2020 proved to be a relatively modest year for M&A in Taiwan, yet there were still some significant transactions across different sectors, including privatisation takeovers of listed companies and transactions in the energy sector. Continuing the momentum from the end of 2019, the emergence of activity in the renewable energy sector in 2020 parallels the Taiwanese government's policy to promote green energy, with this trend being projected to continue into 2021.

The Taiwanese market is driven by both private and public M&A transactions. While there were a few notable public M&A transactions in 2019 and 2020, there have been a number of private M&A transactions in the market as well. For example, there have been several acquisitions in the energy sectors, and smaller M&A deals for emerging technology companies. There may have been fewer investments by Chinese investors in Taiwanese companies through M&A, due to the change of political climate and the sensitive cross-strait situation.

Privatisation, through a two-phased transaction by tender offer plus share exchange transaction with cash consideration (cash squeeze-out), is still a popular transaction structure in Taiwan's M&A market. One notable case in 2020 is Hakuhodo, a Tokyo Stock Exchange-listed company's acquisition and privatisation of Growww, a leading local advertising and exhibition company listed on the Taiwan Stock Exchange (TWSE), with a total consideration of around US$94.1 million.

|

|

M&A transactions in the energy sector continued to thrive in 2020 |

|

|

iPhone assembler Pegatron, through its 100% owned special purpose vehicle (SPV), conducted a reverse triangular merger with Casetek, a subsidiary of Pegatron. After the merger, Casetek became a 100% direct subsidiary of Pegatron and was de-listed from the TWSE. The value of the deal is around NT$14.5 billion (approximately US$490.93 million). The transaction led to heated discussion on whether this deal was for the future cooperation with Luxshare, a Chinese company and the key assembler of Apple's AirPods wireless earphones, since Luxshare acquired Wistron's iPhone assembly plant in Kunshan, China in July 2020 to strengthen its ties with Apple and showed strong ambition to shake up the iPhone supply chain. M&A transactions regarding transformations of Taiwanese tech companies and their positions in the Apple supply chain will likely continue to attract attention in the future.

Another notable reverse triangular merger is the acquisition and privatisation of On-Bright, a maker of chipsets for power management listed on the TWSE, by Magicapital, Pavilion Capital and Axiom Capital with a total cash consideration of US$451.8 million. On-Bright specialises in the design, manufacturing and distribution of the high performance power supply management integrated circuits (ICs).

