Attention to SPACs is increasing in Japan. Well-known Japanese investment companies have listed SPACs in the US, and some of the US-listed SPACs are targeting Japanese companies.

The Japanese government has begun to discuss the introduction of a Japanese version of SPACs (J-SPACs) in Japan. On June 2 2021, the Growth Strategy Conference, an advisory board to the Japanese government, published a draft of the growth strategy implementation plan, which indicates that in light of the experiences of the US and other foreign regulators, general trends of the SPAC market and the perspective of enhancing Japan's international competitiveness, the Japanese government will consider introducing J-SPACs while taking adequate measures required from an investor protection perspective. While the US SEC is strengthening its monitoring as the SPAC boom heats up in the US, Japan is still on the other end of the spectrum. It would be worthwhile for Japan to consider the pros and cons of introducing J-SPACs by looking at experiences in the US market.

In addition, as a more impending issue, Japan would see situations where Japanese companies will consider listing in the US market through business combinations with US SPACs.

Lawyers, investment banks, venture capitalists and private equity (PE) funds, as well as the relevant Japanese regulators, have led the discussion relating to SPAC by publishing thought leadership articles. In this article, major legal issues are summarised on (i) the business combination of Japanese companies with US SPACs; and (ii) the introduction of J-SPACs.

The business combination of Japanese companies with US SPACs

Transaction structure

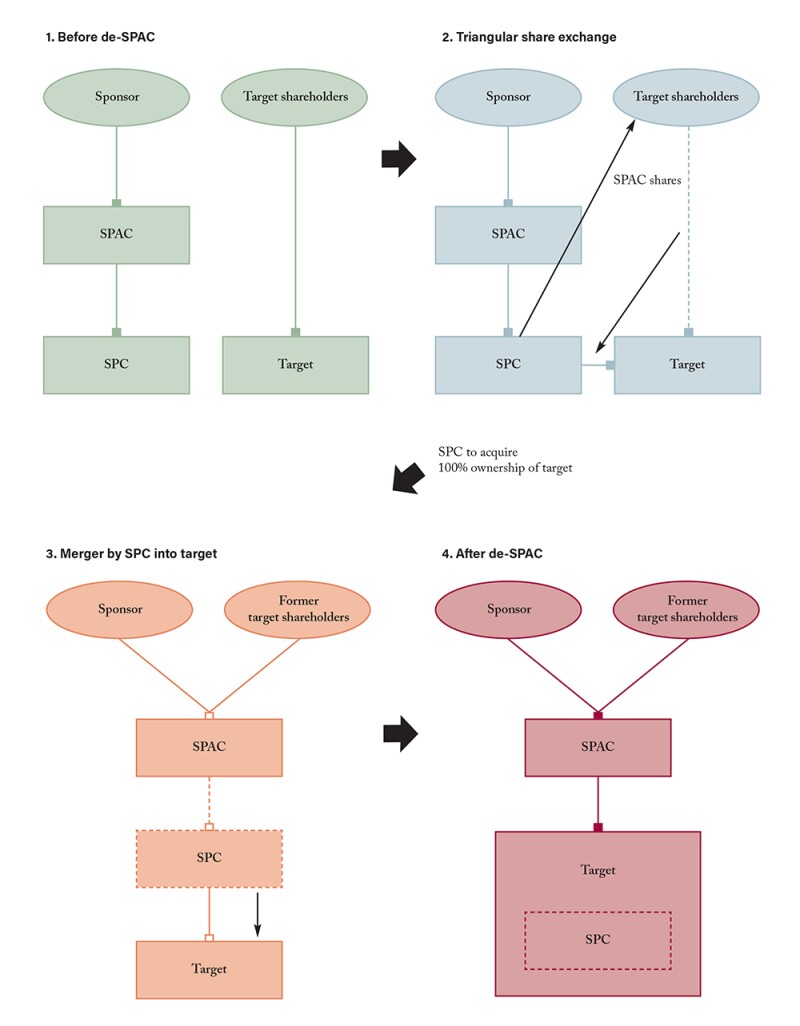

In the US, de-SPACs are typically carried out by way of a reverse triangular merger using SPAC shares as merger consideration. Although a reverse triangular merger is not available under Japanese corporate law, it would be possible, purely from a Japanese corporate law perspective, to create substantially the same capital relationship by way of:

A 'triangular share exchange' followed by the merger of the merger subsidiary into the target company (with the target company being the surviving company); or

A 'forward triangular merger' (with the target company being the dissolving company).

|

|

“If any of the SPAC managers intend to join in the management of the target company, the SPAC would not qualify for the exemptions” |

|

|

While the 'forward triangular merger' structure under Japanese corporate law is similar to that used in the US, the 'triangular share exchange' structure is illustrated in the chart on the following page.

However, the feasibility of these transaction structures should also take into account the specific facts and circumstances of the entities involved, particularly from the taxation and regulatory perspective.

Set out below is a summary of applicable tax treatment to the target and its shareholders in each scenario.

