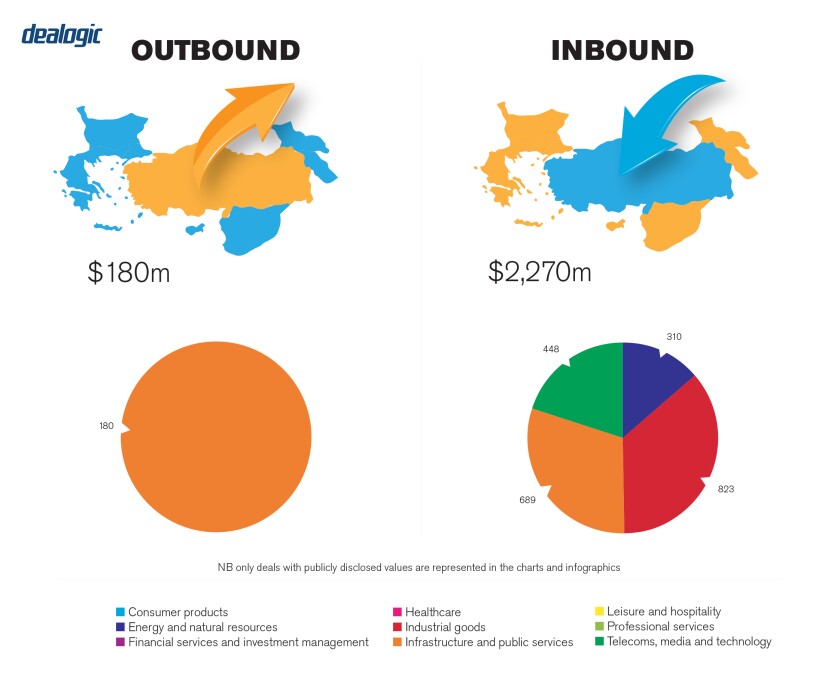

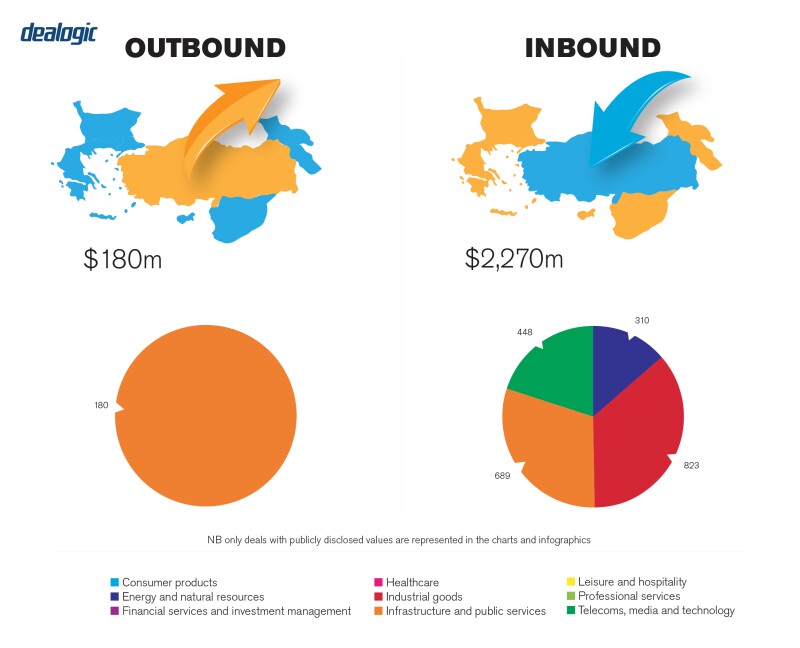

The Annual Turkish M&A Review 2019, produced by Deloitte, reports that around 233 transactions were closed in 2019, with a total value of $5.3 billion. Technology, internet and mobile services, and energy were the leading sectors for the M&A market in 2019. While the infrastructure sector hosted the highest level of deal volume, the technology sector led in terms of numbers. Investors from the US were the most active foreign investors in terms of the deal numbers (10), while investors from China dominated the sector in terms of disclosed deal values, accounting for 31% of total value. Also, although 2019 remained at the bottom in the last 15 years in terms of transaction volume, interest from investors based in the US, Europe and Japan increased, as opposed to the dominant presence of Gulf region investors in previous years.

Although there has been a slight drop in the value of M&A deals, the number of deals was stable in 2019. As with 2018, mostly small and mid-sized transactions were closed in 2019, as 171 out of 233 were estimated or disclosed to have had a value of less than $10 million. Involvement by foreign investors in the deal volume was higher than the average of the last decade, at 64%, while the annual deal number remained flat. After a relatively slow year in 2019, an increase in deal activity is highly anticipated.

