SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

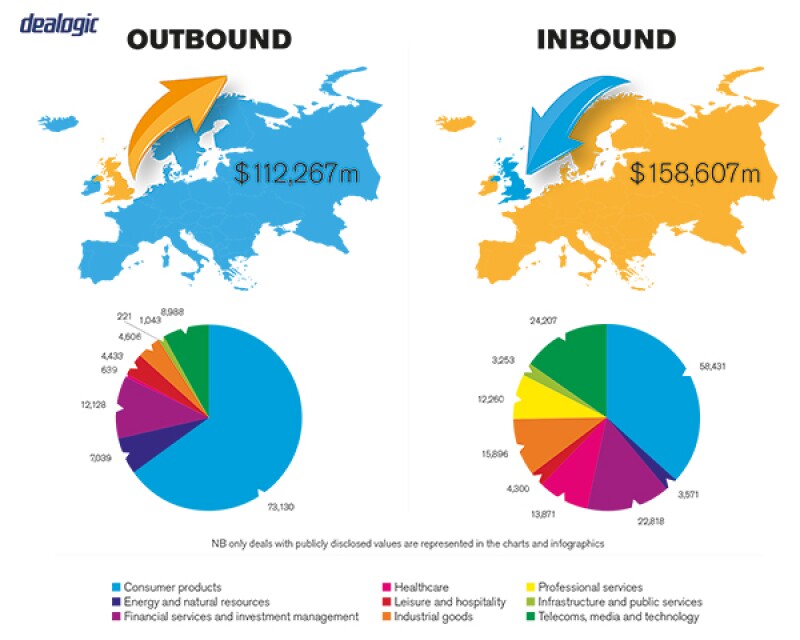

UK M&A in 2016 was primarily driven by inbound deals, encouraged by the post-Brexit decline in the value of sterling and supported by the continuing availability of transaction financing at attractive rates. Chinese acquirers remained active in 2016; there were 25 Chinese-led UK acquisitions, valued at £6.8 billion in 2016; compared with 15 valued at £1.3 billion in 2015. The number of acquisitions of UK companies by US acquirers was at the highest level in ten years with 262 deals valued at $48 billion in 2016. In particular, US acquisitions of UK public companies were up 50% since 2015.

UK domestic deals dropped in value after rising for a number of years; hitting the lowest point since 2013, principally due to uncertainty over Brexit.

Technology was the most active sector for UK M&A in 2016, with deal values rising to £29.14 billion in 2016 from $6.9 billion in 2015. This was largely due to SoftBank's £24.3 billion acquisition of ARM Holdings, which was announced shortly after the Brexit vote and following a drop in sterling. Media, financial services and energy services were the next most active sectors by deal value.

1.2 What M&A deal flow (volume and value) has your market experienced and how does this compare to previous years?

UK M&A was resilient in 2016, with 1,418 deals worth £141.5 billion compared with 1,470 deals worth £273.8 billion in 2015. Although deal value and volume was lower compared to 2015, 2015 was a record year and M&A deal values in 2016 were at their second highest level since 2008.

