Singapore's M&A activity was up in 2019 compared to 2018 notwithstanding global geopolitical uncertainties. This was slightly surprising given the fact that the US-China trade war and Brexit continued to plague the market.

The stock market in Singapore suffered a volatile year, but this in turn opened up a number of privatisation opportunities.

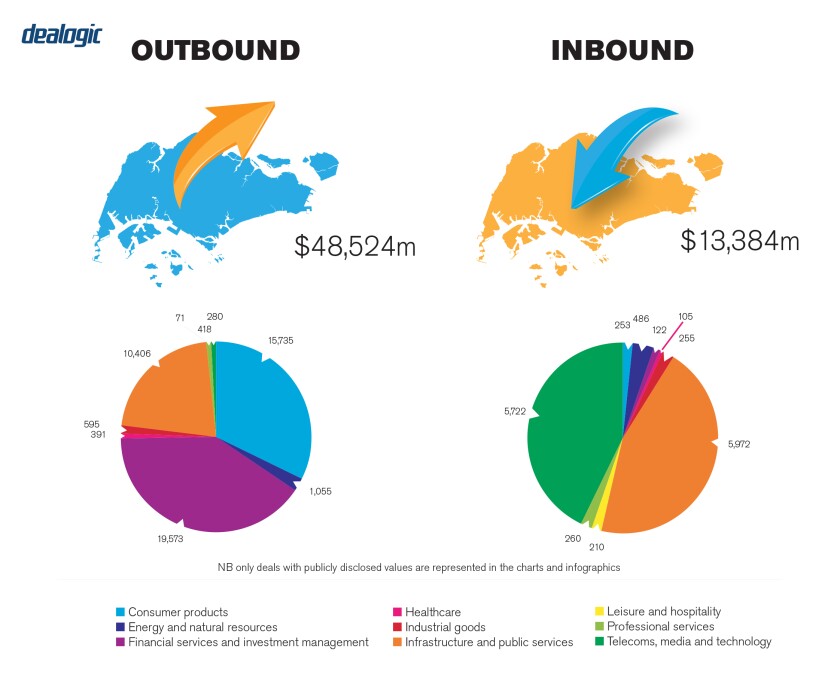

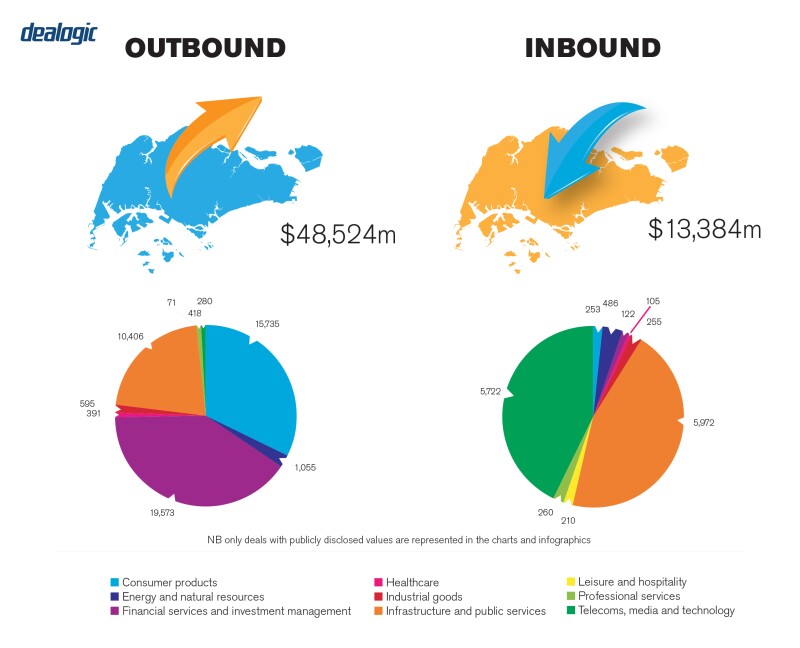

For outbound investments, the year saw many property developers seeking yield properties outside Singapore, with major groups like GIC, Mapletree and SPH acquiring portfolios of student accommodation in London and the US.

