The Japanese M&A market in 2020, like markets globally, was deeply impacted by the COVID-19 pandemic. Notably, there was a dramatic decrease in outbound deal volume with Japanese corporations instead focusing on the domestic market.

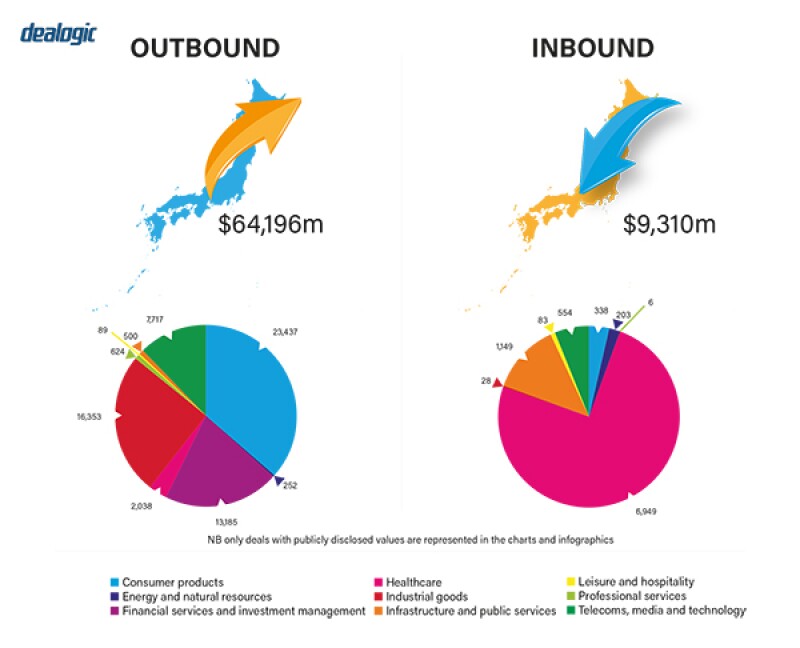

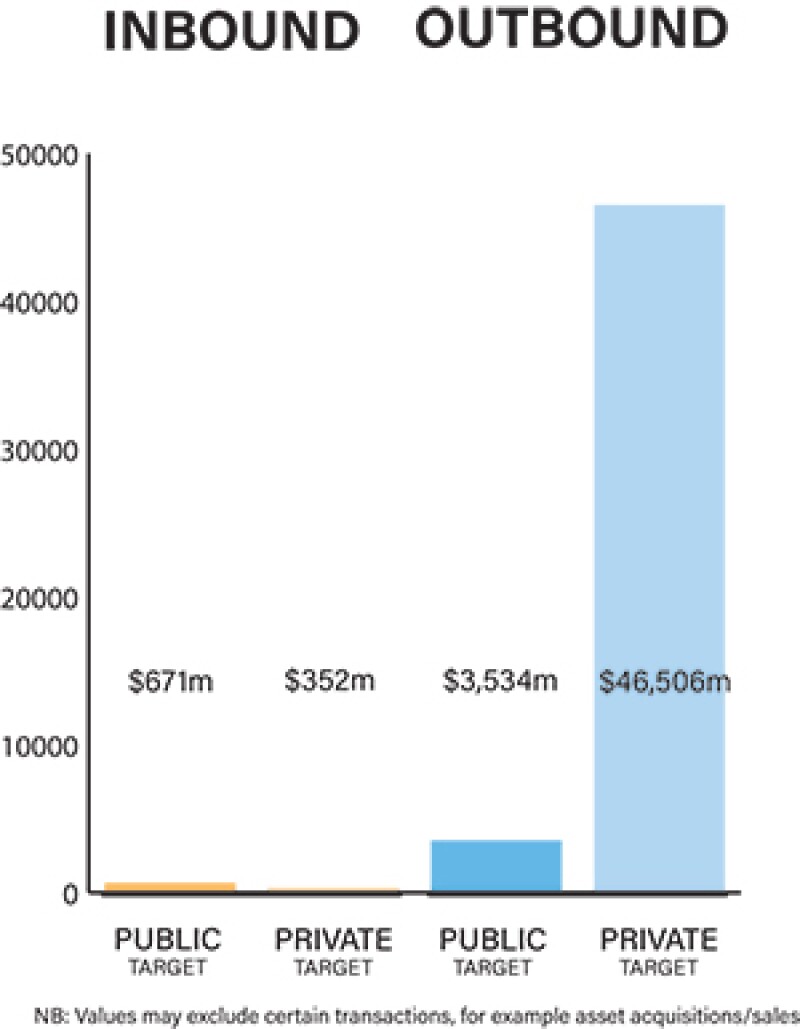

Japanese companies continued the trend of shedding non-core assets and consolidating their businesses. According to data from Dealogic, Japan's M&A deal volume in 2020 fell to 538 total transactions, with a total deal value of over $73 billion. Although deal volume was down from 2019, globally Japan was only surpassed by Germany, the US and the UK in terms of total deal value. The sectors producing the largest number of transactions were retail, financial services, and chemicals.