Restrictions under foreign investment control regulations

Under the Foreign Exchange and Foreign Trade Act of Japan, generally, a foreign investor intending to acquire shares of an unlisted Japanese company engaging in certain designated businesses must file a prior notification with the Minister of Finance and other competent ministers, including the Minister of Economy, Trade and Industry, irrespective of the number of shares to be acquired.

While there are certain exemptions, if any of the SPAC managers intend to join in the management of the target company, the SPAC would not qualify for the exemptions and therefore, a prior notification must be filed. In addition, no exemption is available if the target company engages in certain highly-sensitive businesses, in the so-called 'core' business sectors, including the manufacture of semi-conductors and software.

If a prior notification is filed, the proposed acquisition cannot be consummated until a 30-day waiting period has lapsed from the date of filing (although this period may be shortened or extended up to five months). The ministers may ultimately order the acquisition to be modified or stopped after considering various factors, including the management and investment policy of the foreign purchaser and the relationship of Japan with the government of the place of organisation of the foreign purchaser as well as any person effectively managing it.

Disclosure

In the proxy statement to be issued in connection with a de-SPAC, the US SEC rules require the SPAC to include two to three years of audited financial statements of the target, which must comply with US generally accepted accounting principles (GAAP) or the International Financial Reporting Standards (IFRS) in certain cases, as well as the pro forma financial statements of the combined company. For targets that have not had a public company audit, the preparation of financial statements could impose a significant burden and delay the timing of the completion of the de-SPAC.

The target business disclosure in the proxy statement is similar to what would be required in a Form S-1 IPO prospectus of the target's business, including a detailed description of the business, management discussion and analysis (MD&A) and background of the de-SPAC and projections of the target company. Furthermore, after the de-SPAC, the combined company will need to comply with the continuous disclosure obligations and the internal control requirements under the US Sarbanes-Oxley Act of 2002 (SOX Act).

In reality, generally, Japanese private companies do not prepare IFRS-compliant financial statements or disclosure documents in English nor do they establish effective internal controls compliant with the US SOX Act. Therefore, it is important for the SPAC to analyse the target's capabilities relating to disclosure and internal control during the due diligence process, and to procure the management's commitment regarding these matters in the de-SPAC definitive agreement.

Triangular share exchange |

Forward triangular merger |

|||

Tax-qualified share exchange |

Non-tax qualified share exchange |

Tax qualified merger |

Non-tax qualified merger |

|

Target |

Non-taxable |

Mark-to-market tax, while the scope of the subject assets are limited |

Non-taxable |

Capital gains tax |

Target shareholders |

• If cash consideration is included, capital gains tax • If the consideration consists only of SPAC shares, no capital gains tax |

Non-taxable |

• If cash consideration is included, capital gains tax • If the consideration consists only of SPAC shares, no capital gains tax • Deemed-dividend tax in addition to capital gains tax |

|

Legal issues in introducing J-SPACs

Listing criteria and requirements

As the current listing criteria of Japanese stock exchanges does not jibe with the nature of SPACs, it would be necessary for the stock exchanges to design listing criteria and requirements that are applicable to SPACs.

In addition, Japanese stock exchanges need to modify their listing examination practices for SPACs. Unlike the US, where issuers and underwriters retain their respective lawyers to conduct due diligence and prepare disclosure documents, and the stock exchanges and SEC do not conduct substantive examination, a Japanese stock exchange traditionally undertakes a comprehensive and substantive examination of the listing applicant for over a year or more, partly because issuers and underwriters generally do not retain lawyers in Japanese domestic IPO deals due to the low litigation risk. In other words, in the US, investor protection focuses on fair disclosure supported by a severe litigation risk, while in Japan, the stock exchange is expected to conduct, and has in fact conducted, 'paternalistic' investigations on behalf of investors.

|

|

“The introduction of J-SPACs would be an important challenge for the Japanese capital markets” |

|

|

Substantive investigations by stock exchanges in Japan are not practicable during the life span of the IPOs of SPACs and de-SPACs considering that these processes may be completed within a short period.

A theoretically possible approach under the existing listing rules would be to apply the rules relating to 'back-door listing' to the SPACs. Under these rules, if it is discovered that a listed company is not a substantive surviving company after a merger or otherwise with an unlisted company, the listed shares will be designated as securities under supervision, and the listed company will go through an examination that is equivalent to a listing examination. The listed company will be delisted if it is found that it does not meet the listing criteria within a certain period of time.

If J-SPACs are to be introduced in the future, it would be necessary for the Japanese stock exchanges to revisit the manner of investor protection that should be pursued for SPAC investors. This includes whether and how much the stock exchanges will rely on the substantive examination, and to design – if necessary – the workflow of the substantive examination, so as to be practically consistent with the timeline of SPACs and de-SPACs.

SPAC schemes

Units

At the time of the IPOs of US SPACs, units are typically issued to investors, each of which consists of a share of SPAC common stock and fraction of a warrant exercisable for SPAC shares, which will be separated after a certain period of time. Apparently, this 'unit' structure is adopted for ease of market stabilisation. If a similar unit structure is necessary for the IPOs of J-SPACs, it should be noted that there is currently no settlement system or mechanism on which shares and stock acquisition rights can be traded as one unit.

