IFLR Special Focus

Local currency depreciation and the sovereign debt crisis have made investors hesitant but private equity is a bright spot

Local restructuring law harmonisation aims to make the EU more competitive with the UK but implementation is proving difficult

IFLR has partnered with investment leaders to explore the landscape of foreign direct investment (FDI) at a time when the global economic landscape is recovering from COVID-19 and struggling with rocketing gas prices and supply chain issues

IFLR has partnered with leaders in the legal and cryptocurrency spaces to explore the legal and regulatory implications of the growing popularity of digital currencies from South Korea to Ghana

IFLR has partnered with thought leaders from across the legal world to discuss subjects ranging from mandatory disclosure rules to IPOs, in jurisdictions from China to Luxembourg

IFLR’s correspondents from across the African continent discuss topics including the intersection of finance and digitalisation, attracting foreign investment, and legal certainty in deals including M&A, in this latest Special Focus

As the global economy recovers from the shock of Covid-19, it faces further shocks from the Russia-Ukraine war and high inflation. IFLR’s leading correspondents report on the international restructuring and insolvency landscape

As technologies including NFTs, DLT, and blockchain grow in popularity, Asia’s lawmakers are considering how to manage risks and create a stable regulatory environment, as IFLR’s correspondents report.

Sponsored

Sponsored

-

Sponsored by VdAGabon responded quickly to Covid-19, leveraging off its experience with Ebola and Cholera. Matthieu Le Roux, Olivier Bustin and Carolina Reis of Vieira de Almeida (VdA) review the results of the government’s actions and what the pandemic says about Gabon’s future economic development.

-

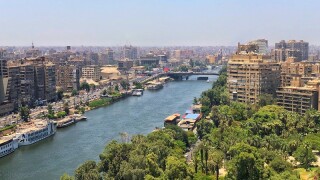

Sponsored by Matouk BassiounyA Q&A with the Matouk Bassiouny & Hennawy team on the ability to furlough employees, reduce salaries, freeze annual raises and other key employment issues under Egyptian law in light of Covid-19.

-

Sponsored by Soliman Hashish & PartnersMohamed Hashish of Soliman Hashish & Partners reviews Egypt’s New Draft Banking Law, which is making its way into the market at the behest of the Central Bank of Egypt. The law diverges substantially from the existing regime