M&A transactions in Turkey have established momentum in 2021. In certain transactions, the relevant parties ought to obtain the approval of the Competition Authority (Authority). The number of transactions reviewed by the Authority has increased by 40% compared to 2020. E-commerce transactions have played a crucial part; digitalisation, logistics and transportation were especially popular subjects among all transactions.

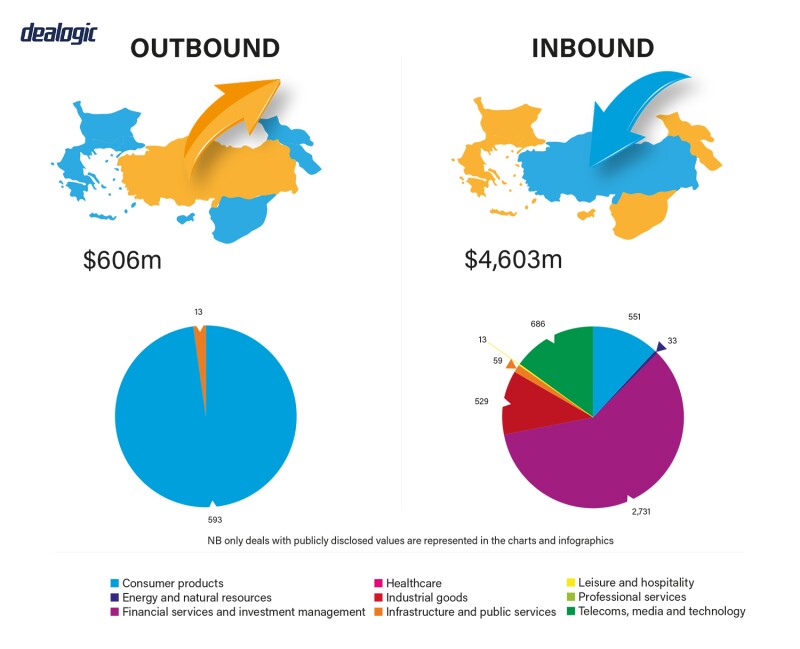

The volatility in the Turkish Lira has been a hot topic for international investors. More than half of the investments in 2021 were made by foreign investors. Venture capital firms and angel investors held an important role in the Turkish M&A market. Private equity deal activity has also increased in 2021.

