Non-call protections have never been popular with sponsors and corporates, but an investors’ market has kept them around. Baker McKenzie lawyers Rob Mathews and Haden Henderson question if now is the time for that to change

1 Minute read |

Non-call protections in fixed rate international high yield bonds have been historically unpopular with sponsors and corporates, who want greater refinancing flexibility, particularly when buying or selling a company or to more aggressively de-lever on an IPO. On the other hand, these provisions are equally important to investors who want to build portfolios with clear visibility on returns. During recent years, flexible options have been introduced, such as floating rate high yield bonds, portability features, and more relaxed restricted payment provisions. Yet still, non-call periods are included in almost all fixed rate offerings. With the shift towards term loan B in Europe and beyond, historically low interest rates and other factors, is it time to consider variations? |

Substantially, all fixed rate international high yield bonds include a non-call period during which the bonds can only be redeemed at a prohibitive make-whole premium. This limitation has been historically unpopular with sponsors and corporates who want greater flexibility, particularly when buying or selling a company or to more aggressively de-lever on an IPO. On the other hand, these provisions are equally important to investors who want to build portfolios with clear visibility on returns.

Non-call periods have shortened in recent years, and floating rate high yield bonds, portability features and more relaxed restricted payment provisions have provided additional options and flexibility to alleviate non-call concerns. Still, non-call periods are included in substantially all fixed rate international high yield bond offerings. Now, given the proliferation of the term loan B (TLB) product in Europe and elsewhere, historically low interest rates and other factors, is it time to consider variations?

The development of international high yield: the advent of the TLB

Following the 2008 financial crisis, the combined forces of market regulation, limited bank liquidity and conservative bank risk profiles led to the establishment of a prolific international (i.e., non-US) high yield bond market. High yield bonds also gained popularity post-crisis because of their incurrence-based covenants, which did not automatically require a sponsor or corporate to seek a waiver from its bank group if it failed to meet a periodic financial test during the volatile post-crisis years, and also provided additional flexibility for conducting business generally compared to a legacy-style LMA bank facility.

The international high yield bond market lagged behind the US market until this tipping point due to numerous factors. These factors included: the availability of low-cost bank lending in the international and local markets; the reluctance of senior lenders to grant the high yield bonds viable credit support protections and the uncertainty of international insolvency regimes; time and expense in drafting and diligencing an offering memorandum; and, to a lesser extent, aversion to the typical fixed rate high yield constructs of the non-call period and quasi-public reporting.

Not to be outdone, in the recent low interest rate period (2016 to 2018), the bank market has rebounded as the TLB product has become a popular competitor and alternative for the place in the capital structure once dominated in Europe by high yield (for example by TLB's adopting bullet maturities, incurrence covenants and greater transferability); but also, importantly, a TLB typically includes a soft-call feature that allows it to be more easily refinanced or repriced earlier in its term.

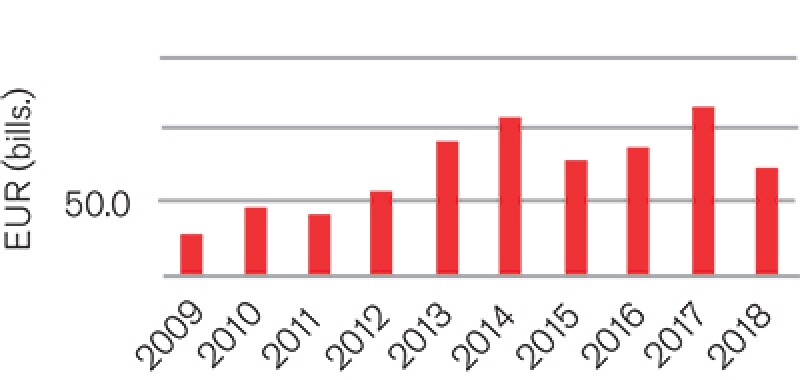

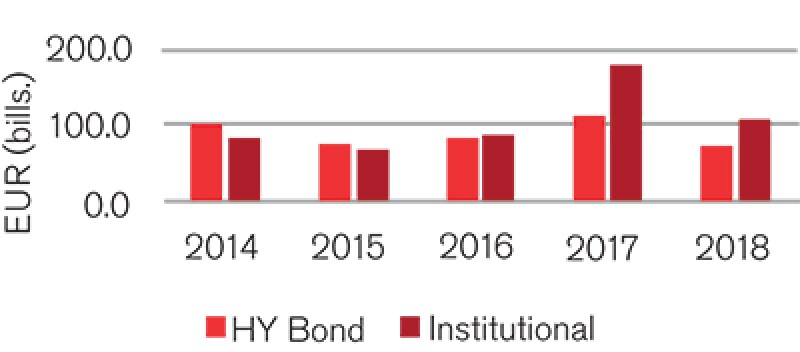

The charts above show the growth of EMEA high yield bonds from 2009 through to 2018 and a comparison of the relative market position of high yield bonds and TLBs for the period 2014 to 2018.

