Deals

Eversheds Sutherland partners told IFLR that aligning traditional PE principles on reinvestment structures with public company considerations for long-term strategies and liquidity was a key issue to overcome

Annabel Parry of Webber Wentzel explains the complexities of, and law firm cooperation needed for, the transaction that won M&A deal of the year at IFLR’s Africa Awards 2024

Meng Ding of Sidley Austin unravels the complexities of advising a Chinese drug start-up on the first listing under a new regime for specialist technology companies

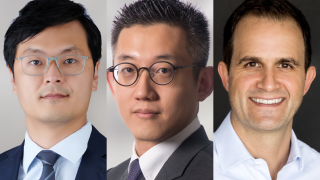

Partners Rocky Mui and Terry Yang join HSBC’s Sami Abouzahr in revealing the intricacies in launching the bank’s gold token for Hong Kong’s retail market

Slaughter and May, Kirkland & Ellis, Paul Weiss and Ashurst are advising on the takeover of Royal Mail’s parent company

Yufei Liao and Janet Fok of Clifford Chance break down the elements behind the transaction that won M&A deal of the year at IFLR’s Asia Pacific Awards 2024

Filippo Modulo, managing partner at Chiomenti, delves into the cross-border hurdles behind the award-winning acquisition

An investment bank and law firm Chapman Tripp discuss the intricacies behind the transaction that won structured finance and securitisation deal of the year at a recent IFLR Awards

Sponsored

Sponsored

-

Sponsored by Allen & OveryAn in-depth look at how it differs from a traditional bond and how it has the potential to change the way capital markets function

-

Sponsored by DechertBuyers and sellers must consider several points when negotiating antitrust provisions in strategic transaction agreements

-

Sponsored by Udo Udoma & Belo-OsagieThe combination provides the template for a successful Africa exit by a financial investor as multinationals bet on the region’s growing middle class