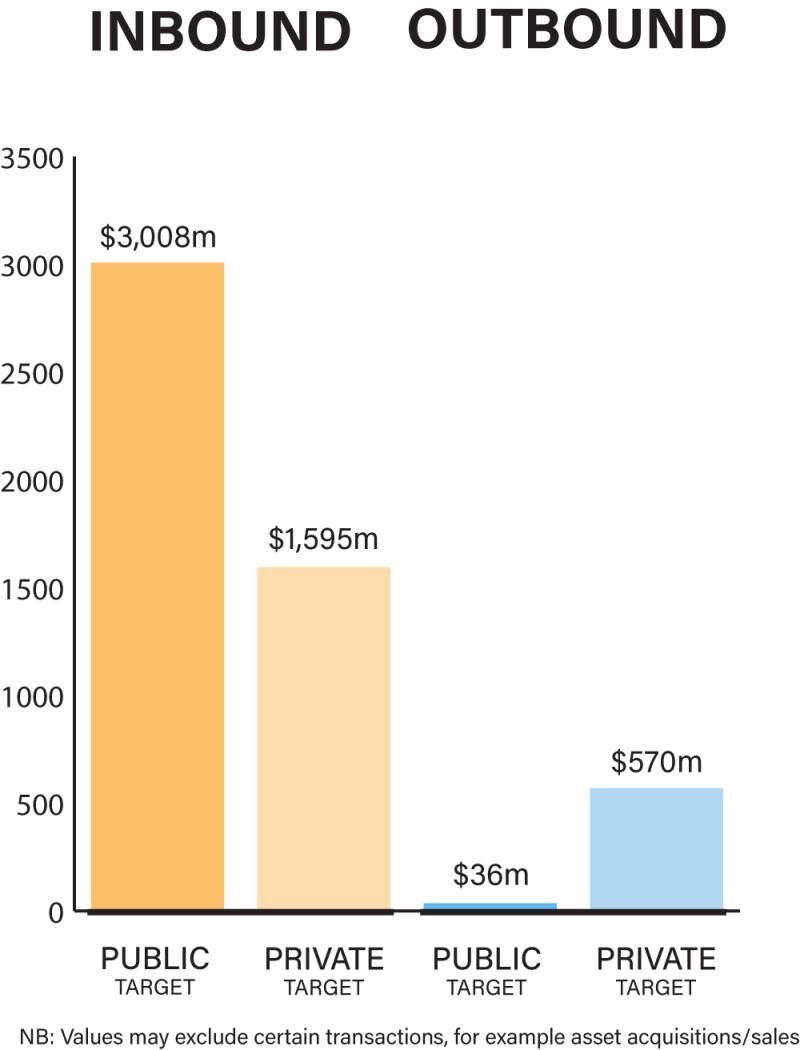

Both private and public M&A transactions were carried out in 2021. A review of the 10 transactions with the highest value shows that two of these were public M&A transactions and five were private M&A transactions.

Trendyol and Getir are two of the largest e-commerce platforms operating in the technology, media and telecommunications (TMT) sector. The investment they received in 2021 was of crucial importance and on the basis of deal value, amount to the highest second and third M&A transactions of the year.

The importance of supply chain and digitalisation grew in line with global trends in 2021. In this respect, e-transportation stands out as well, which is a result of the increasing logistics and transportation needs of the TMT sector. These investments in Trendyol and Getir also restructured the start-up ecosystem in Turkey.

Economic recovery plans

There was an increase in M&A transactions in Turkey in 2021 compared to 2020. There were 304 transactions examined by the Authority, which is higher than the average number of transactions in the last 19 years. Additionally, the number of transactions increased by 40% compared to 2020.

Excluding privatisations, the total value of M&A transactions approximately amounted to TRY42.5 billion. In the same year, seven privatisation transactions with a total transaction value of approximately TRY95 billion were examined before the Authority. The average transaction value in the last nine years for M&A transactions is TRY27.5 billion. 2021 is above average compared to the last nine years, and there was a 46% increase compared to 2020.

The monetary policies and foreign exchange reserves of the Central Bank of the Republic of Turkey (CBRT) has an important impact on the Turkish currency. Establishing predictable monetary and exchange rate policy will have an impact on investors, as it will help to achieve growth and price stability, as well as increased employment. Investors’ interest and risk perception are two important economic indicators for deal flow. It is likely that foreign investors will prioritise strategic sectors. In this regard, TMT; industrial production and automotive; and transportation, pharmaceutical and healthcare are sectors that are likely to be more important in 2022.

|

|

“In 2021, as in the previous year, the TMT sector stands out in terms of the number of transactions by financial investors, with a total of 115 transactions” |

|

|

The realisation of strategic investments by the Turkish Sovereign Wealth Fund, the initiation of tender processes regarding companies that have been transferred to the Savings Deposit Insurance Fund, as well as the assets of the Privatisation Administration, indicate that the transaction volume is likely to increase.

Increasing inflation, taxes and high interest rates constitute pressure on the parties to these transactions. The circumstances dominating the market may lead to investments with high risk and complexity. Deal structures continue to be conventional. The structure generally includes a term sheet, due diligence of the target company, preparation of transaction documents, execution, consent and/or approval of relevant authorities and closing.

The ‘Annual Turkish M&A Review 2021’, produced by Deloitte, reports that venture capital firms and

angel investors increased their activities and had a considerable impact on the financial investors market. KPMG’s ‘Mergers and Acquisitions Trends from a KPMG Perspective’ indicates that financial investors (private equity, venture capital, wealth funds, etc.) accounted for 52% of the total transaction volume with a total of 129 transactions in 2020. In contrast, the 163 transactions made by financial investors represented only 21% of the transaction volume of 2021.

In 2021, as in the previous year, the TMT sector stands out in terms of the number of transactions by financial investors, with a total of 115 transactions. The sale of Trendyol’s shares, with a transaction value of $1.4 billion, is noteworthy as the largest financial investor transaction. Series B, series C and series D investment rounds with transaction values of $555 million, $300 million and $128 million, respectively, realised by Getir, constitute the second, third and fifth highest investments by financial investors.

Legislation and policy changes

For private M&A, Turkish Commercial Code No. 6102 (Official Gazette February 14 2011 No. 27846) is a key piece of legislation governing privately held companies. For public acquisitions, Capital Markets Law No. 6362 (Official Gazette December 6 2012 No. 28513) provides the key framework.

For both privately held and public companies, the Law on Protection of Competition No. 4054 (Official Gazette December 13 1994 No. 22140) requires that the Turkish Competition Board authorise transactions when they result in a change of control and when the revenues of the transaction parties exceed certain thresholds. As a secondary piece of legislation, the Communique on Mergers and Acquisitions by the Turkish Competition Authority No. 2010/4 specifies the requirements and thresholds.

