Despite the ongoing Covid-19 pandemic, M&A transactions have continued to take place at a fairly robust pace in Austria. Although the total transaction volume compared to the previous years decreased, the number of M&A deals with Austrian involvement increased compared to the number of deals reported last year.

According to the M&A Index 2021 published by EY Austria, the number of transactions with Austrian participation rose from 275 to 293 in 2021 compared to 2020 (a plus of 6.5%). Transaction volumes, on the other hand, decreased by 27.8% from €12.6 billion to €9.1 billion.

The impact of the Covid-19 pandemic on companies continues to be as diverse as the economic sectors in which they operate. The environment for M&A transactions became increasingly complex and uncertain for some sectors, notably tourism and the hospitality sectors, but at the same time offered opportunities to buyers willing to take a bit more risk. For other sectors M&A has remained active, including the sectors for commercial and consumer goods as well as housing and construction.

In terms of the reported number of transactions, the real estate sector took the lead in 2021 with 77 deals, followed by companies from the industrial sector with 64 deals and the technology sector with 59 deals. In terms of published transaction volumes, the sector for commercial and consumer goods was the clear first place winner with €2.4 billion – which is due in part to the partial purchase of Selfridge’s department stores by the Austrian-based company Signa Holding. Next in line were the financial sector, the real estate sector and the industrial sector.

Currently the market is still dealing with the effects of high inflation such as energy costs, supply shortages and material shortages, which have created uncertainty. The ECB plans to continue its low interest rate policy, but the bond buyback program is to be reduced. According to Deloitte’s M&A Analysis of 2021, the overall high volume of M&A deals will also have a positive impact on the financial markets.

In 2021, the total global transaction volume amounted to €5.13 trillion. It is to be expected that the proceeds from these sales will be reinvested in 2022, providing liquidity to the market and facilitating the search for investors. Thus, the market environment is interesting for those companies that want to raise new equity.

Also for sellers, the M&A market remains attractive at the current valuation level. In light of the recent turmoil on the financial markets generally resulting from Russia’s invasion of Ukraine, it remains to be seen what impacts this will have on M&A activities.

In response to the pandemic, many companies are restructuring, looking for strategic acquisition targets or divesting parts of their business to realign their portfolios. Thus, strategic investors continue to play an important role in the Austrian market as 276 deals were strategic deals, which is an increase of 16 deals compared to the previous year.

In contrast, private equity investors continue to play a subordinate role in the Austrian transaction market (which is in contrast to the global trend). Nevertheless, some start-ups in Austria recently have achieved substantial financing from private equity investors so that this area of potential M&A activity offers potential (e.g., Bitpanda, GoStudent).

The following top three deals together accounted for over 55% of Austria’s total transaction volume:

The purchase of 50% of Selfridges department stores (Canadian branches excluded) by Signa Holding GmbH for €2.35 billion;

The purchase of 9.92% of shares in Erste Group Bank AG by various investment companies for €1.5 billion; and

The purchase of 33.6% of the shares in CA Immobilien Anlagen AG by a Starwood Capital Group controlled company for €1.157 billion.

All of these transactions show the strength of strategic players in the Austrian M&A market and the Signa Holding transaction shows the capability of Austrian strategic players to be active outside of Austria.

Economic recovery plans

The 2021 EY M&A-Index for Austria shows the following key highlights in developments from previous years.

In the global market new record values were achieved both in the number of M&A deals and in the total transaction volume. The decisive factor for these all-time-high numbers are private equity investors and shell companies, so-called special purpose acquisition companies (SPACs) that raise money via initial public offerings (IPOs) and invest in unlisted companies.

This global trend, however, has not yet found footing in the Austrian market. The number of deals with Austrian participation has increased from 275 to 293 compared to 2020, which however is still 35 deals less than in 2019. The total transaction volume fell from €12.6 billion in 2020 to €9.1 billion in 2021, which nevertheless is still in line with the long-term average.

