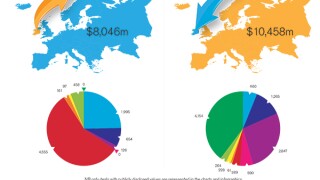

Western Europe

AMLA on track to ‘directly supervise’ 40 ‘most impactful’ financial institutions from 2028, with selection process taking place in 2027

Future Abu Dhabi head Gonçalo Capela Godinho explains why Pérez-Llorca is exporting its Iberian expertise to Abu Dhabi

Scottish manufacturer AG Barr acquires drinks makers Fentimans and Frobishers as it taps in ‘attractive’ adult soft drink market

Partners Marc Hanslin and Daniel Alder discuss the impact of AI on capital markets, M&A work and client billing

Corporate lawyer David Brennan joins the firm after 14 years at Gowling WLG, where he led the global technology group

Winston Taylor is expected to launch in May 2026 with more than 1,400 lawyers across the US, UK, Europe, Latin America and the Middle East

USDU becomes the UAE’s first Central Bank-registered USD stablecoin under the Payment Token Services Regulation

New hires were made across the PE, M&A, banking and finance practices in London, Riyadh and key US hubs

Sponsored

Sponsored

-

Sponsored by Cleary Gottlieb Steen & HamiltonSimon Jay and Michael Preston from Cleary Gottlieb Steen & Hamilton review the likely dominant trends for 2018

-

-

Sponsored by Cleary Gottlieb Steen & HamiltonSimon Jay and Michael Preston, Cleary Gottlieb Steen & Hamilton