Under Turkish law, if a joint stock company has more than 500 shareholders, or if its shares are traded publicly, then it is regarded as a public company. The Capital Markets Law is the key legislative text for public company acquisitions.

Communiqué No. III.-35/A.2. on Crowdfunding by the Capital Markets Board entered into force upon its publication in the Official Gazette No. 31641 and dated October 27, 2021. The communiqué establishes the general principles of debt-based crowdfunding and makes certain amendments to share-based crowdfunding.

Deloitte’s Annual Turkish M&A Review 2021 contends that virtual deal making is the future of M&A activity. There were almost no travels for negotiations or site visits during the pandemic. Virtual data rooms were used commonly and there was almost no due diligence carried out in the premises of the target companies. It is important to note that official authorities involved in transactions have adapted their operations and are also proceeding on digital platforms. Their operations continue without any disruption.

In the future, climate conscious and Covid-safe investments will be interesting options for investors. Turkey ratified the Paris Climate Agreement on October 7 2021 and it was published in the Official Gazette, and thus, the provisions regarding the ESG rules have entered into force. Additionally, the Ministry of Commerce published The Green Deal Action Plan in 2021, which suggests that investments in green projects will be encouraged.

M&A agreements are being drafted taking Covid-19 into consideration. Force Majeure clauses are drafted in detail, as parties prefer comprehensive and prudent structures rather than standard force majeure provisions.

Market norms

One of the most common misconceptions is related to M&A deals that contain English-law governed contracts. Since Turkey is a civil law country, inconsistencies may arise from different implications under civil and common law systems.

When the parties include certain terms and provisions from both Turkish and English law, such as good faith and fair dealing, frustration, or force majeure provisions in English law-governed contracts, misinterpretation of these clauses may give rise to legal disputes.

Law No. 805 on the Mandatory Use of the Turkish Language in Commercial Enterprises (Law No. 805), which requires Turkish commercial enterprises to use the Turkish language, is one of the most overlooked issues. Law No. 805 is commonly referred to in the rulings of the Turkish Court of Cassation, particularly in terms of the validity of arbitration agreements, where the parties are Turkish.

The Court of Cassation has ruled that a Turkish party may not be allowed to base its jurisdictional objection on an arbitration agreement drafted in a language other than Turkish. However, it has been assumed that such obligation is not applicable to transactions that involve a foreign party. Therefore, its scope would be limited to the transactions where both parties are Turkish real persons and/or entities subject to Turkish law.

Another overlooked issue involves dispute resolution clauses. These are generally overlooked during negotiations. In case the dispute is to be settled by the Turkish courts, it is important for the parties to note that the duration of such a procedure may cause parties to incur severe financial losses.

In Turkey, technologies such as artificial intelligence software are not commonly used. More particularly, we do not see due diligence being conducted by artificial intelligence.

Public M&A

Under Turkish law, a public company is a joint stock company either (i) has more than 500 shareholders, or (ii) shares of which are traded publicly. The Capital Markets Law and its secondary legislation comprise the key legislation for public company M&A transactions.

Control of a public company is defined as either (i) directly or indirectly holding more than 50% of the voting rights of a company; or (ii) holding privileged shares that enable the shareholder to appoint the simple majority of its board of directors, or to nominate the majority of the directors in the general assembly, pursuant to Article 12 of Communiqué on Takeover Bids No. II-26.1 (Official Gazette No. 28891 of January 23 2014).

Under Article 11(4) of the abovementioned Communique, and unlike in voluntary takeover bids, conditions attached to mandatory takeover bids are not allowed (whereas voluntary bids may be submitted to all of the shareholders or to a group of them). When submitted for a part of the shares, if the participation demand exceeds the bid, then the pro rata distribution method will be applied to balance the difference between the demand and the voluntary bid.

Further restrictions may be imposed on voluntary takeover bids following the approval of the Capital Markets Board, since the application requires the bidder to submit certain information as to the conditions of a bid. There are also disclosure requirements for tender offers and public takeovers detailed in the Communiqué on Material Events Disclosure No. II-15.1 (Official Gazette, January 23 2014, No. 28891).

An amendment on the Communiqué on Takeover Bids No. II-26-1 was introduced in October 2021, through which provisions on price, takeover bid procedures and exceptions were amended significantly.