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

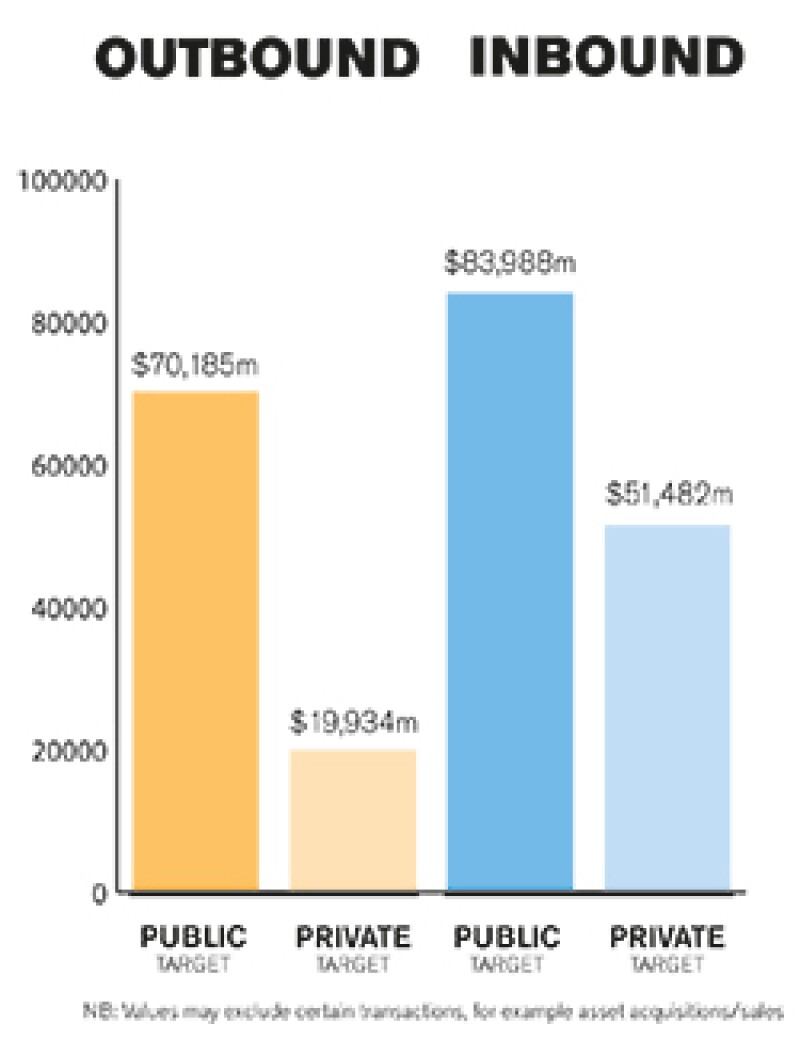

Both public and private M&A play an important part in the UK market. Private M&A deals make up a far higher number of UK target M&A deals (1,331 deals worth £65.6 billion in 2016), and values have been rising in previous years, although 2016 saw a drop in both value and volume on 2015. Whilst down on 2015, public M&A in 2016 was at its second highest value since 2008 with 87 deals worth £75.9 billion. Part of this is accounted for by a number of large inversion deals that announced but aborted in 2015 (for example AbbVie/Shire and Pfizer/AstraZeneca).

Given the increased buying power of US corporates as a result of the reduction in the value of sterling against the dollar, the end of 2016 saw an increase in deals with US style conditionality structures, which is expected to continue through 2017.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The recent acquisition by Priceline of the Momondo Group shows the continued enthusiasm for UK and European businesses from US acquirers. This, along with other inbound acquisitions, indicates that European legal advisers will need to be well versed in both European and US style deal protections and to manage their respective clients' expectations accordingly.

The merger of Technip and FMC Technologies was notable because it was structured under the EU cross-border regulations in a combination of mergers in France (Technip) and the US (FMC) under a new UK holding company, dual-listed on NYSE and Euronext Paris. The structure of the transaction did not offend US Treasury regulations against inversion transactions.

2.2 What have been the most significant trends or factors impacting deal structures?

The cumulative effect of tax developments in the UK and beyond have impacted M&A deal structures. In particular, reduction of the headline UK corporation tax rate has increased the attractiveness of the UK as a holding company jurisdiction. This trend is expected to continue in 2017. While the UK is still behind Ireland and Netherlands in terms of overall number of US-listed holding companies domiciled, recent transaction trends favour the UK.

Prospective changes in the US (for example, possible changes to the US tax regime on current accumulated earnings and the taxation of US based multinationals future overseas earnings) and Europe (for example, the European Commission's tax related state aid investigations) are also likely to influence future structure choices for global M&A deals by UK companies.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The Companies Act 2006 applies to public and private companies registered in the UK. While the Companies Act does not govern M&A activity as such, its requirements dictate the way that deals by UK companies are effected.

The acquisition of private companies is a matter of negotiation between the buyer and seller and no regulated offer process is required. In non-regulated industries (i.e. other than financial services, telecoms, media etc.), deals are not typically subject to input from regulatory bodies, save for competition matters.

