Japan

Partners at JunHe, Morrison Foerster and White & Case discuss the forces that shaped dealmaking across China, Japan and Hong Kong this year

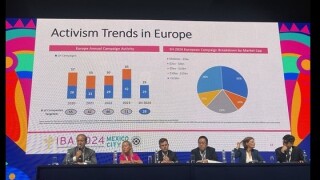

From corporate governance improvements to increasing shareholder activism, a number of factors are fuelling M&A activity in Japan

Succession issues, carve-out opportunities and regulatory reforms are creating a deal environment mutually beneficial for both Japanese business owners and PE firms

New hires were made across the practices in finance, M&A and funds practices in Tokyo, London, New York and Los Angeles

Climate-conscious contracting is gaining traction worldwide as businesses face growing pressure to meet stringent sustainability regulations

Inbound investment interest, particularly from PE firms, as well as take-privates are driving deals in Japan

New hires were made across the M&A and finance practices in New York, Los Angeles, Tokyo and Ho Chi Minh City

The finalists for the 26th annual Asia-Pacific Awards 2025 are revealed - winners will be presented in Hong Kong on April 16

Sponsored

Sponsored

-

-

Sponsored by Nagashima Ohno & TsunematsuA pressing issue in Japan is the ageing population combined with the diminishing birth rate. The Japanese government has been in the dark on how to handle these two elements. At first glance, these two concerns appear to present conflicting demands, namely (i) expanding health and medical services for the elderly, while at the same time; and (ii) minimising the use of public funds for those health and medical services, as a means of tackling the issue. Therefore, in order to deal with this problem, the Japanese government has drawn attention to the use of private resources, such as private funds, including Japanese real estate investment trusts (J-Reits), to provide sufficient monetary resources to the health and medical care industries through the acquisition of their assets.

-

Sponsored by Anderson Mori & Tomotsunewww.amt-law.com