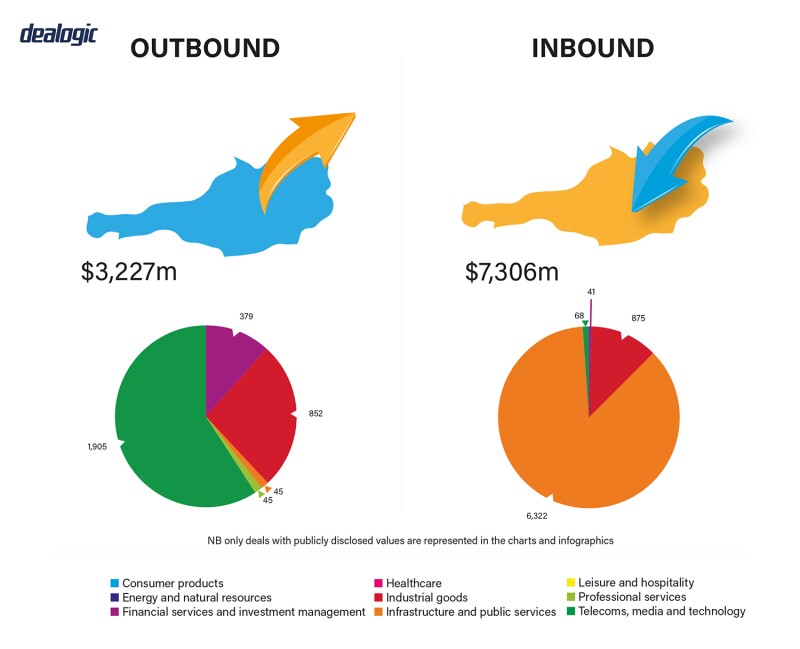

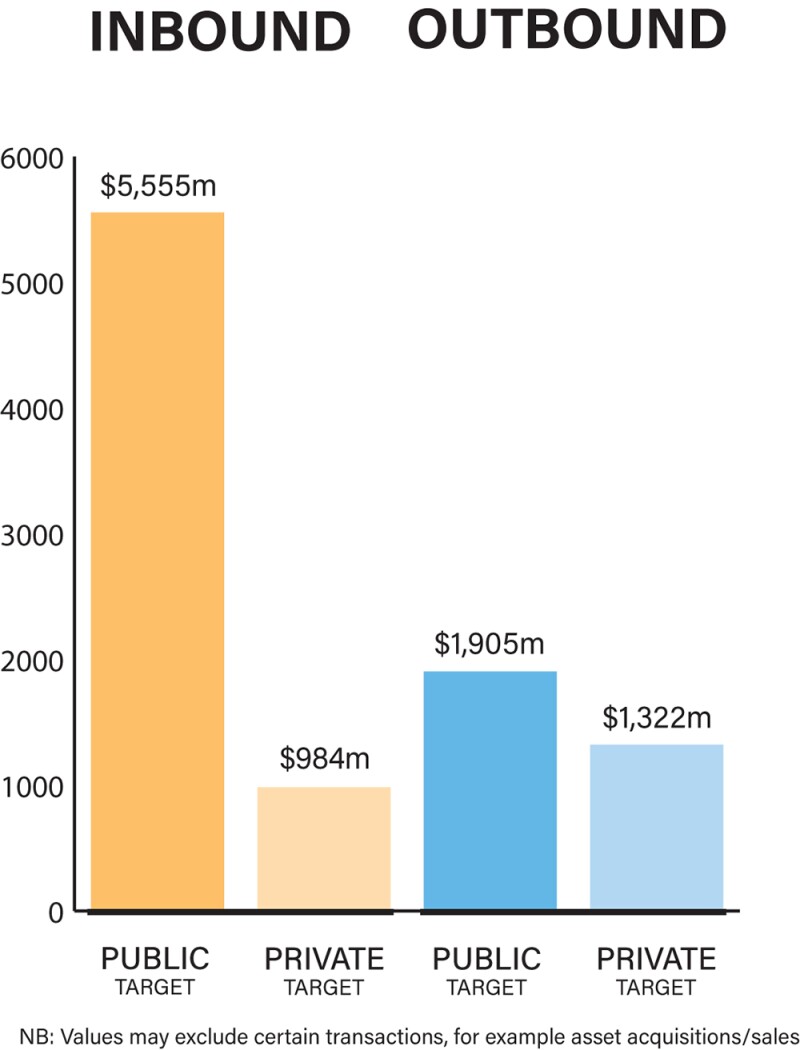

The number of acquisitions of foreign companies by Austrian companies (‘outbound’) remained with 106 deals roughly at the previous year’s level of 104 deals. The number of transactions in the ‘inbound’ segment rose by 32 deals, which is an increase of 31.7%. With 133 deals, there were more inbound deals than at any time since 2015.