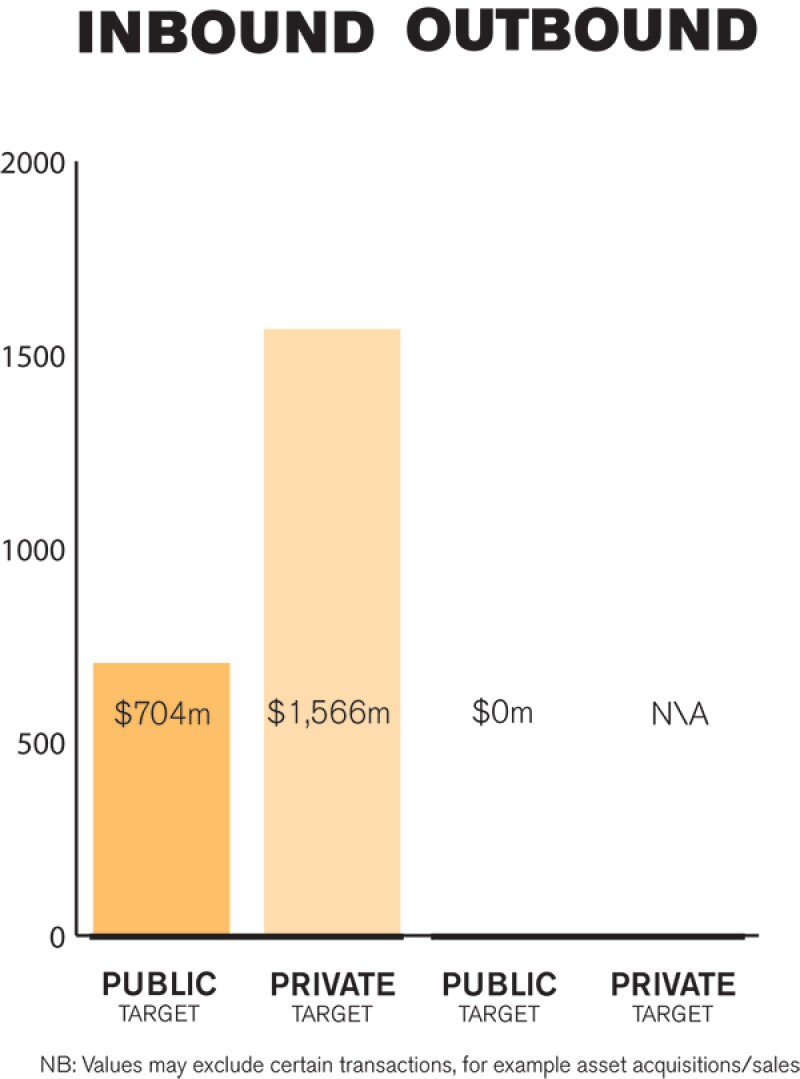

As with previous years, the M&A market mostly hosted private M&A transactions in 2019. Only two privatisation deals were closed in 2019. In both deals, the revenue sharing model was adopted so no deal value exists.

TRANSACTION STRUCTURES

Warranty and indemnity (W&I) insurance is a developing trend in private M&A transactions. Although the use of W&I insurance remains limited in the Turkish M&A market, we anticipate that its use will increase in line with global tendencies.

Private equity deal activity has remained relatively low, with financial investors involved in 37% of deals. Private equity deals predominantly feature venture capital firms and angel investors, alongside private equity-backed deals. Private equity and venture capital investment decreased in 2019.

In recent years, concern has increased over the effects of fluctuations in the national economy and changes in the value of the Turkish lira against foreign currencies. Additionally, certain conditions with respect to sanctions are frequently discussed during negotiations for M&A transactions. We believe that sanction-related terms will become more common and that some new mechanisms may be adopted under the agreements in this respect.

LEGISLATION AND POLICY CHANGES

For private M&A, the Turkish Commercial Code No. 6102 (Official Gazette February 14 2011 No. 27846) is a key piece of legislation governing privately held companies. For public acquisitions, the Capital Markets Law No. 6362 (Official Gazette December 6 2012 No. 28513) provides the key framework. For both privately held and public companies, the Law on Protection of Competition No. 4054 (Official Gazette December 13 1994 No. 22140) requires that the Turkish Competition Board authorises transactions when they result in a change of control and when the revenues of the transaction parties exceed certain thresholds. As a secondary piece of legislation, the Communique on Mergers and Acquisitions by the Turkish Competition Authority No. 2010/4 specifies the requirements and thresholds.