COVID-19 and recovery plans

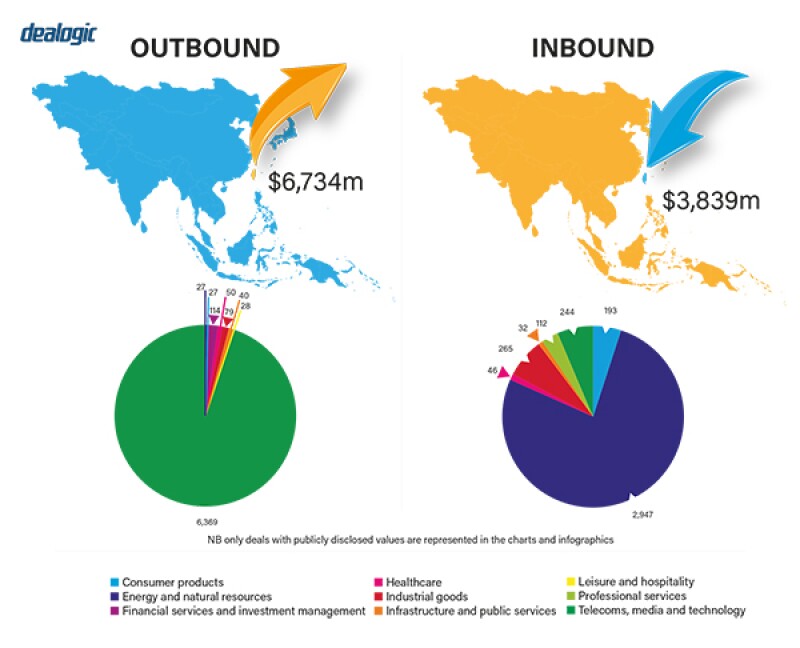

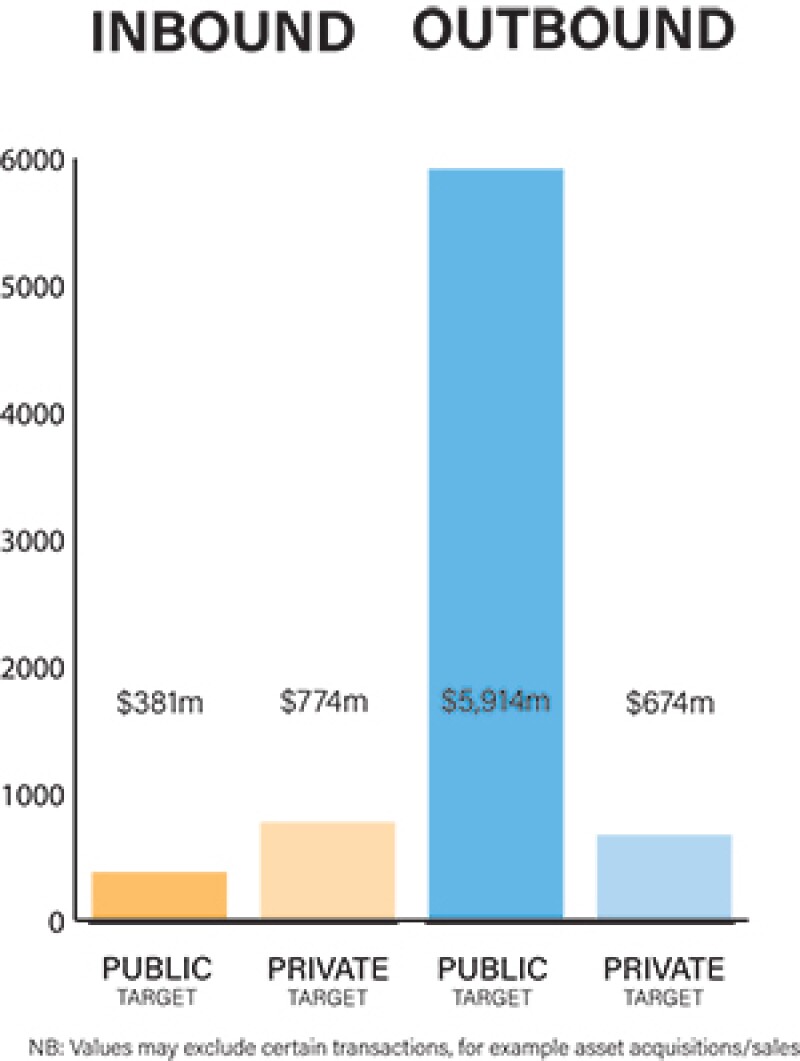

In 2020, inbound M&A transactions in Taiwan were largely unaffected by the COVID-19 pandemic, partly due to the government's effective response to the pandemic. However, given that the COVID-19 crisis is unprecedented in the depth and breadth of its global impact, the fallout regarding outbound M&A transactions remains to be seen.

The number of M&A transactions in 2020 was slightly higher than in 2019; the total value of the transactions increased by $55 million. According to information published by the Department of Commerce, the Ministry of Economic Affairs (MOEA), the total value of announced deals in 2019 was $338 million with a deal count of 197, while the total value of announced transactions in 2020 was $393 million with a deal count of 209. It is projected that M&A in 2021 will mainly follow the pace of 2020.

There have been several driving forces in the structuring of M&A deals in Taiwan. For example, given that the newly amended M&A Act of 2016 allows for more flexibility in terms of the form of the consideration that an acquirer may offer to the shareholders of a target company, it should be easier for an acquirer to achieve a 100% equity interest acquisition. This was evidenced by the increasingly popular cash-out share exchange structure in 2018 and 2019. In 2020, the slowing down of major transactions appears to reflect public calls for more stringent disclosure and voting requirements for cash-out deals and de-listings.