As any other crisis, the Covid-19 crisis, too, offers possibilities for seasoned, crisis-resilient buyers and strategic and financial investors to purchase desired targets under favourable conditions. It is foreseeable that despite the national and European aid packages, which have already been announced and paid out, many companies will come under increasing economic pressure in 2022. Thus, even companies that have not been available for sale and/or have been offered at a much higher purchase price will enter the transaction market. We expect an increase in new distressed M&A deals in 2022.

Legislation and policy changes

Austrian law does not have one specific law regulating all issues on the acquisition of companies, but rather various different statutes apply, depending on the specific type and form of an acquisition.

For asset deals, the regulations of Section 1409 of the General Civil Code and Section 38 of the Commercial Code are the most pertinent. Section 1409 of the General Civil Code provides that a purchaser generally is jointly and severally liable with the seller towards the seller’s creditors for any liabilities of the acquired business having their origin prior to the acquisition. The purchaser’s liability is limited to the current net asset value of the acquired assets and applies in case the purchaser knew or should have known at the time of the purchase of the pre-existing liabilities.

Section 1409 of the General Civil Code is a mandatory law and cannot be waived or amended by contract. Liability can be reduced if the purchase price payable by the buyer is used to pay off the debts of the sold business. Section 38 of the Commercial Code provides that a legal entity, which acquires and continues a commercial business, is liable for all debts the former owner incurred in the course of business conduct, meaning even those which are not contractually agreed to be taken over by the buyer.

Unlike liability under Section 1409 of the General Civil Code, liability under the Commercial Code is not limited to the value of the acquired assets. Nevertheless, under Section 38 of the Commercial Code the seller and the buyer can agree to limit liability of the seller, such limitation of liability, however, being only valid if a timely notification to the commercial register is submitted or otherwise made public.

A key regulatory authority with regard to M&A transactions is the Federal Competition Authority (Bundeswettbewerbsbehörde), which is responsible for the clearance of mergers where a transaction value does not exceed the thresholds of the EC Merger Control Regulation, but exceeds the thresholds under Austrian competition law.

Further relevant authorities are the Commercial Register Courts (Firmenbuchgerichte), which register and publish transactions and reorganisations in the Austrian commercial register, and the Financial Market Authority (Finanzmarktaufsicht), which reviews banking acquisitions.

Public M&A transactions regarding listed joint stock corporations (Aktiengesellschaft) are also subject to the supervision of the Austrian Takeover Commission (Übernahmekommission), which monitors compliance with the Austrian takeover regulations and decides on all matters related to the Takeover Act.

The Austrian legislator implemented a new Section 90a into the Notarial Regulation (NO), which came into force on January 1 2021. Since then there is the possibility to draw up all notarial acts and other public or publicly certified deeds by use of electronic means of communication without the need for physical presence before the notary. Especially for parties located abroad this brings a substantial benefit with regard to avoiding travel expenditures and time delays. This modernisation allows for a clear simplification and acceleration for the performance of the official notarial acts required under Austrian corporate law.

The Covid-19 crisis triggered a series of regulatory amendments and M&A transactions have been impacted by some of these changes. The provisions, which were set to expire at the end of 2021, have been extended to 2022 due to the ongoing Covid-19 pandemic.

With regard to corporate law, the legislator was quick to take advantage of the already existing benefits of digitalisation and thus enacted a law that allows all companies to hold their general meetings and pass shareholder resolutions virtually via video conferencing so that the physical presence of persons is no longer necessary. Due to the ongoing pandemic, the legislator has extended the measures until June 30 2022 in a first step. Virtual meetings will therefore remain an integral part of corporate practice in 2022.

