The Swiss M&A market in 2020 suffered in the first six months, particularly during the first Swiss lockdown, where a decline was seen in deal flow and volume due to the impact of COVID-19, with some sectors deal activity down by 50%.

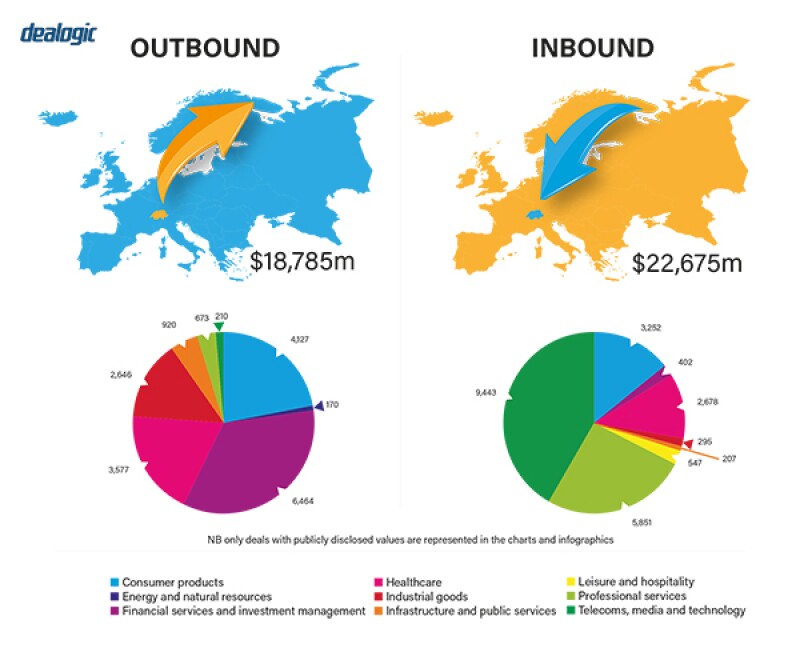

The uncertainty caused by the pandemic was particularly reflected in a decrease of approximately 42% in the number of inbound transactions and a 24% reduction in outbound transactions. However, in the second half of 2020, the overall uncertainty in certain markets was overcome and envisaged deals that were put on hold, were reassumed and closed.

As M&A activity normally directly correlates to the sector specific economic performance, this catch-up in the second half of 2020 was particularly visible in the technology, media and telecommunications sector (TMT). In total, M&A deal count with Swiss participation saw a decline of only approximately 10% for 2020 compared with a very active M&A market in 2019.

The reasons for the low (or lower as expected) impact of the COVID-19 pandemic on M&A activity in Switzerland are manifold. The absence (or near absence) of investment restrictions in Switzerland continues to facilitate investments, even considering the COVID-19 pandemic. Despite the COVID-19 induced uncertainties, Swiss small to medium-sized enterprises (SMEs) remain attractive targets for investors to strengthen their portfolio, as COVID-19 resilient sectors (such as healthcare and TMT) are strongly represented on the Swiss market. This combined with the fact that many SMEs are dealing with their succession planning and growth strategies made the impact of COVID-19 in 2020 less significant and will likely continue to do so.

|

|

A rise in M&A activity is expected in general, but foremost a trend to ‘mega-deals’ and larger volume deals |

|

|

The reformation and strengthening of corporate portfolio in light of the COVID-19 pandemic, as well as the steady high interest of private equity (PE) investors in Swiss SMEs were essential components for the Swiss M&A market in 2020. Overall, M&A deals in Switzerland have rather been delayed than cancelled.