Meanwhile, Taiwan's government promulgated amendments to laws and regulations governing Chinese investors' investment in Taiwan to prevent the circumvention of the investment control. For example, according to the amendments, (i) stricter criteria were adopted for identifying Chinese investment made through third-area intermediary; and (ii) Chinese investors wishing to control a Taiwanese company (other than those listed on the TWSE or Taipei Exchange or traded over the Emerging Market of the Taipei Exchange) via contractual arrangement are also required to apply for regulatory approval. Given so, the transaction structure must be carefully designed to meet the requirements applicable to Chinese investors for making investment in Taiwan.

With the Taiwanese government's policy to promote green energy, there would still be potential growth of M&A transactions in the renewable energy sector. In 2020, there were several major disposals by the original investors and developers of offshore wind project companies, and also various acquisition projects involving large and small-scale solar energy plants conducted by private equity (PE) funds.

During the 2010s, big-ticket M&A in Taiwan has been mostly driven by strategic investors. Financial investors have usually participated in M&A as co-investors or as acquirers of minority stakes in companies.

In 2018 however, there was a boom in financial investors returning to the market after being silent for almost a decade. A series of deals, including KKR's take-private acquisition of LCY, Morgan Stanley's take-private acquisition of Microlife, Blackrock's acquisition of a solar portfolio from J&V Energy Technology and Permira's investment into aquaculture company Grobest, were all led by PE funds. Although, this trend of financial investment did slow down a bit in 2019, in 2020 there were still several transactions initiated by PE funds, such as the take-private acquisition of On-Bright by Magicapital, Pavilion Capital and Axiom Capital.

In response to the Taiwanese government's ambitious effort to promote renewable energy, the M&A transactions in the energy sector continued to thrive in 2020, which were largely driven by foreign and local financial investors. The notable examples are several exits of offshore wind farm developers, as well as a number of large-to-mid-size investments in solar power plant industry.

Legislation and policy changes

The main statutes governing M&A activity in Taiwan are the M&A Act, the Company Act, the Securities and Exchange Act and the Fair Trade Act. In addition, under the Securities and Exchange Act, a set of tender offer rules are prescribed to govern tender offers of public companies. Other statutes may also be relevant, for example the Labour Standards Act, foreign and Chinese investment regulations and tax laws and regulations.

The main regulatory body in charge of public M&A transactions is the Securities Futures Bureau (SFB) of the Financial Supervisory Commission (FSC), which is the government agency responsible for public companies. The other relevant regulatory bodies include the Fair Trade Commission (FTC), the authority in charge of antitrust clearance, and the Investment Commission (IC), the authority in charge of reviewing foreign and Chinese investments. If the target holds any special licence, the authority in charge of that special licence may also need to review the transaction.

After the latest amendments to the Company Act took effect in November 2018, shareholders holding over 50% of shares are permitted to call a shareholders' meeting, without needing the board to call such meeting. This allows insurgent shareholders to replace the incumbent board as soon as the insurgent shareholders acquire a majority stake. This is worth noting for hostile takeovers.

In November 2018, the Justices of the Constitutional Court granted a minority shareholder in a cash-out merger in 2007 an appraisal right in Interpretation No. 770, on the basis that the then effective M&A Act failed to afford sufficient protection in a cash-out merger and was therefore unconstitutional. Several government agencies have launched initiatives to refine and amend the regulatory scheme for cash-out and delisting transactions in 2019, and the competent authority is expected to amend the M&A Act in response to the Constitutional Court's concerns. This includes calls for the disclosure of more detailed information regarding involvement and role of major shareholders/directors and providing the minority shareholders with more protection.

The government has also proposed to amend the Statute for Investment by Foreign Nationals, which governs foreign investments, by replacing the current prior approval system with a post-closing notification system for deals under a certain size. The proposed amendment also aims to shorten the foreign investment review process. The proposed amendment is expected to be friendlier to cross-border M&A deals; however, there is no definitive timeline for the legislative process.

Market norms

Information disclosure and insider trading are important and sensitive areas for public companies in Taiwan. However, local management sometimes underestimates their importance and fails to make the proper disclosures. In many instances, large public M&A transactions have crossed red lines in regard to insider trading and quite a few criminal investigations have been launched.

