M&A operations in Portugal were negatively affected during 2020 by the COVID-19 pandemic. According to data from Transactional Track Record (TTR), M&A transactions in 2020 reached nearly €10.4 billion (approximately $12.6 billion). As a comparison, the 2019 figure had reached €13.4 billion.

According to the same data source, 80 asset acquisition operations (with an aggregate value of €2.4 billion), 56 venture capital transactions (with an aggregate value of €881 million), and 29 private equity transactions (with an aggregate value of €4.28 billion) were carried out in 2020.

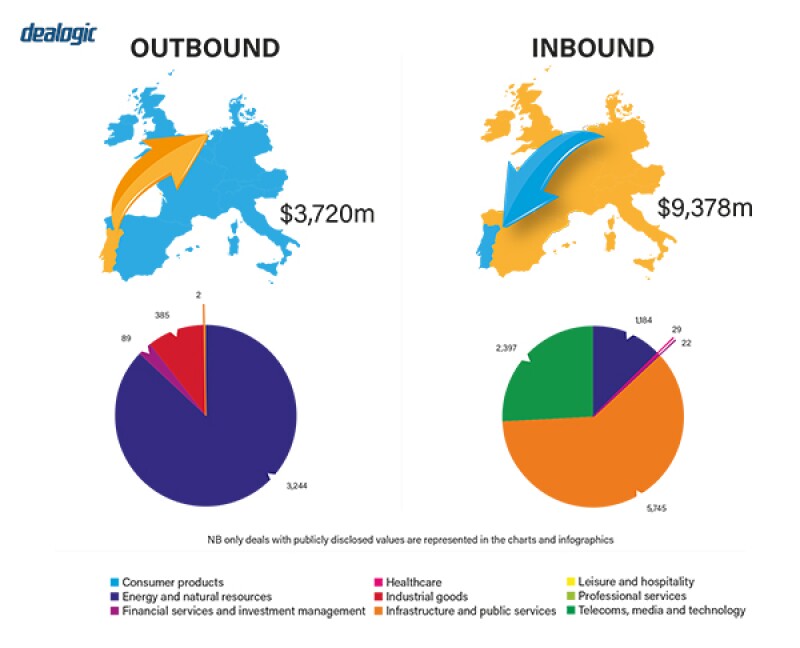

By the end of 2020, Spain-based investors were still leading inbound investments and Spain was once again the favourite destination for Portuguese-based investors. France and the UK are also in the top three for inbound investments.