The total deal value in Japan for 2020 ended slightly higher than 2019, largely due to a small number of high value transactions completed in the fall of 2020, which include:

Nvidia's $40 billion acquisition of Arm from SoftBank Group: The sale of British chip company Arm, which SoftBank had purchased for $32 billion several years earlier, has led to speculation that SoftBank Group may consider going private via a management buyout, and that would be in line with the overall trend in the Japanese market. The deal is expected to close in the second half of 2021.

Seven & i Holdings $21 billion acquisition of Speedway: This transaction was the largest outbound M&A deal of the year and a sign to some that while many large M&A deals had been put on hold due to COVID-19, strategic transactions would continue to move forward, even amid a global pandemic.

Nippon Paint Holdings / Wuthelam Holdings merger: Nippon Paint, Japan's largest paint maker, reached a $12.2 billion agreement with Singapore's Wuthelam in an effort to dominate the paints and coatings market in Asia. When the deal closes, Wuthelam will be the majority shareholder of Nippon Paint. Japanese companies are seeing greater interest in competitors in East and Southeast Asia, they are not only interested in their assets, but also in their non-core businesses as parties on all sides look to drive shareholder returns.

The impact of COVID-19 and recovery plans

In the first half of 2020, Japan saw a diminished deal flow as companies put a greater emphasis on stabilising operations and adjusting to the impact that COVID-19 was having on their businesses. As companies adjusted to become more comfortable with the 'new normal', the market saw an uptick in M&A activity in the latter half of 2020.

Although there was an eventual increase in M&A activity, some of these deals were ongoing projects that had been put on hold earlier in the year. The outlook for cross border deal-making remains somewhat muted as Japanese executives have traditionally relied on in-person meetings to build personal relationships with potential targets. So long as travel restrictions remain in place, this may prove to be an obstacle in cross-border deal-making until Japanese companies become more accustomed to conducting these meetings virtually.

|

|

Japanese executives have traditionally relied on in-person meetings to build personal relationships with potential targets |

|

|

The most significant trend in the Japanese M&A market in 2021 is expected to be the consolidation among companies eliminating so-called 'parent-child listings'. This structure, where both the parent company and its subsidiary are publicly traded, remains prevalent in Japan, though is not often seen in other markets.

In the last decade, the Japanese government has been pushing corporate governance reforms via Japan's Corporate Governance Code and Stewardship Code. In 2019, the Ministry of Economy, Trade and Industry (METI) issued a set of practical guidelines for group governance systems. This requested listed entities to review whether maintaining listed subsidiaries was actually an optimal strategy for their business, and further stated that they must provide reasonable explanations for the need for such listed subsidiaries and the means of controlling such subsidiaries effectively.

In light of these directives, there have been a number of large-scale transactions involving listed subsidiaries whether through going-private transactions, management buyouts (MBOs), or outright sales. The four largest M&A transactions completed in Japan in 2020 were domestic transactions falling within these categories.

Shareholder activism remained robust in 2020. In February, it was reported that Elliot Management was applying pressure on SoftBank Group, in relation to its share buyback on the open market and its increase in number of external directors. SoftBank Group announced a share buyback plan to purchase up to ¥2.5 trillion (approximately $23 billion), out of which ¥2 trillion is to be funded through an asset divestment of no more than ¥4.5 trillion.

In 2020, there was also a record number of MBOs in Japan. MBOs had been relatively rare since the 2008 financial crisis as stock prices have remained high in an extremely low interest rate environment. However, since the onset of the pandemic, as stock prices have been in decline, the market has been ripe for private equity (PE) tender offers and PE-backed MBOs. Should COVID-19 continue to negatively impact stock prices, PE funds are likely to remain an important player in the Japanese M&A market.