The new amendment triggered by Covid-19 also enables the virtual execution of notarial deeds even after the Covid-19 crisis as the legislator decided to implement the rules permanently. These changes enable M&A transactions to be signed and closed without requiring physical presence. This is important for the typical Austrian target M&A transaction, which involves the sale of shares in a limited liability company (GmbH), which must be completed in the form of a notarial deed.

|

|

One of the biggest developments is that warranty and indemnity insurance is no longer pure theory, but has seen increasing use in the Austrian market” |

|

|

Furthermore, the legislator has again extended the eight-month period for the holding of an ordinary general meeting to 12 months (Section 2 (1) to (3) Covid-19 Corporate Law Act). This applies to the ordinary general meeting of stock corporations pursuant to Section 104 (1) of the Austrian Stock Corporation Act and limited liability companies according to Section 35 (1) of the Austrian Limited Liability Companies Act. Shareholder meetings therefore can also be held within 12 months of the beginning of the financial year.

The extension of the deadline for the preparation of annual financial statements and their submission to the members of the Supervisory Board has been extended for 2022 from four months to nine months beginning with the commencement of the financial year. The deadline thus ends at the latest after the first nine months of the financial year. The same applies to other accounting documents that must be submitted within the deadlines applicable to the submission of annual financial statements.

In deviation from Section 277 of the Austrian Business Enterprise Code (UGB), the annual financial statements, the management report documents and other reports as appropriate must now be submitted to the Commercial Court and published no later than 12 months after the balance sheet date.

In 2021 the Austrian Cartel Act, which deals which cartel issues as well as merger control issues, has been amended. In the course of the amendment the Cartel Act has gone ‘green’.

The new version of Section 2 para 1 Cartel Act expands the few legal exceptions to the ban on cartels: In the future, cartels are also to be exempted from the prohibition if their profits make a significant contribution to an ecologically sustainable or climate-neutral economy.

The provision thus creates legal certainty and a free space for entrepreneurial cooperation in favor of sustainable agreements that would otherwise be prohibited under national law. However, it would also be desirable to create a clear ‘safe harbour’ for Austria as in the EU by using the authorisation for block exemption regulations.

The new version of Section 9 para 1 no. 2 Cartel Act restricts the notification requirement for mergers, which is important in practice, in order to apply merger control in a more targeted manner and to avoid unnecessary notifications. Previously, any merger with total domestic sales of more than €30 million in the last fiscal year – provided that all other threshold requirements were met as well – was subject to notification.

Under the new rules, at least two of the companies involved must also have each generated domestic sales of more than one million euros. This prevents transactions, in which the target has no domestic turnover, from having to be filed in Austria only because the purchaser has a turnover of more than €30 million in Austria.

There is also a new substantive review criterion that allows the prohibition of mergers. As an alternative to the creation or strengthening of a dominant position by a merger, mergers can also be prohibited in the future if a significant impediment to effective competition is to be expected as a result. However, there are additional justification criteria. In certain cases the Cartel Court is given the option not to prohibit a merger where an improvement in the conditions of competition is to be expected which outweighs the disadvantages, or where the economic advantages of the merger substantially outweigh the disadvantages.

As regards the main criterion for the prohibition of a merger, i.e. the creation or strengthening of a dominant position, there have been two amendments as well. First, companies in the future will also be deemed to hold a dominant market position if they have significant access to the market or to data of particular competitive relevance, for example, due to their intermediary services for other companies. Second, the concept of market dominance is further tightened by the concept of relative market power.

According to the new Section 4a Cartel Act, a company is also considered to have a dominant market position if it has a superior market position in relation to its customers or suppliers. Thus, the legislator has set its attention on typical market power structures of the digital platform economy.

The topic of environmental social governance (ESG) has started to play a more and more important role in M&A transactions. Due diligence request lists now regularly also target ESG risks. Such ESG due diligence is cross-disciplinary and touches on known and new due diligence aspects alike.