|

|

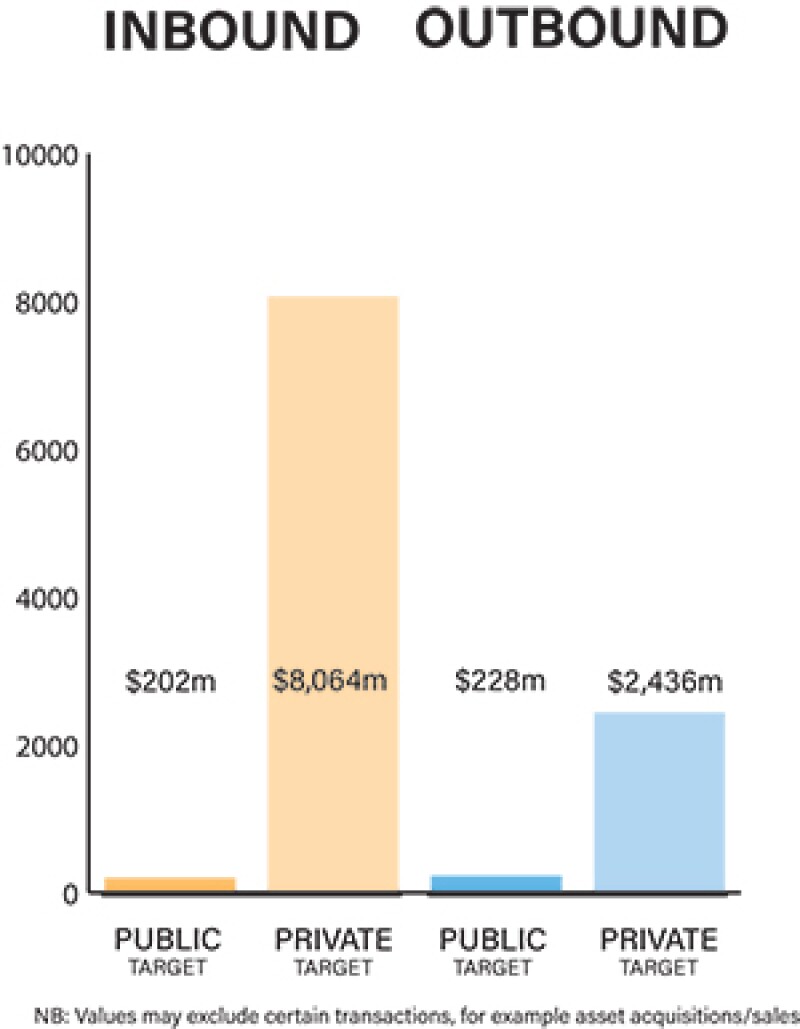

The Portuguese market is mainly driven by private M&A transactions |

|

|

The Portuguese market is mainly driven by private M&A transactions – however this does not mean that there are not relevant public M&A transactions. A recent notable transaction saw Media Capital being sold by the Spanish media group PRISA to a group of Portuguese investors, by the means of a public offer.

Another notable transaction in the Portuguese market saw the sale of a 81.1% stake at Brisa, the company that holds most of the highway concessions in the country, by Grupo José de Mello and Arcus to a multinational consortium. The buying company comprises of APG – which manages the assets of ABP – a pension fund of civil servants from the Netherlands, NPS – a South Korean national pension service, and SLAM – the asset management subsidiary of Swiss Life. This transaction started in 2018 and, according to publicly available information, it was concluded despite its final value being negatively affected by the pandemic.

It is also important to highlight the acquisition by Disa – the fourth largest petrol distributor in Spain – of Prio from Oxy Capital. Prio distributes and commercialises liquid fuels and electric energy for mobility and runs more than 250 fuel stations across Portugal.

COVID-19 and recovery plans

It is yet to be determined if the COVID-19 pandemic has affected the conclusion of ongoing operations and whether it will affect future operations. The number of deals and their values in the years to come, particularly in 2021 and 2022, may be negatively affected.

However, the COVID-19 pandemic and its economic consequences have provided business opportunities in the Portuguese market. It is very difficult at this stage to make any forecast however it is foreseeable that the M&A market will most certainly recover its vigour in the next couple of years.

Despite the continuously low interest rates, the financial institutions' capacity to finance M&A operations may have been impacted by the moratorium granted to their clients. These facilities will most certainly have a negative impact on the financial institutions' yearly statements, and it is yet to be seen what the impact on the institutions' availability of resources will be.

The EU measures of support to the economic recovery are also expected to have a positive impact on the M&A market. Some countries may experience an additional consolidation in the banking sector. This consolidation will also impact M&A activity.

Financial investors have been playing an important role in the Portuguese M&A environment. As a result of their increased presence, sources for financing have been diverted from traditional bank financing to alternative solutions. This has had an impact on the market with the lack of bank financing, no longer being a problem.

It is also important to note that some of the biggest transactions have been concluded by financial investors that recognise the quality of the Portuguese assets and the solidity and stability of the Portuguese market.

It is expected that the M&A market will bounce back in the next couple of years as a result of the economic upturn, supported by the EU and government support measures and structural reform plans. This reform plan will most certainly create opportunities in key sectors such as infrastructure, energy and other utilities, and transportation, among others.