EMEA HY bond insurance

Source: Debtwire Par

EMEA HY bonds vs TLBs

Source: Debtwire Par

The fixed rate non-call period: why do we care?

All fixed rate high yield bonds are subject to a non-call period: the period of time from the date of issuance of the bonds until they become redeemable. In the prevailing market this typically provides for a first call at par plus 50% of the interest coupon after two years for a five-year or seven-year bond and three years for an eight-year or 10-year bond, which then reduces linearly to par in subsequent years.

During the period before the first call, the bonds are considered non-redeemable, although they will include a feature that allow the bonds to be taken out at a prohibitively expensive make-whole premium, which effectively provides investors with the return they would have received had they held the bonds until their first call date (subject to an adjustment related to the applicable treasury rate, plus 50 basis points).

Two key situations in which the non-call period can cause extra concern, particularly for active sponsors or corporates seeking financing flexibility, arise in the context of a change of control or an IPO.

Typically, in the event a new entity or group acquires greater than 50% ownership of a high yield issuer, the issuer is required to make an offer to holders to redeem their bonds at 101% of their face value plus accrued and unpaid interest. While this requirement would not block the completion of a sale, it does potentially create roadblocks. In particular, this would occur in situations where the bonds are trading below par such that the 101% may represent a substantial premium to market value (or conversely where bonds are trading above 101% and investors are not likely to accept any change of control offer, which makes deleveraging more expensive), or by requiring a prudent board of directors to ensure they have committed financing to purchase any bonds tendered in the change of control offer, which will add cost and complexity to the sale transactions.

While high yield bonds typically include a provision that allows corporates to redeem up to 40% of the outstanding high yield proceeds from an IPO at par plus the coupon plus accrued and unpaid interest, the full coupon payment even for this portion is relatively expensive and may not allow for a corporate to reach its deleveraging target to ensure best execution of the IPO process.

Alternatives

There are multiple alternatives to alleviate the impact of non-call periods and provide issuers and sponsors with flexibility during the non-call period, including:

Liability management: tender offers, exchange offers or open market purchases can be used to repurchase bonds or change certain terms. Also, while it may require 90% of holders to agree to a change in a redemption schedule in a high yield bond indenture, many majority consent strategies are available to provide flexibility.

Floating rate bonds: high yield floating rate bonds typically have a much more relaxed call structure, mirroring the soft call provisions of a TLB or other credit instruments. Typically, after one year, the bonds become callable in the 101% range. Presumably, issuers and sponsors would prefer a fixed rate bond in periods of rising interest rates, but hedging options are always available to further alleviate rate concerns. We also note that the recently issued Autodistribution floating rate notes due 2022 are immediately callable at par, which syncs up with the issuer's existing outstanding bonds.

Portability: while still not a universally accepted concept, portability features, which permit a change of control without the requirement for an offer to purchase to bondholders, on a change of control if a pro forma leverage test is satisfied and restricted payment test reset provisions are included in the documentation.

10% at 103 call: this has now become a relatively common feature for sponsors issuing secured high yield bonds in Europe – enabling issuers to redeem 10% of their bonds annually at 103 during the non-call period. While there are some limited exceptions, investors have successfully resisted sponsors from getting this flexibility in unsecured deals, further distinguishing senior note issuances from second lien TLBs that have proved a popular alternative to senior notes issuances in the existing market.

Still, on balance, it is worth considering whether the time has come to change the general approach to the non-call, particularly given the proliferation of the TLB, which has achieved market acceptance without the concept.

