Japan

Partners at JunHe, Morrison Foerster and White & Case discuss the forces that shaped dealmaking across China, Japan and Hong Kong this year

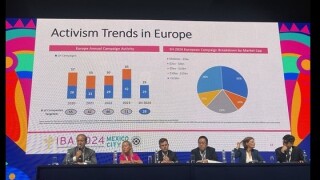

From corporate governance improvements to increasing shareholder activism, a number of factors are fuelling M&A activity in Japan

Succession issues, carve-out opportunities and regulatory reforms are creating a deal environment mutually beneficial for both Japanese business owners and PE firms

New hires were made across the practices in finance, M&A and funds practices in Tokyo, London, New York and Los Angeles

Climate-conscious contracting is gaining traction worldwide as businesses face growing pressure to meet stringent sustainability regulations

Inbound investment interest, particularly from PE firms, as well as take-privates are driving deals in Japan

New hires were made across the M&A and finance practices in New York, Los Angeles, Tokyo and Ho Chi Minh City

The finalists for the 26th annual Asia-Pacific Awards 2025 are revealed - winners will be presented in Hong Kong on April 16

Sponsored

Sponsored

-

Sponsored by Nagashima Ohno & TsunematsuOn April 19 2019, the Financial Services Agency of Japan published the Cabinet Order to Partially Amend the Order for Enforcement of the Financial Instruments and Exchange Act (draft). Of these proposed amendments, this article examines the amendment concerning disclosure regulations that relate to share compensation. Please note that, as of May 31 2019, the effective date of the proposed amendments has not been announced, and the content of the proposed amendments may change.

-

Sponsored by Nagashima Ohno & TsunematsuOn November 30 2018, partial amendments to the Ordinance for Enforcement of the Notary Act (Amended Ordinance) came into force. The Amended Ordinance aims to identify the beneficial owners of companies and improve transparency in order to prevent money laundering or terrorism financing activities. According to the Amended Ordinance, when making an application to a notary for the authentication of articles of association to incorporate new joint-stock companies (kabushiki-kaisha), general incorporated associations (ippan-shadan-houjin) or general incorporated foundations (ippan-zaidan-houjin), applicants must declare to the notary: (i) the beneficial owner of the company; and, (ii) that the beneficial owner is neither a member of criminal organisations nor an international terrorist, and where there is any reasonable doubt the notary will request the applicant to provide explanations.

-

Sponsored by City-Yuwa PartnersIzuru Goto, Yasuyuki Kuribayashi and Takashi Saito of City-Yuwa Partners introduce Japan’s new regulatory regime for virtual currencies, which is due to be in place by about April 2020