Public acquisitions are governed by the City Code on Takeovers and Mergers (the Takeover Code), as administered by the Panel on Takeovers and Mergers.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

The regulatory environment for UK M&A is relatively stable. While M&A practitioners in the UK are awaiting confirmation from the government on the detail of the UK's withdrawal from the EU, the impact of Brexit related changes on the regulation of M&A activity is expected to be gradual. The UK government is promoting foreign investment in the UK and cross-border trade as fundamental pillars of the UK economy post-Brexit.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

Changes are made to the Takeover Code periodically. Recent changes have focused on the manner in which information and opinions are communicated and distributed by, or on behalf of, a bidder or target company during an offer; regulating the use of social media and similar forms of communication by the parties to an offer; and putting further emphasis on the monitoring of meetings and telephone calls with shareholders, analysts and others by requiring supervision from a corporate broker or financial adviser at meetings including telephone calls, video conferences and meetings by other electronic means. This has been welcomed by the market as the Takeover Panel reacting positively to market changes.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

UK companies can be acquired by way of a share purchase (i.e. purchasing all the shares of the target company) or an asset purchase (i.e. purchasing all the assets of the target company) but as a matter of UK domestic law, M&A transactions between private UK companies cannot be consummated by way of a merger by absorption. Mergers by absorption are only possible with respect to UK private companies where there is a combination of a UK company and a company incorporated in an EEA (European Economic Area) state, however such structures are fairly unusual. The Companies Act does provide for mergers for UK public companies but these provisions are generally not used and acquisition of UK public companies by way of a scheme of arrangement is more commonly seen. This is in contrast to other jurisdictions where mergers are frequently encountered.

Although the UK merger control regime is voluntary and there is no obligation for the notification of mergers in the UK, in reality a large number of transactions are notified in the interests of legal clarity and to avoid the disruption caused by interim enforcement orders requiring the businesses to be held separate after closing or even the more remote risk of being ordered to delay closing. Even if the transaction is not explicitly notified to the Competition and Markets Authority (CMA), the CMA may become aware of the merger, either because of third party complaints, or as a result of its own research (undertaken by its Mergers Intelligence Committee). If the deal has an EU dimension, notification must be made to the European Commission prior to implementation of the transaction. Confidential pre-notification contacts can take place earlier, but formal notification typically follows signing of the transaction documents when a transaction is announced.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

See above.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Early engagement with legal counsel, a detailed understanding of both the UK and international legal markets and careful transaction planning are essential. For example, where a deal raises UK anti-trust concerns, parties may seek to pre-emptively engage the CMA and provide the Mergers Intelligence Committee with information about the deal. This can reduce the risk of the CMA calling the deal in for investigation.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

A bidder may choose to stake build in order to obtain control of a public company. If a bidder acquires shares in the three months prior to or during an offer period, any offer must not be on less favourable terms. Any dealing giving rise to speculation, rumour or an untoward movement in the public company's share price may mean an announcement is required. Under the Disclosure and Transparency Guidelines, shareholding interests must be disclosed to the public company, who must then inform a regulatory information service. If a bidder acquires 30% of the voting rights in a public company, a mandatory cash offer for the remainder of the shares a bidder does not own is triggered.

5.2 What conditions are usually attached to a public takeover offer?

A takeover offer will usually be subject to an extensive set of conditions including: securing acceptances carrying more than 50% of the voting rights in the target, antitrust and regulatory approvals, bidder's shareholder approvals, listing of consideration shares (where appropriate), as well as conditions dealing with the state of the target's business. A bid cannot be subject to conditions that depend on the subjective judgement of the bidder. On occasion, a bidder will announce a firm intention to bid on a pre-conditional basis, where posting of the bid document is suspended pending satisfaction of stated pre-conditions, often material antitrust conditions where it is anticipated that these will involve protracted processes.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

In public takeover offers, break fees (where the target pays the prospective buyer) are now largely prohibited whereas reverse break fees (where the prospective buyer pays the target) are not prohibited.

If the bidder is a UK public company and subject to the UK Listing Rules and the total value of the reverse break fee(s) exceeds one percent of the market capitalisation of the bidder, the bidder's directors will need to treat the reverse break fee as a material transaction (which amongst other things, requires shareholder approval). If the bidder controls more than ten percent of the target, a reverse break fee may also constitute a related party transaction for the purposes of the UK Listing Rules.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

According to the Latham & Watkins 2016 European Private M&A Market Study, which examined over 170 deals signed between July 2014 and June 2016, 46% of deals included a locked box mechanism. This trend is consistent with results from the previous two editions of the survey and reflects the continuing seller friendly nature of the M&A market. Thirty three percent of deals included a completion accounts mechanism and 21% of deals did not provide for price adjustment. Completion accounts are relatively common where a business is carved out of a larger group in circumstances where it may not be possible to define or lock the box. The number of deals which feature an earnout remained limited at 13%. Deals which include some element of contingent consideration tend to be sector specific (for example pharmaceuticals) or be in circumstances where the parties were unable to reconcile differing financial projections for the target business. There has been a significant increase in the use of escrows in private M&A deals, for 2014-2016, 33% of deals included an escrow, compared with 22% for the previous two years.

