In 2019 the market saw China-related M&A transactions slump significantly in terms of deal volume and value. The increased scrutiny of CFIUS review in the US and of national security reviews in Europe has been a key driver for outbound M&A decline from China. The uncertainty in M&A deals increasingly comes from antitrust regulators across the globe, which continue to have a strong appetite and the resources to intervene in transactions. This trend makes early planning and engagement with the regulators in a cross-border deal-making a hot topic.

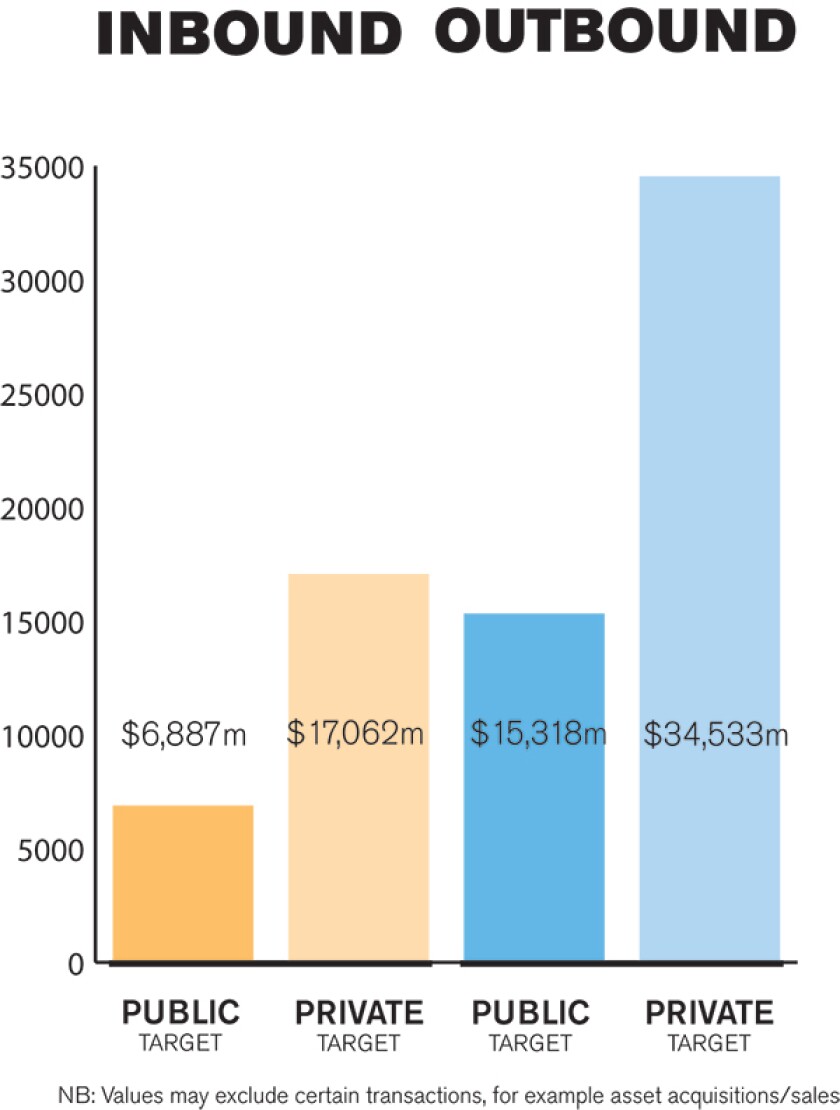

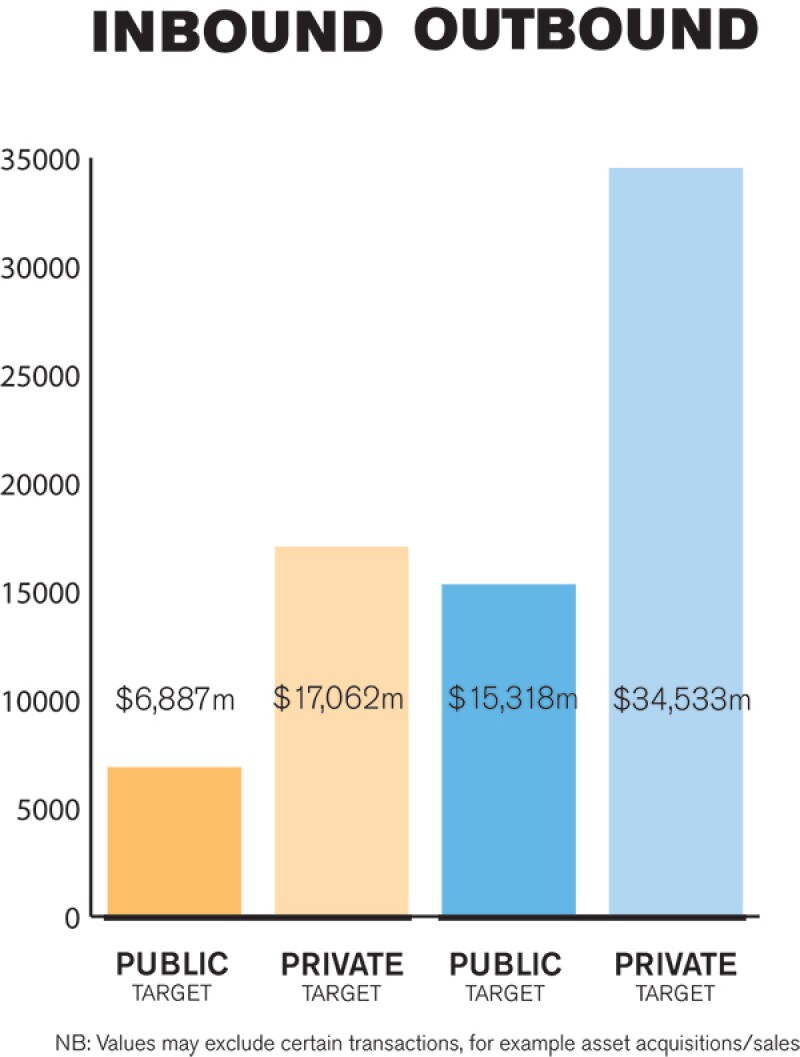

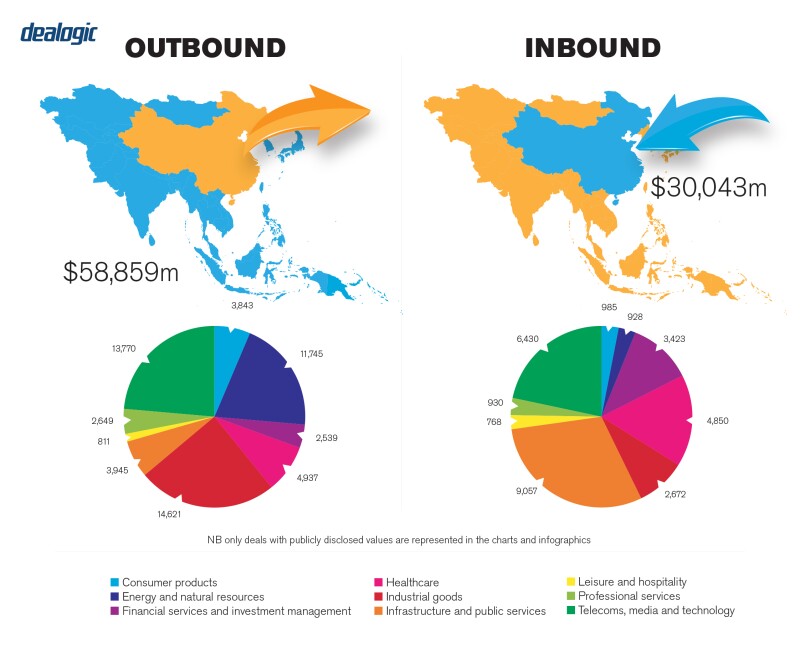

The drop in outbound M&A and private equity (PE) resulted in the lowest year for deal values since 2013. According to Dealogic, announced M&A deals in China amounted to $486 billion, compared to $562 billion in 2018 and $661 billion in 2017. While inbound M&A remains stable ($30 billion in 2019, a slight decrease from $33 billion in 2018), both outbound deals ($53 billion compared in 2019 compared to $72 billion in 2018) and domestic deals ($368 billion in 2019 compared to $440 billion in 2018) saw a notable downturn.

Despite the overall decline, M&A in certain sectors remained active in 2019 – for example the TMT and industrial industries sectors. We are hopeful that in 2020, with US-China trade tensions stabilised through phased agreements, China's new foreign investment policy coming into play since January 2020 and new rules to open up certain heavily regulated industries, such as automobiles and financial services industries, the M&A market will be more active than in 2019, especially in those industries and with inbound deals.

Both private and public M&A transactions are prevalent in China. In some cases, private M&A transactions may be used to raise a bridge loan before including the company into the structure of a listed company, turning a private transaction into a public M&A transaction.