Legislation and policy changes

The main regulatory bodies that govern M&A transactions are the Portuguese Securities Market Commission (Comissão do Mercado de Valores Mobiliários – CMVM); Bank of Portugal (Banco de Portugal); Competition Authority (Autoridade da Concorrência); the Insurance and Pension Fund Supervision Authority (Autoridade de Supervisão de Seguros e Fundos de Pensões); the National Authority for Communications (ANACOM); the Energy Services Regulatory Authority (ERSE); and the ERC (media regulator). Depending on the target and the relevant sector of activity, other laws and regulations may apply.

The key legislation that governs M&A activity is the Companies' Code (Código das Sociedades Comerciais), the Securities Code (Código do Mercado de Valores Mobiliários), Competition Law (Lei da Concorrência and other laws and regulations that may vary according to the industry sector in which the targeted company operates.

A major change to the legal regime of the credit institutions, known as the Banking Activity Code (Código da Actividade Bancária), was under public consultation until January 15 2021. The results are yet to be published.

The legislative process is very dynamic in Portugal and requires permanent update and contextualisation. Given this, local legal advice is mandatory and decisive in the preliminary assessment of the operation.

Market norms

The most common issues that arise in relation to the Portuguese market derives from the fact that legislative and regulatory processes applicable to specific M&A transactions, with specific criteria and requirements are not familiar to foreign investors. It is not uncommon for foreign investors to believe that the procedures of their origin jurisdiction are the same as those applicable in Portugal. This can lead to a duplication of efforts, with irrelevant documents being drafted.

The nature of frequently asked questions by investors varies a lot and depends largely on the target company's sector as well as the stage of the transaction. Nevertheless, the more important questions usually address issues of corporate matters, M&A rules, competition, tax and regulatory aspects.

As for legal practice, technology in the deal-making process is increasingly important and companies are more aware of it and have been acting accordingly. During an M&A process it is not uncommon that a company is exposed to risks because it becomes the object of due diligence and auditing and therefore needs to share documents and negotiate with counterparties that may not adopt the same levels of security and care. Apart from preparing for external threats, companies may also internally control which information is disclosed during a negotiation process.

Public M&A

The applicable rules for obtaining control of a public company are the ones delineated in the Securities Code as well as in the regulations issued by the Portuguese Securities Market Commission. Those rules define the structure, content, and procedure for formalising a public offer. Public offers (addressed to most investors) differ from private offers because they require information to be issued in a standard way and are subject to registration with the CMVM.

The documents containing the offers' mandatory information are called the prospectus (prospecto) and offer announcement (anúncio de lançamento) and are always available on the CMVM's website and elsewhere; when preparing public offers and when drafting these documents the intervention of a financial intermediary is mandatory.

The prospectus and the offer announcement are the official documents that ensure that all the information necessary for the investors to take an informed and well-grounded decision regarding the public offer is made available. The organisation of the information in these documents is subject to models and templates, to allow for an easy comparison with different offers, between several types of securities and between different companies.

The prospectus and the offer announcement shall mandatorily include information on:

The offeror;

The type of offer;

The quality in which the financial intermediaries intervene;

The price and global amount of the offer or the range between the maximum and minimum price, the nature and other terms of payment;

The offer period;

The allotment criteria;

The conditions to which the offer is subject;

The places where the prospectus is published and made available; and

The clearing entity.

The most common conditions attached to public offer takeovers are the approval by regulation authorities such as the competition authorities or sectoral regulators or the acquisition of a certain threshold of shares.

In some offers there are conditions regarding the approval of certain governance documents or amendments to some governance documents by the shareholders.

Break fees in public M&A are also common in Portugal.

Private M&A

With the increasing amount of complex transactions it is standard to see different solutions and mechanisms to determine a transaction's price, either by means of a fixed price (locked-box mechanism) or an adjusted one (depending on the company's performance – earn-out – or based in completion accounts). Considering the characteristics of the different price adjustment models, some are usually seen as pro-buyer and while fixed price models are usually favoured by sellers.