5.5 What conditions are usually attached to a private takeover offer?

The conditions to closing which are included in a purchase agreement will vary based on the circumstances of each transaction. In UK deals, historically conditionality beyond regulatory and anti-trust clearances is uncommon but the increase of US acquirers in the UK market could change this landscape somewhat.

According to the Latham & Watkins 2016 European Private M&A Market Study, only 15% of deals included a material adverse change clause (material adverse changes clauses refer to events which have a negative impact on the market generally or, more specifically, on the target company's business). The use of breach of covenant/warranty conditions and financing conditions also remains very limited, with 13% of deals including a breach of warranty condition and just two percent of deals including financing conditions.

The UK approach contrasts with experience in the US, where conditions typically include a requirement for the seller's representations and warranties to be materially accurate at closing, absence of material breaches of the seller's covenants, absence of material adverse change and completion of a marketing period to obtain financing and regulatory and anti-trust clearances. The difference between UK and US practice results from the different approach taken to deals, under UK practice deal certainty is paramount and business risk is usually transferred to the buyer on signing.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Purchase agreements relating to UK companies and assets are typically governed by English law and subject to the jurisdiction of the English courts. For global transactions, depending on the location of the parties and their advisers, purchase agreements are frequently governed by English law but may alternatively be subject to the laws and courts of another jurisdiction, such as New York. English law is widely perceived as stable, impartial and commercial, with a developed litigation infrastructure. Accordingly, English law is commonly seen as the governing law and jurisdiction for non-UK based companies and assets, particularly in Eastern Europe, the Middle East and parts of Asia.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

According to the Latham & Watkins 2016 European Private M&A Market Study, 13% of UK transactions employed warranty and indemnity insurance, a 60% increase since Latham's 2015 survey. As expected, warranty and indemnity insurance is most prevalent in sales by private equity sellers, with 22% of UK deals taking up a policy.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

2016 was a strong year for UK M&A, despite the political climate in the UK, Europe and the US and various macroeconomic factors. Investors and advisors remain hopeful that UK investment activity will remain robust in 2017. Please refer to our article at page 1 for further analysis of the factors we predict will drive deal terms in 2017.

About the author |

||

|

|

Nick Cline Partner, Latham & Watkins London, UK T: 44 20 7710 1087 F: 44 20 7374 4460 W: www.lw.com Nick Cline is a partner in the corporate department in the London office of Latham & Watkins. Cline is an M&A lawyer with more than 17 years of experience focusing on UK and international cross-border mergers and acquisitions, public takeovers, private equity transactions, carve-outs, minority investments and joint-venture transactions. Cline's recent experience includes advising: ACCO Brands Corporation in connection with its €297 million acquisition of Esselte Group, a leading European office products company, from private equity firm JW Childs; Emerson in connection with its acquisition of Permasense, a leading provider of non-intrusive corrosion monitoring technologies; and Brundage-Bone Concrete Pumping in connection with its acquisitions of Camfaud Concrete Pumps, Premier Concrete Pumping and South Coast Concrete Pumping, UK-based companies providing concrete pumping and material placements services. |

About the author |

||

|

|

Robbie McLaren Partner, Latham & Watkins London, UK T: 44 20 7710 1880 F: 44 20 7374 4460 W: www.lw.com Robbie McLaren is a partner in the corporate department in the London office of Latham & Watkins. McLaren's practice focuses primarily on mergers and acquisitions, private equity, venture capital, reorganisations and general corporate matters. In recent years, McLaren has represented clients who operate in a number of industries, with a particular focus on clients in the life sciences and healthcare; TMT; and mining and metals sectors. McLaren's recent experience includes advising: Momondo in connection with its $550 million sale to Priceline; Baxter International Inc, in connection with its $625 million acquisition of Claris Injectables, an India-based manufacturer of sterile injectables; Sienna Biopharmaceuticals in connection with its acquisition of Creabilis, a privately held specialty pharmaceutical company; and Allergan on its $40.5 billion sale of its global generic pharmaceuticals business to Teva. |