increase transaction certainty. In particular MAC clauses have largely disappeared, but even the outcome of the merger control assessment – with its impact on the timing of the transaction and transaction certainty – may be a criterion for certain sellers to move forward with a specific bidder. Further, we often see "hell or high water" clauses included in the merger clearance closing condition.

Foreign governing law

In case of a Swiss target company, it is absolute market practice to agree on a Swiss law governed share purchase agreement with jurisdiction in Switzerland. In addition to the fact that this is generally expected by Swiss sellers (due to the well-known advantages of the application of domestic law and a domestic forum), various legal questions, such as the process of effecting the transfer of the shares, the board representation, shareholder requirements etc., are not open to any choice of law but governed by Swiss law anyways.

The exit environment

In cases where a private equity or other investor is invested in a target jointly with another party, the conditions under which the investor is able to exit as well as the exit route usually depend on the terms of the shareholders' agreement.

The most prominent exit routes are (still) trade sales (either to a strategic investor or private equity firm), including secondary buyouts. Exits through an IPO on the SIX Swiss Exchange are still less common but have become more attractive in recent years. We are also observing a trend towards dual-track processes to increase deal certainty, specifically in times of volatile and unpredictable markets, and maximize valuation, despite the inherent complexity in running simultaneous IPO and M&A processes.

OUTLOOK

Despite some uncertainties such as potential trade disputes between the US and China, potential (minor) increases of interest rates or high valuations etc., we are fairly positive that the Swiss M&A market will continue to be strong in 2019 as the key drivers which made 2018 a record year will in our view continue to be relevant in 2019. We also expect that the trends outlined above, such as anchor investments and the pursuing of dual-track processes, will continue in 2019.

About the author |

||

|

|

Daniel Raun Partner, Bär & Karrer Zurich, Switzerland T: +41 58 261 52 32 F: +41 58 263 52 32 Daniel Raun advises listed and privately held companies on a broad range of corporate and commercial law matters. The focus of his work is on international and domestic M&A as well as capital market transactions. Daniel further specialises in corporate and regulatory matters affecting listed companies, with a focus on disclosure and reporting requirements under securities law and stock exchange regulations. |

About the author |

||

|

|

Philippe Seiler Partner, Bär & Karrer Zurich, Switzerland T: +41 58 261 56 48 F: +41 58 263 56 48 E: philippe.seiler@baerkarrer.ch Philippe Seiler has broad experience in international and domestic M&A transactions in various industries. Philippe does not only cover big ticket transactions and takeovers but also focuses on small- and mid-size M&A transactions, private equity transactions and venture capital and start-up transactions. Furthermore, he specialises in regulatory matters in the fields of life sciences and healthcare. |