Overall, Singapore's M&A activity stood at $35.3 billion in 2019, up 125.6% from 2018. This represented 134 deals, down 5% from 141 deals in 2018 (Mergermarket).

Singapore bucked the downtrend in the Asian region's M&A. Some attribute this to Singapore being a safe haven for international investors. As at October 2019, Singapore recorded the highest amount of deposits by persons outside Singapore since 2016.

Singapore is also gaining traction in building a start-up ecosystem. It has initiated various schemes in this regard. For example, individuals running certain high potential start-ups and active investors in the start-up space can apply for the Entrepreneur Pass. Separately the Monetary Authority of Singapore (MAS) created a new category of licence for venture capital (VC) fund managers which has lower threshold for qualification.

TRANSACTION STRUCTURES

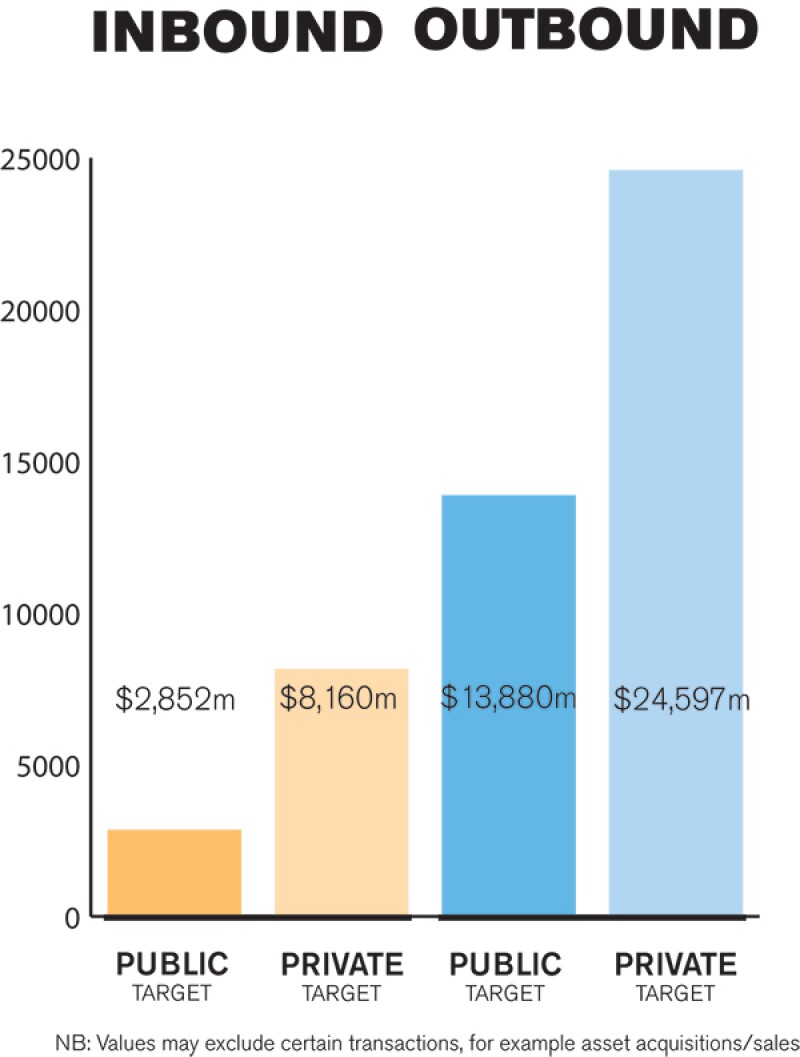

Both public and private deals drive the Singapore market, with private equity participation in public market deals a growing trend.

Many of the listed companies in Singapore are controlled by families or founding entrepreneurs. Any public M&A therefore requires the support of the controlling shareholder. To privatise their companies, a family is likely to form a consortium with private equity and financial investors.

