The process by which financial sponsors or strategic corporates evaluate the ability to finance the leveraged acquisition of a company, or by which lenders or investors evaluate whether or not to loan to or invest in a particular leveraged credit, are driven by a number of factors – the size and profitability of the business, the industry and jurisdiction(s) of the corporate borrower, the cashflow generation available to service debt, plus any number of internal and external factors. These considerations typically lead to an analysis of leverage levels, the availability of structural protections, and the ability of operating companies to fund their businesses while servicing their debt.

But what if the nature of a particular market:

hinders the ability of creditors to receive customary structural support from borrowers, such as asset security or corporate guarantees from operating subsidiaries;

potentially limits a creditor's ability to enforce on its claims in the event of a default, including following a business downturn;

means that traditional measures such as debt/Ebitda leverage may not properly reflect the healthiness (or lack of healthiness) of a business; and/or

puts additional non-market restrictions on the ability of subsidiaries to send cash up to a holdco debtor or to pay dividends to shareholders?

These are some of the factors that become relevant in connection with a leveraged financing for a regulated insurance company, whether for a sponsor or company when trying to ensure compliance with regulatory requirements, or for potential creditors who need to confidently evaluate an insurer's corporate's strength and the protections provided by the financing structure.

This article considers some of the challenges faced by market participants when a regulated insurer seeks to tap the financial debt markets, in the US and internationally. We discuss some alternate metrics and structures often used in these financings, some mitigating factors, and some factors for which market participants just need to play through the differences to get a deal done.

A brief history of debt financing in the regulated insurance market

Insurers traditionally fund their operations through the receipt of customer premium payments and complex money management strategies that take into account risk-return models and regulated capital adequacy requirements. Still, like any company in any industry, insurance companies need to consider all sources of funding when building the optimal capital structure, including third party lending in its traditional forms. Financial sponsors, who typically operate a leveraged investment approach, are increasingly looking to regulated insurance assets. Traditionally, financial sponsors have focused on the lighter-touch regulated insurance brokerage businesses, but there have been a number of recent high profile regulated insurance buyouts – which suggests that regulators and financial sponsors are becoming increasingly familiar with each other and the innovative debt capital structures used to finance these acquisitions.

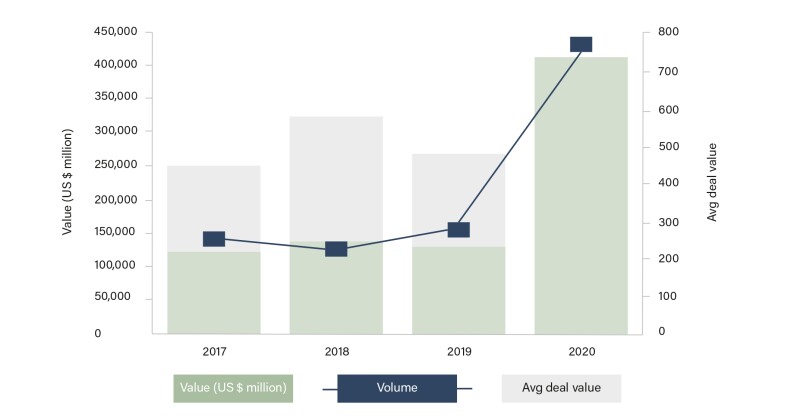

Figure 1 sets out third party borrowing by insurance companies for the year 2017-2019.

Figure 1: Borrowings by Insurance Companies - Value and Volume - 2017-2019

How to measure financial strength

Unlike in traditional leveraged finance models, Ebitda or consolidated cashflow metrics for a regulated insurance business may not be a representative measure of true liquidity, as a substantial amount of capital may be 'locked up' in the regulated group as a result of capital maintenance rules or other regulatory requirements that serve to restrict value leakage. These cashflow metrics may, however, be appropriate for non-regulated segments of the group's operations. Identifiable distributable reserves for the regulated group can provide a better indication of the amount of capital that is available to service debt from time to time, but must be considered after factoring in any discretionary capital buffer and is not directly comparable to traditional liquidity metrics, which can further complicate the picture when trying to assess the financial viability of both the regulated and unregulated aspects of the business.

Consequently, covenants in debt documentation for regulated insurance borrowers are less likely to include many of the financial tests that are considered standard in other parts of the leveraged finance market, including debt/Ebitda leverage ratios. Alternative financial tests deployed in the regulated insurance space include measuring consolidated net worth, additional solvency protections (typically reflecting regulatory requirements), and a leverage ratio test that utilises an equity- or asset-based denominator (for example, the sum of debt and consolidated net worth), which often includes restrictions on netting of regulatory cash and may also exclude debt-like obligations of operating subsidiaries under certain insurance products.

