In business, there are few things that bring greater joy to an executive than being wildly successful. However, sometimes it does feel better when there is success despite loud opposition from critics in the market and you best your competition in the process.

It is a fair prediction that SPACs are always going to attract the haters and the posers, and that there will always be obstacles to overcome.

Trouble makes for good headlines. If the story bleeds, it leads. The financial press and social media platforms will always get their clicks from negative headlines, whether they are about SPAC failures, share price drops, or new US SEC rules and enforcement actions. Indeed, the clickbait trifecta was seen earlier this year with announcements of SEC investigations into failed SPACs that had been promoted by celebrities who thought being a 'CEO' on TikTok meant the same as it does in the business world.

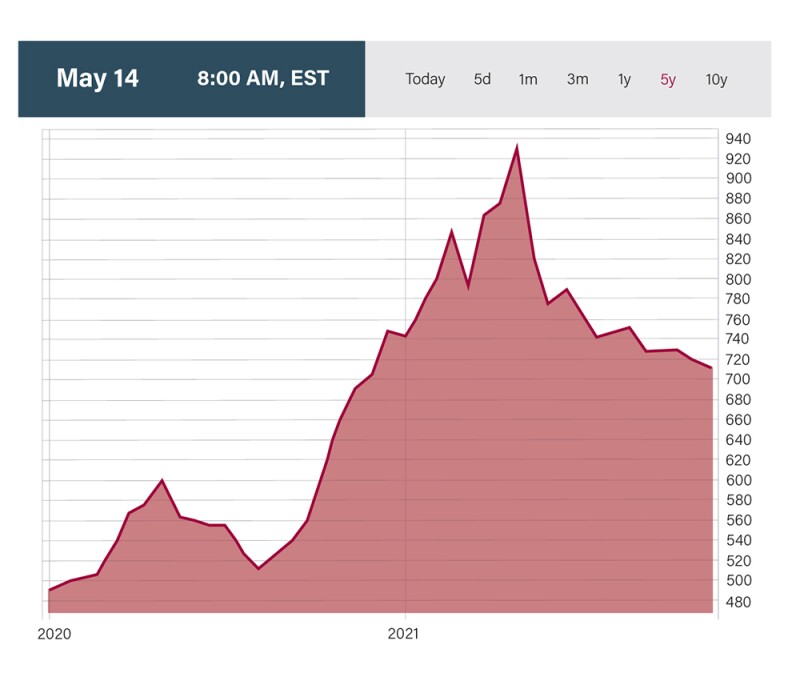

As this article is being written, the weighted performance of a basket of US SPACs is down over 20% from a 2021 peak (see chart).

At similar points in any cycle of growth, one can often tend to see gloomy feedback loops emerging, with professional advisors issuing warnings of impending doom if something is not done to fix a perceived compliance problem.

Right on cue, as this note goes to press in the early summer of 2021, email inboxes are being flooded with alerts from white collar teams highlighting the potential for regulator penalties on SPACs and the threat of shareholder lawsuits. Even so, perhaps it would be good to take a step back from these 'all stick and no carrot' messages and ask, "What about the upside?" Surely there are benefits for SPACs to embrace better legal, risk, and compliance that go beyond avoiding fines and regulatory sanctions. What are they?

This article attempts to briefly articulate a more constructive orientation for legal, regulatory, and compliance (LRC) professionals and other readers of the IFLR, including in-house counsel, senior partners at large law firms, SPAC CEOs and boards and their advisors.

Chart: IPOX SPAC Index May 14 2021

Orient towards the four 'T's to success

Poll any group of successful long-term investors to identify the secrets to success, and you are likely to hear a version of the mantra: "Team. Timing. Technology." The most seasoned venture capital and private equity investors and heads of family offices know, however, that there is a fourth key to future success: Testing.

The first three 'T's make perfect sense. A great team can find a way to thrive, even when the going is rough. Get the moment right, and the returns can be phenomenal. Brilliant tech reaches more customers more efficiently, leading to higher valuations. Yet, the fourth 'T' is also essential. Business leaders must test their assumptions to avoid falling victim to their own bias, conserve precious cash, and make great investments.

|

|

“Of the 849 SPACs listed by SPAC Track in mid-May 2021, only four (less than half of 1%) were identified as having a prominent general counsel, chief risk officer, or compliance officer among their lists of SPAC leaders, directors and advisors” |

|

|

Testing is core to what LRC professionals do all day long. SPACs should avoid taking an 'eat your peas' approach that puts testing in opposition to the rest of the business. LRC talent should not just test. They should make an expanded and more constructive contribution, particularly given their importance in the idea economy.