TRANSACTION STRUCTURES

Economic trade uncertainty, government intervention and data protection have been the most significant factors influencing M&A, especially for Chinese outbound deals. Global M&A activity has been strongly influenced by economic and trade uncertainty. M&A continues to be influenced by government policy across the world, spurred by uncertainty around China-US trade negotiations, increased government power to veto transactions deemed against the national interest and an increased focus on consumer privacy regulation. In addition, uncertainty in M&A deals increasingly comes from antitrust regulators across the globe. Antitrust regulators are becoming more interventionist in transactions. Early planning and engagement with the regulators in a cross-border dealmaking is strongly advised.

With valuations tapering and more companies considering strategic options, the PE market in China continued to attract strong interests from investors. In 2019, Chinese financial investors were active on corporate carve-outs and take-privates of public companies. A notable transaction was the $4.6 billion take-private of China Biologics, which was proposed by a Chinese buyer consortium including Hillhouse, Centurium Capital and Citic Capital. The formation of a mature financial investor environment is expected to be a key driver of long-term growth in China's M&A market.

Despite China's outbound volume dropping year on year, outbound transactions remained active in the shape of investments into Asia-Pacific (outside China), Latin America and EMEA, while transactions into North America weakened. Consistent with China's strategic needs, outbound investments in power and utilities, technology and industrial sectors experienced strong momentum in 2019, with notable transactions including Three Gorges' $3.6 billion cash acquisition of an 84% stake in Peruvian electric company Luz del Sur, Beijing Auto's acquisition of a 5% stake in German automaker Daimler and Jiangsu Shagang Steel Group's $2.2 billion acquisition of London-based Global Switch Holdings. These transactions show that M&A deals in specific areas will still continue and they provide an area of optimism for China in 2020.

LEGISLATION AND POLICY CHANGES

There is no single law or regulation specifically regulating M&A in China. An M&A deal may involve many laws and regulations. PRC Company Law may be relevant when designing the corporate structure of the target company. PRC Securities Law and its supporting regulations may come into play in a public M&A transaction. Contract Law may govern when an asset purchase is part of the deal. Employment Law and Employment Contract Law may come into play when employees need to be transferred in the transaction. Tax law is always relevant. Foreign exchange policy and regulation is important when payment of the deal needs to be made cross-border. Antitrust Law may be relevant if a deal meets a certain threshold triggering a regulatory requirement to make a filing.

The Foreign Investment Law, which will replace a collection of decades-old laws with a single, unified and streamlined legal and regulatory framework for foreign investment (applicable nationwide), took effect on January 1 2020. The Chinese national legislature passed the Foreign Investment Law with the aim of creating a better business environment for overseas investors. Inbound investment via M&A in China is expected to reach $1.5 trillion over the next 10 years, according to a recent report from Xinhua News. The Foreign Investment Law seeks to protect the rights of foreign investors and their intellectual property, and clearly incentivises them to invest in China. It also helps Chinese companies move up the value chain. The evolving nature of China's consumer economy and the desire for Chinese industry to continue to move up the value chain are two particularly important drivers of economic opportunity. These factors are expected to boost inbound M&A transactions in the future.

On January 2 2020, China's State Administration for Market Regulation (SAMR) issued the Anti-Monopoly Law (Draft Amendment) to solicit the public's opinion. This is the first draft amendment unveiled officially since the Anti-Monopoly Law (AML) came into effect on August 1 2008. The Draft Amendment optimises legal responsibilities, increases penalties and adds the Fair Competition Review System, stop-the-clock mechanism, etc. Most notably, the Draft Amendments have reinforced the deterrence effects of the AML by proposing harsher penalties for violations. Most striking among these is the proposal to increase the maximum penalties for failure to file (or prematurely closing) notifiable mergers or other transactions, from RMB500,000 ($72,000) to 10% of turnover. In addition, the Draft Amendment appears to open up, for the first time, the possibility for criminal liability for antitrust violations (antitrust violations in China are not criminal offences at the moment). Article 57 of the Draft Amendment add a new provision saying that criminal liabilities will arise where the violation constitutes a crime.

MARKET NORMS

M&A transactions in China are subject to different approvals or filings to the relevant government authorities in China. Approvals from the State Administration of Industry and Commerce, Ministry of Commerce and foreign exchange filings are the most common processes in M&A transactions. Depending on the nature of the case, the order of such approvals and filings are subject to change. In many instances, the parties to a transaction can overlook any changes when designing payment terms and transaction structures.