Regulated insurance markets: what's different?

Overview

The global insurance industry is highly regulated, with many internationally and locally-focused organisations providing oversight. Internationally, groups like the International Association of Insurance Supervisors (IAIS), an arm of the Financial Stability Board (FSB), seek to establish standards and to identify risks that support the stability of the international financial markets, which is balanced against the need to ensure that policyholders are treated appropriately. These regulatory initiatives are similar to Dodd-Frank in the US, where insurance industry regulation is primarily state-driven, with federal oversight established in the wake of the market destabilisation caused by the financial crisis from the prior decade. The key objectives of these regulations include promoting global competitiveness, reducing inefficiencies and complexity, providing for comparability of products and markets, aligning industry standards, and promoting financial stability.

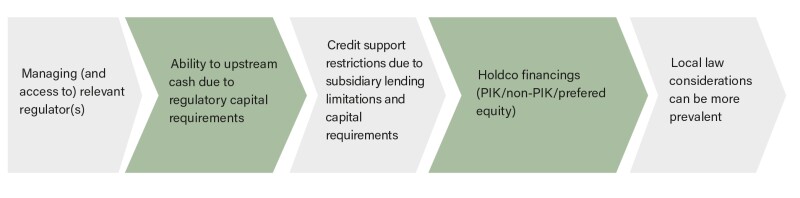

These considerations lead to a unique set of issues in the regulated insurance space. Debt financing, including in the context of the acquisition of regulated insurance assets, generally follows traditional forms, but, in the case of a regulated insurer with an additional set of hurdles, are similar in many ways to the issues facing other FIG [financial institutions group] financings. These include:

Figure 2: Financial tests in regulated insurance deals

Deal X |

Deal Y |

Deal Z |

||

Product |

Syndicated loan |

Syndicated loan |

Senior facilities |

|

Regulated vs. unregulated business? |

Regulated |

Regulated |

Regulated |

|

Leverage ratio |

Numerator |

Consolidated total debt Not calculated net of cash Excludes obligations of any insurance subsidiary under any primary insurance policy, reinsurance agreement or other insurance or reinsurance product |

Consolidated total debt Calculated net of unrestricted (statutorily and otherwise) cash in an aggregate amount not to exceed $25.0 million, to the extent such cash is subject to a lien and deposited in an account subject to a control agreement, in each case, in favour of the collateral agent Excludes obligations with respect to insurance products underwritten by an insurance subsidiary and obligations under any reinsurance agreements or retrocession agreements or in connection with certain permitted investments of insurance subsidiaries |

Net debt Calculated net of operational cash, i.e. cash and cash equivalents held by the group less cash and cash equivalents held by the insurance group in order to meet its targeted solvency levels Does not exclude obligations under or with respect to insurance products |

Denominator |

Sum of consolidated total debt (see above) +consolidated tangible net worth (see below) |

Sum of consolidated total debt (see above) + consolidated net worth (see below) |

Adjusted EBIT Derived from consolidated operating profit of the insurance group |

|

Interest coverage ratio |

Numerator |

N/A |

N/A |

Adjusted EBIT (see above) |

Denominator |

N/A |

N/A |

Net finance charges |

|

Solvency ratio |

Definition |

N/A |

N/A |

Calculated on the same basis as solvency is tested by the relevant regulator |

Net worth test |

Definition |

Consolidated tangible net worth = consolidated stockholders’ equity less consolidated intangible assets |

Consolidated net worth = consolidated stockholders’ equity less the amount of certain investments |

N/A |

Managing (and access to) the relevant regulator(s)

Similar to other regulated industries, financial sponsors face additional complexity in the context of competitive bid processes for regulated insurance assets. While this is a jurisdiction-by-jurisdiction analysis and regulators are interacting with financial sponsors more frequently, access to the relevant regulator may not always be available at the bid stage to approve the financial sponsor's proposed acquisition structure, including in particular the amount of debt that can be incurred in or above the regulated group. Nonetheless, this is often required to provide a certain funds bids in order to compete with trade buyers. Accordingly, financial sponsors may run multiple commitment papers or structures with their lenders (across different leverage levels) and/or agree to finance the acquisition with a 100% equity commitment, and take the risk of confirming their financing structure with the relevant regulator after signing the sale and purchase agreement.