SPAC leaders should remember, for example, that great legal work was essential to the creation of iTunes and the App Store. Sure, Steve Jobs did a fine job – but the lawyers who wrote the strategic agreements with music industry partners, and who penned the end-user subscription contracts, were also critical innovators who contributed to the growth of the world's first trillion dollar business.

So far, this more constructive orientation does not appear to have been adopted.

When the rosters of SPAC teams are examined, one can see that SPACs have attracted hundreds of prominent and experienced founders, CEOs and CFOs. However, only a few SPACs spotlight stars are from the LRC community, based on data maintained on the popular platform SPAC Track. Of the 849 SPACs listed by SPAC Track in mid-May 2021, only four (less than half of 1%) were identified as having a prominent general counsel, chief risk officer, or compliance officer among their lists of SPAC leaders, directors and advisors.

This data aligns with anecdotal experiences at I-OnAsia, where the core business includes performing due diligence background checks on management teams on behalf of underwriters. Very few of the subjects of inquiries into SPAC management teams have included professionals with a background in legal, risk, or compliance.

These facts and observations hint at lost upside.

Preservation instincts

To win, a SPAC must hire great LRC talent, include them among the core C-suite team, and focus them on business growth.

Fintech SPACs seem to be a particularly rich area for LRC professionals to put their natural instincts for preservation to good use. When fintech SPACs focus on market segments that involve high risk products or counterparties (or both), the best LRC talent can help identify safe paths upon which the business may take a step forward, but where others may get tripped up. The field seems wide open. As of mid-May 2021, there are only two fintech SPACs with LRC superstars spotlighted by SPAC Track.

After the colossal $20 billion blow-up of Archegos Capital in 2021, financial firms with reportedly strong risk management approaches were in a stunningly advantageous position in comparison to their lesser competitors. Archegos was a privately run hedge fund, also known as a family office, run by Bill Hwang. Hwang was a customer of many major banks, but he was over-leveraged and had become a bad bet in the run-up to his collapse. Of the financial firms serving Archegos, those with reportedly less robust risk and compliance approaches got hung up, suffered severe losses and stark share price drops. The Archegos debacle clearly showed that successful LRC teams can preserve capital as a means of creating advantage and generating new avenues for growth.

It is much easier to compete when your peer has suffered a stunning wipe-out of years' of its profits and has embattled leadership.

There is a wider lesson here for SPACs.

Mature companies have c-suites stuffed with all manner of LRC professionals who help achieve revenue and profit predictability. Unfortunately, there are many reasons why a mature operating company that has generated strong revenues for years and is on a growth path to tremendous profitability will not choose to access the public markets through a SPAC or de-SPAC transaction.

This limits the universe of the types of companies attracted to SPACs: ones with less revenue and profit predictability. Investors will demand a higher risk premium for such businesses, increasing their cost of capital. To the extent, therefore, that LRC professionals can help a SPAC avoid such wild twists of fate and generate more reliable growth, they will be adding shareholder value by lowering the venture's borrowing costs.

Fraud prevention

One critical challenge SPACs should be positioning themselves to address is operational risk (OpRisk); regardless of whether the SPAC's orientation is financial services, space, or China.

OpRisk losses tend to be larger after boom cycles and periods of easy money, mostly due to increased levels of internal fraud and improper business practices, according to a recent working paper published by the Bank for International Settlements (BIS), a multilateral. Actually, historic data collected by the BIS identifies fraud as a significant OpRisk at any time. So, it would not hurt for SPACs to seek assistance from fraud specialists.

The constructive purpose for their inclusion is to beat the competition and prove the SPAC critics wrong. This will require an open and multi-dimensional mindset by SPAC executive leaders. However, this has really been a best practice for decades, at least since a panel of experts on financial reporting quality known as the Treadway Commission issued a study on the topic.

As SPACs and de-SPAC transactions often involve a universe of companies with less of a track record for generating profits (or even revenue), a specific focus for legal, risk and compliance should include lending a hand to test the quality of financial statements.