It is not limited to environmental issues, but also relates to factors like social and corporate management and organisation (governance). It also covers the question of the use of renewable energies and the prevention of environmental pollution in the area of the entire value chain (which legal possibilities exist, for example, to replace an existing supplier of operating resources in order to improve the carbon footprint and what costs are associated with this), the compliance with diversity and discrimination prohibitions, recognised human rights principles, as well as general employee concerns and the existence of transparency, reporting, sustainable corporate governance and bonus systems, including the existence of whistleblowing systems.

Market norms

The Austrian legal system has a few peculiarities that are commonly misunderstood. As most M&A deals in Austria are private M&A transactions where the target company is an Austrian limited liability company, the share deal take the form of a notarial deed in front of an Austrian notary public. One misconception is that the notarial requirement poses a large hurdle. This is not true as share purchase agreements can also be executed in the English language with notaries so qualified. With the increasing foreign involvement in Austrian M&A transactions, it indeed has become increasingly common that such notarial deeds are drawn up in English.

Furthermore, before the end of 2020 the Austrian legislator implemented a significant improvement for M&A transactions by allowing electronic notarisation. The introduction of the new Section 90a of the Notarial Regulation (NO) by the fourth Covid-19 Act opens up the possibility to draw up all notarial acts and other public or publicly certified deeds by use of electronic means of communication without the need for physical presence before the notary. The new regulation came into force on January 1 2021.

The amendments to the law now bring a clear simplification and acceleration for the performance of the official notarial acts required under corporate law, which are often associated with a high level of travel and time expenditure, especially if the parties involved are located abroad.

An area that requires specific attention is Austrian stamp duty tax. Typically, stamp duty tax can become payable based upon the simple fact that a written document is being drawn up in Austria. Though a share purchase agreement itself is not subject to stamp duty tax, suretyship arrangements whereby one company is obliged to step in and fulfil a liability if, for example, a subsidiary does not perform can trigger stamp duty.

For real estate transactions care needs to be taken in the structuring so as not to trigger real estate transfer tax, which also can apply to share deals.

The Covid-19 pandemic has brought liberation by accelerating digitisation in M&A transactions. Since mid-March 2020 the Austrian government has issued new laws and regulations that enhance the use of technology in corporate law. The new regulations give shareholders, as well as executive and supervisory board members, the possibility to hold virtual corporate meetings via video and/or telephone conference, and pass legally binding resolutions while maintaining physical distance. This can be important for board decisions that need to be taken to get an M&A transaction to the finish line.

Moreover, the virtual execution of notarial deeds was implemented by the legislator. As in Austrian corporate law and M&A transactions notarial deeds are often required this represents a relief for M&A transactions.

Public M&A

Most factors regarding the acquisition of a controlling stake in a public company are regulated in the Austrian Takeover Act. A mandatory public offer has to be made to the other shareholders when a shareholder acquires a stake of 30% or more. Different rules do not apply to hostile bids. While in a friendly bid, the bidder is commonly given the opportunity to carry out due diligence, in a hostile bid the bidder is generally restricted to publicly available information. In hostile takeovers the management board is obliged to remain neutral. Due to the limited number of Austrian-listed companies hostile bids are rather unusual in Austria.

The bid may not be conditional to the extent a mandatory takeover-bid needs to be made due to a stake of 30% or more having been acquired, and unless conditions are required by law, such as merger control clearance. In all other cases conditions are only permissible if they are objectively justified, in particular if they are based on legal obligations of the bidder, or if the occurrence of the condition or the assertion of the right of withdrawal does not depend exclusively on the discretion of the bidder. In the past MAC-conditions have been seen, but this is no development driven by Covid-19 in particular.

In public M&A transactions, such fees are rather uncommon, which is partly due to legal restriction

Private M&A

One of the biggest developments is that warranty and indemnity insurance is no longer pure theory, but has seen increasing use in the Austrian market. Private equity buyers are at the forefront of this development. Given the bridge function warranty and indemnity insurance serves between buyers needing increased contractual protection and sellers for various reasons not willing to provide this, we expect a further increase in the use of warranty and indemnity insurance.

Earn-outs and escrows have also become more common, but whether a buyer can successfully negotiate these is very deal specific. Whereas locked-box mechanisms are common in auction settings, closing accounts often are agreed upon in one-on-one negotiated deals.

