The US M&A market continued at a strong level in 2019, with robust activity across several sectors. Most of 2019's mega-deals (>$10 billion) involved a US target, spurring record high deal values on both a domestic and global scale.

Representation and warranty insurance (RWI) is increasingly common in private M&A transactions among both financial and strategic buyers, across a broad spectrum of industries and sectors. RWI has reduced the need for sellers to provide indemnification, particularly in competitive auctions, and lessened negotiation regarding representations and warranties.

Shareholder activism continues to shape deal-making. A significant portion of activist campaigns launched in 2019 against US public companies focused on M&A-related objectives, resulting in a substantial number of sales and spin-offs of underperforming or non-core businesses, or the company itself.

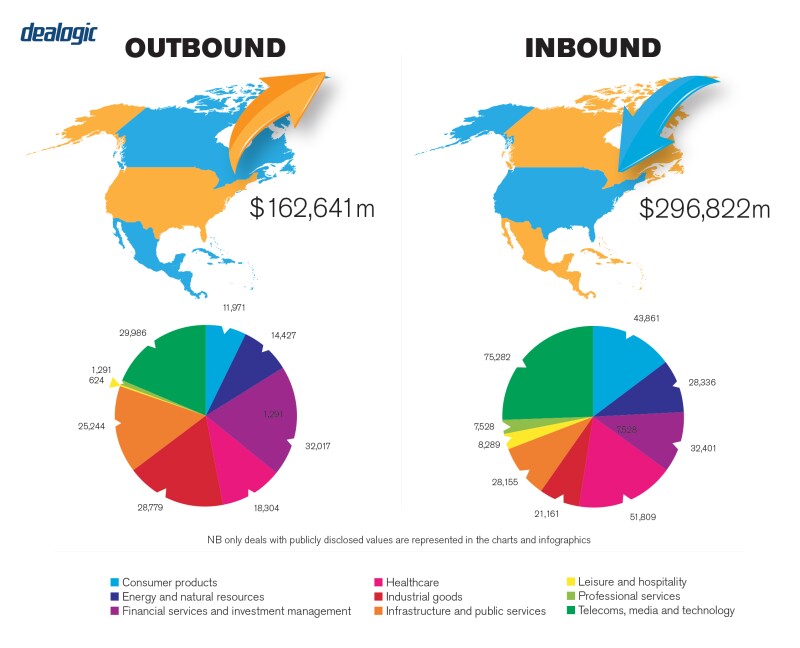

Cross-border deal-making declined in 2019 from 2018, as geopolitical tensions and heightened regulatory scrutiny caused a shift toward domestic deal-making in the US