There have been many attempts to manipulate the stock prices of listed companies, or to intentionally buy or sell the shares of the target company by the management before the information is legally and properly disclosed to the market in order to reap improper gains. A few notable deals in 2019 and 2020 were reported to have involved insider trading issues.

This type of misconduct harms the buyer's trust and if, for example, the price goes up unreasonably before the information disclosure, the buyer might ask for a cooling-down period or even choose to halt the transaction. Public companies therefore need to pay more attention to information disclosure when they plan M&A transactions. This includes understanding what information should be disclosed and the proper timing for disclosing certain pieces of information to the market. Most important of all, public company insiders should not trade any shares in the public company before proper information disclosure. Professional advice should be sought regarding this issue.

In Taiwan, M&A transactions are often subject to regulatory approvals, such as foreign investment approvals or Chinese investment approvals. For those industries that are required to hold a special licence/permit, such as banking, securities firms, insurance companies, and so on, approval from the competent authority, such as the FSC, needs to be obtained in advance.

Meanwhile, any M&A transaction triggering the pre-closing antitrust filing threshold needs to obtain antitrust clearance before closing. Given all these requirements, whether and how regulatory approvals can be smoothly obtained is a critical issue to the completion of an M&A transaction in Taiwan. As such, it is advisable that investors intending to conduct an M&A transaction in Taiwan seek professional assistance in advance, in order to better understand the regulatory requirements and application process.

In Taiwan, there has also been some discussion regarding how new technologies, such as artificial intelligence (AI), could support legal practice, including M&A transactions. However, these new technologies are still not commonly seen in Taiwan in M&A.

Public M&A

Given that under the Taiwan Company Act, material decisions require the approval from shareholders holding two-thirds of the voting shares of a company, in order to gain an absolute control of a public company, an acquirer should aim to acquire or control at least 67% of the shares. In practice, given that not all shareholders attend shareholder meetings, to control the management or operation of a listed company, it is sometimes enough for one investor to control 30% to 40% of the voting rights in a listed company. In sum, this would largely depend on the shareholding structure of the listed company.

|

|

Taiwan’s government promulgated amendments to laws and regulations governing Chinese investors’ investment in Taiwan |

|

|

In local practice, the conditions of a tender offer usually include the minimum and maximum number of shares that the shareholders of the target company agree to tender during the tender offer period; the tender offeror obtaining the required government approvals, if any (such as antitrust clearance and foreign investment approval, for example); and no occurrence of any material adverse event (subject to the approval of the FSC).

After the XPEC case, the FSC amended the relevant tender offer regulations in 2016 to increase scrutiny and enhance transparency in tender offers. Specifically, under the amended tender offer regulations, a tender offeror must prove its ability to pay the tender offer consideration. Such proof can be in the form of either a bank guarantee, a report from an independent financial adviser or a certified public accountant (CPA) attesting to the offeror's ability to pay the tender offer consideration.

In terms of tender offers and other types of M&A transactions between public companies, Taiwan has rarely seen break fee arrangements.

Private M&A

Large private M&A transactions in Taiwan often adopt a completion accounts mechanism under which the purchase price is adjusted in accordance with the post-closing audit of the financial status of the target company, as at closing date. For transactions with a smaller value, it is more common for the parties to adopt the locked-box mechanism, which has become increasingly popular in recent years. Earn-out mechanisms and escrow arrangements are commonly seen in private M&A transactions.

The customary closing conditions attached to a private takeover offer usually include, among others, that the seller's representations and warranties remain true and correct; that the required government approval (if any) has been obtained; that required third party consent (if any) has been obtained; that no material adverse event has occurred; that no action or government order is seeking to deter or enjoin the proposed M&A transaction; and that other commercial arrangements required by the parties have been completed or achieved (this would usually be structured based on the due diligence findings).

If any party in a private M&A transaction belongs to a foreign corporate group, that party would normally require that the transaction documents be governed by the law of the foreign country where the headquarters of the foreign corporate group is located. Any dispute arising from the transaction documents will then be resolved via the court of a foreign jurisdiction or an arbitration proceeding conducted outside Taiwan. Local parties would normally accept such arrangements.