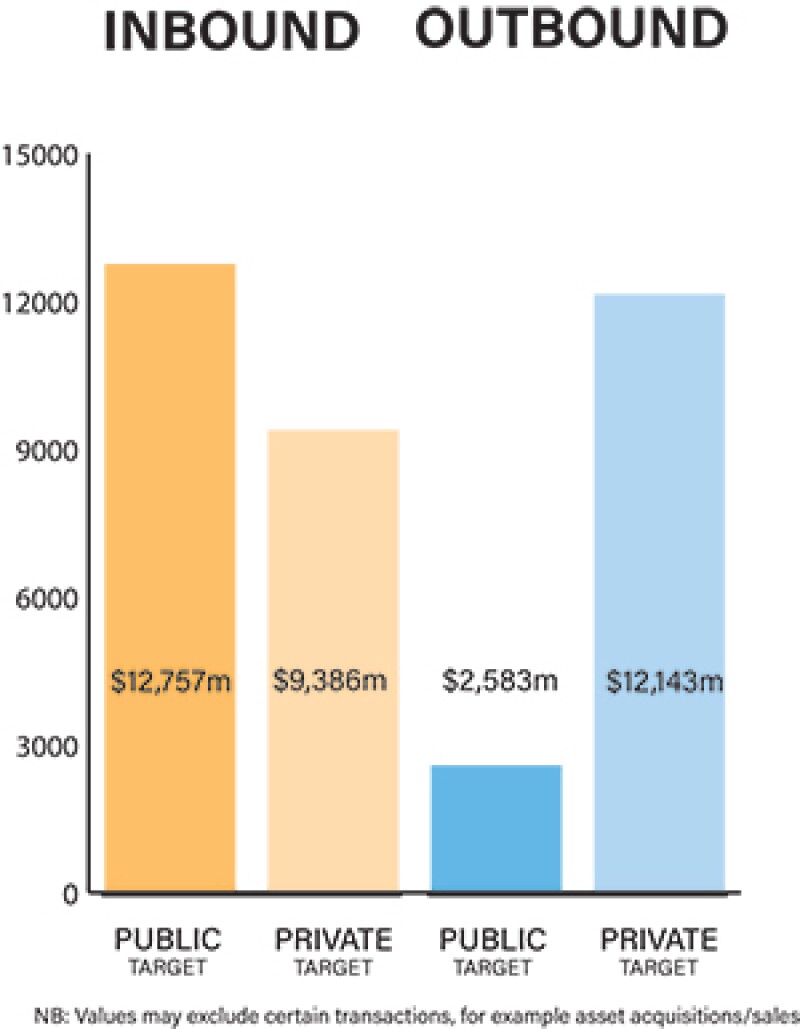

Private M&A transactions accounted for the majority of the overall Swiss M&A market both in terms of number of deals and deal value in 2020. However, private M&A activity is often fuelled by public M&A and vice versa. For example, taking-private of a company by way of a public tender offer and subsequent squeeze-out is often followed by subsequent disposals or bolt-on acquisitions to focus, transform or grow the business.

For PE in particular, IPOs have gained in importance in exit strategy considerations either as a standalone solution or as part of a dual-track process.

On February 2 2020 (shortly before the start of the COVID-19 pandemic in Switzerland and the first nationwide lockdown), Migros-Genossenschafts-Bund (MGB), Switzerland's largest retailer and private employer, announced the sale of its department store Magazine zum Globus AG (Globus) together with eight prime real estate properties in Zurich, Basel, Berne and St. Gallen to a consortium of Austrian SIGNA and Thai Central Group. Despite all uncertainties and difficulties caused by the COVID-19 pandemic the transaction was successfully closed in May 2020.

Another noteworthy deal was the sale of Swissbit, a leading Swiss based manufacturer of secure, high-quality storage and embedded Internet of Things (IoT) solutions, to PE investor Ardian amid the COVID-19 pandemic. The two transactions are proof of the M&A market's and its participants' ability to quickly adapt to new situations (such as meeting restrictions due to COVID-19) as a shift from physical signings and closing to pure remote signings and closing could be observed which will likely facilitate deal-making also after COVID-19.

COVID-19 and recovery plans

Compared to other crisis, the COVID-19 pandemic appeared unexpected and hit a global unprepared economy. However, due to the strong Swiss TMT (80 deals) and industrial sector (63 deals), a certain catch-up could be seen in the second half of 2020, as these sectors seem to be resilient to the current pandemic.

Despite the smaller decline of the total deal amount in Switzerland for 2020 by 10%, the total deal value saw a significant drop by around 50% (total transaction volume 2021 approximately CHF56 billion (approximately $61 billion)). In 2020, M&A deals tended to have a lower transaction volume, which is consistent with the low number of 'mega-deals' in the pharmaceutical and life sciences as well as in the industrial and financial services sectors. In addition, there has been a significant shift from inbound to outbound transactions in Switzerland in 2020, as in 42% of the overall transactions with Swiss participation, Swiss companies acquired foreign entities, compared to 23% of inbound transactions.