Simple due diligence on all audits would be a good start, checking for errors and overstatements on balance sheets and income statements. Financial fudging can spring from unseen biases of business leaders seeking to satisfy the animal spirits of the market. Joseph Wells, the founder of the Association of Certified Fraud Examiners (ACFE), has written that the "most common reasons why senior management will overstate business performance" are to "meet or exceed the earnings or revenue growth expectations of stock market analysts".

LRC professionals should also be invited to prevent bad decisions stemming from conflicts of interest, which can result in a loss of investor capital or leaders' reputations. "The inadequate disclosure of conflicts of interest is among the most serious of frauds", writes Wells. LRC teams play a critical role in testing the integrity of any de-SPAC transactions to ensure they are negotiated in good faith.

Enhanced due diligence can play a key role in looking for red flags. Before the screening process, the LRC team can consider what are the best risk indicators specific to the transaction. These may be nuanced, and involve tests of character, performance, and track record. The goal is an independent and unbiased product that addresses governance, performance, and leadership aspects. Enhanced due diligence teams can even examine supply chain vulnerabilities, test the robustness of products in the pipeline, and consider other issues. For example, LRC teams and specialist risk management vendors can be ethically track peers and keep a finger on the pulse of the market to ensure a solid feel for market timing.

Lean mean pro-business machines

For over 20 years, the team at I-OnAsia has supported in-house counsel, board risk committees, and corporate compliance teams with due diligence and other risk management services on both sides of the Pacific, as well as in Europe. Along the way, it has seen many savvy LRC customers find a way to do their jobs without running bloated departments. SPAC LRC teams must find ways to stay lean and avoid becoming a drag on the business.

Unfortunately, a majority of banks spend significant sums on these functions. For example, according to a 2018 Risk Management Association study, 50% of institutions surveyed spent between 6% and 10% of their annual revenue on compliance costs, which is a lot. Sometimes these large costs are a necessary function of an entity's importance to the global economy, but still create a competitive disadvantage.

One way to avoid becoming too costly is to include LRC teams in technology strategy setting; internalising LRC needs into the firm-wide digital strategy and embracing new tools that can help the business scale to address the risks of the future most competitively. Another very successful approach has been to actually populate the c-suite with more than one senior risk management professional. Executive committees with multiple members who understand risk are in a better position to address tomorrow's challenges most cost-effectively.

Balancing act

Getting all of this right is a balancing act.

As their nickname 'blank check company' implies, SPACs have firm-specific mandates to take investor capital and spend it wisely. So, the stakes are raised for SPAC leaders. If they want to enjoy success, they will have to get all four 'T's very, very right, because they may only have one shot.

Most SPAC executives are already well-aware of the challenges. They have heard the critics and have listened to warnings from the regulators. LRC professional officers can offer business leaders so much more than warnings. Their instincts, skills, and experiences can bring competitive advantage.

Derek Elmer

Chairman

I-OnAsia

T: +852 2896 4489

Derek Elmer is chairman of I-OnAsia, a global due diligence and risk management company. He is a fluent Cantonese-speaking British national and Hong Kong SAR permanent resident with three decades' experience as a leader in due diligence, crisis management, private security, and litigation support.

Before establishing I-OnAsia, Derek had significant experience working in leadership positions at one of Hong Kong SAR and greater China's most successful industrial businesses. Since establishing I-OnAsia in 2001, he has built I-OnAsia's excellent team of high-performing professionals.

I-OnAsia is a market leader in pre-IPO and M&A due diligence. I-OnAsia regularly performs background screenings around SPAC listings and de-SPAC transactions in Asia, the Americas, and Europe. I-OnAsia's risk advisory consultancy helps companies address the challenges of international trade, including performing Foreign Corrupt Practices Act (FCPA) checks and customer due diligence as well as CFIUS reviews, not just in Asia.

James Tunkey

Chief Operating Officer

I-OnAsia

T: +1 917 608 3476

James Tunkey is chief operating officer of I-OnAsia. Prior to joining I-OnAsia in 2004, James was the director of a major security company in Asia. He is a member of the National Committee on US-China Relations and other organisations. He is a certified fraud examiner.

James holds a Trium MBA, jointly conferred by New York University Stern School of Business, the London School of Economics, and HEC Paris.