Typically, private takeover offers prior to the signing of definitive agreements are conditional upon a satisfactory due diligence, the completion of transaction documentation and the approvals of internal boards.

Generally, the parties to a private M&A share purchase agreement agree on Austrian substantive law and dispute resolution in Austria. For the mode of transfer, which is necessary for the transfer of shares in a limited liability company, Austrian law is mandatorily applied. This means that the share purchase agreement for such transfers needs to be in the form of a notarial deed.

IPOs do not play a significant role in the Austrian market. Generally, a shareholder interested in selling its shareholding will either seek potential purchasers and negotiate exclusively or will initiate a structured bidding process to which interested parties are invited. As the Austrian market is rather small, the shareholder will very often be aware of potentially interested parties in the domestic market and address them directly.

Looking ahead

Many M&A deals were ultimately postponed or cancelled due to Covid-19. Nevertheless, the immense potential of M&A deals should by no means be underestimated. Even if a complete recovery of the market cannot be assumed in the short term, there will be a gradual stabilisation in the medium term. In addition, an uptick in distressed M&A can be expected as Covid-19 relief programmes start to run out.

The last few months also have shown ingenuity and great flexibility on the part of those players getting deals done. Digitisation has received an immense boost and now enables M&A transactions to run completely digitally.

Overall, the market will continue to become a different one than it was before the crisis. Whereas in 2019 it was still possible to speak more of a seller’s market, in which sellers were able to select the suitable buyer from several interested parties, achieve high purchase prices and enforce seller-favourable provisions in purchase agreements, there may well be a continued shift- towards a more buyer friendly market.

As the economy recovers, those companies that have come through the Covid-19 crisis in good shape, in many cases large companies such as industrials, will try to expand their market shares and acquire assets and know-how at low prices through clever acquisitions of competitors and start-ups that have come under pressure.

Private equity funds are also expected to become more active, having accumulated liquidity and thus on the lookout for investment opportunities. There is a particularly good outlook for companies in the pharmaceutical and healthcare sectors, technology companies, companies concerned with sustainability and the environment and online retailers. In these areas, investor demand is likely to be even stronger than before the crisis.

What is currently difficult to gauge is the impact of the turmoil that has resulted on financial and other markets from Russia’s invasion of Ukraine.

Click here to read all the chapters from the IFLR M&A Report 2022

Markus Fellner

Partner

Fellner Wratzfeld & Partners

T: +43 1 53770 311

About the author

Markus Fellner is a founding partner and the head of Fellner Wratzfeld & Partners’ corporate and M&A practice. He also specialises in banking and finance, insolvency law and restructuring and dispute resolution.

Markus has a law degree from the University of Vienna and a business degree from the Vienna University of Economics and Business. He was admitted to the Austrian Bar in 1998 and lectures at various institutions.

Paul Luiki

Partner

Fellner Wratzfeld & Partners

T: +43 1 537 315

About the author

Paul Luiki is a US native partner at Fellner Wratzfeld & Partners specialising in the full range of M&A transactions. He has a specific focus on cross-border transactions, in particular in the CEE and US regions. His other fields of specialisation are contract law and commercial dispute resolution.

Paul is a graduate of the University of Vienna and completed a JD at the University of Iowa. He is also a frequent lecturer on M&A and joint ventures.

Roswitha Seekirchner

Attorney-at-law

Fellner Wratzfeld & Partners

T: +43 1 53770 362

E: roswitha.seekirchner@fwp.at

About the author

Roswitha Seekirchner is an attorney-at-law at Fellner Wratzfeld & Partner.

Roswitha specialises in corporate and M&A. She obtained a law degree from the University of Innsbruck and was admitted to the bar in 2021.

Peter Blaschke

Attorney-at-law

Fellner Wratzfeld & Partners

T: +43 1 53770 345

About the author

Peter Blaschke is an attorney-at-law at Fellner Wratzfeld & Partner specialising in corporate and M&A, arbitration and takeover law.

Peter has extensive experience in negotiating as well as litigating M&A transactions, which include transactions in CEE, Asia and Africa.

He obtained a law degree from the University of Vienna and was admitted to the bar in 2003.