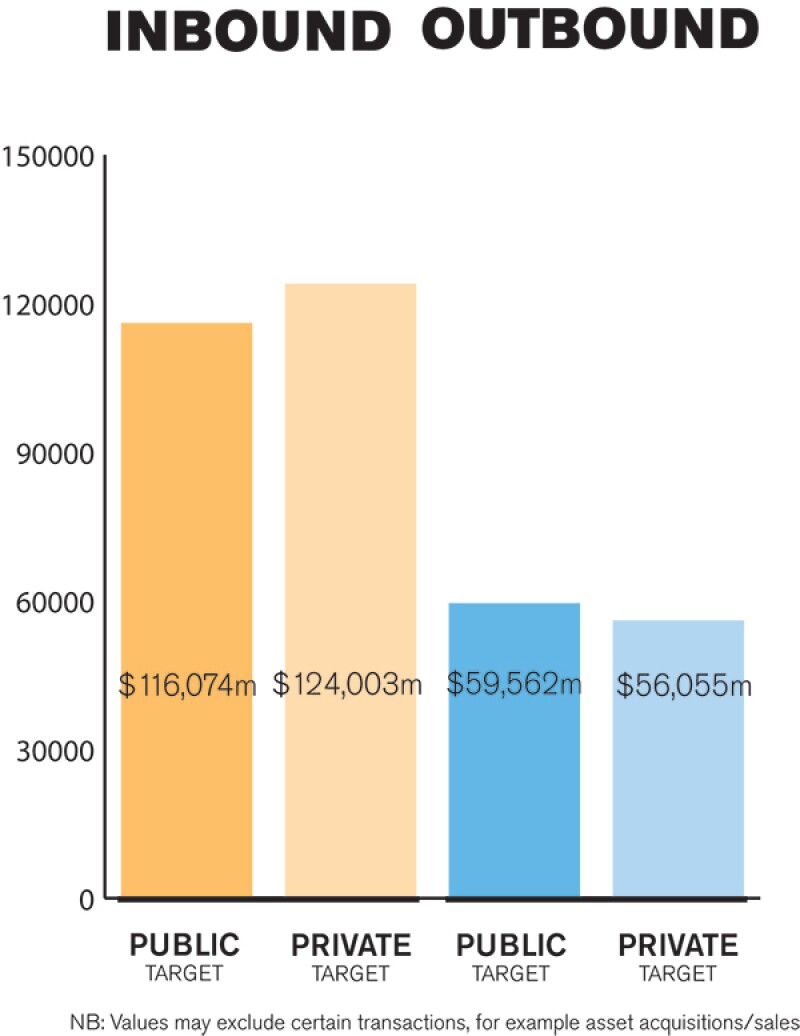

According to Mergermarket, there were 5,757 announced US deals worth $1.57 trillion in 2019, compared to 6,734 announced US deals worth $1.55 trillion in 2018. However, the number and value of deals declined in the second half of 2019, and US M&A activity in 2020 appears to be off to a slow start. A number of US mega-deals across various sectors (including the industrials and life sciences sectors) bolstered aggregate deal value in 2019, including the $135 billion United Technologies/Raytheon merger and Bristol-Myers Squibb's $74 billion acquisition of Celgene. Although cross-border deal-making declined overall in 2019 from 2018, according to Mergermarket, the value of inbound deals into the US from non-US buyers increased 12.9% from 2018.

The US M&A market is driven by both private and public M&A transactions, although private M&A is more prevalent because there are many more private than public companies in the US. Ready availability of financing continues to be a driving factor, particularly for private company and private equity deal-making where acquirer stock is not available as transaction consideration.

TRANSACTION STRUCTURES

According to JP Morgan's 2020 Global M&A Outlook, concerns about a recession are leading US corporations to increasingly use stock as consideration, rather than assuming debt to finance cash transactions.

The enactment in 2013 of Section 251(h) of the Delaware General Corporation Law, which (subject to certain conditions) eliminates the stockholder approval requirement following the successful completion of a tender offer, has led to increased use of tender offers (as opposed to one-step mergers) as a means of acquiring Delaware public companies.

Private equity firms remain a driving force of US deal-making. According to Mergermarket, the value of private equity buyouts of domestic targets reached nearly $225 billion in 2019, the highest level in over 10 years. Record levels of uncommitted capital at private equity firms are expected to drive M&A activity in 2020 as firms look to deploy that capital. Meanwhile, public M&A activity in the US in 2020 is expected to be fuelled by activist campaigns.

In notable transactions, the failed acquisition by Fresenius Kabi of Akorn in 2018 resulted in the first case in Delaware where a material adverse effect (MAE) was deemed to have occurred which excused the buyer's obligation to close the acquisition. Despite this ruling, which was based on extreme facts and did not change existing Delaware law, buyers in the US market will continue to bear a heavy burden to establish an MAE in M&A transactions.

The acquisition of Anadarko Petroleum by Occidental Petroleum was a significant transaction for a number of reasons. It was one of the largest deals in the oil and gas sector in recent years; Occidental broke up a pending acquisition of Anadarko by Chevron, a much larger rival; and Occidental relied on an approximately $10 billion investment by Berkshire Hathaway to complete the acquisition, demonstrating the influence of Berkshire Hathaway in diverse sectors of the US economy.

LEGISLATION AND POLICY CHANGES

US M&A transactions are primarily governed by US federal laws, including federal securities laws, federal antitrust laws, federal tax laws, federal laws addressing national security concerns of foreign investment in the US and other federal laws governing certain regulated industries. In addition, stock exchange rules may impose additional rules on public target companies. Further, the laws of the state where the target company is incorporated govern that company's internal affairs and impose requirements for shareholder approval of merger transactions as well as the procedures for effecting mergers.