Moreover, on a sectoral basis, transactions may require approvals from different regulatory bodies, such as the Energy Market Regulatory Authority.

The Regulation regarding Mandatory Mediation in Commercial Disputes entered into force in 2019. Accordingly, mediation before initiating a lawsuit is now a pre-condition in commercial cases where there are claims for receivables and compensation – where the subject matter of the commercial dispute is the payment of a certain amount of money.

The Communiqué on Equity Based Crowdfunding also entered into force in 2019. The main purpose of the Communiqué is to regulate the procedures and principles for equity-based crowdfunding and the listing of crowdfunding platforms and their activities, and to control and audit of the funds so they are used in line with the specified purposes. Only crowdfunding that is based on equity is regulated under the Communiqué, and donations and reward-based crowdfunding models do not fall under its scope.

The Communiqué on the Principles on Abolishment of the Privileges of Voting Rights and Representation on the Board of Directors numbered II-28.1 also entered into force in 2019. The Communiqué regulates procedures and principles on the abolishment of the privileges as to voting rights and representation on the board of directors in publicly held companies through the decision of the Capital Markets Board in the event of a loss incurred for five consecutive years according to its financial statements.

Certain amendments were also introduced to the Payment and Securities Settlement Systems, Payment Services and E-Money Institutions through Law No. 7192, with major implications for settlement systems. Most of the powers and obligations granted to the Banking Supervision and Regulation Board under the Payment and Securities Settlement Systems, Payment Services, and Electronic Money Institutions Code have been transferred to the Turkish Central Bank.

Looking ahead, an amendment proposal for public companies has been put before the legislature. The proposal could impact M&A transactions with respect to takeover bids. It adopts the fair price basis for bids and proposes a bid structure akin to a priority right or pre-emption right. It is notable that the legislative proposal includes material amendments in both capital markets.

MARKET NORMS

As Turkey is a civil law country, different implications under civil and common law systems may cause incongruities. When the parties include typical Turkish law provisions, such as good faith and fair dealing, frustration or force majeure provisions to the English law-governed contracts, misinterpretation can be a problem.

One of the most overlooked issues in the Turkish market is the legal necessity for Turkish commercial enterprises to use the Turkish language. This goes back to Law No. 805 on the Mandatory Use of the Turkish Language in Commercial Enterprises, which was legislated in 1926. Decisions by The Turkish Court of Cassation have also extended this requirement to arbitration agreements, stating that a Turkish party may not be allowed to base its jurisdictional objection on an arbitration agreement drafted in a language other than Turkish. Similarly, through its decisions the Court of Cassation expanded the scope of Law No. 805; however, the market has so far assumed that this obligation is not applicable to transactions that involve a foreign party.

Parties sometimes also overlook dispute resolution while negotiating deals. Losing time between the emergence of a dispute and the Court's final decision on a dispute can cause parties to incur financial losses.

In terms of legal practice norms, technologies that facilitate the M&A deal-making processes, such as artificial intelligence software, are still not commonly used in Turkey.

PUBLIC M&A

Under Turkish law, if a joint stock company has more than 500 shareholders, or if its shares are traded publicly, then it is regarded as a public company. The Capital Markets Law is the key legislative text for public company acquisitions.

The concept of control is defined as either: (i) direct or indirect, holding more than 50% of the voting rights of a company; or (ii) holding privileged shares that enable the shareholder to appoint the simple majority of its board of directors, or to nominate the majority of the directors in the general assembly, pursuant to Article 12 of Communiqué on Takeover Bids No. II-26.1 (Official Gazette No. 28891 of January 23 2014).

Under Article 11(4) of the abovementioned Communique, and unlike in voluntary takeover bids, conditions attached to mandatory takeover bids are not allowed (whereas voluntary bids may be submitted to a group of, or all, the shareholders). When submitted for a part of the shares, if the participation demand exceeds the bid, then the pro rata distribution method will be applied to balance the difference between the demand and the voluntary bid. Further restrictions may be imposed on voluntary takeover bids following the approval of the Capital Markets Board, since the application requires the bidder to submit certain information as to the conditions of a bid. There are also disclosure requirements for tender offers and public takeovers detailed in the Communiqué on Material Events Disclosure No. II-15.1 (Official Gazette, January 23, 2014, No. 28891).