The COVID-19 crisis also leads, and will in the near future also lead, to a certain shift of the driving factors in M&A activity in Switzerland. In sectors where the COVID-19 pandemic has had a significant impact (such as travel or vacation/recreational near sectors), the main focus of M&A transactions will be laid on distressed companies in need of financial aid and reorganisational matters. This trend will continue far into 2021, companies will increasingly dispose of non-core assets and business to ensure and provide for more financial stability.

The Swiss government reacted to the impending COVID-19 crisis with the possibility for SMEs to obtain government secured loans from banks. Many SMEs utilised this possibility due to the predominant uncertainty in the market. These loans however were coupled with certain restrictions regarding financial matters, in particular dividends and acquisitions. These financial restrictions may have prevented an entity to pursue their M&A strategy. In the course of a transaction it was thus necessary to ensure the repayment of such loans.

Funding has become a major focus in M&A transactions. Even though banks remain inclined towards financing transactions and conditions remain favourable for funding, due to the financial strain on Swiss enterprises induced by the pandemic, the focus for banks has been slightly shifted to sustaining the financial health of a company. Consequently, the availability of bank loans for M&A transactions has seen a slight decline.

During the first half of 2020, PE activity was down by around 25% compared to the same period in 2019. However, by the end of 2020, the PE deal number had increased by 6% while the total deal value was down by 15%. This can be led back to PE houses seizing the opportunity in 2020 to acquire targets with a lower valuation, due to the impact of the COVID-19 pandemic. This is also reflected in the number of PE-driven acquisitions, which was roughly twice as high as PE-driven disposals. However, this activism is accompanied by a harsh competitive environment for good assets between different PE houses, which in turn leads to a more sophisticated and bolder approach. In 2020, PE activity, especially in mid-market businesses were key drivers for the Swiss M&A market. In general, PE buyers remain a major driver in the Swiss M&A market.

A rise in M&A activity is expected in general, but foremost a trend to 'mega-deals' and larger volume deals. Taking into consideration the growing experience in a functional operating system during a pandemic as well as the vaccine approvals in late 2020, a significant improvement of the Swiss economy in general is likely which will lead to an up-rise in M&A activity.

Legislation and policy changes

Swiss M&A transactions revolving around companies, which have their equity securities (fully or partially) listed on a Swiss exchange (in case of non-Swiss domiciled issuers only if the main listing is in Switzerland) are subject to the Swiss Financial Market Infrastructure Act (FMIA; including its implementing ordinances) and the Swiss Federal Merger Act.

This legislation is mainly driven by the concept of freedom of investment, meaning that the targets' shareholders should be in a position to make a free decision whether to accept a tender offer or not, without having to fear repercussion by being minoritised. Another fundamental concept implemented in these legislation acts is the equality of a target's shareholders and their equal treatment. These two concepts in essence demand a higher grade of regulation compared to private transactions.

Within the framework of the FMIA, the SIX Swiss Exchange is tasked with issuing of regulations regarding the admission of securities to listing and subsequently the continued compliance with such obligations. The Federal Takeover Board (TOB) and the Swiss Financial Market Supervisory Authority (FINMA) form the controlling body and are responsible to enact such regulations in light of the Swiss public takeover regime. In this setup, the FINMA acts as superior instance to the TOB to the course that decisions made by the TOB may be disputed in front of FINMA and ultimately in front of the Swiss Federal Administrative Court.

Private transactions are a lot less regulated as there is no specific act regulating the acquisition of a privately held company. The key legislation for private M&A is the Swiss Code of Obligations, with its general laws regarding sales law, which in general implements the concept of the will of the parties. The involved parties thus possess a bigger flexibility to determine the specific applicable contractual rules. These contractual rules are driven by individual negotiations and agreements. However, certain legislation may be applicable depending on the parties involved and the nature of the transaction, this may for instance include the Antitrust Act and the Act on the Acquisition of real Estate by Persons Abroad (Lex Koller).

The Financial Services Act (FinSA), the Financial Institutions Act and their respective (updated and amended) implementing ordinances entered into force on January 1 2020. These legislations inter alia formalise rules regarding the obligation to publish a prospectus in the case of a public offering of securities and determines certain minimum content requirements. These rules have already been practiced by SIX Swiss Exchange for listings prospectuses and have been considered standard in the international context. Despite FinSA primarily addressing the financial service industry, the provisions and obligations regarding a prospectus influences public M&A in instances where securities are offered as consideration to the target's shareholders in the course of a public tender offer. While the FinSA provides for an exemption from the prospectus requirement in a public takeover, the exemption is subject to equivalent information being available. An offeror in a public takeover would therefore need to satisfy both the requirements under FinSA and the less stringent requirements of Swiss takeover law.