The enactment of the Foreign Investment Risk Review Modernization Act (FIRRMA) in 2018 increased the scope and depth of national security review by the Committee on Foreign Investment in the US (CFIUS). In January 2020, CFIUS adopted final rules requiring mandatory filing of certain foreign investments (including minority and non-passive investments) in US businesses involving critical technology, infrastructure or sensitive personal information. FIRRMA is expected to extend waiting periods for deal clearance and could affect how US businesses evaluate the competitiveness of foreign bids, which may ultimately have a chilling effect on foreign investment in the US.

In January 2020, the Federal Trade Commission (FTC) and Department of Justice (DoJ) jointly released for public comment draft vertical merger guidelines, in part to provide transparency on how the two agencies analyse vertical mergers and make enforcement decisions with respect thereto.

In November 2019, the Securities and Exchange Commission (SEC) proposed certain rules governing proxy advisory firms and their interactions with public companies and investment advisors. If adopted, these rules would enhance the regulation of the proxy voting advisory process and may give public companies greater ability to influence the recommendations of proxy advisory firms regarding public company mergers as well as activist campaigns.

MARKET NORMS

Contrary to the practice in many non-US jurisdictions, a US target typically does not provide a vendor due diligence report. Buyers are typically responsible for conducting their own due diligence through virtual data rooms (VDRs), management presentations and conversations with selected company personnel.

Further, unlike many non-US jurisdictions, the US does not impose a 'funds certain' requirement on an acquirer to demonstrate that it has sufficient funds to satisfy the cash portion of a proposed takeover offer. Acquirers typically have sufficient cash or commitments under existing credit facilities or seek acquisition financing. In the latter case, successful completion of the acquisition financing is usually not a closing condition.

Acquirers of a US company, particularly non-US acquirers, should keep in mind that:

Any written statements regarding the competitive advantages or strengths of a proposed combination should be avoided as US antitrust regulators may interpret them as supporting a finding of anti-competitive effects of the transaction.

Shareholder activists are playing an increasingly prominent role in US M&A and may militate against announced acquisitions unless the acquirer raises its price.

The vast majority of acquisitions of US public companies involve shareholder lawsuits alleging deficiencies in the sale process or related disclosures, which the target company must often settle in order to consummate the transaction.

In relation to legal practice, VDRs have arguably made the due diligence process significantly more efficient than physical data rooms and they allow for remote access and instantaneous exchange of information. Acquirers should be careful to monitor materials added to the VDR and to make sure the principal transaction documents reflect the latest materials.

Further, the increasing number of data breaches and cybersecurity attacks will require M&A transaction participants to take measures to preserve the confidentiality of M&A transactions.

PUBLIC M&A

In light of the fiduciary duties of public company directors that generally require them to maximise shareholder value in a sale, target company boards usually conduct some form of a pre-signing market check, ranging from a broad-based auction to private approaches to a limited number of other possible buyers. In addition, target boards generally are required by state law to preserve the right to terminate a transaction to accept a superior offer, even after signing a definitive agreement.

Most states require shareholder approval (usually by a majority of outstanding shares) of most mergers and some other change of control transactions. Activist shareholders may use the shareholder approval process to seek a higher offer price.

A number of regulatory approvals, including clearance under the Hart-Scott-Rodino (HSR) antitrust statute, and for non-US acquirers, under the CFIUS statute, must be obtained before an acquirer can take control of a public company.

The acquisition of a US public company can be structured either as a one-step transaction involving a merger between the acquirer (or more commonly a subsidiary of the acquirer) and the target, or a two-step transaction involving a tender or exchange offer by the acquirer for all the target's outstanding shares followed by a back-end merger to eliminate any shareholders who did not tender their shares. A one-step transaction typically requires majority shareholder approval, while a two-step transaction is typically conditioned on the tender of at least a majority of the outstanding shares. Both types of transactions are typically subject to the additional following conditions:

Accuracy of representations and warranties;

Material compliance with covenants;

No MAE on the target;

Receipt of regulatory approvals; and

Absence of any law, court order or injunction prohibiting the transaction.