In the age of disruption, many big corporates and listed companies are acquiring new competencies, people and products by investing in start-ups. The earlier trend of starting up corporate VCs did not necessarily generate success, which is possibly why a number of corporates are now investing in start-ups directly. Singapore has always positioned itself as an attractive country for establishing an investment holding company. This strategy has started to bear fruit, as many start-ups from the ASEAN region now choose to establish their holding companies in Singapore.

As regards some the key movers in the market in 2019, Temasek was the major player and source for a rise in the M&A numbers. It generated two mega deals – as buyer and offeror for a 30.55% stake in listed company Keppel Corporation, worth S$4.08 billion ($2.93 billion), and as seller of all its shares in Ascendas-Singbridge to property developer CapitaLand, for S$11 billion. Following the latter acquisition, the combined group became one of Asia's largest diversified real estate groups. This deal was the fourth largest M&A deal in Asia-Pacific, excluding Japan, for 2019. Notwithstanding the active Singapore market, the M&A activity in Asia-Pacific, excluding Japan, generated the lowest value since 2013 and the smallest deal count since 2014.

Singapore's real estate investment trusts (REITs) had a bumper year, with REITs seeking to grow and consolidate their positions through M&A. In April, OUE Commercial REIT agreed to buy OUE Hospitality Trust to create one of Singapore's 10 biggest REITs. Then in July, Ascott Residence Trust and Ascendas Hospitality Trust agreed to create the largest hospitality trust in the Asia-Pacific region, with $7.6 billion of assets. Frasers Logistics & Industrial Trust announced in December a $1.54 billion transaction to buy Frasers Commercial Trust.

LEGISLATION AND POLICY CHANGES

The Singapore Code on Take-overs and Mergers (Code), which is administered by the Securities Industry Council (SIC), governs takeovers and mergers of public companies in Singapore, in addition to REITs, business trusts and corporations listed on Singapore Exchange Securities Trading Limited (SGX-ST).

The SGX-ST listing manual contains rules that regulate corporations, REITs and business trusts listed on both the main and secondary boards of the SGX-ST, and prescribes disclosure and approval by equity holders for transactions by listed entities exceeding a minimum transaction size relative to the size of the listed entity. Compliance with the listing rules is overseen by the Singapore Exchange Regulation, a wholly owned subsidiary of Singapore Exchange.

The Securities and Futures Act (Cap. 289) requires parties that acquire significant equity stakes in entities listed on the SGX-ST to make disclosures on changes in their levels of equity holdings. In addition, the Competition Act (Cap. 50B), administered by The Competition and Consumer Commission of Singapore, prohibits mergers that result in a substantial lessening within any market in Singapore for goods and services. The Companies Act (Cap. 50) applies to all Singapore incorporated companies, and contains rules for mergers and amalgamation of companies, as well as schemes of arrangement and squeeze-out provisions that may apply in a take-private situation.

There is also legislation applicable to certain industries that restricts changes in shareholdings or acquisitions beyond a given threshold, including newspaper companies, telecoms companies and banks.

Following amendments to the SGX listing rules in June 2018, which allowed for the listing of corporations with a dual class share structure on the SGX-ST, the Code was amended in January 2019 to clarify that shareholders who trigger a mandatory general offer under the Code due an increase in their voting rights as a result of changes in the number of multiple voting shares (through conversion of multiple voting shares into ordinary shares, or reduction in voting rights of multiple voting shares) may be absolved from making a mandatory general offer under certain circumstances. The Code amendments also clarified that no distinction should apply in the offer prices for ordinary voting shares and multiple voting shares in a general offer.

There were no proposals to amend any rules or legislation that will significantly impact M&A activity in Singapore in early 2020.

MARKET NORMS

There are certain structuring challenges commonly encountered in Singapore.