As there is no particular provision under the Capital Markets Law regime regarding break fees. The Turkish Code of Obligations No. 6098 (Official Gazette, February 4 2011, No. 27836) will apply as the lex generalis on contracts. If a transaction is made via a tender offer, break fees serve as a deterrent against a breach of exclusivity or of non-occurrence of closing. Although break fees are not common in public M&A deals, under the Turkish Code of Obligations, there is no restriction on break fees in terms of transactions between merchants.

PRIVATE M&A

Over 2019 the Turkish private M&A market was driven by buyers. Purchase price adjustments have been, once again, the most popular mechanism for pricing and payment. The earn-out method and locked-box mechanisms have not been commonly resorted to.

Economic fluctuations experienced during the previous years have encouraged parties to employ certain calculations in M&A deals: both sellers and buyers aim to maximise certainty, especially where M&A projects are financed through external loans, or where the share purchase price is agreed to in a foreign currency. Accordingly, certain specific conditions with respect to the economic situation have been more frequently included in agreements as a material adverse effect, force majeure, or other similar concepts.

Other common conditions precedent for private takeover offers are regulatory authority clearances and third-party change of control approvals. Among these, the most ubiquitous condition precedent is merger clearance from the Turkish Competition Authority. Additionally, if the target company holds certain licences or permits, approval must be obtained for changes in the shareholding structure of the licence-holder target company.

It is common to choose a foreign governing law in the Turkish market. In the M&A sector, it is more common for parties to choose Turkish law as the governing law where the target is a Turkish company. However, most of the time, parties prefer to choose a different governing law in M&A projects for secondary agreements, as much as the mandatory provisions allow, and where enforceability is not endangered. Furthermore, arbitration becomes a more popular choice each day.

IPOs continue to be one of the most common exit strategies for financial investors. One of the biggest recent M&A deals in terms of value was in fact a financial sponsor exit. The deal saw the European Bank of Reconstruction and Development (EBRD) sell its shares in Pasabahce, the largest glassware company in Turkey with both domestic and global businesses, to its parent, which previously held approximately 85% of the shares of the company. Through the deal, Pasabahce's parent acquired approximately 15% of the shares.

LOOKING AHEAD

An increase in M&A is expected in 2020. The Turkish M&A market maintains its advantageous nature for both long-term and short-term investors as a result of a promising economic recovery and the opportunities that reside in the developing character of the market.

About the author |

||

|

|

H Ercüment Erdem Founder and senior partner, Erdem & Erdem Law Office Istanbul, Turkey T: +90 212 291 73 83 Ercüment Erdem is the founder and senior partner of Erdem & Erdem. He has approximately 35 years of experience in M&A, international commercial law, privatisations, corporate finance and arbitration. He serves international and national clients in a variety of industries, including energy, construction, finance, retail, real estate, aerospace, healthcare and insurance. Ercüment is a member of the Istanbul Bar Association and International Bar Association (IBA). He is Chair of the ICC Commercial Law and Practice Commission and a member of the ICC Court of Arbitration, ICC Institute Council, ICC Incoterms Expert Group, and ICC Turkish National Committee Arbitration Council, as well as a member of several ICC task forces. Ercüment has a strong academic background. He is an emeritus professor and continues to lecture in leading universities including Galatasaray University, Turkey, and Fribourg University, Switzerland. He has authored books on M&A, international trade law, competition law, commercial law and CIF sales, among other topics. He has also authored numerous articles in national and international publications related to commercial law, competition and antitrust law, contracts law, arbitration, complex business litigation issues and dispute resolution. He has been selected as an Expert Consultant in M&A by the IFLR1000. |

About the author |

||

|

|

Özgür Kocabaşoğlu Partner and head of corporate, Erdem & Erdem Law Office Istanbul, Turkey T: +90 212 291 73 83 E: ozgurkocabasoglu@erdem-erdem.av.tr Özgür Kocabaşoğlu is a partner and the head of the corporate department of Erdem & Erdem. Özgür has 20 years of experience in national and multijurisdictional complex M&A structuring, banking, capital markets transactions and corporate and project finance. He has extensive experience in international transactions involving several overseas jurisdictions in a variety of business sectors, including energy, mining, transportation, ports, airports, construction, finance, retail and real estate. He focuses on privatizations, public private partnership (PPP) models and complex cross-border transactions involving commercial banks, corporate entities, and public and private companies. In recent years, he has led M&A deals in Europe, Latin America, Russia, CIS countries, Africa and Asia. Moreover, he regularly provides consultancy services to multinational corporations on every aspect of commercial law, contract law, capital markets, and mergers and acquisitions. He is a member of the Istanbul Bar Association and International Bar Association (IBA). He is listed as Notable Practitioner in M&A by IFLR1000. |