There have been certain political undertakings to intensify foreign investment control in 2020. Most noteworthy is the initiative to suspend (albeit temporary) an exemption clause in the Act on the Acquisition of Real Estate by Persons Abroad (so-called Lex Koller), which contained an exemption for an approval for the sale of a business premises to a foreign buyer. Up-to-date real estate, which is not used for residential purpose (such as offices, production and manufacturing sites, etc.), is not subject to an approval by the competent authority. The temporary suspension is intended to have effect during an extraordinary or special situation (ausserordentliche oder besondere Lage) and two years thereafter. These might have a far-reaching impact on the M&A market and the necessary structuring of a transaction, as even an indirect sale of a real estate (such as in a share purchase) may trigger the approval requirement and thus must be assessed carefully case by case.

Market norms

The Swiss M&A market is very investor friendly and allows for far-reaching individual solutions. In this context in should be noted that, aside from certain regulated sectors (such as if a financial institution is involved) and antitrust approvals, most M&A transactions do not need an approval or consent from a regulatory or governmental authority.

As there is no publicly available register which can be relied upon to positively confirm the chain of ownership in an entity, in practically every transaction it will not be possible to trance back the ownership in a company back to its incorporation. It should therefore be considered by potential sellers to plan and initiate a title clean-up well in advance of a sales process as such clean-up undertakings can take a long time.

The ongoing digitalisation in Switzerland, especially in times of work from home obligations, and the usage of big data are becoming increasingly important for Swiss law firms on their journey to further increase efficiency.

Public M&A

In an ideal scenario, an offeror holds more than 98% of the voting rights in the target company following a public tender offer as this allows the offeror to file for cancellation of the remaining shares in a statutory squeeze-out court procedure pursuant to the FMIA against payment of the offer price to the holders of the cancelled shares. If the offeror falls short of the 98% threshold but holds at least 90% of the voting rights, full ownership can be achieved through a squeeze-out merger pursuant to the Swiss Merger Act which, however, carries a higher litigation risk than the FMIA procedure.

Therefore, while holding more than 50% of the voting rights will give an offeror effective control over a company, and 66.66% of the voting rights together with the majority of the capital allows the taking of certain important resolutions that by law are subject to this higher quorum, an offeror will typically want to reach at least the 90% threshold in order to be able to obtain full control.

In mandatory takeover offers, minimum acceptance threshold conditions are not permissible (more on this below). A voluntary offer, however, may be conditional on a minimum acceptance threshold, though only if the threshold is not unrealistically high, which the TOB assesses based on the circumstances of the specific case. Absent significant holdings by the offeror in the target company prior to the offer the TOB will typically not permit a condition requiring that the offeror reaches the 90% threshold.

|

|

In 2020, M&A deals tended to have a lower transaction volume |

|

|

Swiss law allows hostile and friendly takeover bids, but an offer that is supported by the target company's board is more likely to be successful. In a friendly takeover, the offeror and the target company will normally enter into a transaction agreement pursuant to which the target's board of directors agrees to recommend the offer to its shareholders and not to solicit offers from third parties (but with a 'fiduciary out' in case of unsolicited superior offers).

The permissibility of conditions that may be attached to a public takeover offer depends on whether the offer is voluntary or mandatory. The duty to make a mandatory offer is triggered if the offeror acquires shares in a company exceeding the threshold of 33.33% of the voting rights or a higher threshold of up to 49% that applies pursuant to a so-called 'opting-up' clause in the target's articles of association (Swiss law also allows companies to opt out from the mandatory bid regime).

With respect to mandatory offers there is only a very limited number of offer conditions that the TOB deems permissible. These include that no injunction or court order prohibiting the transaction will be issued and that necessary regulatory approvals will be granted, as well as conditions ensuring the ability of the offeror to exercise the voting rights (i.e. entry in the share register and abolishment of any transfer and/or voting restrictions). In voluntary offers, the scope of admissible conditions is much wider, including minimum acceptance thresholds (see above) and no material adverse change (MAC) conditions.