The IPO market in Taiwan is generally perceived as serving the purpose of fund-raising rather than exiting, due to lock-up requirements, minimum shareholding requirements, legal requirements and limitations on selling shares that are applied to major shareholders, directors and supervisors.

For the major shareholders of a public company that wish to sell their shares to a potential buyer, a mandatory tender offer may be triggered if more than 20% of the shareholding will be transferred within 50 days. Consequently, major shareholders' exit in the open market may be treated as a trade sale. In recent years, due to the low PE ratio of the Taiwan stock market and the strong performance of other stock exchanges in Asia (such as Shanghai Stock Exchange), the Taiwanese IPO market has been slow. This is another reason why major shareholders usually would not consider a Taiwanese IPO as an exit priority.

On the other hand, trade sales or sales to financial sponsors have always been a major exit route. Other than highly regulated industries (such as media or cable television) or acquisitions involving Chinese funding, there should be no substantial hurdle for an exit, albeit that the regulatory approval process may sometimes take a long time. As for highly regulated industries and investments involving Chinese funding, the Taiwanese government has been criticised for the prolonged regulatory approval process and lack of transparency in its decision-making process.

In addition to the above, applications for foreign investments in Taiwan (including application for initial investment in Taiwan or subsequent application for sale/exit in M&A projects) seem to have become more difficult, compared to several years ago, due to the government's concern about ultimate beneficial owners of the foreign investors being from China.

Due to these concerns, the competent authorities tend to ask the applicant to submit more information in order to verify the identity and background of the beneficial owners. The entire process could become more time-consuming. It is also likely that the competent authorities might reject an application due to factors such as national security.

Looking ahead

Considering the Taiwanese government's conservative attitude towards investment from Chinese investors (specifically the newly amended investment regulatory scheme for Chinese investors as indicated above), major transactions involving Chinese funding taking place in Taiwan cannot be expected.

Given that investments made by Chinese investors through the 'control via contract' structure – such as variable interest entities (VIEs) – also requires regulatory approval under the amended scheme, it is anticipated that there will be more inquiries regarding the alternative structures to achieve cross-strait collaboration.

Seeing that Taiwanese government continues to promote renewable energy, it can be expected that the M&A transactions in energy sector will continue to thrive in 2021.

Click here to read all chapters from the IFLR M&A Report 2021

Yvonne Hsieh

Senior counsellor

Lee and Li, Attorneys-at-Law

T: +886 2 2763 8000 ext. 2188

Yvonne Hsieh is a senior counsellor at Lee and Li. Her practice focuses on M&A, international investment, securities and antitrust.

Yvonne has assisted many foreign companies in acquiring and privatising listed companies, including the recent acquisition of a Taiwan chemical company conducted by a PE fund. She is also an expert on antitrust and has been recognised by guides as being among the world's leading competition lawyers since 2013.

Eddie Chan

Partner

Lee and Li, Attorneys-at-Law

T: +886 2 2763 8000 ext. 2139

Eddie Chan is a partner at Lee and Li and co-leads the firm's M&A practice group.

Eddie has exposure to a wide range of clients from different industries and provides advice on various complex acquisitions. He is also specialised in Chinese investment projects in Taiwan. He recently advised private and state-owned Chinese companies on investment projects in Taiwan.

Patricia Lin

Senior counsellor

Lee and Li, Attorneys-at-Law

T: +886 2 2763 8000 ext.2235

Patricia Lin is a senior counsellor at Lee and Li. Her practice focuses on banking, securities, capital market, financings – particularly, structured and aircraft financing – and M&A.

Patricia has worked on many international capital market offerings (depositary receipts, external commercial borrowings and Formosa bonds). She is an M&A expert in both general and highly regulated financial and telecom industries. She advised on the first Chinese investment in the LED industry.

Cheng-Chieh Huang (James)

Partner

Lee and Li, Attorneys-at-Law

T: +886 2 2763 8000 ext.2157

Cheng-Chieh (James) Huang is a partner at the banking and capital market department of Lee and Li, with principal practice areas in banking, capital market and M&A.

James has represented clients in various high profiles M&A transactions. He also advises local and international banks, securities firms, insurance companies, financial holding companies and other financial institutions on matters including syndicated loans, acquisition finance and project finance.