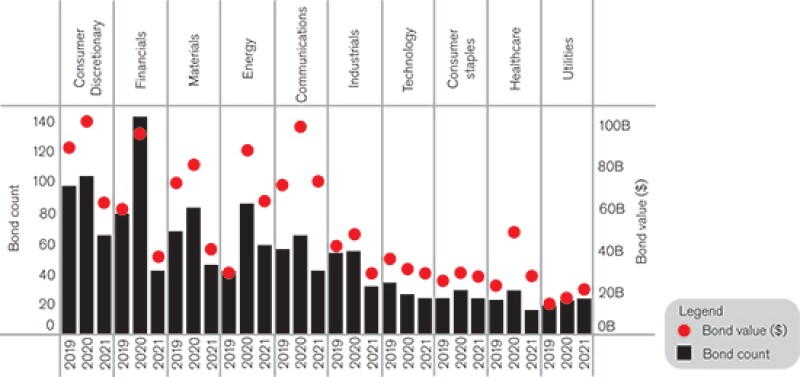

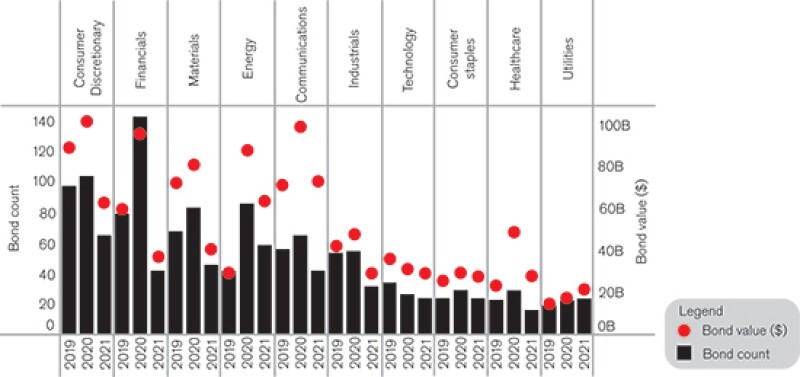

To give an indication of the size of the market and the opportunities for potential refinancings or other corporate transactions in the upcoming periods, the accompanying charts provide a snapshot of the EMEA high yield bonds that will become first callable during 2019-2021, by industry and jurisdiction.

High-yield bond volume and value by next callable year and issuer sector

Source: Bloomberg Finance

High-yield bond volume and value by next callable year and issuer ultimate parent nation (EMEA)*

Source: Bloomberg Finance

*Based on country of risk, which translates to the country where most of the revenue is generated in the EMEA region.

Case studies: some previous ideas

From time to time, the international high yield bond market has tried some variations on the classic non-call period, but none have gained real traction. Two examples are:

Mezzanine bonds of the early 2000s, such as Focus Wickes and Baxi: This short-lived effort to address the non-call period early in the progression of European high yield provided that, in the event of an 'exit event' (such as a qualifying IPO of change of control) after one year from issuance, the bonds could be redeemed at 103% plus accrued and unpaid interest, reducing to 100% by the end of the non-call period.

Adler Pelzer Group: In 2017, the Adler Pelzer Group issued senior secured notes that provided, during the first 18 months after issuance, that the issue could redeem all or up to 40% of the outstanding notes at a special redemption price of 102% plus accrued and unpaid interest (then reverting to a standard non-call for the next eighteen months).

Market perspectives

We asked some market participants to share their views on the non-call feature of fixed rate international high yield bonds, and the relevance of this feature in their decision making as to whether to pursue a high yield bond or some other form of financing.

Market-leading investors

With the help of the newly formed European Leveraged Finance Alliance Investor Group, we surveyed a number of market-leading international high yield investors. They generally said that the non-call period remains an important aspect of their investment decision. Some comments we received took a strong position.

"Absolutely no way," one commenter says. "Coupons are currently so low and average maturities so short that we should be pushing to have the same non-call life protections that the investment grade market enjoys. Certainly it is a key issue for us and a major determinant if we do or don't invest in the name."

|

|

It is worth considering whether the time has come to change the general approach to the non-call, particularly given the proliferation of the TLB |

|

|

The non-call period is of relevance when determining the total return expectation and the accuracy of pricing for a particular issuance. One investor noted that it is more difficult to properly price any variation from market norms, which raises the concern of value under-pricing for transactions with unique features. However, this investor indicated that, given the direct and indirect softening of the non-call protections, the non-call protection is less relevant than it was in previous periods, and they would also focus on other aspects of the bond terms, such as value leakage that the portability/restricted payment provisions might permit.

"In reality what causes a make-whole payment is not the non-call period. The change of control provision is a 101% put and it saves me money but it never makes me money. If a credit is trading at 105% and doing well you are never going to take the put at that price. The only reason that you get the make-whole is because there is something else in the documentation that the company doesn't want to deal with under the proposed change of control transaction, so I try and focus my attention on the restricted payment restrictions. Of course, that has been difficult to achieve in a sponsor friendly environment, and I am worried that the market is not pricing this additional flexibility correctly."