As Singapore is commonly used as an investment holding entity, it is relatively straightforward for parties to effect a share transfer. Parties however should not overlook the need to consider antitrust and merger control issues in countries in which the subsidiaries of the target may be located. The transaction timetable should factor this in or include appropriate conditions precedent to address this issue.

Several Singapore entities or REITs are focused on the development or acquisition of assets in the People's Republic of China (PRC). In view of the indirect disposal rule, they need to be conscious of the capital gains tax which a vendor is subject to, notwithstanding that the shares may be transacted at an offshore level, and withhold the relevant amount of the tax from the sale proceeds before transferring the consideration to the vendor.

In 2019, the laws in various tax haven countries such as the Cayman Islands, British Virgin Islands and elsewhere came into force, requiring businesses falling within a certain list of designated activities for example, fund management, intellectual property holding company, etc, to prove their economic substance in the place in which they are tax resident. It would be prudent to obtain advice from tax advisers to set out a tax efficient structure for an M&A deal in conjunction with the proposed acquisition and eventual exit.

With more cross-border deals, more thought should be given to the integration of culture and assimilation of the employees. If the post-merger integration is not well managed and friction arises among the ranks, a lot of the value which was assumed by the investment bankers may not be realised from the M&A.

PUBLIC M&A

An acquiror can choose to acquire a majority stake in an SGX-ST listed entity by way of (a) a general offer, (b) a scheme of arrangement, or (c) an amalgamation.

In a general offer, the acquiror will make an offer to all shareholders in the listed entity (the target) to acquire their shares. The offer will become successful only if shareholders holding at least 50% of target shares accept it within the prescribed offer timeframe.

In a scheme of arrangement, the acquiror's proposed offer must be approved by the target shareholders in a court-convened meeting, where at least a majority in number of the target shareholders present, and representing at least 75% in value of the target shares voted at such meeting, approving the transaction. The acquiror's proposal must also be approved by the High Court of Singapore.

In an amalgamation, the acquiror (through a corporate vehicle) will seek to acquire the target by amalgamating (or merging) both entities. An amalgamation requires approval by special resolution of shareholders of both companies.

|

|

Temasek was the major player and source for a rise in the M&A numbers |

|

|

The choice of method depends on the acquiror's main objective: for instance, if the acquiror values speed as being of essence, but does not intend to acquire 100% of the target, or if the offer is hostile in nature, a general offer would be the method of choice. Conversely, if the acquiror wishes to acquire 100% of the target in a friendly, non-competitive situation, and where timing for completion is not critical, the takeover can be effected by way of a scheme of arrangement or an amalgamation. It is noteworthy that an amalgamation can only be implemented where both entities are Singapore incorporated companies.

All general offers in Singapore must be subject to a minimum acceptance condition, where the acquiror must receive acceptances for shares which results in the acquiror (and its concert parties) acquiring more than 50% of the target's voting shares. This is the only condition permitted for mandatory general offers.

In voluntary general offers, other conditions may be imposed by the acquiror – although the Code prohibits conditions whose fulfilment depends on the subjective interpretation or judgement by the acquiror or which lies in the acquiror's hands. In the event of doubt, an acquiror should consult the SIC. An acquiror is also permitted to announce a pre-conditional voluntary offer where the announcement of a firm intention to make an offer is subject to certain pre-conditions being fulfilled, provided that certain conditions are met.

While break fee arrangements are not prohibited in Singapore takeovers, the Code prescribes certain safeguards to be observed: a break fee must be minimal (normally no more than 1% of the value of the target) and the target's board of directors and financial advisors are required to provide certain written confirmations to the SIC regarding the break fee arrangement. The Code also requires acquirors and targets to consult with the SIC at earliest opportunity in all cases involving a break fee or similar arrangement.

PRIVATE M&A

Completion accounts are a common mechanism used for the adjustment of consideration at completion. Locked-box mechanisms are not common in Singapore. The use of escrow arrangements is quite common, particularly in deals where deposits are paid, or parties envisage post completion adjustments.