Figure 3

Ability to upstream cash

The ability to upstream cash from regulated operating companies in order to make interest payments on external debt (or to pay dividends to equity investors) is often limited in these structures, including by capital adequacy rules or the need for ad hoc regulatory approval, as well as by customary limitations such as the availability of distributable reserves. If debt at a holding company is to be serviced via interest payments on shareholder loans, such loans may need to include restrictions on early prepayment and/or a lengthy non-call period in order to qualify as permissible capital under the applicable solvency regulations.

Credit support restrictions

Solvency requirements, among other factors, may limit the pool of collateral and guarantees that may be available to grant in support of a debt financing, particularly from a regulated group. In addition, the terms of the debt may need to provide for the automatic release of security or guarantees granted by non-regulated entities in the group if such entities subsequently fall within the scope of regulation.

Single points of enforcement through share pledges become particularly important in these structures. Local regulations may prohibit share pledges over target entities, so establishing a non-regulated holdco structure can provided critical protections (see financing case study). Similarly, intercreditor arrangements with other creditors should be established to confirm the expected ranking of claims in an enforcement scenario. An indirect or direct change of control over a regulated entity (or in certain jurisdictions, acquisitions of equity or other ownership rights by a third party) may require pre-approval from regulatory authorities, thereby increasing the risk that lenders will not be able to enforce key share pledges or impede a distressed sale.

Holdco and PIK financing structures

These structures are more prevalent in insurance deals in light of the security/ guarantee and debt service restrictions discussed above, as financial sponsors look to add their leverage structure above the regulated group.

Local law considerations

Local counsel should be approached early in any proposed financing process to advise on the foregoing issues and structural considerations, including in particular any structural ringfencing of the regulated group and the extent to which local laws or regulations restrict the ability of regulated entities to grant security and/or guarantees for the benefit of creditors. Local counsel may also be well-placed to advise on the risks of any particular financing structure being rejected by, and to guide related discussions with, the relevant regulator.