The investors also noted that another consideration when evaluating a floating rate high yield bond vs TLB (namely where the non-call is less relevant) is the ease of repricing a TLB compared to a high yield bond.

"In a rallying market, TLBs are a very attractive option for sponsors as they benefit from the fact that, notwithstanding a soft call period, they have the ability to perpetually refinance or reprice their loan debt with relative ease compared to the European high yield market. This is a very valuable option for sponsors and while this is in large part due to structural considerations of the CLO market and, in particular CLO trade limitations, I would argue that loan investors could be asking for more in return."

Top-tier sponsor

On the opposite side of the argument, a top-tier European sponsor advised us that the non-call feature is the primary consideration against putting high yield bonds into its capital structure:

"We invest in highly cash generative companies, and having a multi-year non-call period high yield bond in our capital structure that limits our ability to repay debt at a low cost is unattractive when compared to the current TLB market."

The sponsor was also relatively indifferent to the possibility of a rising interest rate environment and the effect of such a development on its decision to issue fixed rate high yield bonds versus floating rate notes or TLBs given the relative ease to swap floating rate debt to fixed rate debt at a low cost in the existing market. Accordingly, the sponsor thought that the addition of a call-ability feature that would limit the cost of an early redemption upon a change of a control or IPO would materially affect how it assessed the attractiveness of issuing a high yield bond versus a TLB. That said, the sponsor did highlight that there were other factors outside call periods that influenced its decision, including the amendment process for TLBs (in particular, a closely held second lien) being less onerous when compared to high yield bonds.

Leading capital markets desk

Investment banks play an essential role connecting investors and issuers and have invaluable insight into both sides of the market. To get the investment bank perspective, we spoke with Dominic Ashcroft, managing director, and co-head of EMEA leveraged finance capital markets and syndicate at Goldman Sachs. Dominic agreed that the non-call feature was one of the main driving factors that distinguished high yield bonds and the TLB product, particularly since the TLB product had moved to a covenant-lite instrument:

"You could argue that six or seven years ago when we had covenanted loan deals, there was more of an even playing field between high yield bonds and leverage loans as sponsors and issuers had to balance the choice between a covenant-lite non-call period high yield bond on the one hand and a callable covenanted loan on the other. That distinction no longer exists and from an issuer perspective call-ability is probably the biggest single driver."

But is the non-call feature of high yield bonds going to change substantially? While there are always exceptions, Dominic is sceptical about such a development:

"The traditional high yield investor has normally held pretty firm on call protection. You may argue with an increasing amount of exceptions but in reality the call schedules and structures have been reasonably constant over an extended period of time."

On the flipside, will floating rate investors demand more call protection if we get into a period where there is a fall off in investor demand from loan accounts combined with an increase on the supply side?

"Right now the reality is that loan investors only get six months of soft call but you don't need to go back too far in time when we had 12 months of soft call and then not too much further back when we saw a handful of loan deals flex to 101 to 102% hard call. In that market, the gap in call periods between high yield bonds and TLBs becomes less pronounced."

Outlook

While market participants are confident that the international high yield market will provide a popular source of liquidity for the foreseeable future in its existing form, circumstances may be favourable in 2019 for the appropriate issuer at the right time and in a strong market to test the boundaries of the non-call period, in particular in the case of sponsors and/or corporates looking for additional flexibility for key market events like changes in ownership or IPOs.

Further, if the market mix for financial products continues to weigh towards the TLB in preference to the high yield bond, investors who require or wish to hold portfolio investments in bond form may become more amenable to this broader thinking, in particular if the market balance affects the quality and scope of the available credits.

There is also a question of whether TLB investors have gone too far and are not pricing the additional flexibility of their product correctly. Will this and/or other factors, such as the end of a rallying market and the possibility of raising interest rates, result in a rebalancing towards the high yield bond market without substantive change to call structures?

Structural factors such as the strength of the European CLO market and the effect of global economic uncertainty dampening the prospects of central banks raising interest rates may suggest otherwise, but watch this space in 2019.

|

Rob Mathews Partner Baker McKenzie, London E: rob.mathews@bakermckenzie.com T: +44 20 7919 1832 |

|

|

Haden Henderson Partner Baker McKenzie, London E: haden.henderson@bakermckenzie.com T: +44 20 7919 1711 |