Legislation and policy changes

Japan's principal regulator of M&A activity is the Japan Fair Trade Commission (JFTC) in particular, the JFTC is responsible for reviewing merger control filings. The JFTC regulates M&A deals under the Act on the Prohibition of Private Monopolization and Maintenance of Fair Trade (Antimonopoly Act) and the Foreign Exchange and Foreign Trade Act (FEFTA).

While the JFTC did not block any major M&A transactions in 2020, it did, pursuant to the Antimonopoly Act, order the secondary review of DIC Corporation's proposed acquisition of the shares of BASF Colors and Effects Japan Ltd. (BASF), part of DIC Corporation's acquisition of BASF's global pigment business, for possible impacts on competition from the proposed acquisition of shares. The JFTC eventually determined not to issue a cease and desist order, allowing the transaction to proceed, however, the secondary review process lasted over six months.

As Japanese companies continue to consolidate their core businesses and look to acquire rivals within the same market segment, the JFTC is likely to remain very active in its review of M&A activity in Japan.

In May 2020, certain amendments to the FEFTA took effect. In the interest of national security, the amended FEFTA lowers the threshold of the shareholding ratio for the advance notification to the Bank of Japan (in practice, this is equivalent to an approval) requirement from 10% to 1% for investments in certain public companies deemed 'covered businesses'. This designation is made from the standpoint of the businesses' relationship to national security. The review process generally takes between two weeks and one month depending on the Bank of Japan's familiarity with the company applying and the nature of their business.

In conjunction with the implementation of the amended Companies Act on March 1 2021, which will introduce a 'share delivery' (kabushiki koufu) concept, whereby Japanese joint stock companies use their own shares as consideration paid to a target company's shareholders in certain domestic M&A transactions and when creating a new subsidiary.

The tax reform outline (zeisei kaisei taikou) for 2021 is expected to introduce a tax deferral for capital gains resulting from a 'share delivery', in order to promote business reorganisations and enhance the competitive power of Japanese companies. 'Share delivery' may not be used in the event that a foreign company is either the buyer or the target. Discussions among practitioners in relation to how to use 'share delivery' in a take-over-bid context involving a listed company are ongoing.

Market norms

There remains a misconception that decision-making–and therefore deal speed–is negatively impacted because of the need for Japanese companies to reach consensus among numerous decision makers within the company before a deal will be approved.

While there is still some validity to this view among less sophisticated players, more sophisticated Japanese companies have made efforts over the last decade to grow more nimble by streamlining internal procedures and putting more decision making power into the hands of project managers.

In cross-border M&A transactions, typical areas where issues may arise are in relation to human resource integration, in particular, pension plans, healthcare insurance and fringe benefits. The benefits in these areas often vary greatly among the parties to a transaction, and these differences can prove difficult to reconcile. These benefits often occupy a relatively small space within the M&A documentation, but in practice, can prove to be some of the most important factors in terms of closing deals in a timely manner and the success of integration plans post completion.

Over the last few years there has been a rapid increase in the breadth of technology available to M&A practitioners and clients in Japan. Since the COVID-19 pandemic began, video conferencing software use has become ubiquitous among not only professionals, but also the public at large.

Since mid-year 2020, the Japanese government has been pushing companies to ensure that at least 70% of their staff work from home, meaning more people are becoming accustomed to conducting meetings and negotiations virtually, and leveraging on a wider variety of technologies to interact remotely, resulting in greater access to technology and a client base comfortable with those technologies. In addition to the rapid advances in video conferencing, virtual data room service providers are constantly providing more advanced services which make completing the due diligence process completely online a real possibility.

Public M&A

The primary law governing M&A, including those of public companies, is the Companies Act. The most common method for obtaining control of a public company in Japan is by means of a cash tender offer. The detailed rules in relation to when a mandatory tender offer must be made, are detailed in the Financial Instruments and Exchange Law.

When making a tender offer, the bidder is required to make the offer on the same terms and conditions to all shareholders. Conditions customarily attached to tender offers include that the bidder will not purchase any shares if (i) the number of shares tendered is less than the number of shares originally specified by the bidder in the offer; or (ii) a part or any part of the shares tendered exceeds the number (which must be less than two-thirds, above which level the bidder must offer and purchase all shares tendered) of shares originally specified by the bidder in the offer (in the case of (ii), the bidder must purchase on a pro rata basis). A tender offer may be withdrawn only on the basis of certain statutorily prescribed conditions. A financing-out is generally not allowed.