Financing case study

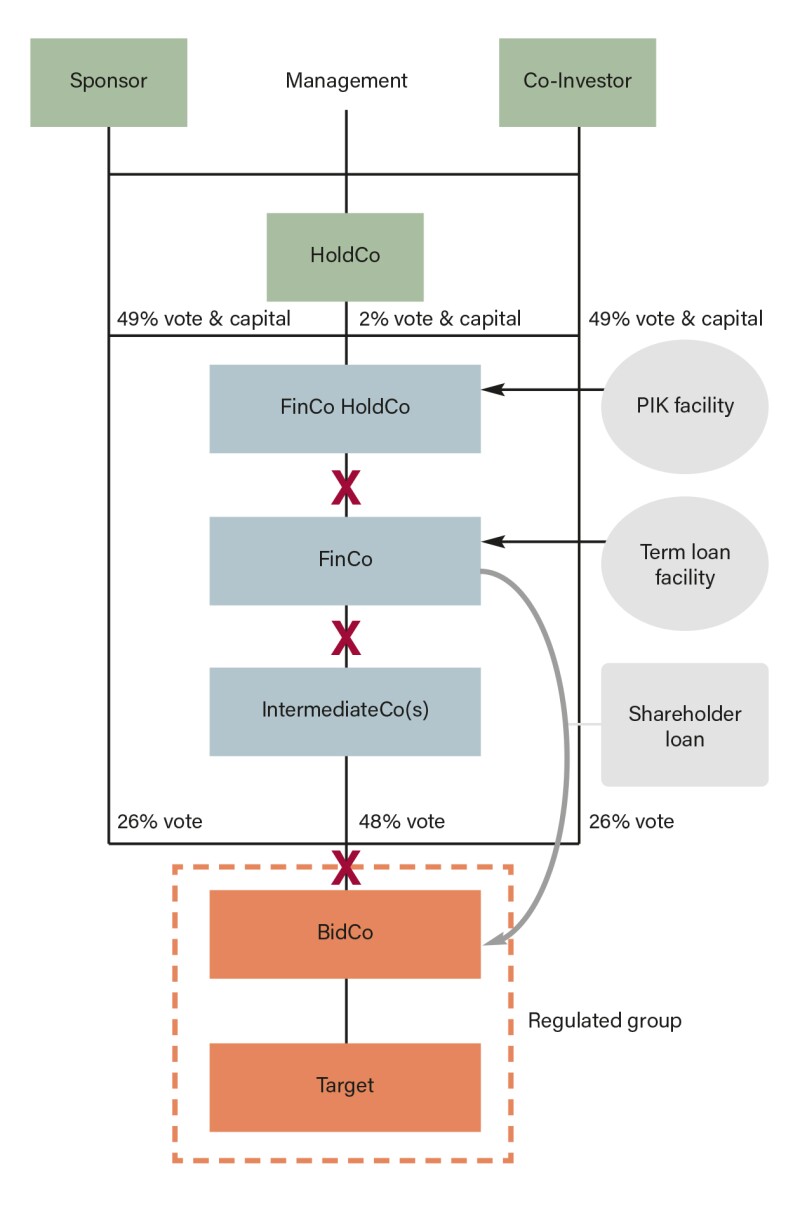

The hypothetical case study below considers some of the issues faced when structuring a leveraged debt financing for a regulated insurance company. In this sponsor-driven example, a newly formed bidco (BidCo) acquires a regulated European insurance provider and its consolidated subsidiaries (Target Group) through a holding company structure.

The hypothetical financing is comprised of PIK [payment in kind] facilities (by 'FinCo HoldCo') and Senior Facilities (by FinCo).

Key structuring considerations

Ringfencing of regulated group:

The target group is subject to full regulatory supervision and capital adequacy/solvency requirements. Due to local regulatory requirements, the sole shareholder of the target group (BidCo) is subject to the same regulatory regime and comprises part of the regulated group.

The financing structure is meant to ensure that HoldCo, FinCo HoldCo, FinCo and IntermediateCo(s) (each as shown in figure 4) are not subject to regulatory oversight as no single holdco or investor entity (including the sponsor/co-investor) owns more than 50% of the share capital and voting rights in any member of the regulated group. Depending on the type of activities undertaken by the regulated group and the jurisdictions involved, this ringfencing can also be achieved by a placing a non-EEA holdco borrower above the regulated group.

Credit support:

Senior facilities are not guaranteed but benefit from security over intra-group loans made by FinCo to BidCo, as well as pledges over shares of Finco, IntermediateCo and BidCo and (potentially) Target Group (if local regulation allows).

PIK facilities benefit from (i) guarantees by FinCo HoldCo and HoldCo and (ii) certain topco share pledges, pledges over shares of FinCo HoldCo, and the assignment of certain receivables owing to HoldCo.

No Target Group guarantees and no Target Group assets apart from shares may be pledged due to regulatory solvency requirements.

Figure 4

Covid-19's impact on the insurance industry

As discussed above, insurance companies rely on premiums paid under policies and portfolio management to generate revenues, with the requirements for third party financing often limited to one-off needs. In the context of this article, the main effects of the Covid-19 crisis may be that insurance companies delay or cancel opportunistic transactions, such as acquisitions or strategic investments. On the flipside, the crisis may provide opportunities to invest in undervalued assets.

Risks facing the insurance industry in general due to the pandemic include:

Payment risk Delayed payments from policies balanced against the expectation that insurers will still pay out on claims, or a decrease in payment volumes (e.g., if consumers buy fewer houses, cars, etc. which require insurance backing).

Investment risk Insurers' investment portfolios may be significantly impacted, both in terms of value and interest income. Additionally, interest income revenue streams may be impacted as interest rates continue to fall.

Expanded coverage scope The market is unsettled with respect to coverage for business interruption and other losses for claims resulting from the Covid-19 pandemic.

While the usual rules of leveraged finance don't always apply to regulated insurance companies, market participants have adapted to these challenges and developed innovative financing structures to enable insurance companies and financial sponsors to access debt financing on terms that, where possible, mitigate the risks to lenders and investors who provide such financing. While it is difficult to assess the financial impacts of the Covid-19 pandemic on the insurance industry and what the mid- to long-term future holds for M&A activity for insurance assets and the debt capital markets generally, this article highlights that insurance companies and financial sponsors (and their advisors) who are well prepared to face the sector-specific issues and address these issues early in the debt financing process, will have a strategic advantage in mitigating the risks associated with financing regulated insurance assets and getting the deal across the line with their financiers.

Rob Mathews

Partner

Baker McKenzie, London

Peter Stankewitsch

Partner

Baker McKenzie, Frankfurt

peter.stankewitsch@bakermckenzie.com

Haden Henderson

Partner

Baker McKenzie, London

haden.henderson@bakermckenzie.com

Samantha Greer

Associate

Baker McKenzie, London