One of the most frequently overlooked areas in general is tax planning. Through advanced design and arrangements, the corporate tax burden is reasonably reduced within the scope permitted by the tax law and can reduce M&A costs and maximise transaction benefits. The parties should not only consider the tax burden of the transaction itself, but also the tax arrangements between target company and the transaction parties. Considering reasonable and effective commercial arrangements, the parties to a transaction can rationally plan the transaction structure with tax planning to find a feasible solution to improve transaction efficiency.

Finally, technology is playing an increasingly important in the M&A dealmaking process. For example, in big M&A transactions, sellers usually upload relevant documents into a data room for buyers to review for due diligence purposes. Technology will support needs for efficiency in M&A deals.

PUBLIC M&A

In public transactions, obtaining a certain percentage of equity is the key to gaining control of a listed company. Generally speaking, the acquirer should be the largest shareholder of the listed company and hold at least 20% of the shares after the completion of the control acquisition of the listed company. Of course, in an actual transaction, a company or person may obtain control of a public company in a variety of ways other than owning 20% of the shares.

The purchase price, the purchase price payment method, the offer validity/commitment period, the change of the offer and the cancellation of the offer are usually attached to a public takeover offer.

The current laws and regulations stipulate that the liquidated damages shall not exceed 30%. In practice, break fees are generally agreed at about 20% of the transaction price. However, break fees are subject to change according to the situation of the target company, negotiation leverage and the transaction price.

PRIVATE M&A

Locked-box mechanisms, completion accounts and earn-outs are all common mechanisms for consideration in private M&A transactions. In some cases, a locked-box mechanism is combined with earn-outs calculation by requiring the equity seller to bear certain operational risks in order to protect the buyers' interests. In terms of protection mechanism, escrow accounts are commonly used in M&A transactions in China, while indemnity insurance is only used in big M&A deals.

Parties in a private takeover may agree on different conditions based on the nature of the transaction, the needs of both parties and the negotiation leverage. It is uncommon to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements, unless both parties are foreign enterprises and prefer foreign jurisdictions or the target company is located in a foreign jurisdiction.

Although the use of warranty and indemnity (W&I) insurance has become commonplace in the US and European M&A markets over recent years, the product is less well-known in the Chinese market. Such a gap may start to close with Chinese investors getting more familiar with outbound M&A transactions.

There are many ways for a company to exit after an acquisition. IPOs, share transfers, shares buy-backs and liquidation are all feasible and common exit plans for investors in China. Before the execution of a M&A transaction documents, parties usually have a specific goal for the future of the target company. In addition, these exit options should be carefully and clearly listed in the transaction document to prevent any dispute in the future.

LOOKING AHEAD

Looking to 2020, outbound transactions focused on strategic areas will continue to be the main driver of M&A activity in the region. Potential continued tensions between China and the US, along with hurdles expected to be presented by CFIUS, may dampen interest in outbound activities into the US. However, with US-China trade tensions stabilised through phased agreements, China's new foreign investment policy adopted in January 2020 and new rules to open up certain heavily regulated industries, such as automobiles and financial services industries, we believe that the M&A market will be slightly more active than in 2019, especially in certain industries and in respect of inbound M&A transactions.

About the author |

||

|

|

Carl Li Senior partner, Allbright Law Offices Shanghai, China T: +86 138 1668 1760 Carl Li is a senior partner at AllBright Law Offices, primarily working from the Shanghai office. His practice areas include M&A, private equity funds, foreign direct investment (FDI) and compliance. Carl's experience includes providing comprehensive legal support to the Chinese arms of multiple renowned transnational groups in global reorganisations, separations and mergers. He has also facilitated the equity mergers and asset acquisitions of foreign enterprises and public companies in China. Moreover, Carl has represented several foreign and private enterprises in the sales of their main businesses and assets to investors. In the private equity field, Carl has assisted various well-known funds in establishing domestic and overseas private funds, designing compliance regulations, making filings with the Asset Management Association of China, facilitating product launches and fundraising exercises, and providing beginning-to-end services to funds' project investment. The latter includes legal due diligence, negotiations, governmental approvals and closing. He has also represented start-ups on significant financing projects at different stages of their development. In the area of FDI, Carl is legal counsel to dozens of famous foreign enterprises in China. He provides comprehensive legal support to the establishment of new projects and capital increases, totaling billions of US dollars. He also provides long-term services to their daily operation, covering compliance issues related to HR, business and EHS. Carl has extensive experience in the medical, health and life science industries and provides long-term services to medical treatment investment funds, healthcare start-ups, pharmaceutical companies and medical instrument companies. |