However, a similar effect may be achieved under the current Japanese corporate law and settlement system. Assume that at the time of the IPO, only shares will be issued, but the board of directors of the J-SPAC will approve a resolution on a gratuitous allotment of stock acquisition rights (i.e. pro rata allotment to SPAC shareholders of stock acquisition rights without contribution immediately upon the IPO) which will take effect on a specific date after a certain period of time. Through this mechanism, the SPAC shares will be tradable with a right to receive a pro rata allotment of the warrants until the ex-rights date.

Redemption

For US SPACs, general SPAC shareholders have the right to have their SPAC shares redeemed upon their request at the time of the de-SPAC or if the de-SPAC transaction is not completed within the prescribed timeframe.

Under Japanese law, there are no material issues if such a redemption feature is included in the terms and conditions of the class of SPAC shares held by such shareholders. The class of shares issued to general SPAC shareholders would be different from those issued to SPAC sponsors, as the sponsors are not given the right to have their SPAC shares redeemed.

Disclosure for SPAC IPO and de-SPAC

It would be necessary for the regulator to consider designing a new SPAC-compliant disclosure regime. More specifically, under Japanese securities regulations, IPO disclosures would be made by the SPAC by filing a securities registration statement, just like a traditional IPO. However, as the SPAC will not be conducting any business at the time of the IPO, its disclosures would be significantly different from ordinary companies, and the existing disclosure form would not be appropriate in that it includes many items that are not relevant for SPACs.

In addition, under the existing Japanese securities regulation framework, even if the consideration for the de-SPAC includes SPAC shares, material information on the target company (such as the nature of its business and risk factors) would not be required to be disclosed at the time of the de-SPAC. This is because the registration requirement is not applicable to a reorganisation that involves the distribution of shares as consideration if the shares to be distributed are already listed.

It is true that a convocation notice including agenda items relating to the proposed de-SPAC will be circulated by the SPAC for the shareholders meeting, but under the Japanese regulatory regime, such convocation notice is governed by corporate law and not by securities regulations.

Conclusion

As investors flock to SPACs in the US, the world's largest capital market, the impact on the Japanese capital market and M&A market would be inevitable. SPAC schemes have some issues that may not be easy to harmonise with traditional IPO practices in Japan. However, the US SPAC boom seems to imply that traditional IPOs alone cannot meet the evolving needs of the capital markets, and the same can be said for Japan, when strong demand for J-SPACs from unicorns, venture capitalists, PE funds and investors are seen.

The introduction of J-SPACs would be an important challenge for the Japanese capital market to fulfil its function to properly supply risk money. As said, lawyers have led the discussion among market participants, including the regulators, on concepts relating to SPACs in Japan, and will continue to contribute for the development of capital markets in Japan by introducing SPACs to Japan, with cooperation with players outside Japan as well.

Katsumasa Suzuki

Partner

Mori Hamada & Matsumoto

T: +81 3 6212 8327

E: katsumasa.suzuki@mhm-global.com

Katsumasa Suzuki is a partner at Mori Hamada & Matsumoto. He is renowned as a practitioner in capital markets, M&A and the crisis management areas and has received high evaluation from legal media publications. His clients include investment funds, investment banks, venture capitals, companies in the technology, media, and telecom (TMT) and retail industries, both in and outside Japan.

Katsumasa has advised in many sophisticated deals in Japan, such as on the global IPOs of the Japan Post group companies, Recruit and Mercari. He has chaired the M&A sub-committee (2018-2020) and the public company practice and regulation subcommittee (2020-present) in the security law committee of the International Bar Association.

Masakazu Kumagai

Partner

Mori Hamada & Matsumoto

T: +81 3 6266 8522

E: masakazu.kumagai@mhm-global.com

Masakazu Kumagai is a partner at Mori Hamada & Matsumoto. His practice focuses primarily on M&A, corporate, capital markets and PE fund formation matters. Leveraging on his wide-ranging expertise, he has particular strength in cross-border transactions as well as complex, cross-disciplinary transactions. He has been highly evaluated by a number of major financial and corporate publications.

Masakazu graduated with a law degree from University of Tokyo and a LLM from the University of Chicago Law School. He is admitted to practice in Japan and New York.

Yu Nimura

Senior associate

Mori Hamada & Matsumoto

T: +81 3 6266 8779

Yu Nimura is a senior associate at Mori Hamada & Matsumoto. He has wide experience in advising on Japanese and international capital markets, finance transactions and financial regulations. He has experience in working for leading securities firms in Hong Kong SAR and Japan, where he was involved in both domestic and international capital market transactions.

Yu graduated with a JD from Keio University Law School. He joined the firm in 2020, after nine years of experience in the capital markets group at a leading international law firm, Clifford Chance. He is admitted to the bar in Japan, and fluent in English and Japanese.