Most public company merger agreements require the target to pay the buyer a termination fee if the target terminates the agreement to accept a superior offer, or if the buyer terminates because the target changes its recommendation in favour of the deal or materially breaches the agreement's non-solicitation restrictions. Common law in many states imposes a limit on the amount of termination fees to prevent unduly discouraging superior offers. Accordingly, termination fees are usually between 3% – 4% of the transaction's enterprise value, but can vary based on deal size, the context of the transaction, and other factors.

In some cases, the acquirer must pay the target a reverse termination fee under certain circumstances (for example, if all closing conditions have been satisfied and the acquirer fails to consummate the transaction or fails to obtain regulatory approval). These fees are highly variable but often range between 5% – 7% of the transaction's enterprise value (and sometimes much more).

PRIVATE M&A

Completion accounts (known as working capital or balance sheet adjustments in the US) are common in US private company acquisitions. An American Bar Association (ABA) study of 151 private M&A transactions from 2018 through Q1 2019 found that 95% involved a purchase price adjustment mechanism. Locked-box mechanisms are much less prevalent in private company acquisitions in the US than in other jurisdictions. The study found that earnout provisions appear in approximately 27% of private M&A agreements and provide security for indemnity claims in most of those agreements. As discussed above, in recent years RWI has become more prevalent in US private M&A deals. According to the ABA, in 2018 and Q1 2019, 52% of such deals used RWI (compared to 29% in 2016-2017).

All the conditions listed above for a public M&A (see the bullet points), except the minimum tender condition, generally also apply in private M&A transactions. However, representations and warranties usually survive the closing in private M&A transactions and may give rise to post-closing indemnity claims.

Merger and share purchase agreements are typically governed by the law of the target company's state of incorporation. If a target company is incorporated in a state with sparsely developed corporate law, the parties sometimes provide that Delaware law will govern certain issues. In addition, some parties provide that disputes will be resolved through arbitration.

The current exit environment in the US is robust due to the ready availability of financing, relatively low interest rates and the amount of uncommitted private capital. Exits in the form of M&A transactions are more common than IPOs, partly because they generally allow the sellers to dispose of 100% of their interests in the target company without undertaking the time-consuming and complex securities registration process. In recent years, many US public companies have elected to spin off underperforming or non-core businesses into separate standalone companies, often in response to activist shareholders.

LOOKING AHEAD

Geopolitical tensions, trade disagreements, fears regarding the timing and severity of a recession and the upcoming presidential election have all created uncertainty and will likely shape M&A strategies in 2020. Despite this uncertainty, the US M&A market is expected to remain robust in 2020 due to the availability of financing, the relatively low interest rates, and the amount of uncommitted capital of private equity firms. Activist shareholders will continue to pressure public companies to execute M&A transactions to enhance shareholder value.

About the author |

||

|

|

Thomas Christopher Partner, Latham & Watkins New York, US T: +1 212 906 1242 W: www.lw.com/people/thomas-christopher Thomas W Christopher is a partner in the M&A practice in the New York office of Latham & Watkins. He advises domestic and multinational companies, special committees and private equity firms in negotiated and hostile M&A transactions, activist situations, equity investments and corporate governance and similar matters. Thomas has advised on numerous transactions across a diverse range of industries, including the energy/power, infrastructure, industrials, life sciences, financial services, and communications sectors. |

About the author |

||

|

|

Peter Harwich Partner, Latham & Watkins New York, US T: +1 212 906 1899 W: www.lw.com/people/peter-harwich Peter Harwich is a partner in the M&A practice in the New York office of Latham & Watkins. He advises leading US and international public companies, as well as their boards of directors, in their most significant M&A transactions and other sensitive corporate matters. Peter represents clients in high-stakes transactions across a variety of industries, with a particular focus on the technology, healthcare, consumer products, and financial services sectors. He also routinely represents issuers and underwriters on SEC-registered capital markets transactions. |