As warranty and indemnity (W&I) insurance is not often purchased in Singapore, unlike in the UK or Australia, purchasers will sometimes demand to escrow certain consideration sum to support representations and warranty claims.

The list of conditions precedent for private deals can be quite long these days. Regulatory approvals and antitrust and merger clearances are important conditions for major M&A deals. Consents might be required for change of control.

|

|

These days, the condition that there must not be any material adverse change in a whole series of events is also common |

|

|

Where there is prolonged period between signing and closing, the purchaser will inevitably want the vendor to repeat the representations and warranties as at closing. These days, the condition that there must be any material adverse change in a whole series of events is also common.

Singapore law is the usual governing law for private M&A deals in Singapore. Singapore law is also increasingly acceptable to foreign parties signing M&A deals in Singapore or even in the Asian region. For dispute resolution, arbitration before the Singapore International Arbitration Centre is widely accepted. Where parties are less sensitive to the need for dispute to be confidential, they will have the disputes under their agreement governed by the courts of Singapore. Last year, 46 countries signed the Singapore Convention on Mediation, also known as the United Nations (UN) Convention on International Settlement Agreements Resulting from Mediation – which will provide for the enforcement of mediated settlement agreements across countries.

The usual exit routes for investors are via an IPO or trade sale. With the recent capital markets downturn, it has become increasingly difficult to list a company. Consequently, trade sales have emerged as the popular option. Founders and shareholders of start-ups, and even unicorns, must exit via secondary sale of their shares. On the buy side, there is growing demand from family offices, high net worth individuals (or private banks acting on behalf of such clients), and investment firms which acquire in the secondary market to manage their overall entry price on transactions. VCs may also acquire secondary stakes from fellow investors to increase their exposure in a portfolio company. Some global investors, such as US and European pension funds, may also tap on secondary sales to get a piece of the South east Asian growth story.

LOOKING AHEAD

Amid the global uncertainties, Singapore is viewed as a safe place to deposit money and make investments, and as a place where the rule of law will be upheld in case of any dispute or injustice.

We expect private equity-led transactions to continue to feature strongly. As we are now living in a world where the winner takes all, and where organic growth is limited, we might witness a trend of companies relying on M&A to bulk up and grow.

In the funds space, the Variable Capital Companies Act came into force in January 2020. Fuelled by the MAS grant scheme, which subsidises the costs of establishment or redomiciliation of funds, fund managers in Singapore are strongly incentivised to co-locate their funds in Singapore. The increase in activity in the funds space may well lead to an uptake in M&A activity in Singapore.

About the author |

||

|

|

Rachel Eng Managing director, Eng and Co Singapore T: +65 6597 3343 Rachel Eng has close to 28 years of corporate law experience and advises on a broad range of corporate and commercial matters, specialising in M&A, start-up investments and equity capital market transactions. She has advised numerous international and domestic corporates in relation to mergers and acquisitions, corporate restructuring, corporate governance and regulatory compliance matters. She also has substantial experience in advising issuers and underwriters in relation to international offerings of securities, including REITs and business trusts and their listing on the Singapore Stock Exchange. Rachel has been recognised as a leading corporate lawyer by numerous independent legal publications, including being ranked as one of the top 300 leading female transactional experts globally by IFLR1000's Women Leaders Guide 2019. |

About the author |

||

|

|

Colin Ong Director, Eng and Co Singapore T: +65 6597 3331 E: colin.ph.ong@engandcollc.com Colin Ong is a corporate and capital markets lawyer. He advises clients on a range of corporate and fund-raising activities, including M&A, early-to-mezzanine stage investments, initial public offerings, secondary offerings and the issuance of debt and perpetual securities. Colin has substantial experience in advising issuers and underwriters in relation to international offerings of securities, including REITs and business trusts, and their listing on Singapore Stock Exchange. He is also cited by several legal publications as a recommended lawyer and has contributed articles to legal publications and monographs. |