Break fees are generally considered permissible if the amount is set to compensate the offeror for the approximate costs of a breakup. Break fees that have a punitive character and significantly restrict shareholders in their freedom to accept or not accept an offer and/or deter potential competing offerors may be invalid, although the question has not been answered conclusively in Swiss legal doctrine and case law to date.

Private M&A

Unlike in the US and Asia, locked-box pricing mechanisms are widely used and accepted in Switzerland. In particular in the current seller-friendly market, sellers seeking to limit balance sheet risks and reduce the risk of post-closing purchase price adjustment disputes push towards using locked-box pricing mechanisms.

As a consequence of the (continuing) current seller's market, locked-box pricing mechanisms are often combined with an interest payment or cash-flow participation for the period between the locked-box date and actual payment of the purchase price (i.e. closing), and buyers tend to accept longer periods between the locked-box accounts date and closing.

In line with the current insecurities, a comeback of conditionality and flexibility into share purchase agreements in order to minimise potential risk for the buyer post signing/closing at the cost of deal certainty cannot be fully excluded although we still see high transaction certainty in current transactions and as such very few conditions to closing due to the competitive situations in auction processes.

In a Swiss target company, it is absolute market practice to agree on a Swiss law governed share purchase agreement with jurisdiction in Switzerland. In addition to the fact that this is generally expected by Swiss sellers (due to the well-known advantages of the application of domestic law and a domestic forum), various legal questions, such as the process of validly effecting the transfer of shares, the board representation, shareholder requirements etc., are not open to any choice of law but governed by Swiss law anyway.

In an investment setup, where there are multiple investors jointly involved, the terms and conditions of an exit and the predefined route of an exit are mostly defined in a shareholders' agreement.

A direct or indirect trade sale to a strategic or financial buyer remains the most common form of an exit. As IPOs are generally accompanied by a complex issuance structure this exit form is still less common but has become more attractive in recent years, especially when combined with a private exit (dual-track process) to increase deal certainty and maximise valuation.

Looking ahead

As mentioned above, the predominant uncertainties and liquidity problems many companies face in Switzerland will likely lead to change of deal structuring and negotiation power of a party. For example, more reorganisational undertakings and a change of the strategic approach in a company is expected. The main focus, especially in sectors where the pandemic had a large impact, will be to maximise cost-effectiveness, dispose of non-essential business parts and strengthen digital capabilities to cope with the changing economic environment.

However, it is likely that the economy and the M&A market in 2021 will catch up to pre-COVID heights, the capability of such has already been shown by the catch-up in the M&A market in the second half of 2020.

Click here to read all chapters from the IFLR M&A Report 2021

Christoph Neeracher

Partner

Bär & Karrer

T: +41 58 261 52 64

E: christoph.neeracher@baerkarrer.ch

Christoph Neeracher is a partner at Bär & Karrer, who specialises in the corporate and M&A areas.

Christoph works on international and domestic M&A transactions, with a focus on private M&A and PE transactions, including secondary buyouts, public to private transactions and distressed equity. He also assists clients on matter related to transaction finance, venture capital, start-ups and corporate restructurings among other mandates. He also represents clients in litigation proceedings relating to his specialisation.

Christoph has completed law degrees at the University of Zurich, and has a LLM in corporate law from New York University.

Philippe Seiler

Partner

Bär & Karrer

T: +41 58 261 56 48

E: philippe.seiler@baerkarrer.ch

Philippe Seiler is a partner at Bär & Karrer, who specialises in the corporate and M&A areas. He has broad experience in international and domestic transactions across various industries.

Philippe covers M&A transactions of all sizes, PE transactions, as well as venture capital and start-up transactions. Furthermore, he specialises in regulatory matters in the fields of life science and healthcare.

Philippe has completed law degrees at the University of St.Gallen, and has a LLM from the University of Chicago.

Raphael Annasohn

Partner

Bär & Karrer

T: +41 58 261 52 65

E: raphael.annasohn@baerkarrer.ch

Raphael Annasohn is a partner at Bär & Karrer, who specialises in the corporate and M&A areas.

Raphael has broad experience in international and domestic M&A transactions, corporate reorganisations and restructurings as well as corporate law and general contractual matters. In particular, he has vast knowledge of shareholders' agreements and employee participation plans. Furthermore, he specialises in the fields of venture capital and start-ups and is the co-founder of Bär & Karrer's start-up desk.

Raphael has completed law degrees at the University of Berne, and has a LLM from University of California, Los Angeles (UCLA).