Break fees that are reasonable are thought to be generally enforceable in Japan, however, they are not common in public M&A transactions.

Private M&A

The consideration mechanism used in most private transactions is closing accounts, with the use of a locked-box mechanism being relatively rare. Lump-sum payments without a completion true-up are also relatively common, in particular, for deals involving small and medium-sized enterprises.

The use of earn-outs and escrow arrangements in Japan remains relatively rare.

Deals of a certain size will typically condition closing upon satisfactory due diligence, accuracy of representations and warranties, no breach of obligations and undertakings, completion of all transactional documentation and internal approvals, third party approval of a change-of-control, resignation (or retention) of directors, the absence of any material adverse change, and regulatory consents, including merger control and inward direct investment approval, for deals over a certain threshold or in regulated industries.

Deals involving Japanese assets or shares are most commonly governed by Japanese law and subject to the jurisdiction of Japanese courts. However, where one of the parties is based outside of Japan, the parties may negotiate for the use of commonly accepted laws (England and Wales or New York) or the parties may agree upon the use of foreign-seated arbitration.

In recent years, both trade sales and IPOs continue to be viable options for exits in Japan.

Looking ahead

The market outlook for 2021 remains generally positive and expectations are that the uptick in M&A activity at the end of 2020 should continue into 2021 on the premise that COVID-19 will remain at current levels or see some improvement.

With Japanese corporations and PE funds both sitting on substantial amounts of cash available for new transactions, it is reasonable to assume that corporations will continue to divest assets and non-core businesses and PE funds will continue to be interested in acquiring these assets and businesses. For the companies who have already trimmed assets and non-core businesses domestically, they may begin looking to opportunities abroad to make complimentary acquisitions.

Due to the continuing impact of COVID-19, an increase in number of M&A deals involving distressed business or companies over the next 12 months can also be expected. In relation to METI's announcement of the 'Practical Guidelines for Business Restructuring: Toward Transformation of Business Portfolio and Organization' aimed at achieving sustainable growth amid the rapid changes being implemented in the Japanese business environment, the market is potentially likely to see more 'selection and concentration' activity by Japanese companies.

Furthermore, there is a likelihood of seeing the first transaction using a 'share delivery' combined with a take-over-bid, once the tax deferral is crystalised in the upcoming tax reform in 2021.

Click here to read all chapters from the IFLR M&A Report 2021

J Ryan Dwyer III

Managing partner (Tokyo)

K&L Gates

T: +81 3 6205 3601

J Ryan Dwyer III is the managing partner of K&L Gates' Tokyo office and is a member of the firm's global advisory council.

Ryan concentrates his practice on cross-border M&A for Japanese clients investing outside of Japan, foreign direct investment into Japan by US and other non-Japanese companies and international joint ventures involving Japanese parties. He has extensive experience advising non-Japanese companies on the corporate, regulatory, employment and commercial aspects of transactions and investing in Japan and setting up and operating businesses in Japan. He has a particular focus in the technology sector, advising companies in relation to licensing and distribution agreements, and regulatory issues.

Ryan holds a bachelor's degree from the University of Vermont and a JD from William S Richardson School of Law, the University of Hawaii.

Tsuguhito Omagari

Partner

K&L Gates

T: +81 3 6205 3623

E: tsuguhito.omagari@klgates.com

Tsuguhito Omagari is a partner at K&L Gates' Tokyo office.

Tsuguhito is experienced in matters including domestic and cross-border M&A, PE, domestic and international joint ventures, investments into Japan and by Japanese companies overseas, and private investment in public entities (PIPEs). He has acted for domestic and international banks, PE firms, manufacturing companies in various industries, securities firms and real estate asset managers.

Tsuguhito has a bachelor's degree in law from the University of Tokyo and a LLM from the University of Pennsylvania.

Kyle Jackson

Associate

K&L Gates

T: +81 3 6205 3639

Kyle Jackson is an associate at K&L Gates' Tokyo office, where he is a member of the corporate practice group.

Kyle has advised clients on a wide range of cross-border transactions, in particular M&A, joint ventures and strategic alliances, licensing, and supply and distribution arrangements, often involving multi-jurisdictional issues. Prior to joining the firm, he served as legal counsel for a leading Japanese chemical company in Tokyo where he was responsible for the execution of international acquisitions, joint ventures and joint development projects.

Kyle completed his bachelor's degree at the University of South Florida and his JD at Duke University.