Likewise, the increase in M&A has led to more activity in the M&A-related insurance sector. This has become a trend in recent years and can be found not only in M&A transactions but also in assets transactions, especially in real estate transactions.

|

|

In 2020, the market for IPOs was virtually non-existent in Portugal |

|

|

It is very difficult to determine what type of conditions are more commonly attached to a private takeover offer because they depend on the particulars of the transaction. What appears in a written SPA depends on the situation and what is agreed between the parties. Most M&A transactions involving Portuguese companies are subject to Portuguese law and jurisdiction, despite transaction parties being able to subject the documents to foreign law, especially when there are foreign investors involved. It is also very common that disputes are subject to foreign arbitration.

In 2020, the market for IPOs was virtually non-existent in Portugal. There were some public subscription offers of securities, but no IPOs in the market, and it is likely that COVID-19 may have been one of the reasons for this.

According to the CMVM latest report, the secondary market in January 2021 reached €2.36 billion, a €304.6 million (14.8%) increase from December 2020 and a €113.8 million (-4.6%) decrease on January 2020. Transaction value on the Euronext Lisbon was €2.36 billion, representing an increase of 14.8% on a monthly basis and a 2.1% increase year-on-year.

These figures also reflect the impact of COVID-19 on the market and do not show the potential of the Portuguese market.

Looking ahead

At this stage, it would be very bold to make any predictions. Nevertheless, the economic upturn and the opportunities that are foreseen will most certainly have a positive impact on the M&A market and in the legal practice associated to it.

The support plans to be implemented by the EU, as well as the Portuguese government's plans to boost economic recovery, will most certainly have a positive impact.

Click here to read all chapters from the IFLR M&A Report 2021

Nelson Raposo Bernardo

Managing partner

Raposo Bernardo & Associados

T: + 351 21 3121330

E: nrbernardo@raposobernardo.com

Nelson Raposo Bernardo is the managing partner of Raposo Bernardo & Associados. He is the head of the firm's banking and projects practices and co-heads the corporate practice. He has more than 25 years of experience as a lawyer in high-profile and complex legal operations.

Nelson is strongly experienced and reputed in legislating, being a co-author of the present Portuguese Securities Code and has led several legislative reform committees, in several countries, in banking, financial, insurance, projects, start-ups and venture capital areas. He regularly advises clients on transactional work in the banking, infrastructure and pharmaceutical sectors. His recent transactions include advising an international bank consortium on an aircraft portfolio financing, a Portuguese bank in relation to asset and portfolio structuring for securitisation purposes in the automotive industry, and working for a Japanese bank concerning international credit operations.

Nelson is a graduate of law from the University of Lisbon, and also earned a master's degree in juridical sciences (corporate law) from the same school. He is an assistant professor of corporate and commercial law at the University of Lisbon for almost 20 years and on a regularly basis teaches entrepreneurship, start-up, and management courses at INDEG-ISCTE Executive Education in Portugal.

Joana Andrade Correia

Partner

Raposo Bernardo & Associados

T: + 351 21 3121330

E: jacorreia@raposobernardo.com

Joana Andrade Correia is a partner at Raposo Bernardo & Associados, who has co-headed the corporate and M&A department for 20 years.

Joana has led multiple domestic and international operations, including corporate restructurings and M&A transactions for key players in different sectors such as aviation, banking and finance, pharmaceutical, energy and infrastructure. She has worked on several logistics projects in many special commissions to review and reform legislation in the telecommunications, media, broadcasting and infrastructure sectors. Her recent work includes advising a major European private airline in the privatisation of a public airline, a large German bank in the negotiation and preparation of a bank financing relating to the acquisition of commercial aircraft portfolio, and an aircraft leasing platform on transactions involving airlines and aircraft leasing companies, acquisitions and leveraged financings.

Joana holds a degree in law from the University of the Lisbon. She has further post-graduate qualifications in business and corporate law by the Catholic University of Lisbon, in legistics and legislation science by the University of Lisbon, and in tourism law by the Estoril Tourism School.