If a transaction is made via a tender offer, break fees serve as a deterrent against a breach of exclusivity or of non-occurrence of closing and under the Turkish Code of Obligations, there is no restriction on break fees in terms of transactions between merchants. However, break fees are not common in public M&A deals. Since the Capital Markets Law does not provide for a specific provision on break fees, the Turkish Code of Obligations No. 6098 (Official Gazette, February 4 2011, No. 27836) would be applicable as the lex generalis on contracts.

Private M&A

When compared to 2020, which was the first year of the Covid-19 outbreak, 2021 was a more active year for the M&A market. However, market dynamics have not much changed. Purchase price adjustments have been, once again, the most popular mechanism for pricing and payment. The earn-out method and locked-box mechanisms have not been commonly resorted to as the lack of certainty and sustainability are the main problems for the market as a long effect of Covid pandemic.

Currency fluctuations experienced during recent years have encouraged parties to employ certain calculations in M&A deals; both sellers and buyers aim to maximise certainty, especially where M&A projects are financed through external loans, or where the share purchase price is agreed to in a foreign currency. Accordingly, certain specific conditions with respect to the economic situation have been more frequently included in agreements as a material adverse effect, force majeure, or other similar concepts such as introducing certain references on foreign currency levels.

In a private takeover offer, the most common conditions could be summarised as (i) regulatory authority clearances, i.e. merger clearance from the Turkish Competition Authority, and if the target company holds certain licenses or permits, approval for the changes in the shareholding structure of the license-holder target company; and (ii) third-party change of control approvals.

In general contract law practice in the Turkish market, it is common to choose a foreign governing law. However, in the M&A sector, where the target is a company that is subject to Turkish law, it is more common for parties to choose Turkish law as the governing law.

Most of the time, parties prefer to choose a different governing law in M&A projects for secondary agreements, to the extent allowed by mandatory provisions, and where enforceability would not be challenging in practice. Furthermore, both domestic and international arbitration is a more popular choice than litigation.

The exit mechanism is still one of the most used instruments by financial sponsors which invest both in public and private companies. Notable examples of financial sponsors’ exit were seen in the gaming market in previous years. Whereas, in trade sales, it is common for the parties to negotiate put options and call options, along with the exit rights, depending on the market power of the parties. Additionally, although it is not as common as in previous years, international private equity shareholders continued to enforce their exit rights at a couple of notable IPOs in 2021.

Looking ahead

An increase in M&A is expected in 2022, especially when considering the fact that market actors have now better adapted to (post) Covid-19 circumstances.

The Turkish M&A market maintains its advantageous nature for both long-term and short-term investors as a result of a promising economic recovery and the opportunities that result from the developing character of the market.

Click here to read all the chapters from the IFLR M&A Report 2022

Ercument Erdem

Senior partner

Erdem & Erdem

T: +90 212 291 73 83

About the author

Ercument Erdem is the founder and senior partner of Erdem & Erdem. He has more than 35 years of experience in international commercial law, M&A, privatisations, corporate finance and arbitration.

Ercument has extensive experience in cross-border projects concerning project finance, privatisations, M&A and private equity transactions in a wide geography including Europe, Asia and CIS countries. He has successfully represented clients in many arbitration proceedings and enforcement claims in relation to arbitral awards obtained outside of Turkey.

Ercument is an emeritus professor and lectures in leading universities such as Galatasaray University in Turkey and Fribourg University in Switzerland.

Ercument is the Chair of the ICC Commercial Law and Practice Commission.

Tuna Colgar

Partner

Erdem & Erdem

T: +90 212 291 73 83

E: tunacolgar@erdem-erdem.av.tr

About the author

Tuna Colgar is a partner in the M&A and contracts departments of Erdem & Erdem. He is highly specialised in a wide range of corporate matters including national and multijurisdictional complex M&A, investments, joint ventures and share transfer transactions.

Tuna focuses on corporate structuring including the spin-offs, option rights and group company managements. He is also experienced in cross-border strategic business transactions, project finance, structured finance, acquisition finance, privatisations and private equity investments.

Tuna has a master’s degree from the Istanbul Bilgi University.

Melissa Balikci Sezen

Senior associate

Erdem & Erdem

T: +90 212 291 73 83

E: melissabalikci@erdem-erdem.av.tr

About the author

Melissa Balikci Sezen is a senior associate in the corporate and dispute resolution department of Erdem & Erdem. She provides legal advice on M&A, corporate law, contract law and arbitration.

She advises clients on a range of corporate and commercial matters across a number of sectors and has a particular expertise in domestic and cross-border merger and acquisitions and share transfer transactions.

Melissa has master’s degree in comparative and international dispute resolution from the Queen Mary University of London. She is dual qualified, both in England and Wales and in Turkey.